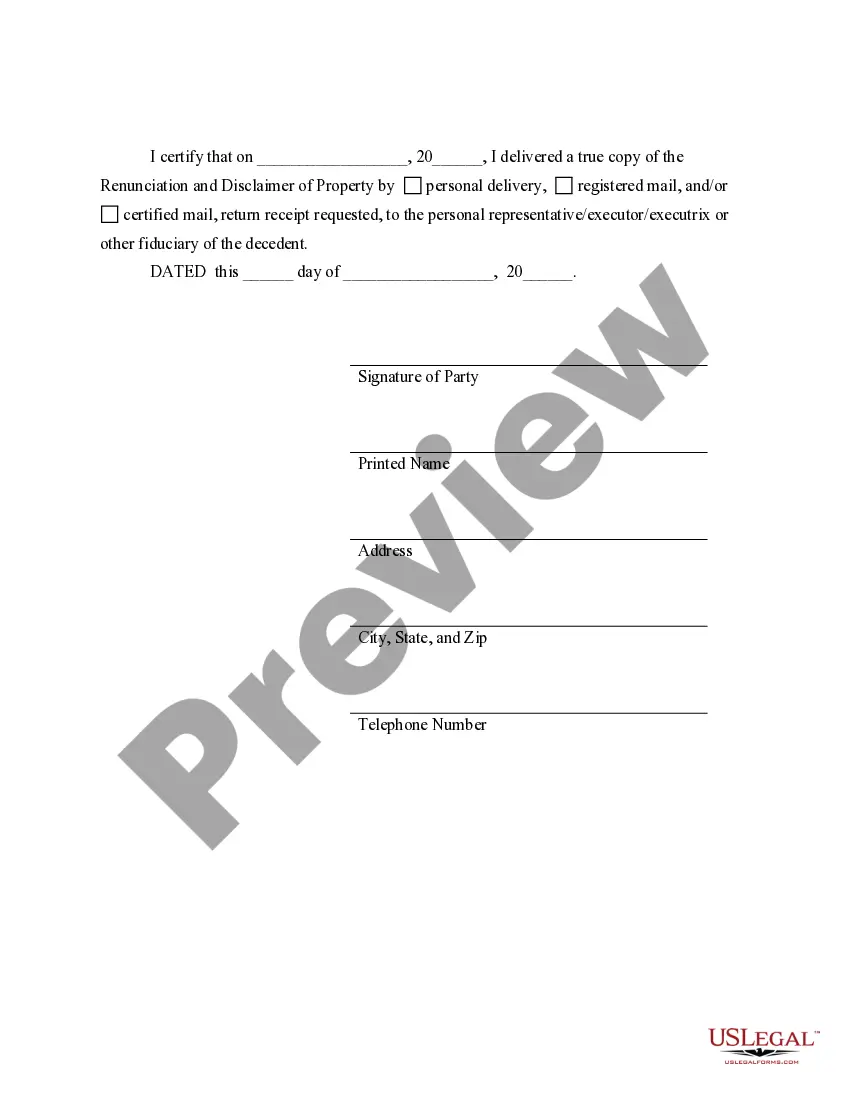

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property, but, will terminate a portion of or the entire interest in the property pursuant to the Texas Statutes, Chapter II. The property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Collin Texas Renunciation And Disclaimer of Property received by Intestate Succession is an important legal process that individuals need to be familiar with to effectively handle estates and property distribution in Collin County, Texas. When an individual passes away without a valid will, their property is distributed based on the rules of intestate succession. However, in certain situations, beneficiaries may choose to renounce or disclaim their right to inherit the property. Renunciation refers to the act of formally rejecting the inheritance or property rights vested upon a beneficiary through intestate succession. A Collin Texas Renunciation And Disclaimer of Property document, also known as a renunciation form, allows the beneficiary to waive their claim to a share of the estate. By renouncing their rights, beneficiaries can avoid assuming any obligations or liabilities associated with the inherited property. In Collin County, Texas, there are two main types of renunciation and disclaimer options available for beneficiaries: 1. Collin Texas Renunciation And Disclaimer of Property to Qualify for Medicaid: This type of renunciation is commonly used when a beneficiary is eligible or planning to become eligible for Medicaid benefits. Medicaid is a government program that provides healthcare coverage for low-income individuals and families. By renouncing their inheritance, beneficiaries can prevent the inherited property from being considered as an asset for Medicaid eligibility purposes. This can help individuals qualify for Medicaid benefits without jeopardizing their eligibility. 2. Collin Texas Renunciation And Disclaimer of Property to Avoid Debts or Liabilities: Beneficiaries may choose to renounce their inheritance to prevent potential debts or liabilities associated with the inherited property. When someone passes away, their debts and liabilities typically become the responsibility of the beneficiaries. By renouncing their rights, beneficiaries can protect themselves from assuming any financial burdens that come with the property, such as outstanding mortgage payments, liens, or legal claims. It is important to note that when a beneficiary renounces their inheritance, the property does not automatically pass on to the next beneficiary in line. Instead, it is distributed according to the laws of intestate succession as if the renouncing beneficiary had predeceased the decedent. This means that the renounced share would be distributed to the other eligible heirs or beneficiaries based on their relationship with the decedent. To initiate the Collin Texas Renunciation And Disclaimer of Property process, beneficiaries must complete a formal renunciation form, which includes detailed information about the beneficiary, the decedent, and the renounced property. The renunciation form must be filed with the appropriate probate court in Collin County within a specified timeframe, usually within a few months of the decedent's passing. In conclusion, Collin Texas Renunciation And Disclaimer of Property received by Intestate Succession provide beneficiaries with the option to waive their inheritance rights for various reasons such as protecting Medicaid eligibility or avoiding potential debts and liabilities. Initiating this process requires completing a renunciation form and filing it with the appropriate probate