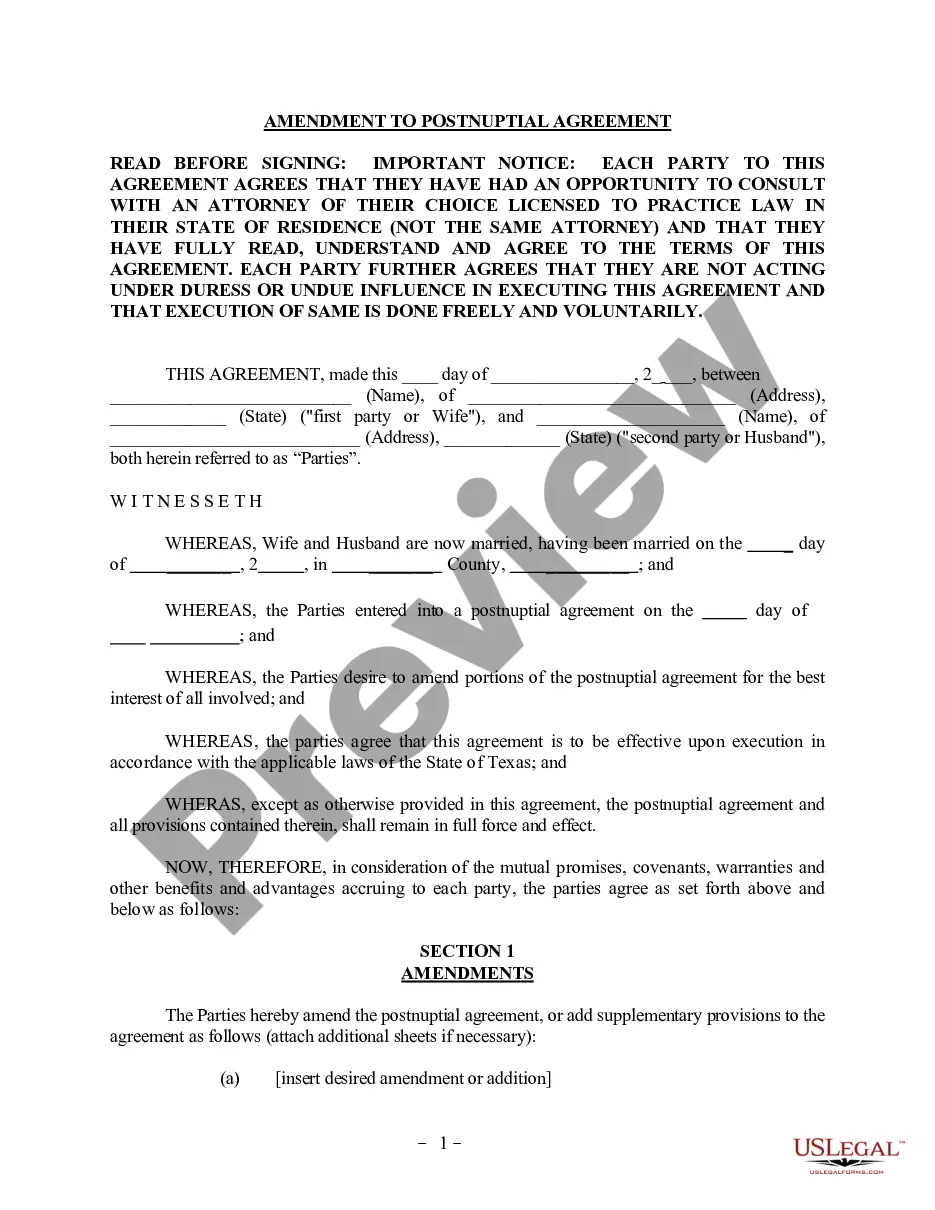

The Round Rock Amendment to Postnuptial Property Agreement is a legal document that modifies or adds provisions to an existing postnuptial property agreement in the state of Texas. It is commonly used by couples who wish to update their postnuptial agreement due to changing circumstances or for specific purposes. The Round Rock Amendment to Postnuptial Property Agreement allows couples to make adjustments to the division of marital assets, spousal support, debts, and other financial matters outlined in their original postnuptial agreement. This agreement is especially beneficial when couples have acquired new assets, incurred additional debts, or experienced changes in their income or financial situations since the original agreement was executed. The Round Rock Amendment to Postnuptial Property Agreement ensures that both parties' interests are protected and can provide clarity and certainty in case of divorce or separation. It offers a structured framework for addressing and settling disputes related to property division and financial matters, minimizing conflicts and potential litigation. Some common types of Round Rock Amendment to Postnuptial Property Agreement include: 1. Round Rock Amendment to Postnuptial Property Agreement — Property Division Modification: This type of amendment allows couples to modify the terms and conditions for dividing their marital assets, such as real estate, investments, retirement accounts, and personal belongings. It can be useful if either party has acquired new assets or if they want to reevaluate their initial property division arrangement. 2. Round Rock Amendment to Postnuptial Property Agreement — Modification of Spousal Support: This amendment enables couples to modify the spousal support provisions outlined in their original postnuptial agreement. It may involve changes to the duration, amount, or termination of spousal support payments based on evolving circumstances such as changes in income, employment status, or health conditions. 3. Round Rock Amendment to Postnuptial Property Agreement — Debt Allocation Modification: This type of amendment allows couples to modify the way debts acquired during the course of their marriage are allocated. It can be utilized if either party has taken on additional debts or if they want to revise the existing debt allocation arrangement. By utilizing the Round Rock Amendment to Postnuptial Property Agreement, couples in Texas can ensure their postnuptial agreement remains accurate, relevant, and reflective of their current financial circumstances. It is recommended to consult with an experienced family law attorney to draft and execute a Round Rock Amendment to Postnuptial Property Agreement that fully addresses the couple's specific needs and concerns.

