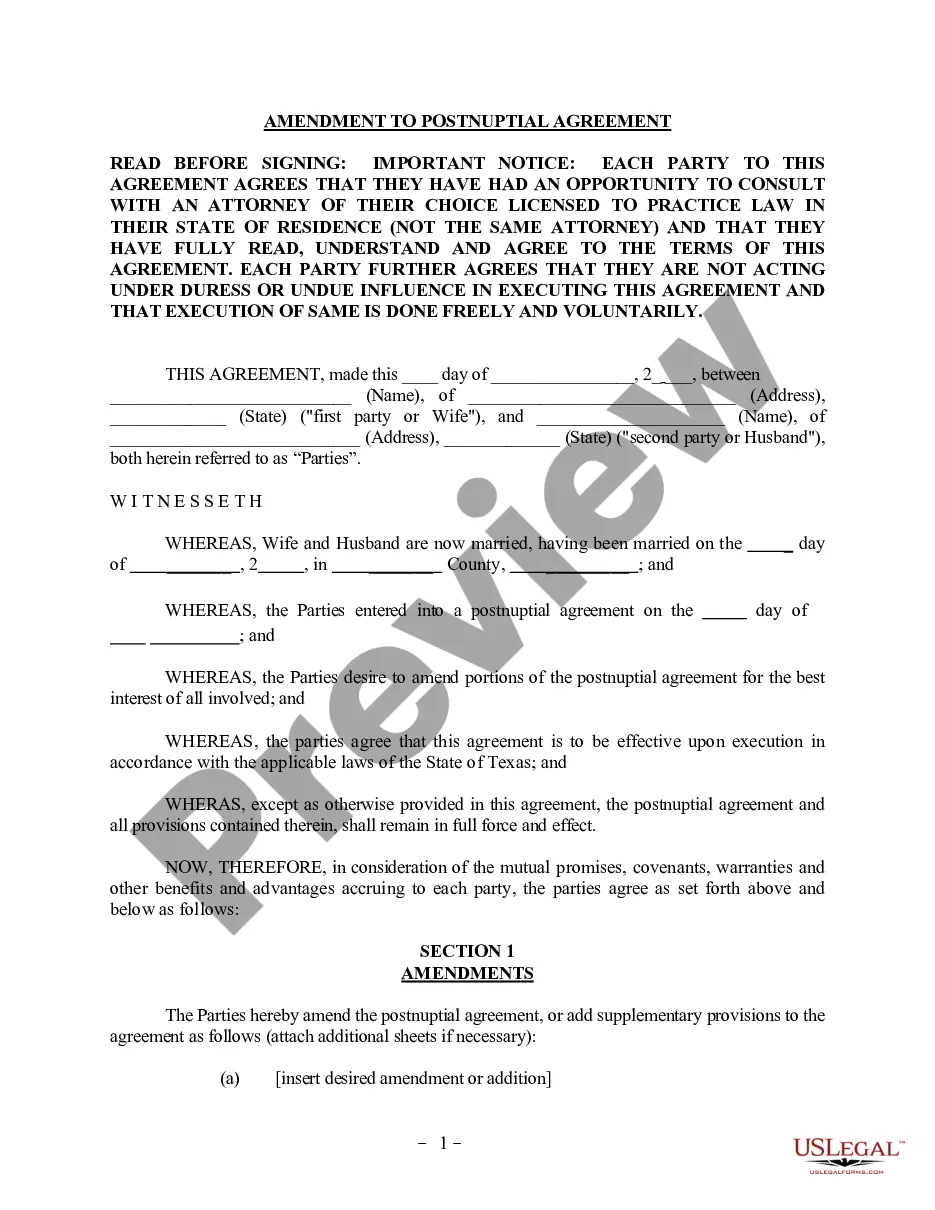

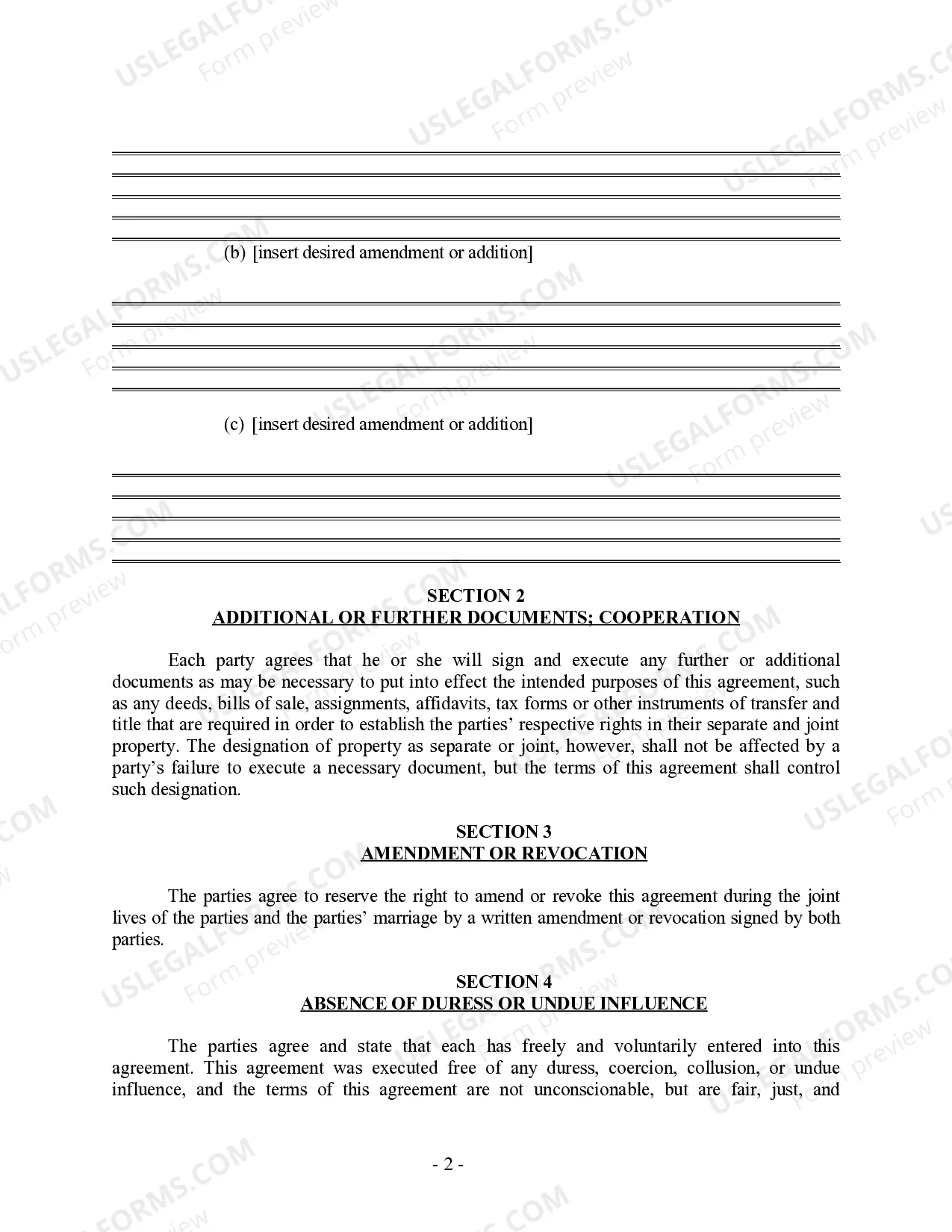

The Tarrant Amendment to Postnuptial Property Agreement is a crucial legal provision in the state of Texas that addresses specific aspects of property division and distribution in postnuptial agreements. This amendment is necessary to ensure clarity and certainty in the event of a divorce or separation for couples residing in Texas. By incorporating the Tarrant Amendment into a postnuptial property agreement, couples can effectively outline their agreed-upon terms for asset and debt allocation, saving them from potential disputes and confusion in the future. The Tarrant Amendment to Postnuptial Property Agreement regulates several key elements of property division, including both community and separate property. Community property refers to assets acquired during the course of the marriage, while separate property consists of assets owned by each individual prior to marriage or acquired separately during the union. The amendment clarifies the classification and distribution of these property types, ensuring that both parties have a comprehensive understanding of their rights and responsibilities. There are different types of Tarrant Amendments to Postnuptial Property Agreements, each tailored to address various specific circumstances. These variations allow couples to customize their agreements according to their unique needs and preferences. Some common types of Tarrant Amendments include: 1. Tarrant Amendment addressing real estate: This type of amendment focuses specifically on the division and distribution of real property, such as houses, land, or commercial buildings, considering factors like equity, mortgage, and potential appreciation. 2. Tarrant Amendment regarding investment portfolios: Couples with significant investments, such as stocks, bonds, or retirement accounts, may opt for this amendment to establish guidelines for the division of these assets, including any accrued interests or potential gains. 3. Tarrant Amendment for business interests: For couples who jointly own or have ownership stakes in businesses, this amendment ensures a clear division of assets or interests in case of divorce or separation, preventing potential conflicts over the fate of the business. 