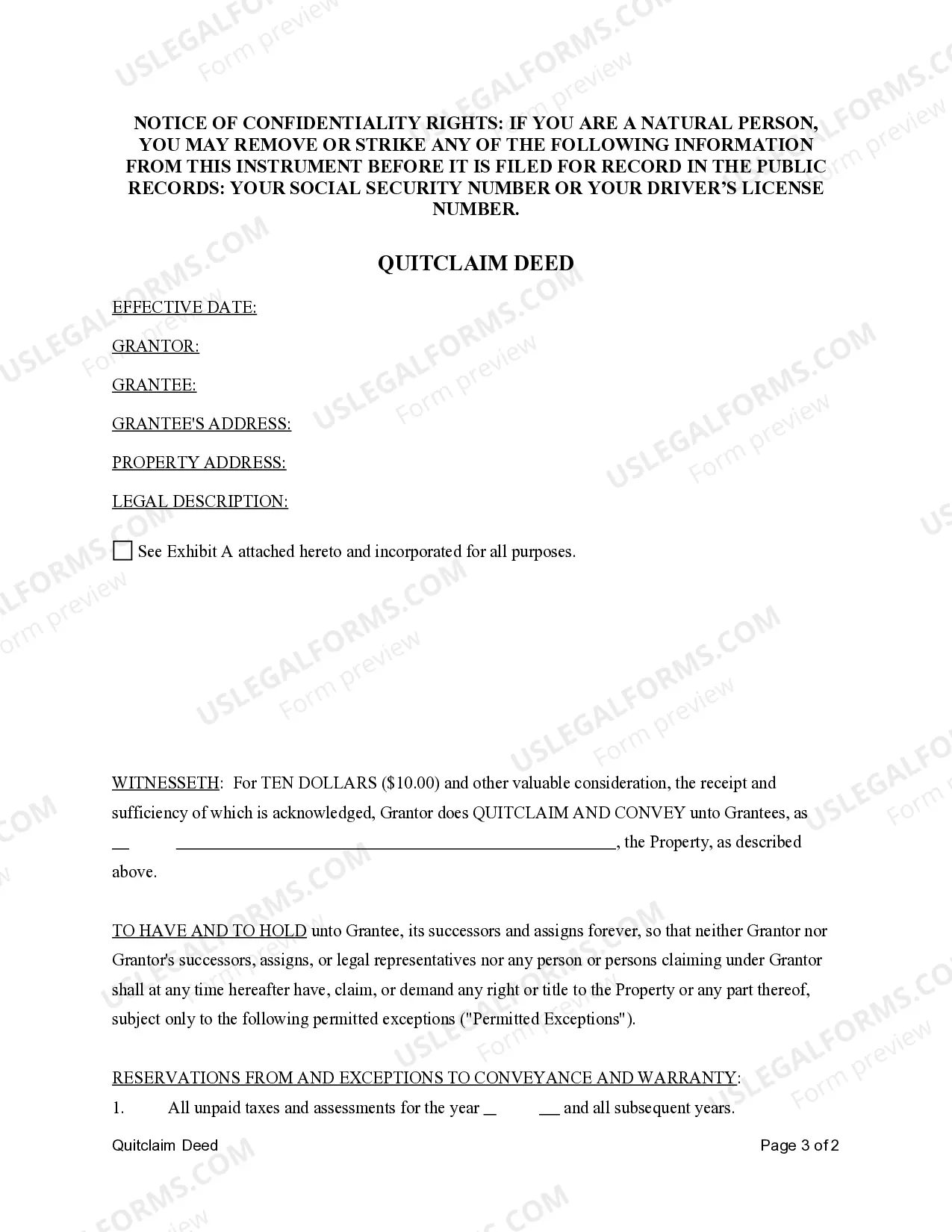

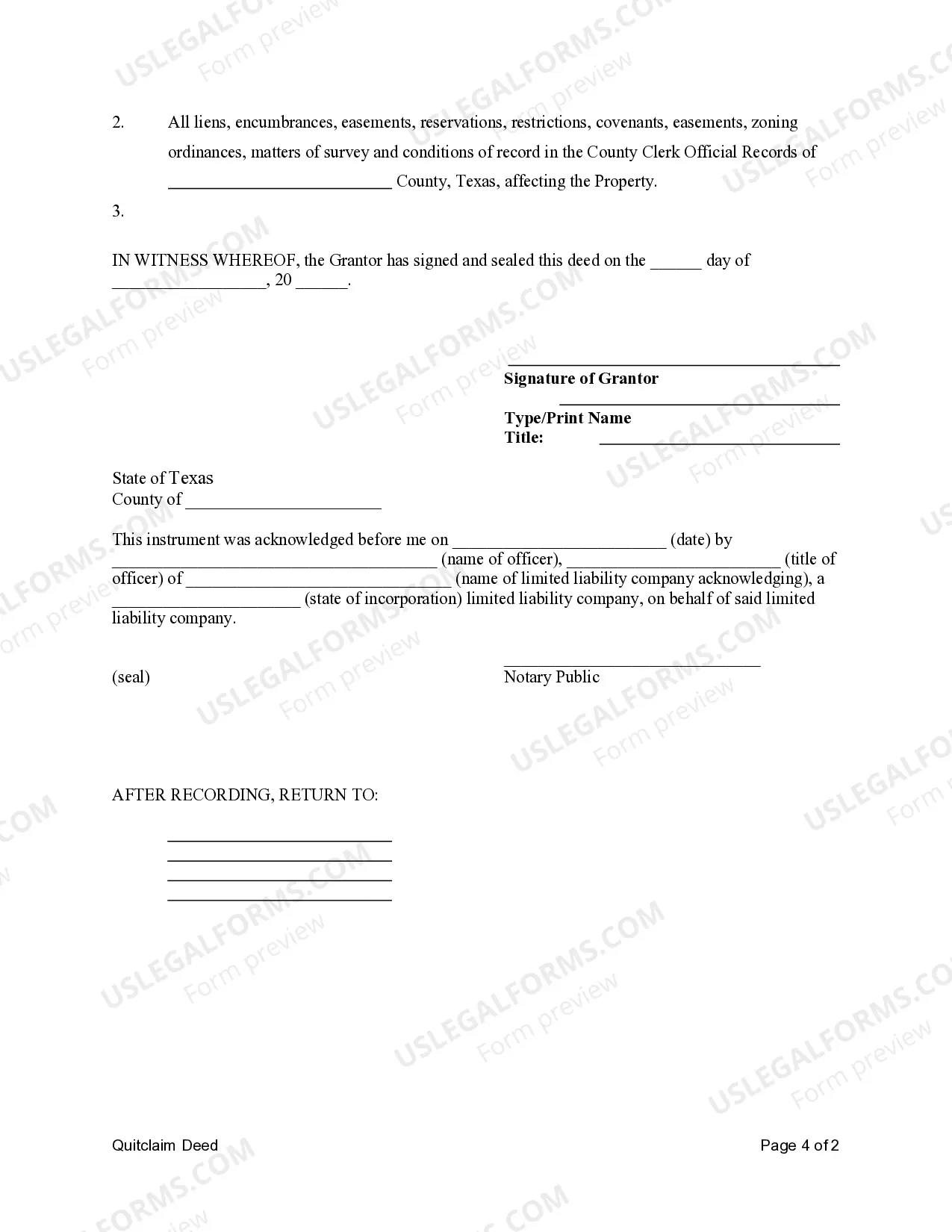

This form is a Quitclaim Deed where the grantor is a limited liability company and the grantee is also a limited liability company. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

A Fort Worth Texas Quitclaim Deed from Limited Liability Company to Limited Liability Company is a legal document that allows for the transfer of ownership of property from one LLC to another LLC. This type of transfer is often used when there is a change in business ownership or structure and the parties involved want to ensure a smooth and official transition. A quitclaim deed is a type of real estate deed that transfers the interest or claim that a person or entity has in a property to another party, without making any warranties or guarantees about the property's ownership or condition. In the case of a transfer between LCS, it is important to ensure that the deed clearly identifies the LCS involved and accurately reflects the current ownership structure. This type of deed is commonly used in Fort Worth, Texas, where property transactions are regulated by specific state laws. It is crucial to comply with these laws and ensure that the deed is properly executed and recorded to establish a valid transfer of ownership. Different types of Fort Worth Texas Quitclaim Deeds from Limited Liability Company to Limited Liability Company may include variations based on specific circumstances or requirements. Some possible variations of this type of deed may include: 1. Single-member LLC to Single-member LLC: This type of quitclaim deed is used when there is a transfer of property ownership between two LCS, both of which are owned by a single individual. 2. Multi-member LLC to Multi-member LLC: In this scenario, the transfer involves two LCS with multiple owners. The quitclaim deed should accurately reflect the proportionate ownership interests of each LLC member. 3. LLC Conversion: Occasionally, a quitclaim deed may be used when converting a different business entity, such as a corporation or partnership, into an LLC. This type of transfer is typically more complex and may require additional legal documentation to ensure compliance with state regulations. When drafting or executing a Fort Worth Texas Quitclaim Deed from Limited Liability Company to Limited Liability Company, it is advisable to consult with a real estate attorney to ensure the document is legally binding and accurately reflects the intentions of the parties involved. Properly executed and