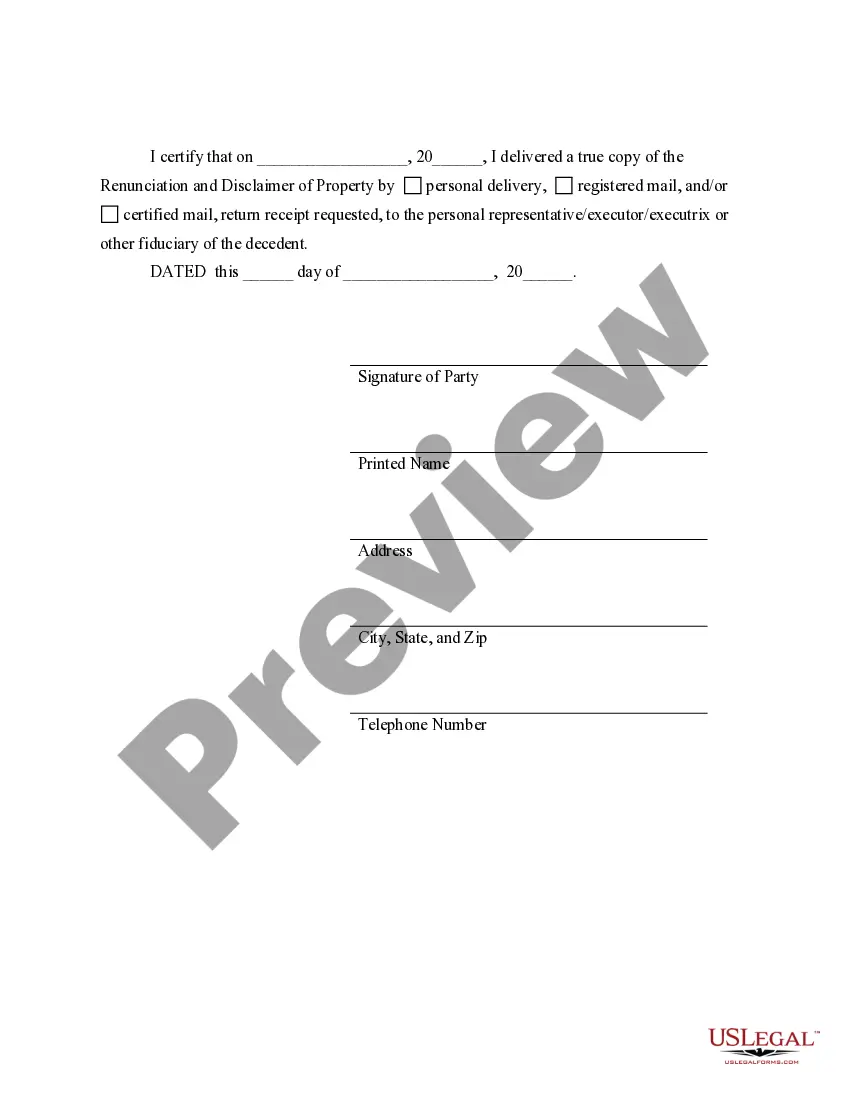

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the property, but, will terminate a portion of or the entire interest in the property pursuant to the Texas Statutes, Chapter II. The property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Corpus Christi Texas Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Texas Renunciation And Disclaimer Of Property Received By Intestate Succession?

Do you require a reliable and affordable provider of legal forms to obtain the Corpus Christi Texas Renunciation And Disclaimer of Property obtained through Intestate Succession? US Legal Forms is your primary option.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a collection of forms to facilitate your divorce in court, we've got your back. Our platform features over 85,000 current legal document templates for personal and business use. All templates we provide are not generic and are tailored based on the requirements of specific states and regions.

To retrieve the document, you must Log In to your account, locate the desired template, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates at any moment in the My documents section.

Is this your first time visiting our website? No need to worry. You can establish an account with great ease, but prior to that, ensure that you.

Now you may create your account. Then select a subscription plan and continue to payment. Once the payment is completed, download the Corpus Christi Texas Renunciation And Disclaimer of Property received through Intestate Succession in any of the available file formats. You can revisit the website anytime and redownload the document at no additional cost.

Locating current legal forms has never been simpler. Give US Legal Forms a chance now, and stop wasting your precious time studying legal documents online for good.

