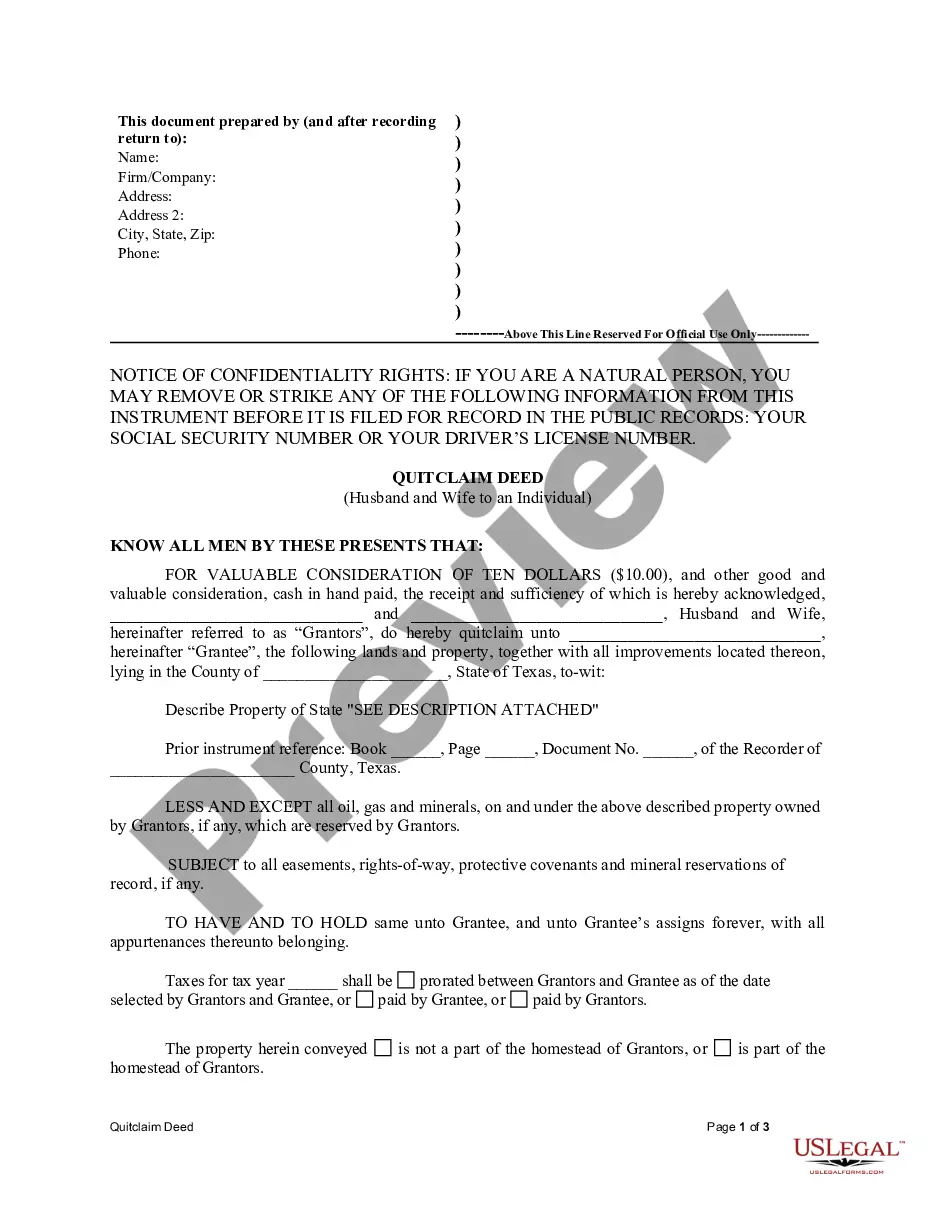

This form is a Quitclaim Deed where the grantors are husband and wife and the grantee is an individual. Grantors convey and quitclaim the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Title: Understanding Harris Texas Quitclaim Deed from Husband and Wife to an Individual keyword: Harris Texas Quitclaim Deed, Husband and Wife, Individual, Property Transfer, Real Estate, Legal Document Introduction: A Harris Texas Quitclaim Deed from Husband and Wife to an Individual is a legal document used to transfer ownership of real property from a married couple to another individual. In this article, we will explore the specifics of this deed type and discuss any variations or different types that may exist. 1. Purpose and Benefits of the Harris Texas Quitclaim Deed: The primary purpose of a Harris Texas Quitclaim Deed from Husband and Wife to an Individual is to legally convey the ownership interests of the married couple to a designated individual. It allows for a seamless transfer of property rights without warranties or guarantees of title. This means that the individual receiving the property takes it as is, assuming any potential risks or encumbrances. 2. Key Elements of the Harris Texas Quitclaim Deed: a. Granter: The husband and wife acting as the granters, representing their joint ownership of the property. b. Grantee: The individual who will receive ownership of the property from the granters. c. Legal Description: A detailed description of the property being transferred, including boundaries, lot numbers, and any other pertinent details. 3. Different Types of Harris Texas Quitclaim Deed from Husband and Wife to an Individual: While the basic concept remains the same, there might be variations or additional types of quitclaim deeds based on specific circumstances. Some common variations include: a. Harris Texas Quitclaim Deed with Survivorship Rights: This type of deed ensures that if one spouse passes away, the surviving spouse automatically becomes the sole owner. b. Harris Texas Quitclaim Deed with Marital Release: In situations of divorce or separation, this deed transfers property rights from the married couple to an individual while releasing any obligations or claims each spouse may have against the other. 4. Process of Executing the Harris Texas Quitclaim Deed: To execute a Harris Texas Quitclaim Deed from Husband and Wife to an Individual, the following steps are typically involved: a. Drafting the Deed: Consult an attorney or use a reliable legal template to create the deed with accurate information. b. Notarization: Parties involved must sign the deed in the presence of a notary public, who verifies their identities. c. File the Deed: File the executed deed with the county clerk's office where the property is located to make it a matter of public record. Conclusion: The Harris Texas Quitclaim Deed from Husband and Wife to an Individual serves as a legal instrument for transferring property ownership between a married couple and an individual with minimal legal guarantees. Understanding the specific details and variations