court. Understanding the implications and types of renunciation available can help beneficiaries make informed decisions regarding their inheritance.Collin Texas Renunciation And Disclaimer of Property received by Intestate Succession is an important legal process that individuals need to be familiar with to effectively handle estates and property distribution in Collin County, Texas. When an individual passes away without a valid will, their property is distributed based on the rules of intestate succession. However, in certain situations, beneficiaries may choose to renounce or disclaim their right to inherit the property. Renunciation refers to the act of formally rejecting the inheritance or property rights vested upon a beneficiary through intestate succession. A Collin Texas Renunciation And Disclaimer of Property document, also known as a renunciation form, allows the beneficiary to waive their claim to a share of the estate. By renouncing their rights, beneficiaries can avoid assuming any obligations or liabilities associated with the inherited property. In Collin County, Texas, there are two main types of renunciation and disclaimer options available for beneficiaries: 1. Collin Texas Renunciation And Disclaimer of Property to Qualify for Medicaid: This type of renunciation is commonly used when a beneficiary is eligible or planning to become eligible for Medicaid benefits. Medicaid is a government program that provides healthcare coverage for low-income individuals and families. By renouncing their inheritance, beneficiaries can prevent the inherited property from being considered as an asset for Medicaid eligibility purposes. This can help individuals qualify for Medicaid benefits without jeopardizing their eligibility. 2. Collin Texas Renunciation And Disclaimer of Property to Avoid Debts or Liabilities: Beneficiaries may choose to renounce their inheritance to prevent potential debts or liabilities associated with the inherited property. When someone passes away, their debts and liabilities typically become the responsibility of the beneficiaries. By renouncing their rights, beneficiaries can protect themselves from assuming any financial burdens that come with the property, such as outstanding mortgage payments, liens, or legal claims. It is important to note that when a beneficiary renounces their inheritance, the property does not automatically pass on to the next beneficiary in line. Instead, it is distributed according to the laws of intestate succession as if the renouncing beneficiary had predeceased the decedent. This means that the renounced share would be distributed to the other eligible heirs or beneficiaries based on their relationship with the decedent. To initiate the Collin Texas Renunciation And Disclaimer of Property process, beneficiaries must complete a formal renunciation form, which includes detailed information about the beneficiary, the decedent, and the renounced property. The renunciation form must be filed with the appropriate probate court in Collin County within a specified timeframe, usually within a few months of the decedent's passing. In conclusion, Collin Texas Renunciation And Disclaimer of Property received by Intestate Succession provide beneficiaries with the option to waive their inheritance rights for various reasons such as protecting Medicaid eligibility or avoiding potential debts and liabilities. Initiating this process requires completing a renunciation form and filing it with the appropriate probate court. Understanding the implications and types of renunciation available can help beneficiaries make informed decisions regarding their inheritance.