4. Tarrant Amendment addressing debt allocation: This type of amendment focuses on outlining how debts, such as credit card debt, mortgages, or loans, will be allocated between the parties in the event of a divorce, protecting individuals from being burdened with the entirety of the debt. By recognizing the importance of the Tarrant Amendment to Postnuptial Property Agreements, couples in Texas can navigate the complexities of property division with clarity and confidence. Seeking professional legal advice is highly recommended ensuring the accurate and lawful incorporation of such amendments into their postnuptial agreements.

Tarrant Texas Amendment to Postnuptial Property Agreement

Description

How to fill out Tarrant Texas Amendment To Postnuptial Property Agreement?

Make use of the US Legal Forms and have immediate access to any form you require. Our helpful platform with thousands of templates allows you to find and get virtually any document sample you need. You are able to download, fill, and certify the Tarrant Amendment to Postnuptial Property Agreement - Texas in just a matter of minutes instead of surfing the Net for several hours seeking an appropriate template.

Using our library is a great strategy to raise the safety of your form filing. Our professional legal professionals on a regular basis check all the records to ensure that the templates are appropriate for a particular region and compliant with new laws and regulations.

How do you obtain the Tarrant Amendment to Postnuptial Property Agreement - Texas? If you already have a subscription, just log in to the account. The Download option will be enabled on all the samples you view. In addition, you can get all the previously saved documents in the My Forms menu.

If you haven’t registered a profile yet, follow the instruction listed below:

- Find the form you require. Ensure that it is the template you were seeking: examine its headline and description, and take take advantage of the Preview function when it is available. Otherwise, make use of the Search field to find the needed one.

- Start the downloading process. Click Buy Now and select the pricing plan that suits you best. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Download the file. Indicate the format to obtain the Tarrant Amendment to Postnuptial Property Agreement - Texas and edit and fill, or sign it according to your requirements.

US Legal Forms is one of the most considerable and trustworthy template libraries on the internet. We are always ready to help you in virtually any legal procedure, even if it is just downloading the Tarrant Amendment to Postnuptial Property Agreement - Texas.

Feel free to benefit from our form catalog and make your document experience as straightforward as possible!