recorded quitclaim deeds provide a clear chain of title and help protect the interests of all parties in the property ownership transfer.A Fort Worth Texas Quitclaim Deed from Limited Liability Company to Limited Liability Company is a legal document that allows for the transfer of ownership of property from one LLC to another LLC. This type of transfer is often used when there is a change in business ownership or structure and the parties involved want to ensure a smooth and official transition. A quitclaim deed is a type of real estate deed that transfers the interest or claim that a person or entity has in a property to another party, without making any warranties or guarantees about the property's ownership or condition. In the case of a transfer between LCS, it is important to ensure that the deed clearly identifies the LCS involved and accurately reflects the current ownership structure. This type of deed is commonly used in Fort Worth, Texas, where property transactions are regulated by specific state laws. It is crucial to comply with these laws and ensure that the deed is properly executed and recorded to establish a valid transfer of ownership. Different types of Fort Worth Texas Quitclaim Deeds from Limited Liability Company to Limited Liability Company may include variations based on specific circumstances or requirements. Some possible variations of this type of deed may include: 1. Single-member LLC to Single-member LLC: This type of quitclaim deed is used when there is a transfer of property ownership between two LCS, both of which are owned by a single individual. 2. Multi-member LLC to Multi-member LLC: In this scenario, the transfer involves two LCS with multiple owners. The quitclaim deed should accurately reflect the proportionate ownership interests of each LLC member. 3. LLC Conversion: Occasionally, a quitclaim deed may be used when converting a different business entity, such as a corporation or partnership, into an LLC. This type of transfer is typically more complex and may require additional legal documentation to ensure compliance with state regulations. When drafting or executing a Fort Worth Texas Quitclaim Deed from Limited Liability Company to Limited Liability Company, it is advisable to consult with a real estate attorney to ensure the document is legally binding and accurately reflects the intentions of the parties involved. Properly executed and recorded quitclaim deeds provide a clear chain of title and help protect the interests of all parties in the property ownership transfer.