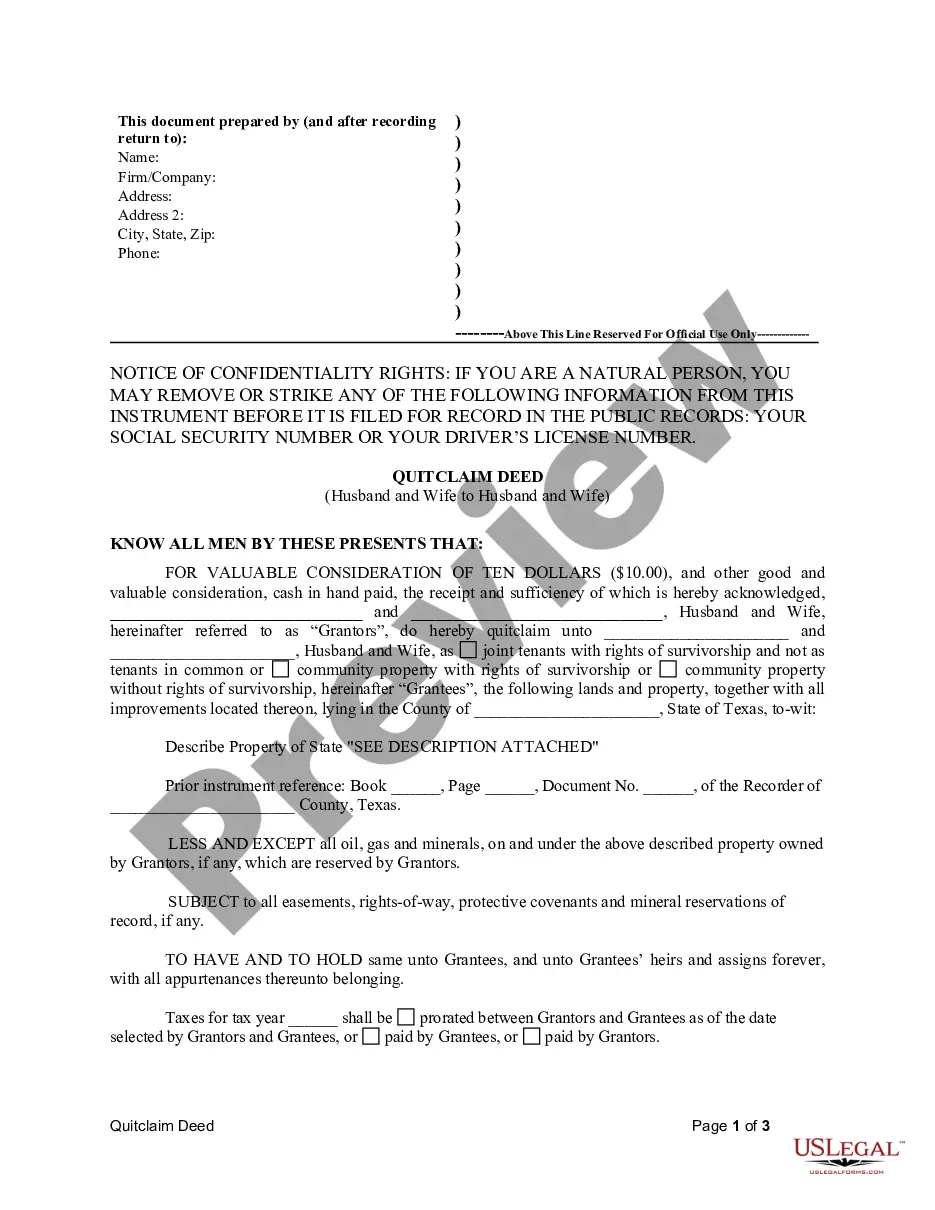

This form is a Quitclaim Deed where the grantors are husband and wife and the grantees are husband and wife. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

A Round Rock Texas Quitclaim Deed from Husband and Wife to Husband and Wife is a legal document that transfers property ownership rights from both spouses (granters) to both spouses (grantees). This type of property transfer typically occurs when both spouses jointly own a property and wish to restructure the ownership arrangement, update title records, or protect their individual interests. In Round Rock, Texas, there are two common types of Quitclaim Deeds from Husband and Wife to Husband and Wife: 1. Voluntary Quitclaim Deed: This type of Quitclaim Deed is executed willingly and voluntarily by both spouses. It allows for a smooth transfer of property ownership without monetary consideration. Voluntary Quitclaim Deeds are often used in situations such as updating ownership rights after marriage, divorce, or refinancing. 2. Divorce-Related Quitclaim Deed: In the case of a divorce, a Quitclaim Deed may be utilized to partition ownership rights between spouses. This type of deed ensures that both parties have legally severed their interest in the property, removing any claims or liabilities tied to the marital asset. When executing a Round Rock Texas Quitclaim Deed, it is crucial to provide accurate and detailed information to avoid legal complications in the future. The deed should include key elements such as: 1. Granter Information: The Quitclaim Deed should clearly state the names and addresses of the husband and wife transferring ownership rights. This ensures proper identification of the parties involved. 2. Grantee Information: The names and addresses of the husband and wife who will be receiving the property rights should be accurately stated. 3. Property Description: The deed should contain a detailed legal description of the property being transferred. This description typically includes the property's address, Lot number, Subdivision name, and any other relevant information that identifies the property's boundaries. 4. Consideration: While Quitclaim Deeds often involve no monetary consideration, it is common to mention a nominal amount (e.g., $10) as consideration to make the transfer enforceable. 5. Signatures and Notarization: Both granters must sign the Quitclaim Deed in the presence of a notary public, who will acknowledge their signatures. This step ensures the deed's legality and authenticity. By executing a Round Rock Texas Quitclaim Deed from Husband and Wife to Husband and Wife, the parties involved can effectively transfer property rights, clarify ownership interests, and protect individual assets. It is always advisable to consult with a qualified attorney or real estate professional to ensure compliance with state and local laws, as well