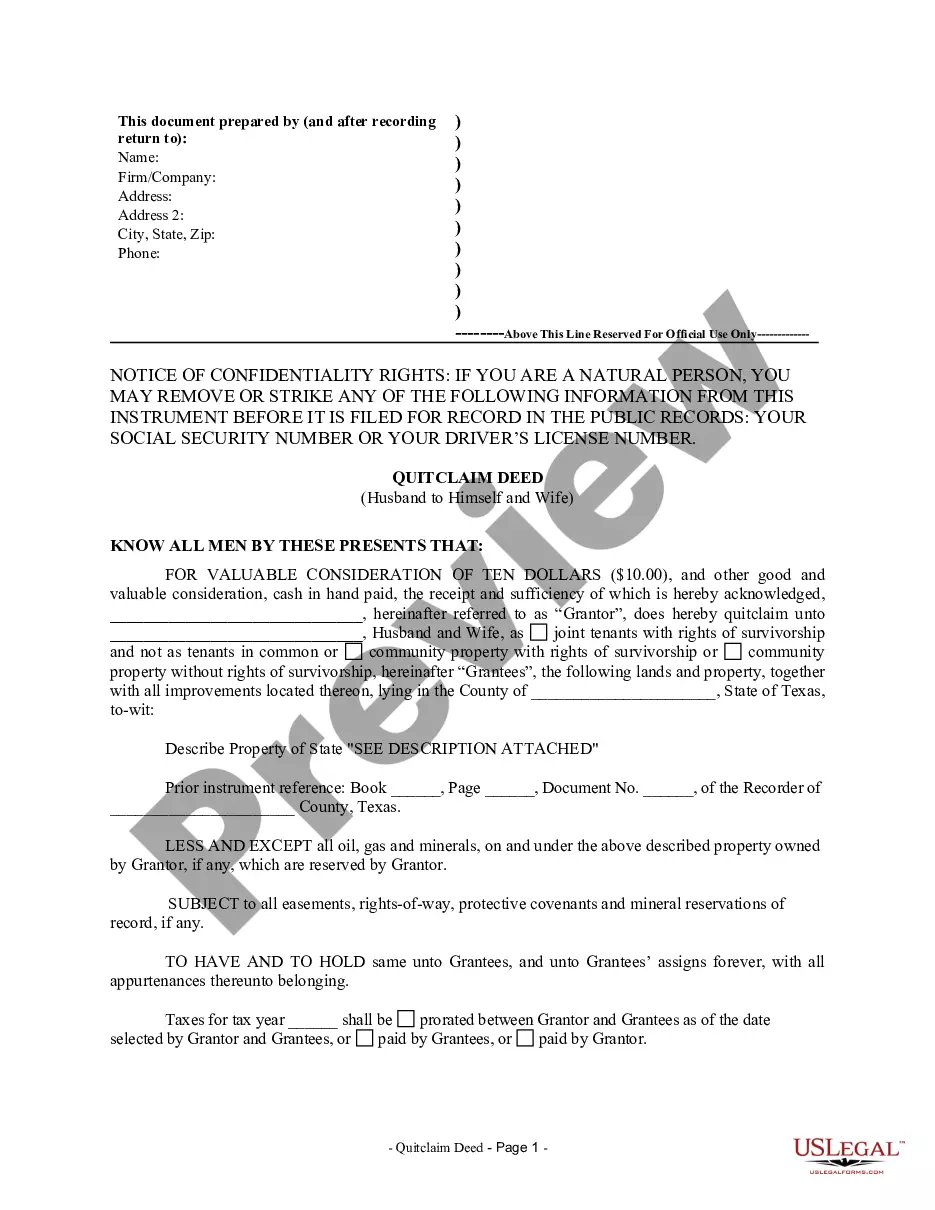

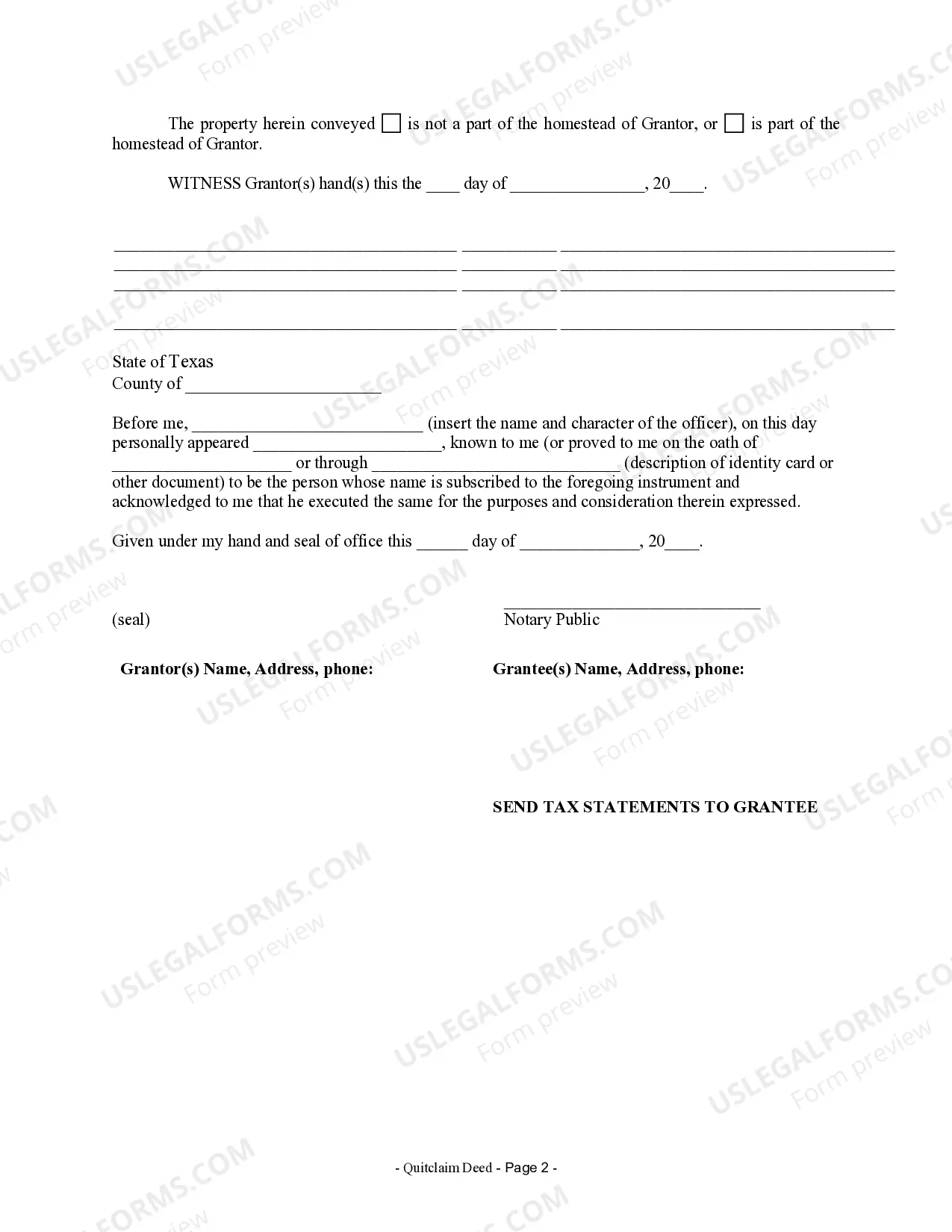

This Quitclaim Deed from Husband to Himself and Wife form is a Quitclaim Deed where the Grantor is the husband and the Grantees are the husband and his wife. Grantors convey and quitclaim the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

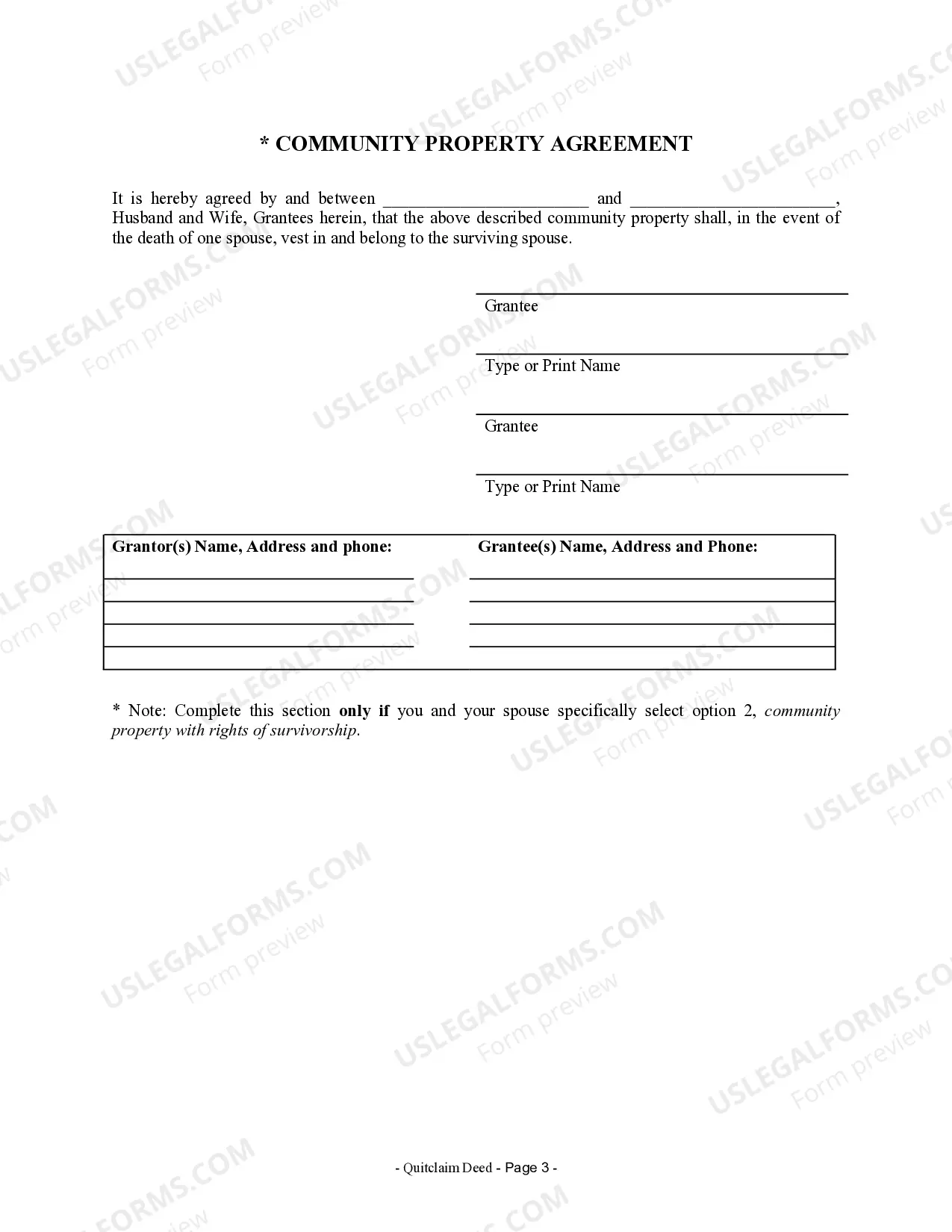

A Sugar Land Texas Quitclaim Deed from Husband to Himself and Wife is a legal document used to transfer ownership of real estate from a husband to himself and his wife. This type of deed is commonly used when a husband is the sole owner of a property and wishes to add his wife as a co-owner. The quitclaim deed variant used in Sugar Land, Texas allows the husband to transfer his interest in the property to himself and his wife without making any warranties or guarantees regarding the property's title. Essentially, the husband is relinquishing any rights or claims he may have to the property and transferring them to both himself and his wife jointly. This type of deed can be beneficial for couples who want to establish joint ownership and equal rights to a property that was previously owned solely by the husband. Common scenarios where a Sugar Land Texas Quitclaim Deed from Husband to Himself and Wife might be used include marriages, post-marital property transfers, or during the estate planning process. Different types of Sugar Land Texas Quitclaim Deed from Husband to Himself and Wife include: 1. Joint Tenancy with Right of Survivorship: In this case, both the husband and wife have an equal share of ownership in the property, and if one spouse passes away, the surviving spouse automatically inherits the deceased spouse's share. 