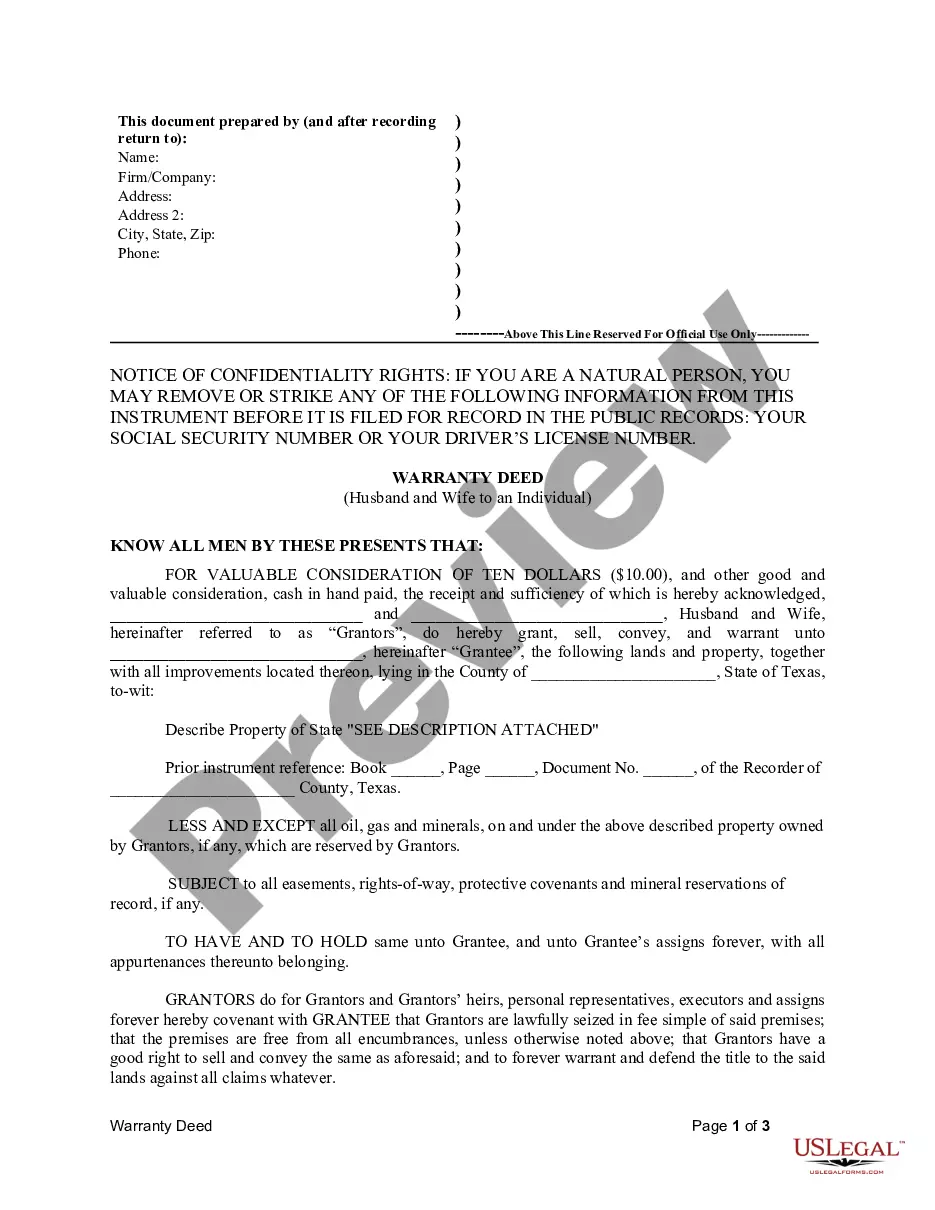

This form is a Warranty Deed where the grantors are husband and wife and the grantee is an individual. Grantors convey and warrant the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Title: Understanding the Grand Prairie Texas Warranty Deed from Husband and Wife to an Individual: Types and Details Introduction: The Grand Prairie Texas Warranty Deed from Husband and Wife to an Individual is a legal document used to transfer ownership of real estate property in Grand Prairie, Texas. This comprehensive guide will provide a detailed description of this deed, including its purpose, key elements, and potential types. 1. What is a Grand Prairie Texas Warranty Deed from Husband and Wife to an Individual? A Grand Prairie Texas Warranty Deed from Husband and Wife to an Individual is a legal instrument used by married couples to transfer their joint ownership rights to a third-party individual. This deed provides a guarantee that the property is free from any undisclosed encumbrances or claims, except those specifically mentioned in the deed. 2. Key Elements of a Grand Prairie Texas Warranty Deed from Husband and Wife to an Individual: Granteror(s): The husband and wife, collectively referred to as the granter(s), who currently own the property being transferred. — Grantee: The individual who will receive ownership of the property. — Property Description: Precise details describing the property being transferred, including its legal description, address, and any additional identifying elements. — Consideration: The amount of money or other value agreed upon by the parties involved. — Covenants: A set of promises made by the granter(s), ensuring that the property is free from undisclosed claims, liens, or encumbrances. — Signatures and Notarization: The deed must be signed by both granter(s) and notarized to be considered legally valid. Types of Grand Prairie Texas Warranty Deed from Husband and Wife to an Individual: 1. General Warranty Deed: This type of deed offers the broadest level of protection for the grantee, as it guarantees the property's title against all claims, regardless of when they arose. 2. Special Warranty Deed: A special warranty deed provides a more limited level of protection compared to a general warranty deed. The granter(s) only warrant against claims that may have arisen during their ownership, excluding any prior claims. 3. Quitclaim Deed: Although not a warranty deed, the quitclaim deed is worth mentioning. Unlike the warranty deeds, a quitclaim deed provides no guarantees or warranties regarding the property's title. It simply transfers the current ownership interest of the granter(s) to the individual, if any. Conclusion: Understanding the Grand Prairie Texas Warranty Deed from Husband and Wife to an Individual is crucial when involved in property transfers. Whether it's a general warranty deed, special warranty deed, or quitclaim deed, ensuring a comprehensive understanding of these types and their key elements is vital to protect the rights and interests of all parties involved in the transaction. Always consult