as to address any specific requirements or complexities associated with the property transfer process.A Round Rock Texas Quitclaim Deed from Husband and Wife to Husband and Wife is a legal document that transfers property ownership rights from both spouses (granters) to both spouses (grantees). This type of property transfer typically occurs when both spouses jointly own a property and wish to restructure the ownership arrangement, update title records, or protect their individual interests. In Round Rock, Texas, there are two common types of Quitclaim Deeds from Husband and Wife to Husband and Wife: 1. Voluntary Quitclaim Deed: This type of Quitclaim Deed is executed willingly and voluntarily by both spouses. It allows for a smooth transfer of property ownership without monetary consideration. Voluntary Quitclaim Deeds are often used in situations such as updating ownership rights after marriage, divorce, or refinancing. 2. Divorce-Related Quitclaim Deed: In the case of a divorce, a Quitclaim Deed may be utilized to partition ownership rights between spouses. This type of deed ensures that both parties have legally severed their interest in the property, removing any claims or liabilities tied to the marital asset. When executing a Round Rock Texas Quitclaim Deed, it is crucial to provide accurate and detailed information to avoid legal complications in the future. The deed should include key elements such as: 1. Granter Information: The Quitclaim Deed should clearly state the names and addresses of the husband and wife transferring ownership rights. This ensures proper identification of the parties involved. 2. Grantee Information: The names and addresses of the husband and wife who will be receiving the property rights should be accurately stated. 3. Property Description: The deed should contain a detailed legal description of the property being transferred. This description typically includes the property's address, Lot number, Subdivision name, and any other relevant information that identifies the property's boundaries. 4. Consideration: While Quitclaim Deeds often involve no monetary consideration, it is common to mention a nominal amount (e.g., $10) as consideration to make the transfer enforceable. 5. Signatures and Notarization: Both granters must sign the Quitclaim Deed in the presence of a notary public, who will acknowledge their signatures. This step ensures the deed's legality and authenticity. By executing a Round Rock Texas Quitclaim Deed from Husband and Wife to Husband and Wife, the parties involved can effectively transfer property rights, clarify ownership interests, and protect individual assets. It is always advisable to consult with a qualified attorney or real estate professional to ensure compliance with state and local laws, as well as to address any specific requirements or complexities associated with the property transfer process.