of this deed ensures a smooth and legally binding transfer, safeguarding the interests of all parties involved.Title: Understanding Harris Texas Quitclaim Deed from Husband and Wife to an Individual keyword: Harris Texas Quitclaim Deed, Husband and Wife, Individual, Property Transfer, Real Estate, Legal Document Introduction: A Harris Texas Quitclaim Deed from Husband and Wife to an Individual is a legal document used to transfer ownership of real property from a married couple to another individual. In this article, we will explore the specifics of this deed type and discuss any variations or different types that may exist. 1. Purpose and Benefits of the Harris Texas Quitclaim Deed: The primary purpose of a Harris Texas Quitclaim Deed from Husband and Wife to an Individual is to legally convey the ownership interests of the married couple to a designated individual. It allows for a seamless transfer of property rights without warranties or guarantees of title. This means that the individual receiving the property takes it as is, assuming any potential risks or encumbrances. 2. Key Elements of the Harris Texas Quitclaim Deed: a. Granter: The husband and wife acting as the granters, representing their joint ownership of the property. b. Grantee: The individual who will receive ownership of the property from the granters. c. Legal Description: A detailed description of the property being transferred, including boundaries, lot numbers, and any other pertinent details. 3. Different Types of Harris Texas Quitclaim Deed from Husband and Wife to an Individual: While the basic concept remains the same, there might be variations or additional types of quitclaim deeds based on specific circumstances. Some common variations include: a. Harris Texas Quitclaim Deed with Survivorship Rights: This type of deed ensures that if one spouse passes away, the surviving spouse automatically becomes the sole owner. b. Harris Texas Quitclaim Deed with Marital Release: In situations of divorce or separation, this deed transfers property rights from the married couple to an individual while releasing any obligations or claims each spouse may have against the other. 4. Process of Executing the Harris Texas Quitclaim Deed: To execute a Harris Texas Quitclaim Deed from Husband and Wife to an Individual, the following steps are typically involved: a. Drafting the Deed: Consult an attorney or use a reliable legal template to create the deed with accurate information. b. Notarization: Parties involved must sign the deed in the presence of a notary public, who verifies their identities. c. File the Deed: File the executed deed with the county clerk's office where the property is located to make it a matter of public record. Conclusion: The Harris Texas Quitclaim Deed from Husband and Wife to an Individual serves as a legal instrument for transferring property ownership between a married couple and an individual with minimal legal guarantees. Understanding the specific details and variations of this deed ensures a smooth and legally binding transfer, safeguarding the interests of all parties involved.