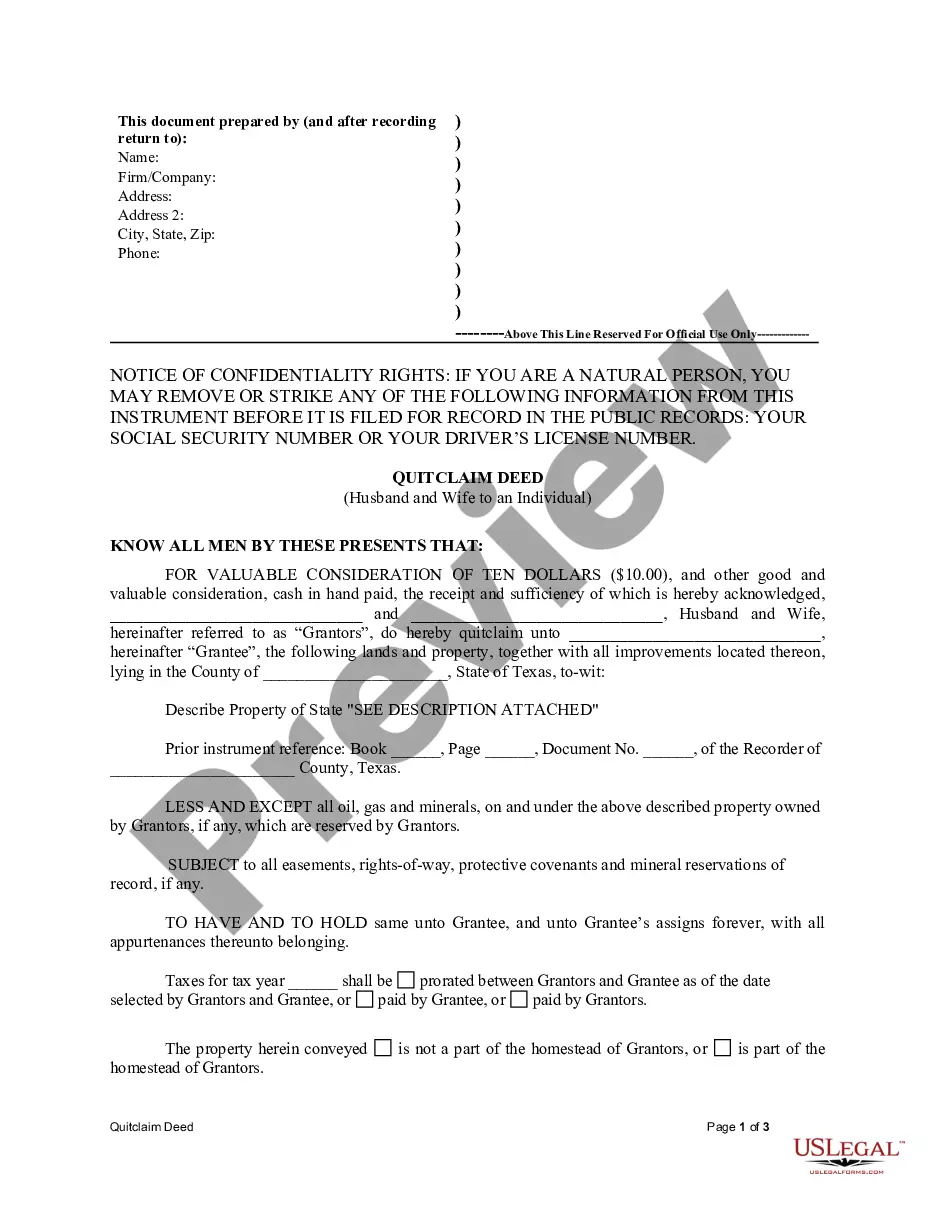

This form is a Quitclaim Deed where the grantors are husband and wife and the grantee is an individual. Grantors convey and quitclaim the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Lewisville Texas Quitclaim Deed from Husband and Wife to an Individual is a legal document used for the transfer of property ownership rights from a married couple to a singular individual. This type of deed is commonly utilized in cases where the couple wants to transfer their interest in the property to a third party, such as in cases of divorce, gifting, or estate planning. A Quitclaim Deed is a specific type of deed used in Texas real estate transactions. It provides a straightforward and rapid method to transfer property ownership rights, but it does not provide any guarantees or warranties about the property's title. Instead, it simply conveys whatever interest the granter (the husband and wife in this case) has in the property to the grantee (the individual receiving the property). There are a few different types of Lewisville Texas Quitclaim Deed from Husband and Wife to an Individual, which may include: 1. Divorce Quitclaim Deed: This type of quitclaim deed is used to transfer property ownership from a divorcing couple to one spouse individually. It ensures that one spouse relinquishes their rights and interests in the property to the other spouse. 2. Gift Quitclaim Deed: Sometimes, a married couple might want to gift a property to an individual, such as a family member or a close friend. In such cases, they can use a Gift Quitclaim Deed to transfer ownership rights. 3. Estate Planning Quitclaim Deed: In estate planning, a Lewisville Texas Quitclaim Deed from Husband and Wife to an Individual can be utilized to transfer property to a specific individual as part of the couple's estate plan. This type of deed allows the couple to determine how their property should be distributed upon their death. 4. Financial Agreement Quitclaim Deed: Occasionally, a husband and wife may use a Quitclaim Deed to transfer ownership of the property to an individual as part of a financial agreement or arrangement. This could include repayment of a loan or a settlement agreement. In all cases, it is essential to consult with a qualified attorney or real estate professional well-versed in Texas real estate laws to ensure that the quitclaim deed is properly prepared, executed, and recorded.A Lewisville Texas Quitclaim Deed from Husband and Wife to an Individual is a legal document used for the transfer of property ownership rights from a married couple to a singular individual. This type of deed is commonly utilized in cases where the couple wants to transfer their interest in the property to a third party, such as in cases of divorce, gifting, or estate planning. A Quitclaim Deed is a specific type of deed used in Texas real estate transactions. It provides a straightforward and rapid method to transfer property ownership rights, but it does not provide any guarantees or warranties about the property's title. Instead, it simply conveys whatever interest the granter (the husband and wife in this case) has in the property to the grantee (the individual receiving the property). There are a few different types of Lewisville Texas Quitclaim Deed from Husband and Wife to an Individual, which may include: 1. Divorce Quitclaim Deed: This type of quitclaim deed is used to transfer property ownership from a divorcing couple to one spouse individually. It ensures that one spouse relinquishes their rights and interests in the property to the other spouse. 2. Gift Quitclaim Deed: Sometimes, a married couple might want to gift a property to an individual, such as a family member or a close friend. In such cases, they can use a Gift Quitclaim Deed to transfer ownership rights. 3. Estate Planning Quitclaim Deed: In estate planning, a Lewisville Texas Quitclaim Deed from Husband and Wife to an Individual can be utilized to transfer property to a specific individual as part of the couple's estate plan. This type of deed allows the couple to determine how their property should be distributed upon their death. 4. Financial Agreement Quitclaim Deed: Occasionally, a husband and wife may use a Quitclaim Deed to transfer ownership of the property to an individual as part of a financial agreement or arrangement. This could include repayment of a loan or a settlement agreement. In all cases, it is essential to consult with a qualified attorney or real estate professional well-versed in Texas real estate laws to ensure that the quitclaim deed is properly prepared, executed, and recorded.