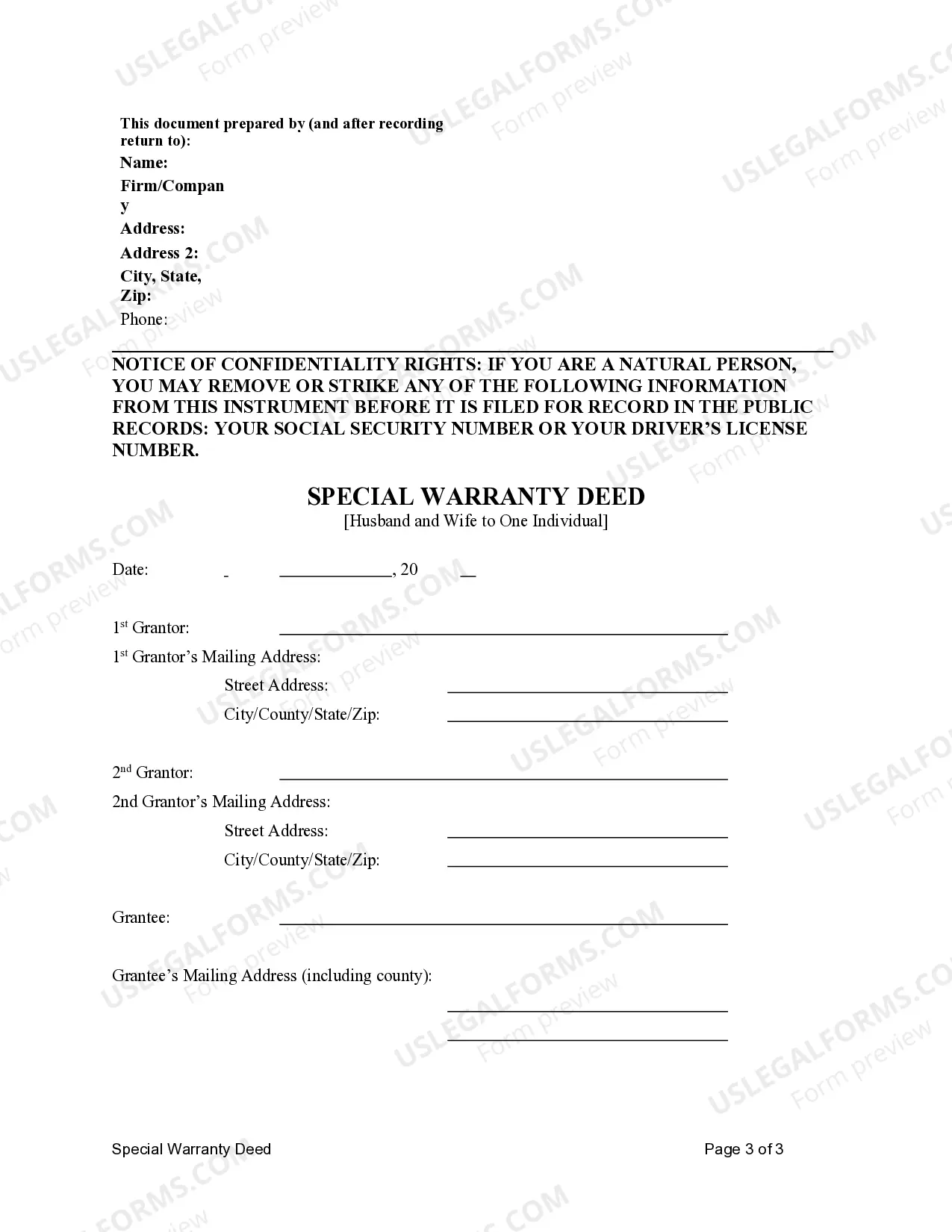

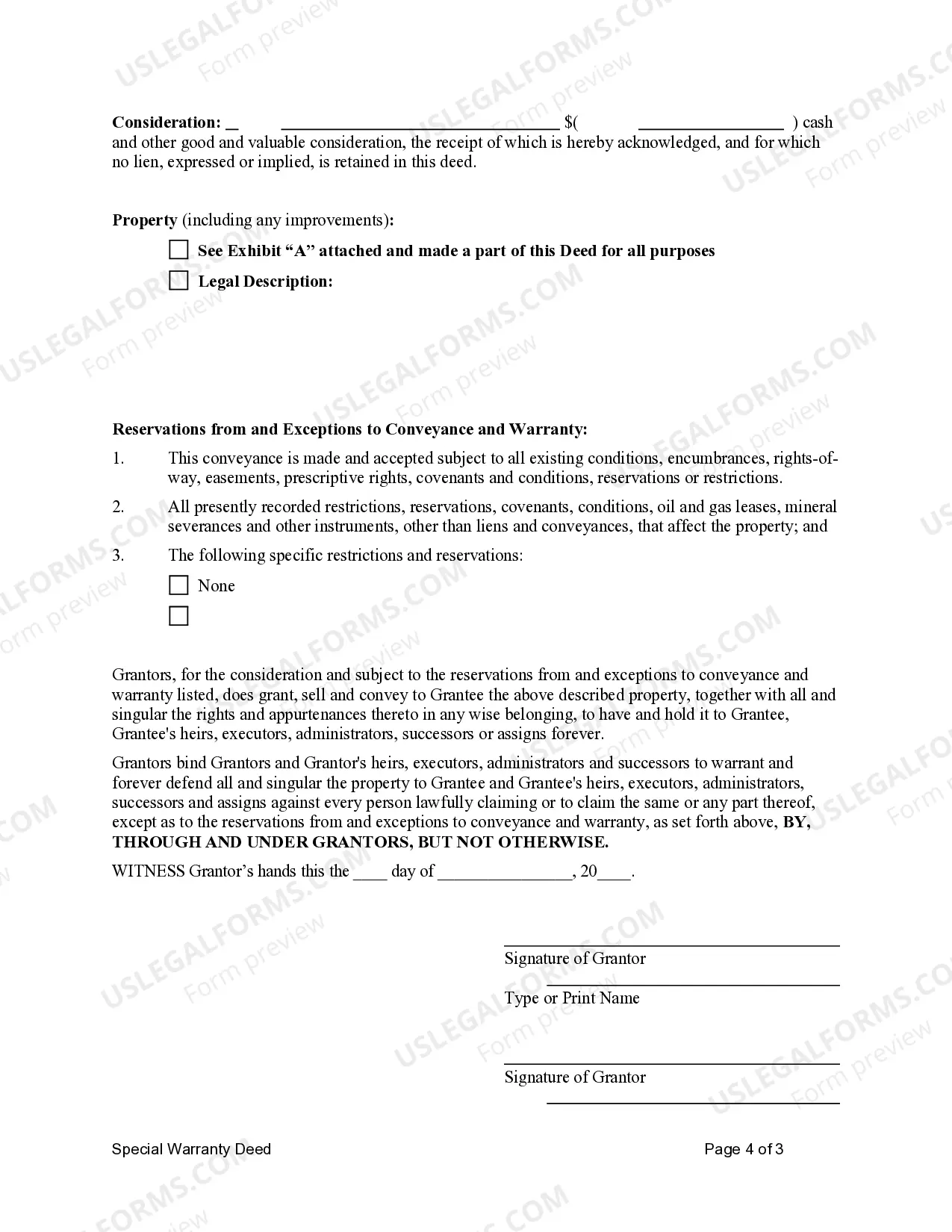

This form is a Special Warranty Deed where the grantors are husband and wife and the grantee is an individual. Grantors convey and specially warrant the described property to the grantee. The grantors only warrant and will defend the property only as to claims of persons claiming by, through or under grantors, but not otherwise. This deed complies with all state statutory laws.