a legal professional to guarantee absolute accuracy and adherence to local laws and regulations during the process.Title: Understanding the Grand Prairie Texas Warranty Deed from Husband and Wife to an Individual: Types and Details Introduction: The Grand Prairie Texas Warranty Deed from Husband and Wife to an Individual is a legal document used to transfer ownership of real estate property in Grand Prairie, Texas. This comprehensive guide will provide a detailed description of this deed, including its purpose, key elements, and potential types. 1. What is a Grand Prairie Texas Warranty Deed from Husband and Wife to an Individual? A Grand Prairie Texas Warranty Deed from Husband and Wife to an Individual is a legal instrument used by married couples to transfer their joint ownership rights to a third-party individual. This deed provides a guarantee that the property is free from any undisclosed encumbrances or claims, except those specifically mentioned in the deed. 2. Key Elements of a Grand Prairie Texas Warranty Deed from Husband and Wife to an Individual: Granteror(s): The husband and wife, collectively referred to as the granter(s), who currently own the property being transferred. — Grantee: The individual who will receive ownership of the property. — Property Description: Precise details describing the property being transferred, including its legal description, address, and any additional identifying elements. — Consideration: The amount of money or other value agreed upon by the parties involved. — Covenants: A set of promises made by the granter(s), ensuring that the property is free from undisclosed claims, liens, or encumbrances. — Signatures and Notarization: The deed must be signed by both granter(s) and notarized to be considered legally valid. Types of Grand Prairie Texas Warranty Deed from Husband and Wife to an Individual: 1. General Warranty Deed: This type of deed offers the broadest level of protection for the grantee, as it guarantees the property's title against all claims, regardless of when they arose. 2. Special Warranty Deed: A special warranty deed provides a more limited level of protection compared to a general warranty deed. The granter(s) only warrant against claims that may have arisen during their ownership, excluding any prior claims. 3. Quitclaim Deed: Although not a warranty deed, the quitclaim deed is worth mentioning. Unlike the warranty deeds, a quitclaim deed provides no guarantees or warranties regarding the property's title. It simply transfers the current ownership interest of the granter(s) to the individual, if any. Conclusion: Understanding the Grand Prairie Texas Warranty Deed from Husband and Wife to an Individual is crucial when involved in property transfers. Whether it's a general warranty deed, special warranty deed, or quitclaim deed, ensuring a comprehensive understanding of these types and their key elements is vital to protect the rights and interests of all parties involved in the transaction. Always consult a legal professional to guarantee absolute accuracy and adherence to local laws and regulations during the process.