- Verify whether the Corpus Christi Texas Renunciation And Disclaimer of Property received through Intestate Succession aligns with the laws of your state and locality.

- Review the details of the form (if available) to determine the intended recipient and purpose of the document.

- Initiate the search again if the template does not fit your specific circumstances.

Form popularity

FAQ

When writing a beneficiary disclaimer letter, you should begin by clearly identifying yourself and the property you are disclaiming. Include a statement that indicates you choose to reject your entitlement, and make sure to sign and date the letter. By doing this correctly in Corpus Christi, Texas, you can avoid legal complications later. We provide helpful resources to assist you in drafting the Corpus Christi Texas Renunciation And Disclaimer of Property received by Intestate Succession letter effectively.

To write an inheritance disclaimer letter, start with a clear statement of your intent to decline the inheritance. Specify the property involved, include your name and contact details, and provide a signature. It is vital to follow any legal requirements specific to Corpus Christi, Texas, to ensure your disclaimer is valid. Our platform offers templates to help you create an effective Corpus Christi Texas Renunciation And Disclaimer of Property received by Intestate Succession letter.

A disclaimer of estate means a person formally rejects their share of an estate or property. For example, if a relative bequeaths you property in Corpus Christi, Texas, and you choose not to accept it to assist other beneficiaries, you would file a disclaimer. This choice can streamline estate distribution and minimize potential disputes among heirs. You can find guidance and forms for Corpus Christi Texas Renunciation And Disclaimer of Property received by Intestate Succession on our site.

An inheritance letter typically informs recipients of their rights and responsibilities regarding a will or estate. For example, if you inherit a home in Corpus Christi, Texas, the letter may outline how to handle taxes, maintenance, and the eventual transfer of the property. This letter serves as essential documentation in the process of managing your inherited assets. Consider utilizing our platform for templates related to Corpus Christi Texas Renunciation And Disclaimer of Property received by Intestate Succession.

An inheritance disclaimer allows an heir to refuse their share of an estate. For instance, if you inherit property from a relative in Corpus Christi, Texas, but do not wish to accept it, you can formally decline this inheritance. This action can benefit your family's financial planning by preventing unwanted tax obligations. You can use specific forms designed for Corpus Christi Texas Renunciation And Disclaimer of Property received by Intestate Succession.

To write a disclaimer for an inheritance in Corpus Christi Texas, begin by drafting a statement that clearly identifies the property you wish to renounce. Include your full name, the decedent's name, and a declaration that you disclaim any interest in the property received through intestate succession. Make sure to sign and date the disclaimer, and consider filing it with the appropriate court to formalize your decision. For assistance with this process, consult resources available at US Legal Forms, which provide templates tailored for the Corpus Christi Texas Renunciation and Disclaimer of Property received by Intestate Succession.

A disclaimer of interest in property is a legal document that allows a beneficiary to legally refuse an inheritance. This step is crucial for those wanting to avoid tax liabilities or other burdens associated with the property. Understanding this concept is fundamental when engaging with Corpus Christi Texas Renunciation And Disclaimer of Property received by Intestate Succession, as it directly impacts beneficiaries’ decisions.

To disclaim an inheritance in Texas, you must prepare a formal written disclaimer that complies with Texas laws. This document should explicitly state your decision not to accept the property and should be filed with the probate court. Seeking assistance from professionals familiar with Corpus Christi Texas Renunciation And Disclaimer of Property received by Intestate Succession can streamline this process and ensure compliance with legal requirements.

Creating a disclaimer of inheritance requires careful wording to reflect your intentions clearly. A proper sample should include your name, a description of the property, and a statement expressing your wish to disclaim the inheritance. For those unfamiliar with the format, using templates from uslegalforms can provide the guidance needed to draft an effective disclaimer for Corpus Christi Texas Renunciation And Disclaimer of Property received by Intestate Succession.

Recent changes to inheritance laws in Texas emphasize clear documentation and intention in estate planning. The updates aim to simplify the process and protect beneficiaries’ rights, including streamlined procedures for disclaiming inheritances. Staying informed about these changes is essential for anyone involved in Corpus Christi Texas Renunciation And Disclaimer of Property received by Intestate Succession, as they could affect inheritance outcomes.