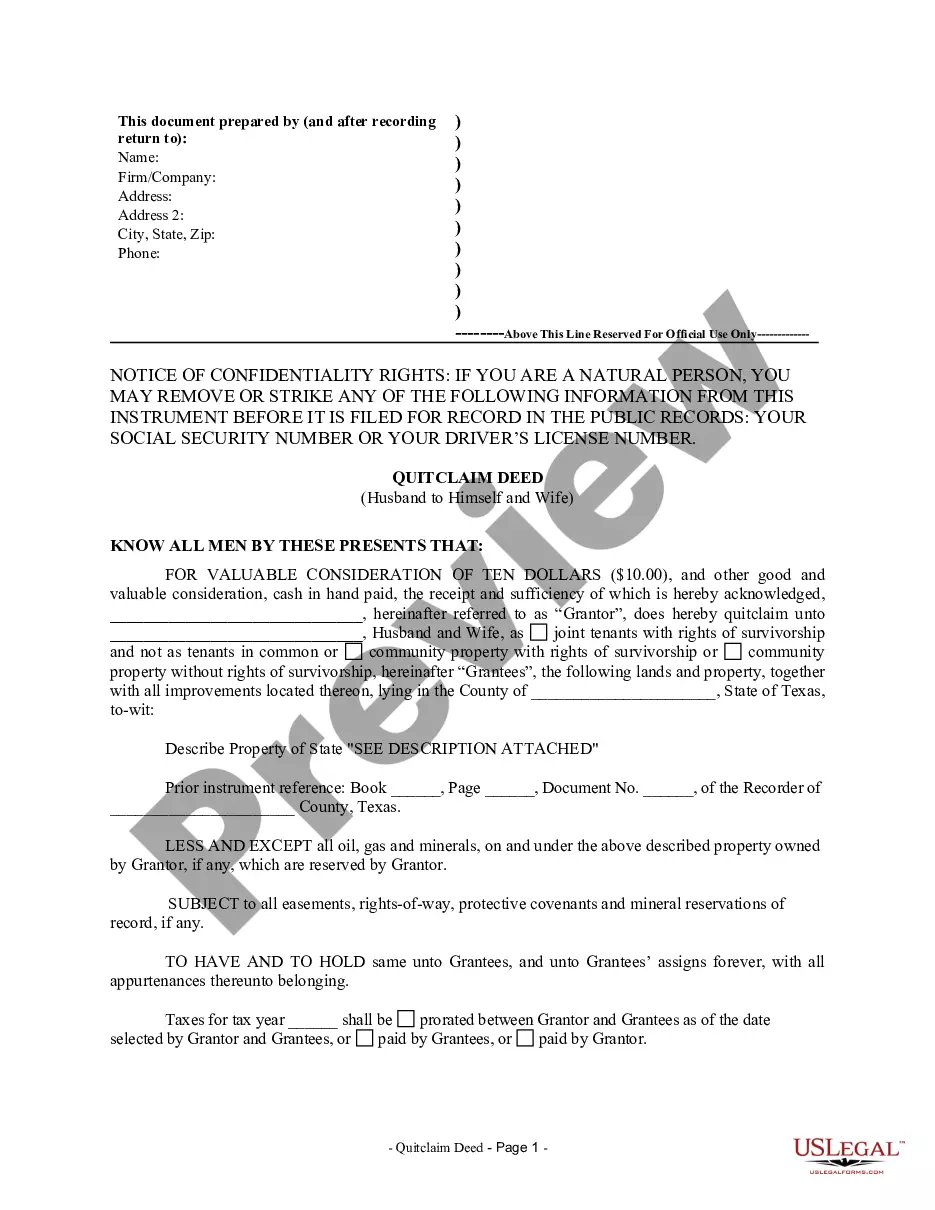

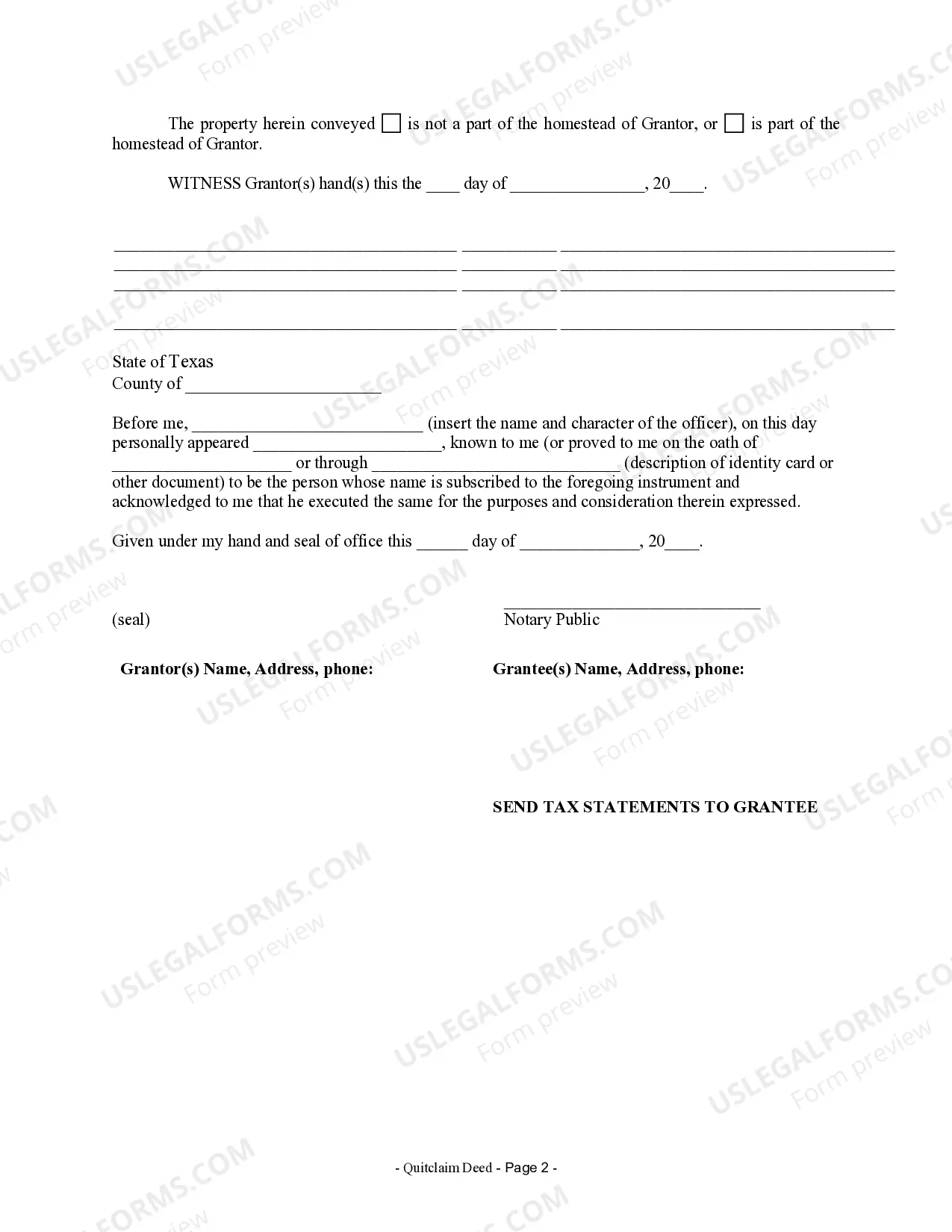

This Quitclaim Deed from Husband to Himself and Wife form is a Quitclaim Deed where the Grantor is the husband and the Grantees are the husband and his wife. Grantors convey and quitclaim the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

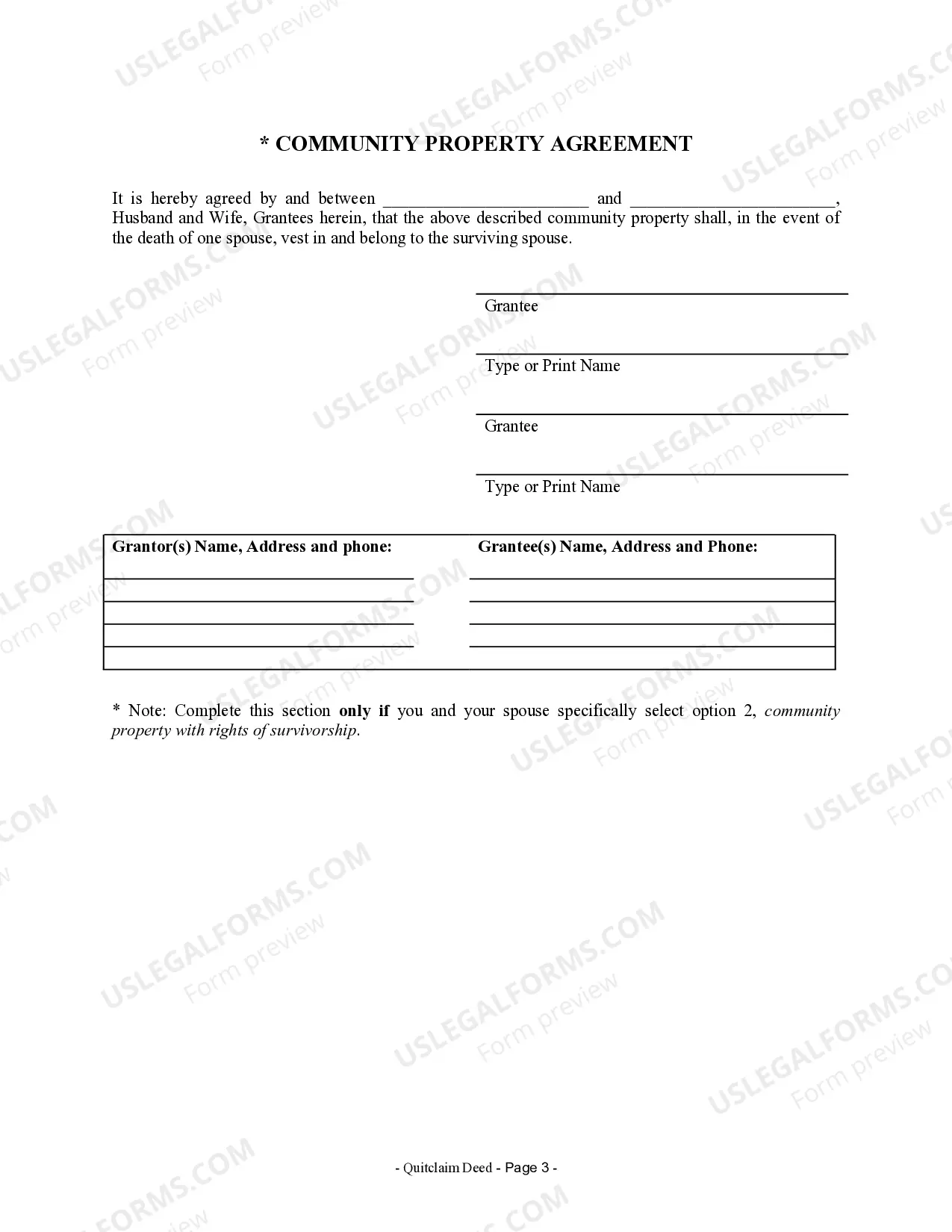

A Fort Worth Texas quitclaim deed from husband to himself and wife is a legal document that transfers ownership of a property from a husband to himself and his spouse. This type of deed is typically used in situations where the husband solely owns the property and wants to add his wife as a co-owner. The quitclaim deed is a straightforward way to transfer ownership without making any guarantees or warranties about the title of the property. It simply states that the husband, as the granter, is releasing any interest he has in the property to himself and his wife, who are referred to as the grantees. It is important to note that quitclaim deeds do not provide any assurances about the title and may not be appropriate for all situations. There are several variations of a Fort Worth Texas quitclaim deed from husband to himself and wife, namely: 1. Joint Tenancy with Right of Survivorship: This type of quitclaim deed allows both the husband and wife to have equal ownership rights in the property. In the event of one spouse's death, the surviving spouse automatically inherits the deceased spouse's share of the property. 2. Tenancy by the Entirety: This type of quitclaim deed is only available to married couples and provides equal ownership rights with the added benefit of protection against individual creditors. In the event of a divorce or death of one spouse, the property would be transferred solely to the surviving spouse. 