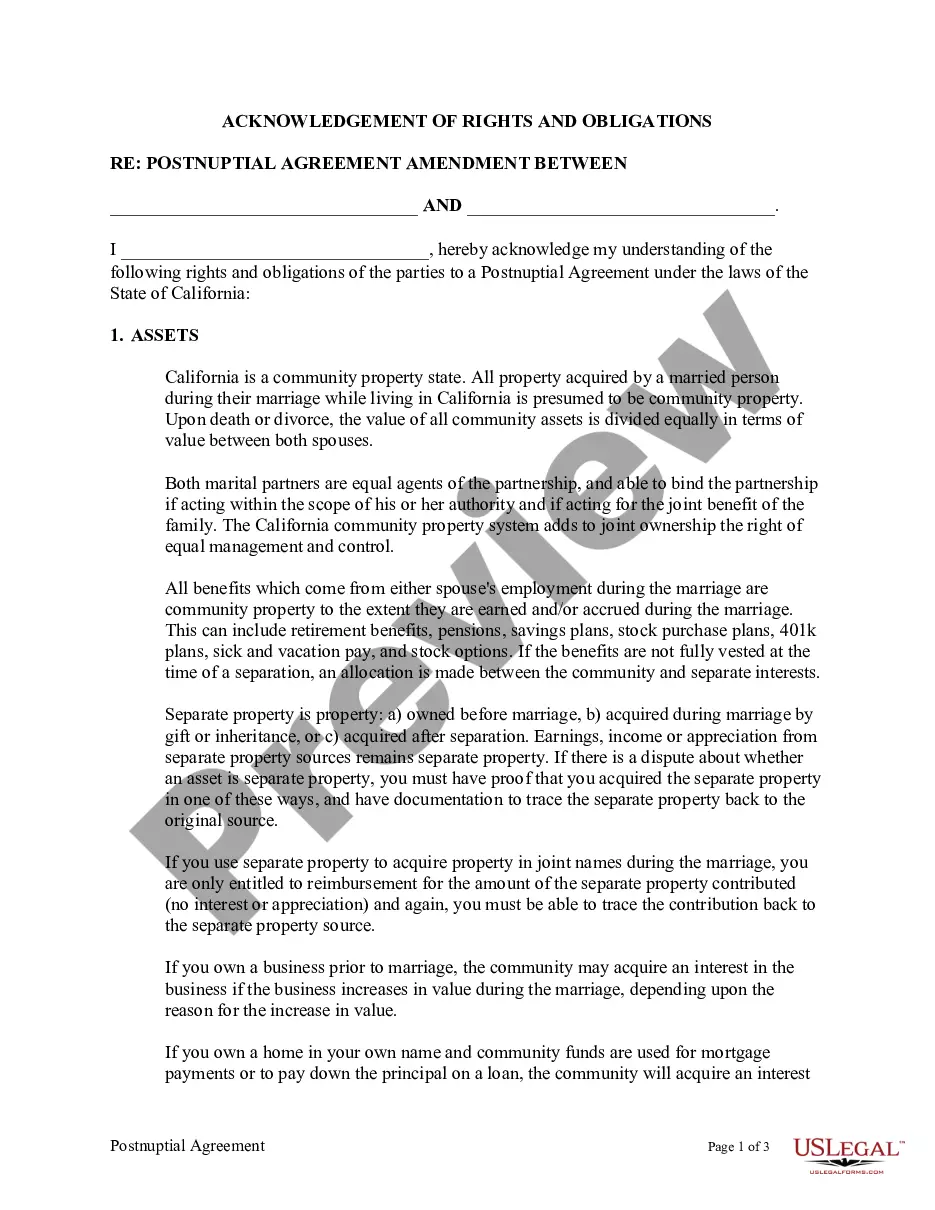

The Lewisville Amendment to Postnuptial Property Agreement is a legal document used in the state of Texas that allows married couples to make changes to their existing postnuptial property agreement. It provides a framework for couples to modify the terms of their property division, asset ownership, and financial arrangements. The agreement allows couples to address specific concerns or changes in their circumstances that have arisen since the original postnuptial property agreement was established. This legal document ensures that both parties are in agreement, providing a fair and transparent process for amending their financial arrangements. There are various types of Lewisville Amendments to Postnuptial Property Agreement available, depending on the specific changes couples wish to make. Some common types include: 1. Property Division Amendment: This amendment allows couples to modify the way their assets and liabilities are divided in the event of a separation, divorce, or death. It may specify changes in the distribution of property, such as real estate, investments, personal belongings, and debts. 2. Financial Support Amendment: Couples may use this amendment to alter the financial support provisions outlined in the original postnuptial agreement. It might address changes in spousal maintenance (alimony), child support, or any other financial support arrangements agreed upon. 3. Inheritance Rights Amendment: This type of amendment focuses on modifications related to inheritance rights. It may address changes in the distribution of assets upon the death of one spouse, ensuring clarity and fairness in the inheritance process. 4. Business Ownership Amendment: If one or both spouses own or have ownership interests in a business, this amendment allows them to modify the terms pertaining to business operations, profit sharing, ownership transfers, or other related matters. Regardless of the type of Lewisville Amendment to Postnuptial Property Agreement, it is essential to consult with a qualified attorney to ensure compliance with Texas laws and to protect both parties' rights and interests. This legal document requires the signatures of both spouses and should be notarized to ensure validity and enforceability.