A Sugar Land Texas Special Warranty Deed — Husband and Wife to Individual is a specific type of legal document that is used in real estate transactions to transfer ownership of a property from a married couple to an individual buyer. This deed provides limited protection to the buyer, referred to as the grantee, by ensuring that the sellers, the husband and wife, will defend against any claims or defects that occurred during their ownership of the property. The Sugar Land Texas Special Warranty Deed — Husband and Wife to Individual is commonly used in various scenarios, including: 1. Residential property transfers: This deed is frequently employed when a married couple, acting as joint owners, wishes to sell their residential property to an individual buyer. It allows for a smooth transfer of ownership while offering some level of protection to the buyer. 2. Investment property transactions: In cases where a husband and wife jointly own an investment property and decide to sell it to an individual investor, the Sugar Land Texas Special Warranty Deed — Husband and Wife to Individual can be employed. The deed grants the buyer limited assurance against any defects or claims that may arise during their period of ownership. 3. Land sales: This type of special warranty deed is also used when a married couple intends to sell a vacant land parcel to an individual purchaser. By utilizing this specific type of deed, the grantee can be confident that the sellers will defend against any claims pertaining to the property's title, but only for the time the husband and wife owned it. It is important to note that there may be variations of the Sugar Land Texas Special Warranty Deed — Husband and Wife to Individual that cater to specific circumstances, such as: 1. Special Warranty Deed with Encumbrances: This type of deed includes additional protections for the buyer by specifically addressing any existing liens or encumbrances on the property. It ensures that the sellers will defend against any claims arising from these encumbrances during their ownership. 2. Special Warranty Deed — Husband and Wifindividualua— - Limited Liability Company (LLC): In certain situations, a married couple may choose to sell their property to an individual who is acquiring it on behalf of an LLC. This type of deed provides the necessary legal framework to effect the transfer of ownership, with the sellers warranting against any claims or defects that occurred during their period of ownership. In conclusion, the Sugar Land Texas Special Warranty Deed — Husband and Wife to Individual is a legally binding instrument that allows for the transfer of property ownership from a married couple to an individual buyer. This deed provides the buyer with some assurance against claims or defects, only limited to the period the husband and wife owned the property. Different variations of this deed exist to address specific circumstances, such as encumbrances or transfers to an LLC.A Sugar Land Texas Special Warranty Deed — Husband and Wife to Individual is a specific type of legal document that is used in real estate transactions to transfer ownership of a property from a married couple to an individual buyer. This deed provides limited protection to the buyer, referred to as the grantee, by ensuring that the sellers, the husband and wife, will defend against any claims or defects that occurred during their ownership of the property. The Sugar Land Texas Special Warranty Deed — Husband and Wife to Individual is commonly used in various scenarios, including: 1. Residential property transfers: This deed is frequently employed when a married couple, acting as joint owners, wishes to sell their residential property to an individual buyer. It allows for a smooth transfer of ownership while offering some level of protection to the buyer. 2. Investment property transactions: In cases where a husband and wife jointly own an investment property and decide to sell it to an individual investor, the Sugar Land Texas Special Warranty Deed — Husband and Wife to Individual can be employed. The deed grants the buyer limited assurance against any defects or claims that may arise during their period of ownership. 3. Land sales: This type of special warranty deed is also used when a married couple intends to sell a vacant land parcel to an individual purchaser. By utilizing this specific type of deed, the grantee can be confident that the sellers will defend against any claims pertaining to the property's title, but only for the time the husband and wife owned it. It is important to note that there may be variations of the Sugar Land Texas Special Warranty Deed — Husband and Wife to Individual that cater to specific circumstances, such as: 1. Special Warranty Deed with Encumbrances: This type of deed includes additional protections for the buyer by specifically addressing any existing liens or encumbrances on the property. It ensures that the sellers will defend against any claims arising from these encumbrances during their ownership. 2. Special Warranty Deed — Husband and Wifindividualua— - Limited Liability Company (LLC): In certain situations, a married couple may choose to sell their property to an individual who is acquiring it on behalf of an LLC. This type of deed provides the necessary legal framework to effect the transfer of ownership, with the sellers warranting against any claims or defects that occurred during their period of ownership. In conclusion, the Sugar Land Texas Special Warranty Deed — Husband and Wife to Individual is a legally binding instrument that allows for the transfer of property ownership from a married couple to an individual buyer. This deed provides the buyer with some assurance against claims or defects, only limited to the period the husband and wife owned the property. Different variations of this deed exist to address specific circumstances, such as encumbrances or transfers to an LLC.