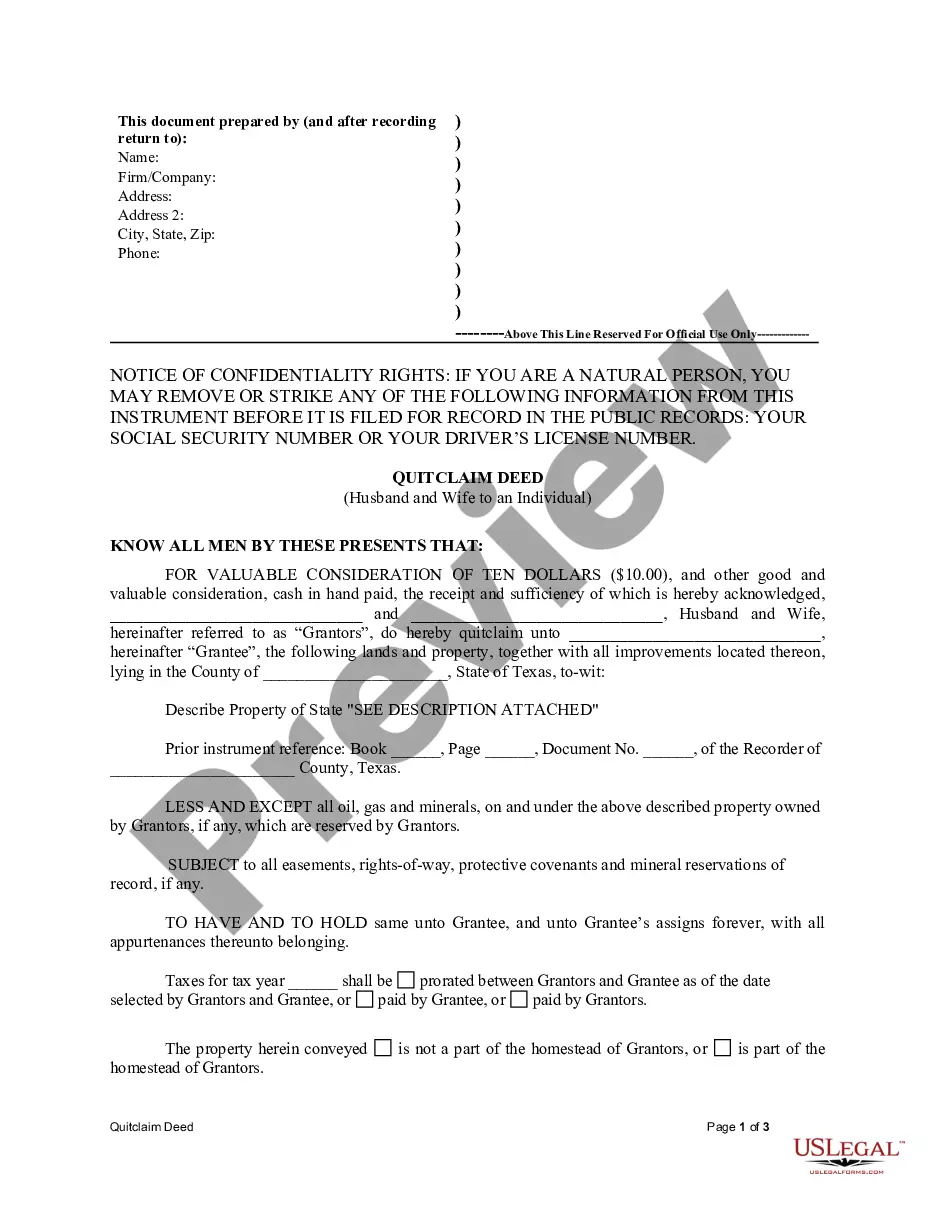

This form is a Quitclaim Deed where the grantors are husband and wife and the grantee is an individual. Grantors convey and quitclaim the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Mesquite Texas Quitclaim Deed from Husband and Wife to an Individual: A Comprehensive Guide A Mesquite Texas Quitclaim Deed from Husband and Wife to an Individual is a legal document used to transfer property ownership rights from a married couple to an individual without any warranties or guarantees. This type of deed is typically utilized in situations such as divorce settlements, estate planning, or gifting property to someone other than a spouse. Keywords: Mesquite Texas Quitclaim Deed, Husband and Wife, Individual, property ownership, legal document, transfer, warranties, divorce settlements, estate planning, gifting. Different Types of Mesquite Texas Quitclaim Deed from Husband and Wife to an Individual: 1. Divorce Settlement Quitclaim Deed: In cases of divorce, where a couple jointly owns real estate, a Quitclaim Deed is often used to transfer the property from both spouses to one individual. This deed is commonly employed to secure the rights of one spouse over the marital property while relinquishing the other spouse's claim. 2. Estate Planning Quitclaim Deed: When a married couple wishes to include a third party or an individual outside the marriage as a beneficiary for a property, an Estate Planning Quitclaim Deed can be used. This deed enables the transfer of ownership rights to the designated beneficiary while clarifying the intentions of the couple regarding the property distribution. 3. Gifting Quitclaim Deed: A gifting Quitclaim Deed from Husband and Wife to an Individual allows couples to voluntarily gift their property to a specific person or entity. Whether it's transferring ownership of a family home to their child or donating the property for charitable purposes, this deed helps facilitate the legal transfer of title smoothly. Note: It is essential to consult with a qualified attorney or legal professional familiar with Texas laws and regulations to ensure the proper execution and recording of these deeds.Mesquite Texas Quitclaim Deed from Husband and Wife to an Individual: A Comprehensive Guide A Mesquite Texas Quitclaim Deed from Husband and Wife to an Individual is a legal document used to transfer property ownership rights from a married couple to an individual without any warranties or guarantees. This type of deed is typically utilized in situations such as divorce settlements, estate planning, or gifting property to someone other than a spouse. Keywords: Mesquite Texas Quitclaim Deed, Husband and Wife, Individual, property ownership, legal document, transfer, warranties, divorce settlements, estate planning, gifting. Different Types of Mesquite Texas Quitclaim Deed from Husband and Wife to an Individual: 1. Divorce Settlement Quitclaim Deed: In cases of divorce, where a couple jointly owns real estate, a Quitclaim Deed is often used to transfer the property from both spouses to one individual. This deed is commonly employed to secure the rights of one spouse over the marital property while relinquishing the other spouse's claim. 2. Estate Planning Quitclaim Deed: When a married couple wishes to include a third party or an individual outside the marriage as a beneficiary for a property, an Estate Planning Quitclaim Deed can be used. This deed enables the transfer of ownership rights to the designated beneficiary while clarifying the intentions of the couple regarding the property distribution. 3. Gifting Quitclaim Deed: A gifting Quitclaim Deed from Husband and Wife to an Individual allows couples to voluntarily gift their property to a specific person or entity. Whether it's transferring ownership of a family home to their child or donating the property for charitable purposes, this deed helps facilitate the legal transfer of title smoothly. Note: It is essential to consult with a qualified attorney or legal professional familiar with Texas laws and regulations to ensure the proper execution and recording of these deeds.