Lewisville Texas Amendment to Postnuptial Property Agreement

Description

How to fill out Lewisville Texas Amendment To Postnuptial Property Agreement?

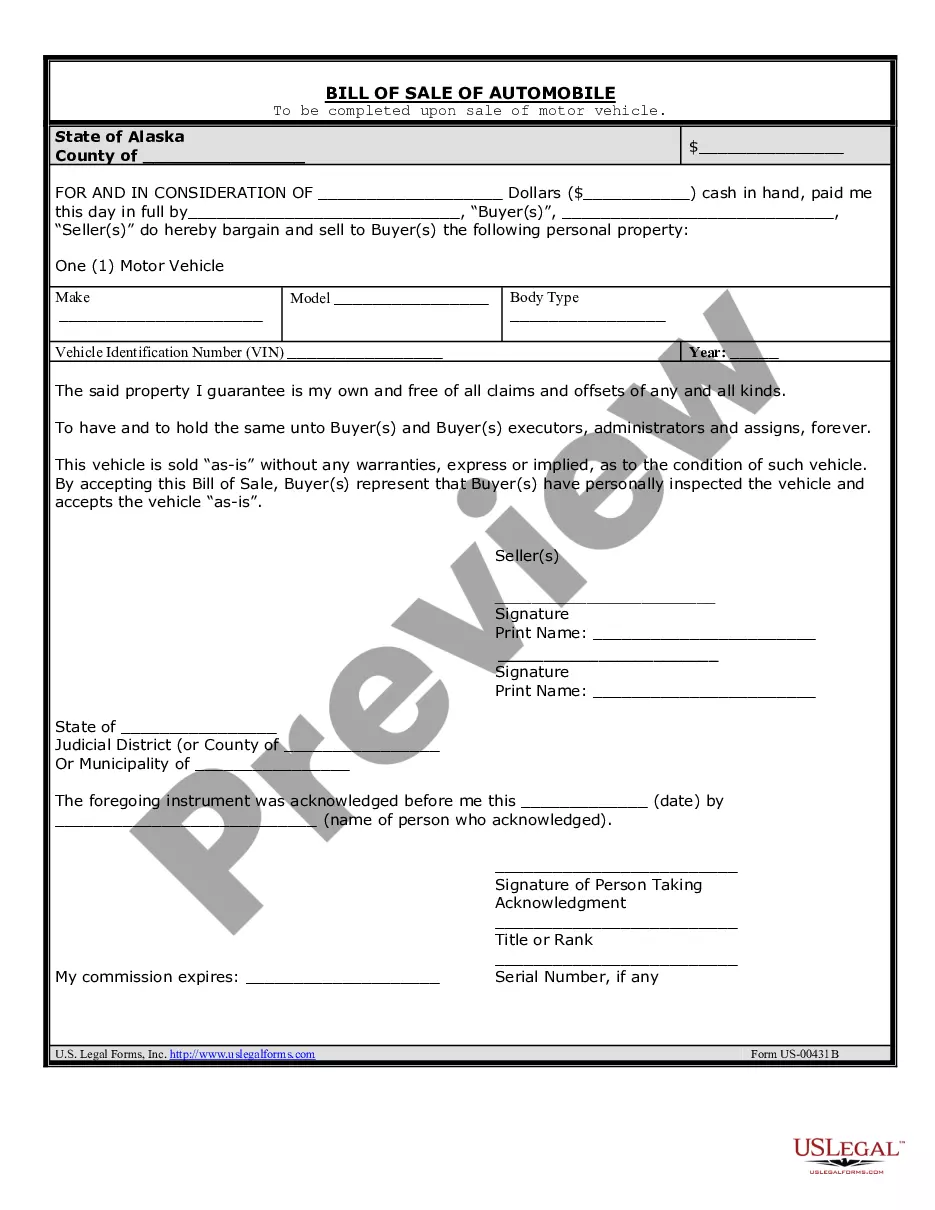

Are you looking for a trustworthy and affordable legal forms provider to buy the Lewisville Amendment to Postnuptial Property Agreement - Texas? US Legal Forms is your go-to solution.

Whether you need a simple agreement to set regulations for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked in accordance with the requirements of separate state and area.

To download the document, you need to log in account, locate the needed form, and click the Download button next to it. Please take into account that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Lewisville Amendment to Postnuptial Property Agreement - Texas conforms to the regulations of your state and local area.

- Read the form’s details (if available) to find out who and what the document is good for.

- Restart the search in case the form isn’t good for your specific situation.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Lewisville Amendment to Postnuptial Property Agreement - Texas in any available file format. You can get back to the website when you need and redownload the document free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending hours researching legal papers online once and for all.