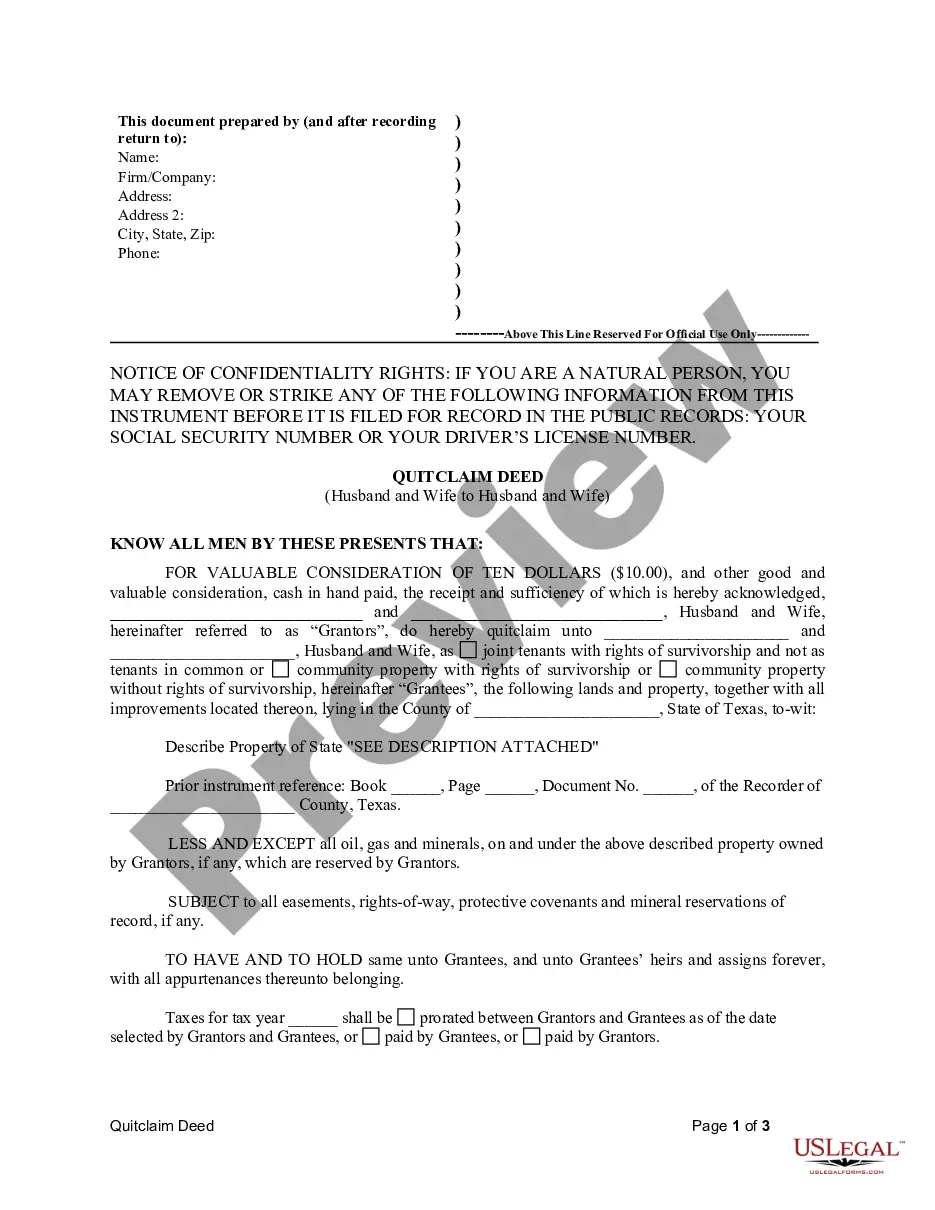

This form is a Quitclaim Deed where the grantors are husband and wife and the grantees are husband and wife. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

A Tarrant Texas Quitclaim Deed from Husband and Wife to Husband and Wife is a legal document that transfers ownership of a property from both spouses to both spouses, effectively relinquishing any interest, claim, or rights they have in the property. Here, we will discuss the different types of Tarrant Texas Quitclaim Deeds from Husband and Wife to Husband and Wife: 1. General Tarrant Texas Quitclaim Deed from Husband and Wife to Husband and Wife: This type of deed is the most common, where both spouses transfer their entire interest in the property to each other. It is used when both spouses are in agreement and wish to update or establish joint ownership. 2. Joint Tenancy with Right of Survivorship Tarrant Texas Quitclaim Deed from Husband and Wife to Husband and Wife: In this deed, both spouses transfer the property to themselves as joint tenants, with the right of survivorship. This means that if one spouse passes away, the other automatically becomes the sole owner of the property without the need for probate. 3. Tenancy in Common Tarrant Texas Quitclaim Deed from Husband and Wife to Husband and Wife: This deed type allows both spouses to hold the property as tenants in common, with each spouse having a separate and distinct share of ownership. If one spouse passes away, their share will be passed according to their will or through intestate succession laws. 4. Community Property Tarrant Texas Quitclaim Deed from Husband and Wife to Husband and Wife: This type of deed is specific to Texas, as it is a community property state. It recognizes that any property acquired during the marriage is owned jointly by both spouses, and this deed ensures the property is transferred to both spouses as community property. Upon the death of one spouse, the property will be subject to probate and may pass according to the deceased spouse's will or through intestate succession laws. It is essential to consult with a licensed attorney or legal professional specializing in real estate law to ensure the proper type of deed is used based on the specific circumstances and desired outcome. Remember, this description is for informational purposes only and should not be considered legal advice.A Tarrant Texas Quitclaim Deed from Husband and Wife to Husband and Wife is a legal document that transfers ownership of a property from both spouses to both spouses, effectively relinquishing any interest, claim, or rights they have in the property. Here, we will discuss the different types of Tarrant Texas Quitclaim Deeds from Husband and Wife to Husband and Wife: 1. General Tarrant Texas Quitclaim Deed from Husband and Wife to Husband and Wife: This type of deed is the most common, where both spouses transfer their entire interest in the property to each other. It is used when both spouses are in agreement and wish to update or establish joint ownership. 2. Joint Tenancy with Right of Survivorship Tarrant Texas Quitclaim Deed from Husband and Wife to Husband and Wife: In this deed, both spouses transfer the property to themselves as joint tenants, with the right of survivorship. This means that if one spouse passes away, the other automatically becomes the sole owner of the property without the need for probate. 3. Tenancy in Common Tarrant Texas Quitclaim Deed from Husband and Wife to Husband and Wife: This deed type allows both spouses to hold the property as tenants in common, with each spouse having a separate and distinct share of ownership. If one spouse passes away, their share will be passed according to their will or through intestate succession laws. 4. Community Property Tarrant Texas Quitclaim Deed from Husband and Wife to Husband and Wife: This type of deed is specific to Texas, as it is a community property state. It recognizes that any property acquired during the marriage is owned jointly by both spouses, and this deed ensures the property is transferred to both spouses as community property. Upon the death of one spouse, the property will be subject to probate and may pass according to the deceased spouse's will or through intestate succession laws. It is essential to consult with a licensed attorney or legal professional specializing in real estate law to ensure the proper type of deed is used based on the specific circumstances and desired outcome. Remember, this description is for informational purposes only and should not be considered legal advice.