2. Tenancy in Common: With this type of deed, both the husband and wife have undivided interests in the property. However, the shares of ownership can be unequal, and unlike joint tenancy, there is no automatic right of survivorship. Each spouse can independently transfer their share to a third party through a subsequent deed or will. 3. Community Property: This is a unique form of ownership recognized in Texas. If the property is acquired during the marriage, both the husband and wife have an equal share of ownership, regardless of how the property was titled initially. In the case of a Sugar Land Texas Quitclaim Deed from Husband to Himself and Wife using community property, it solidifies joint ownership and equal interest in the property under Texas law. It's crucial to consult with a qualified real estate attorney when creating a Sugar Land Texas Quitclaim Deed from Husband to Himself and Wife to ensure compliance with state laws and to address any specific concerns or requirements related to the property in question.A Sugar Land Texas Quitclaim Deed from Husband to Himself and Wife is a legal document used to transfer ownership of real estate from a husband to himself and his wife. This type of deed is commonly used when a husband is the sole owner of a property and wishes to add his wife as a co-owner. The quitclaim deed variant used in Sugar Land, Texas allows the husband to transfer his interest in the property to himself and his wife without making any warranties or guarantees regarding the property's title. Essentially, the husband is relinquishing any rights or claims he may have to the property and transferring them to both himself and his wife jointly. This type of