Round Rock Texas Amendment to Postnuptial Property Agreement

Description

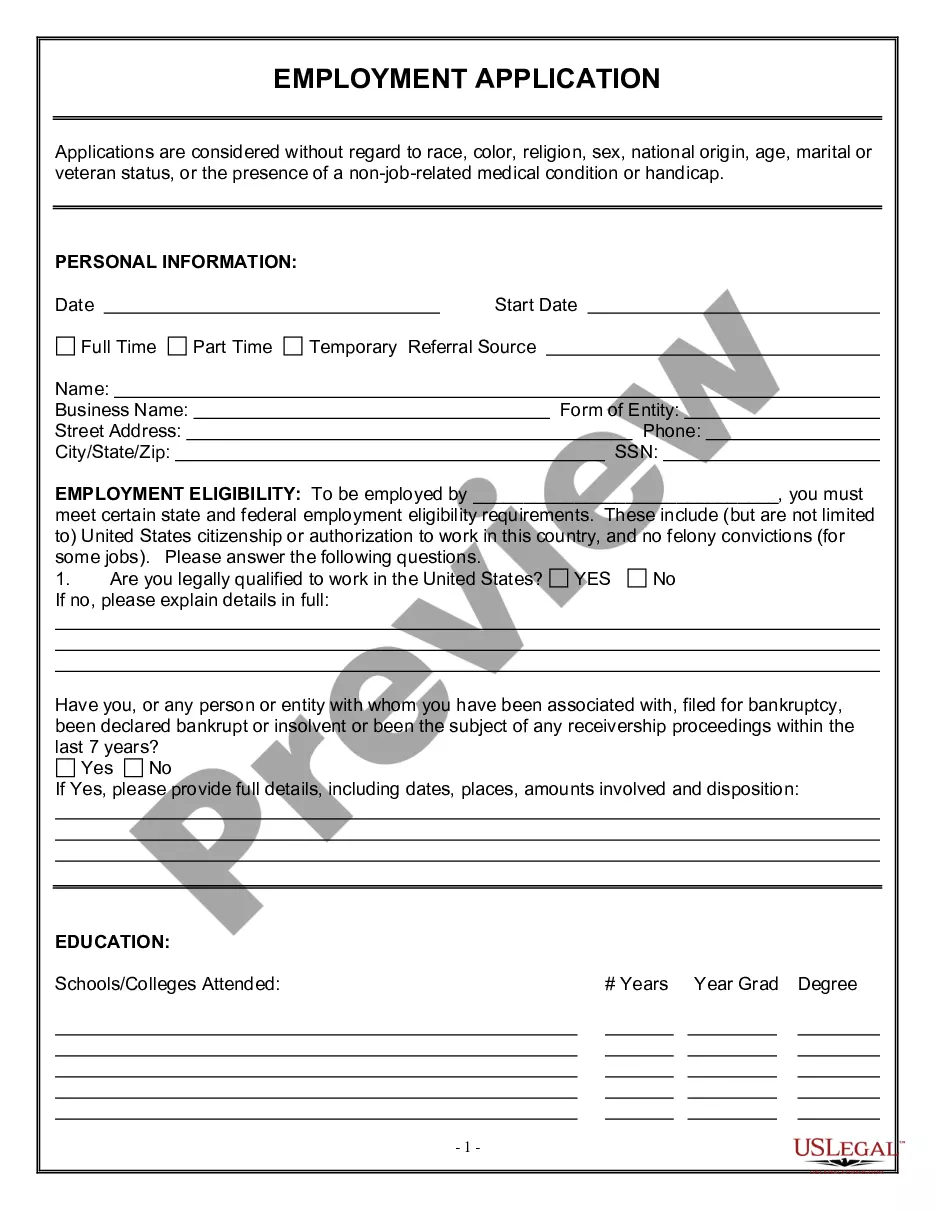

How to fill out Round Rock Texas Amendment To Postnuptial Property Agreement?

Do you need a reliable and affordable legal forms provider to buy the Round Rock Amendment to Postnuptial Property Agreement - Texas? US Legal Forms is your go-to choice.

No matter if you require a simple agreement to set rules for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked in accordance with the requirements of separate state and area.

To download the form, you need to log in account, find the required template, and hit the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Round Rock Amendment to Postnuptial Property Agreement - Texas conforms to the regulations of your state and local area.

- Read the form’s details (if available) to learn who and what the form is intended for.

- Start the search over in case the template isn’t good for your legal situation.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Round Rock Amendment to Postnuptial Property Agreement - Texas in any available file format. You can return to the website when you need and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting your valuable time learning about legal paperwork online for good.