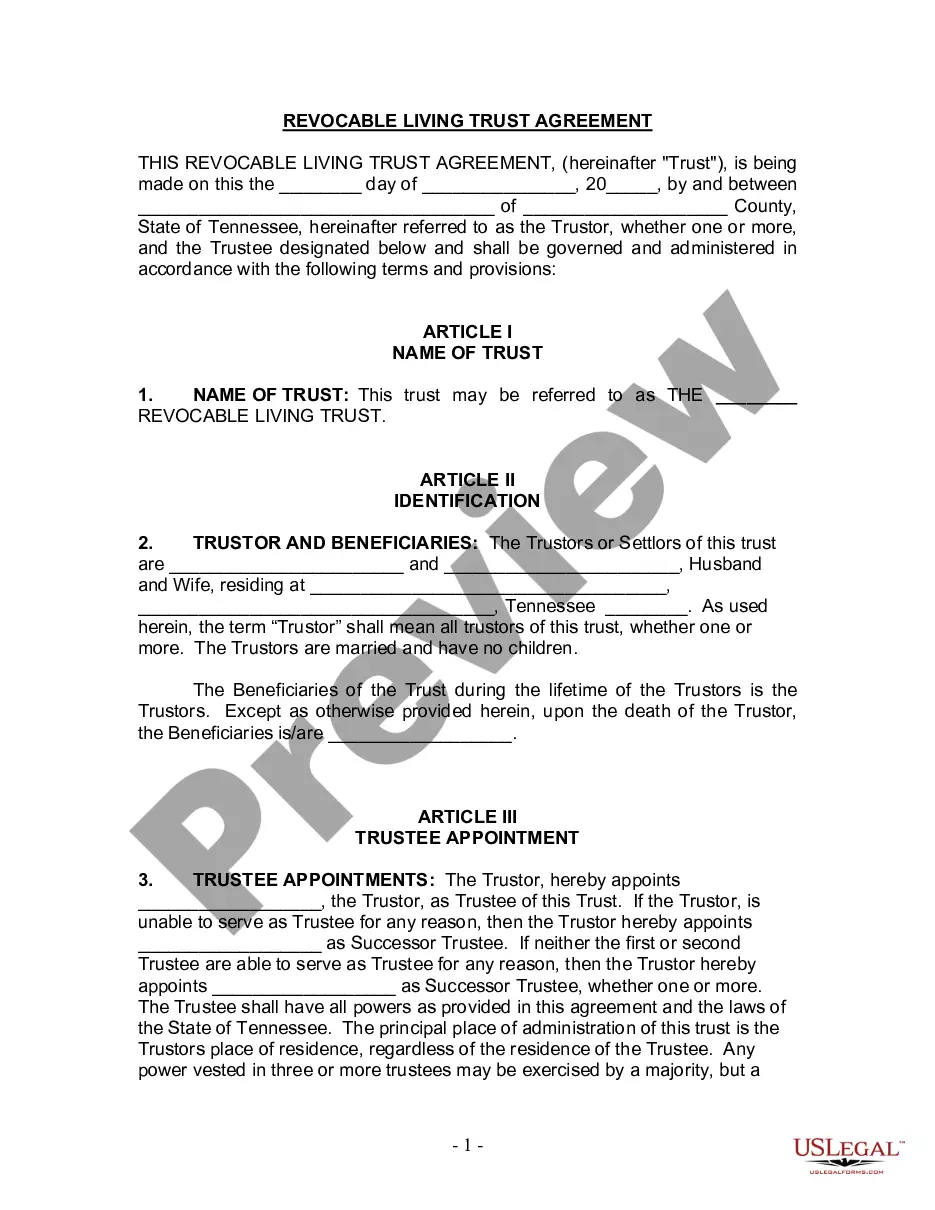

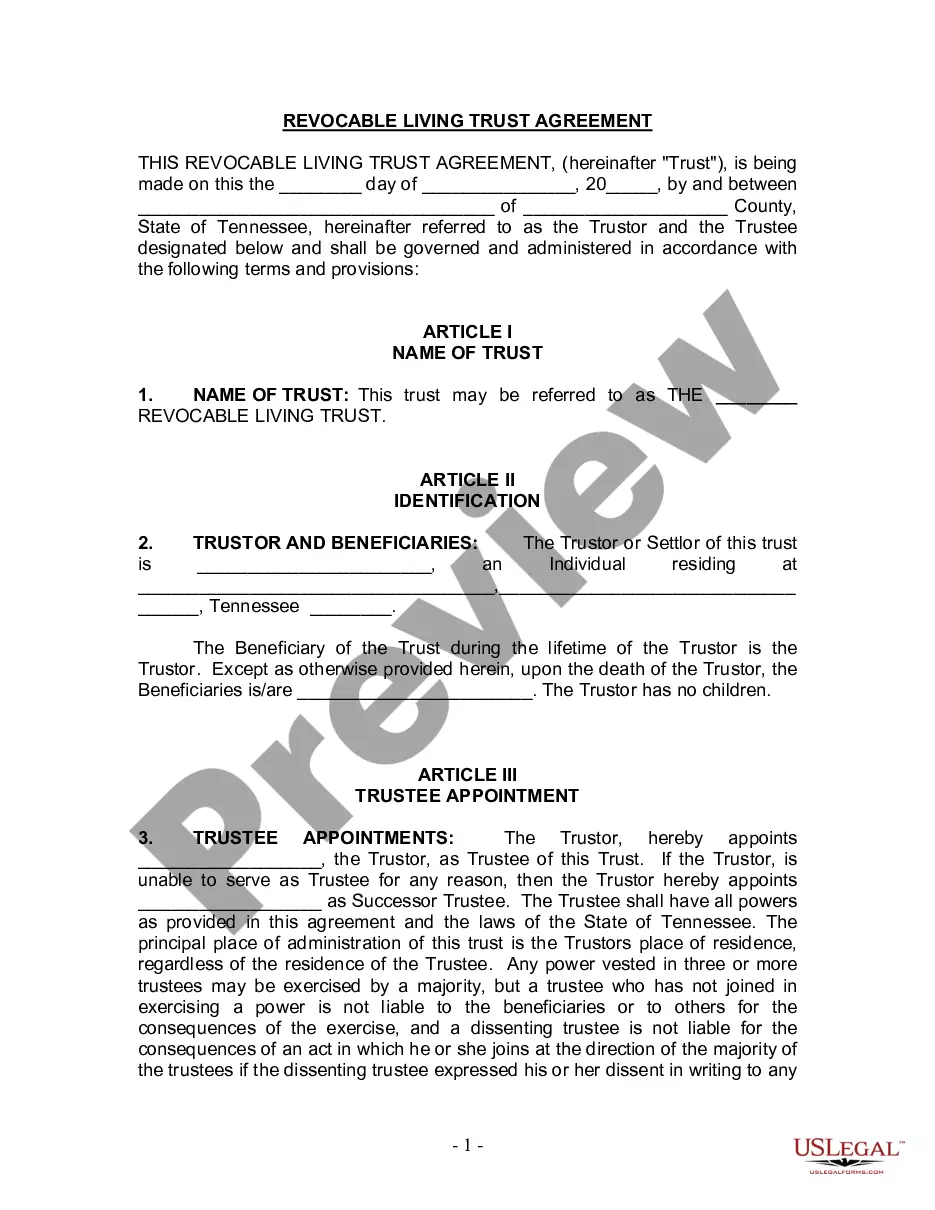

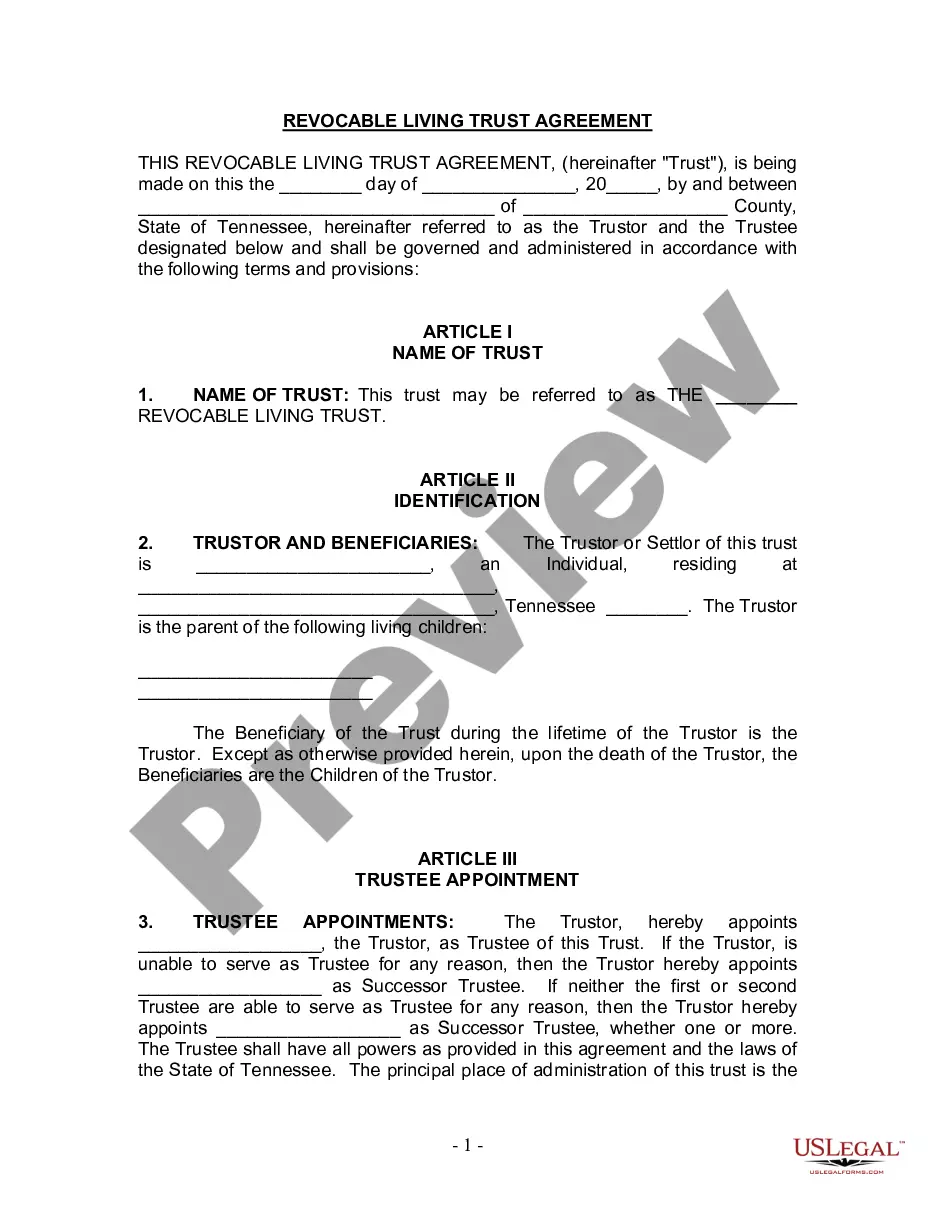

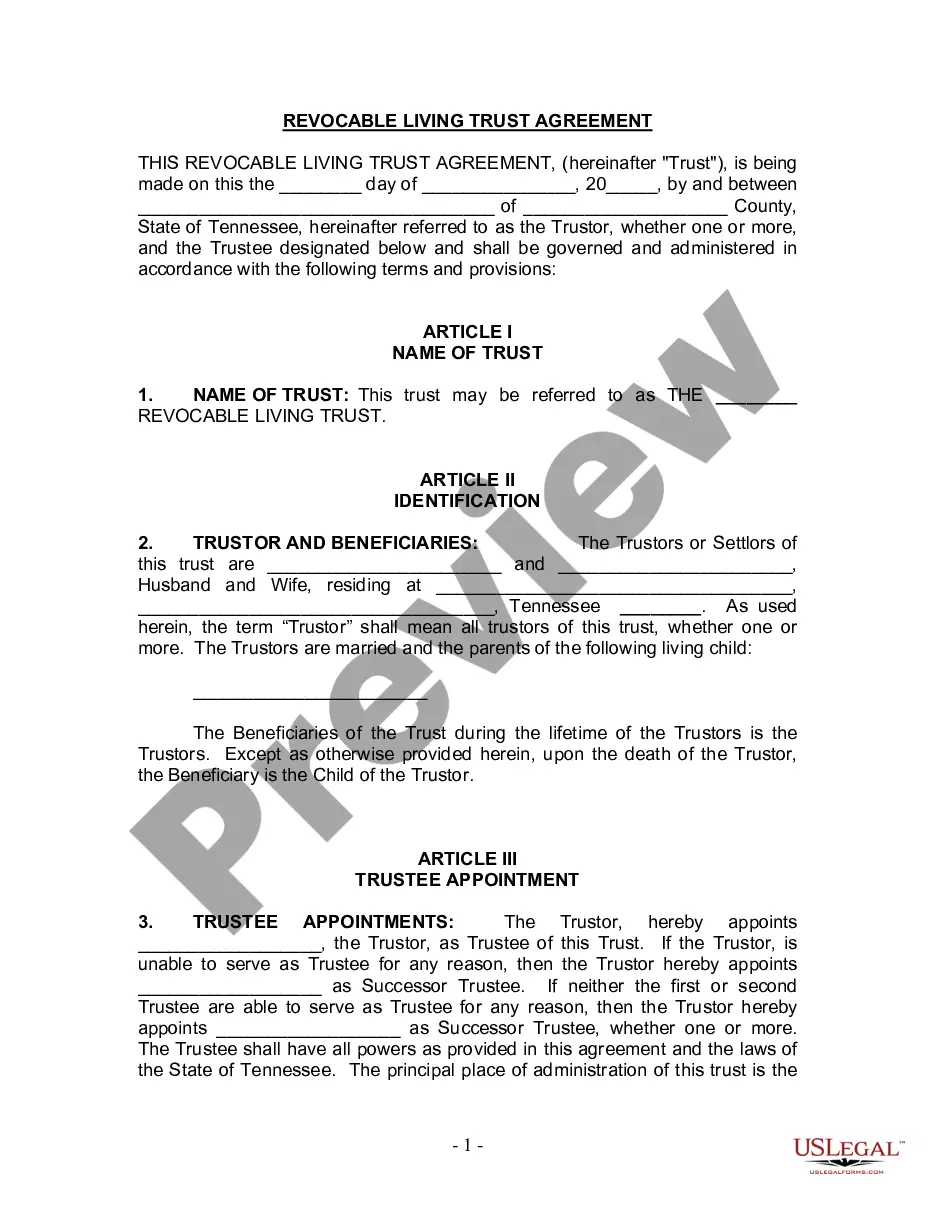

This detailed sample Texas Gift Deed (Individual to Individual)complies with Texas law. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats.

A San Antonio Texas Gift Deed for Individual to Individual is a legal document that allows an individual to transfer ownership of a property or asset as a gift to another individual in San Antonio, Texas. This type of deed is commonly used when a property or asset is being transferred without any monetary exchange, such as when a parent gifts a house to their child. The gift deed acts as a legal record, providing evidence of the voluntary transfer of ownership and ensuring that the recipient is officially recognized as the new owner. This document includes important details such as the names and contact information of both the donor (the person giving the gift) and the done (the person receiving the gift), the description of the property or asset being gifted, and any conditions or terms that may be associated with the gift. In San Antonio, there are no specific types of gift deeds dedicated solely to individual-to-individual transfers. However, individuals can create a custom gift deed based on their specific circumstances and the requirements of the situation. It is always recommended consulting with a qualified attorney or legal professional to ensure that the gift deed aligns with local laws and regulations and meets individual needs. Important keywords related to a San Antonio Texas Gift Deed for Individual to Individual include: gift, transfer of ownership, property, asset, voluntary, legal document, recipient, donor, done, conditions, terms, custom gift deed, attorney, legal professional, and local laws and regulations.