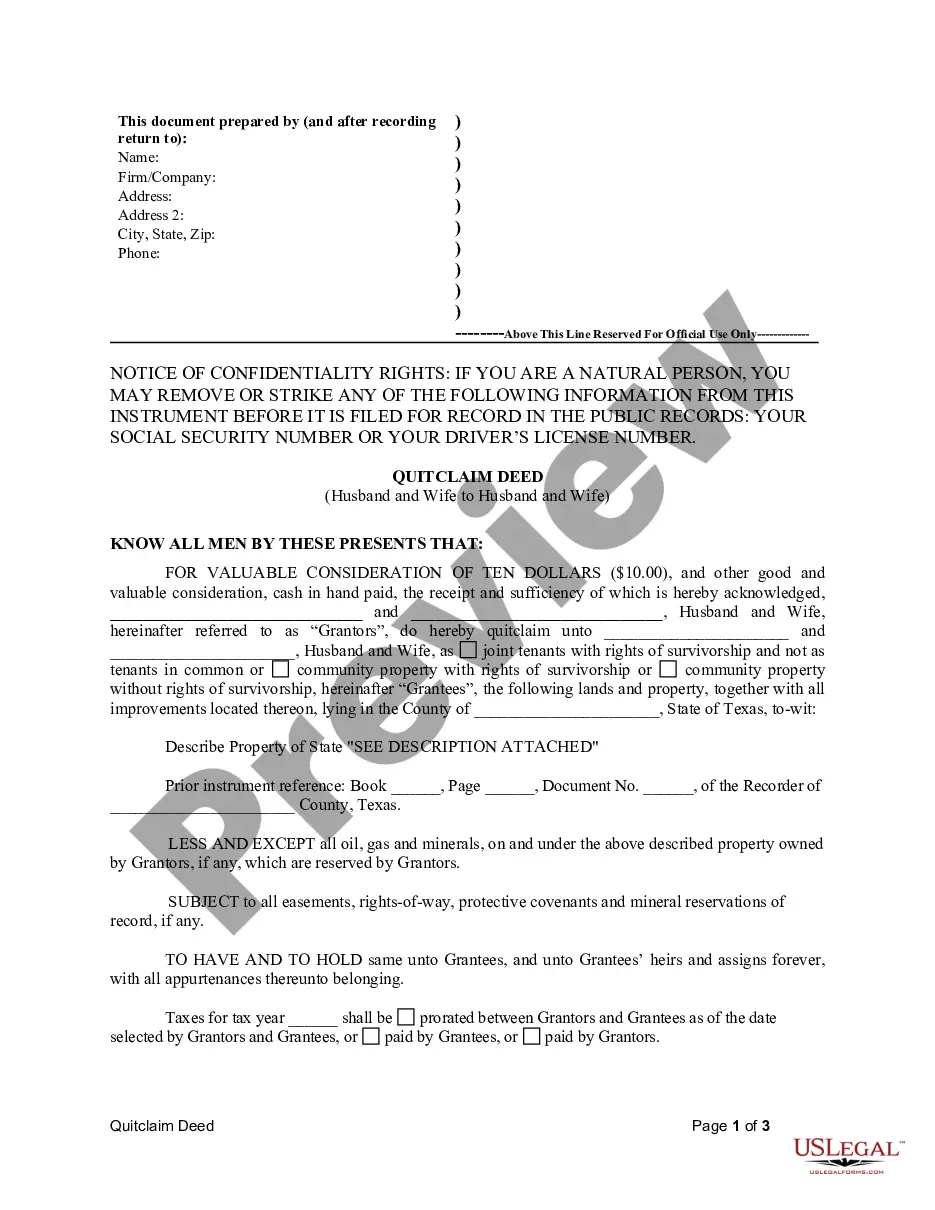

This form is a Quitclaim Deed where the grantors are husband and wife and the grantees are husband and wife. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

A Houston Texas Quitclaim Deed from Husband and Wife to Husband and Wife refers to a legal document used in real estate transactions where a married couple is transferring their joint ownership interest in a property to both spouses as individuals. This type of deed is commonly used when couples want to clarify the separate ownership rights of each spouse while retaining joint ownership of the property. In this deed, the husband and wife are referred to as granters, meaning they are transferring ownership, and granters, meaning they are receiving the property. The purpose of using a quitclaim deed is to transfer whatever interest the granters have in the property to the grantees without making any guarantees or warranties about the property's title or condition. This type of deed can be useful in various situations like divorce, where joint ownership may need to be redefined, or for estate planning purposes. By using a quitclaim deed, the couple can establish separate individual ownership interests in the property. It is important to note that different types of Houston Texas Quitclaim Deeds from Husband and Wife to Husband and Wife may exist depending on the specific circumstances of the property transfer. Some common variations may include: 1. Absolute Quitclaim Deed: This type of deed transfers all the granters' interest in the property to the grantees, with no conditions or limitations. 2. Partial Quitclaim Deed: This deed transfers only a portion of the granters' interest to the grantees. This can be helpful if one spouse wants to relinquish their ownership rights in a specific portion of the property while retaining ownership of the rest. 3. Limited Quitclaim Deed: This deed transfers the granters' interest in the property to the grantees, but with certain restrictions or limitations. For example, the granter may specify that the grantees cannot sell or mortgage the property without their consent. Overall, a Houston Texas Quitclaim Deed from Husband and Wife to Husband and Wife allows married couples to transfer joint property ownership to individual ownership interests. It is important to consult with a real estate attorney to ensure the deed is prepared correctly and executed according to Texas state laws.