deed can be beneficial for couples who want to establish joint ownership and equal rights to a property that was previously owned solely by the husband. Common scenarios where a Sugar Land Texas Quitclaim Deed from Husband to Himself and Wife might be used include marriages, post-marital property transfers, or during the estate planning process. Different types of Sugar Land Texas Quitclaim Deed from Husband to Himself and Wife include: 1. Joint Tenancy with Right of Survivorship: In this case, both the husband and wife have an equal share of ownership in the property, and if one spouse passes away, the surviving spouse automatically inherits the deceased spouse's share. 2. Tenancy in Common: With this type of deed, both the husband and wife have undivided interests in the property. However, the shares of ownership can be unequal, and unlike joint tenancy, there is no automatic right of survivorship. Each spouse can independently transfer their share to a third party through a subsequent deed or will. 3. Community Property: This is a unique form of ownership recognized in Texas. If the property is acquired during the marriage, both the husband and wife have an equal share of ownership, regardless of how the property was titled initially. In the case of a Sugar Land Texas Quitclaim Deed from Husband to Himself and Wife using community property, it solidifies joint ownership and equal interest in the property under Texas law. It's crucial to consult with a qualified real estate attorney when creating a Sugar Land Texas Quitclaim Deed from Husband to Himself and Wife to ensure compliance with state laws and to address any specific concerns or requirements related to the property in question.