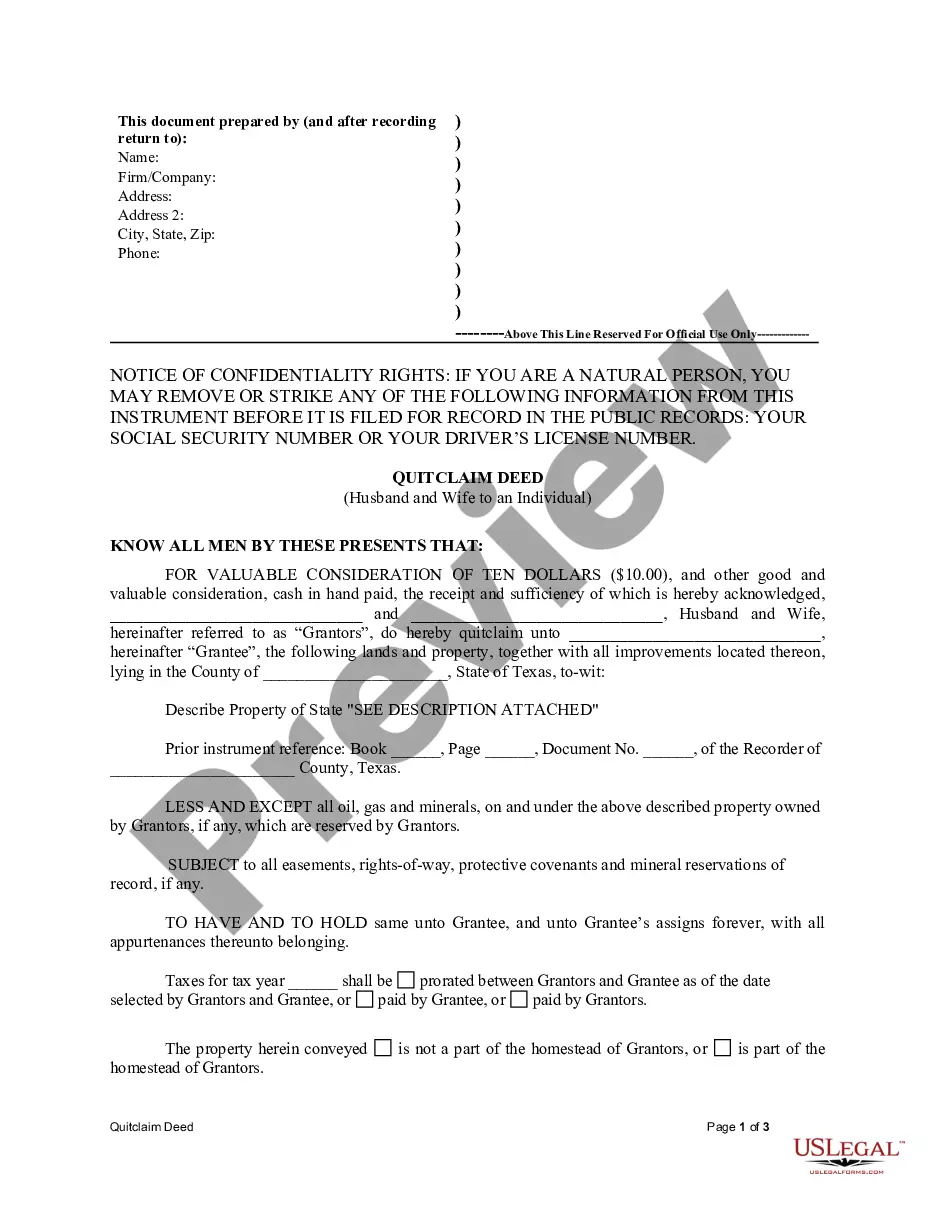

This form is a Quitclaim Deed where the grantors are husband and wife and the grantee is an individual. Grantors convey and quitclaim the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Collin Texas Quitclaim Deed from Husband and Wife to an Individual is a legal document that transfers the ownership interest of a property located in Collin County, Texas, from a married couple to a specific individual. This type of deed is commonly used when one or both spouses wish to transfer their ownership rights to another person, often as part of a divorce proceeding or for estate planning purposes. A Collin Texas Quitclaim Deed from Husband and Wife to an Individual can be further categorized into different types depending on the specific circumstances. Some key variations include: 1. Joint Tenancy with Right of Survivorship: This type of quitclaim deed grants ownership to the individual in a joint tenancy with the husband and wife. In the event of the death of either spouse, the surviving spouse automatically assumes full ownership rights. 2. Tenants in Common: In this variant, the ownership rights are divided equally between the husband, wife, and the individual. Each party has a distinct and separate share of the property, which they can transfer or sell independently. 3. Community Property: This type of quitclaim deed is applicable when the property is classified as "community property" under Texas law. Here, the husband and wife transfer their joint ownership interest to the individual, while acknowledging their marital community interest, if any. 4. Divorce Settlement: A Collin Texas Quitclaim Deed from Husband and Wife to an Individual can also be specifically tailored for situations where the transfer of property is part of a divorce settlement. It helps facilitate the equitable distribution of assets between spouses. When preparing a Collin Texas Quitclaim Deed from Husband and Wife to an Individual, it is crucial to include relevant details such as the legal description of the property, the full names and addresses of the husband, wife, and the individual recipient, and any financial considerations involved in the transfer. Additionally, it is advisable to seek the guidance of a qualified real estate attorney to ensure compliance with all local laws and regulations.A Collin Texas Quitclaim Deed from Husband and Wife to an Individual is a legal document that transfers the ownership interest of a property located in Collin County, Texas, from a married couple to a specific individual. This type of deed is commonly used when one or both spouses wish to transfer their ownership rights to another person, often as part of a divorce proceeding or for estate planning purposes. A Collin Texas Quitclaim Deed from Husband and Wife to an Individual can be further categorized into different types depending on the specific circumstances. Some key variations include: 1. Joint Tenancy with Right of Survivorship: This type of quitclaim deed grants ownership to the individual in a joint tenancy with the husband and wife. In the event of the death of either spouse, the surviving spouse automatically assumes full ownership rights. 2. Tenants in Common: In this variant, the ownership rights are divided equally between the husband, wife, and the individual. Each party has a distinct and separate share of the property, which they can transfer or sell independently. 3. Community Property: This type of quitclaim deed is applicable when the property is classified as "community property" under Texas law. Here, the husband and wife transfer their joint ownership interest to the individual, while acknowledging their marital community interest, if any. 4. Divorce Settlement: A Collin Texas Quitclaim Deed from Husband and Wife to an Individual can also be specifically tailored for situations where the transfer of property is part of a divorce settlement. It helps facilitate the equitable distribution of assets between spouses. When preparing a Collin Texas Quitclaim Deed from Husband and Wife to an Individual, it is crucial to include relevant details such as the legal description of the property, the full names and addresses of the husband, wife, and the individual recipient, and any financial considerations involved in the transfer. Additionally, it is advisable to seek the guidance of a qualified real estate attorney to ensure compliance with all local laws and regulations.