3. Community Property with Right of Survivorship: This type of quitclaim deed is applicable in Texas, which follows community property laws. It allows the husband and wife to share equal ownership of the property, and upon the death of one spouse, their share automatically transfers to the surviving spouse. When creating a Fort Worth Texas quitclaim deed from husband to himself and wife, it is essential to include specific details such as the legal description of the property, the names of both the husband and wife, their marital status, and the signature of the husband as the granter. It is also advisable to consult with a real estate attorney or a title company to ensure that the document complies with all local laws and regulations. Overall, a Fort Worth Texas quitclaim deed from husband to himself and wife is a legal instrument that allows for the transfer of property ownership within a married couple. Understanding the different variations and seeking professional advice can help ensure a smooth and legally compliant transfer of ownership.A Fort Worth Texas quitclaim deed from husband to himself and wife is a legal document that transfers ownership of a property from a husband to himself and his spouse. This type of deed is typically used in situations where the husband solely owns the property and wants to add his wife as a co-owner. The quitclaim deed is a straightforward way to transfer ownership without making any guarantees or warranties about the title of the property. It simply states that the husband, as the granter, is releasing any interest he has in the property to himself and his wife, who are referred to as the grantees. It is important to note that quitclaim deeds do not provide any assurances about the title and may not be appropriate for all situations. There are several variations of a Fort Worth Texas quitclaim deed from husband to himself and wife, namely: 1. Joint Tenancy with Right of Survivorship: This type of quitclaim deed allows both the husband and wife to have equal ownership rights in the property. In the event of one spouse's death, the surviving spouse automatically inherits the deceased spouse's share of the property. 2. Tenancy by the Entirety: This type of quitclaim deed is only available to married couples and provides equal ownership rights with the added benefit of protection against individual creditors. In the event of a divorce or death of one spouse, the property would be transferred solely to the surviving spouse. 3. Community Property with Right of Survivorship: This type of quitclaim deed is applicable in Texas, which follows community property laws. It allows the husband and wife to share equal ownership of the property, and upon the death of one spouse, their share automatically transfers to the surviving spouse. When creating a Fort Worth Texas quitclaim deed from husband to himself and wife, it is essential to include specific details such as the legal description of the property, the names of both the husband and wife, their marital status, and the signature of the husband as the granter. It is also advisable to consult with a real estate attorney or a title company to ensure that the document complies with all local laws and regulations. Overall, a Fort Worth Texas quitclaim deed from husband to himself and wife is a legal instrument that allows for the transfer of property ownership within a married couple. Understanding the different variations and seeking professional advice can help ensure a smooth and legally compliant transfer of ownership.