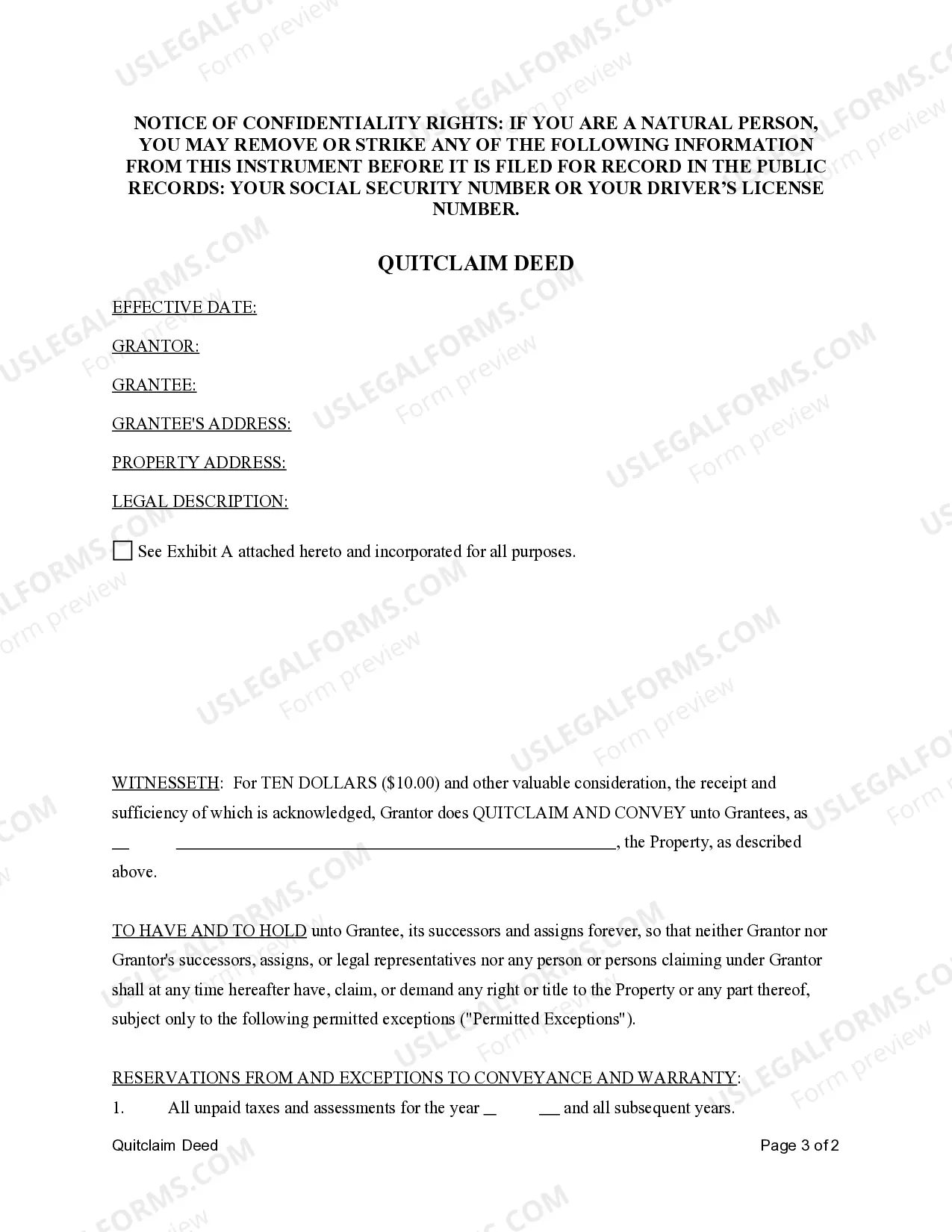

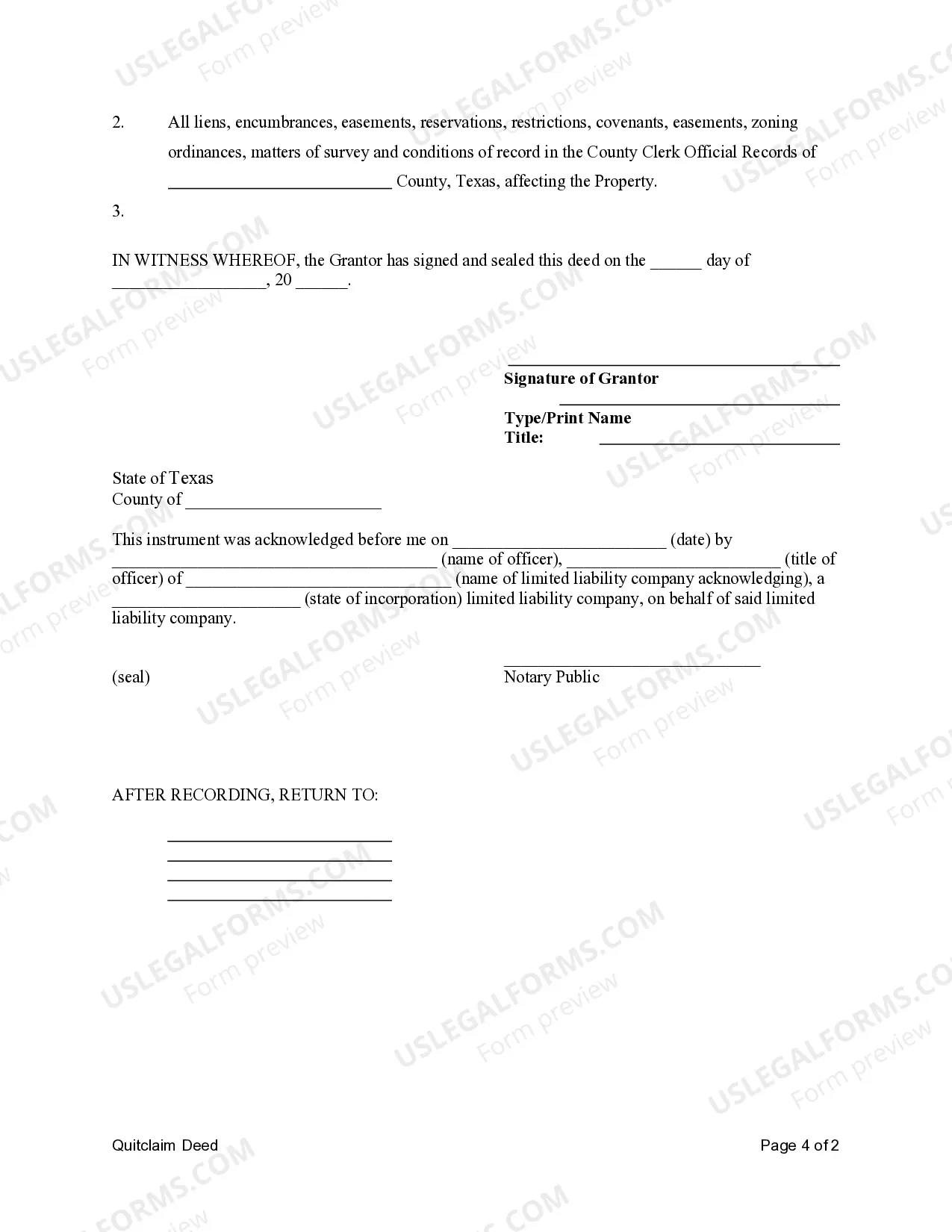

This form is a Quitclaim Deed where the grantor is a limited liability company and the grantee is also a limited liability company. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

A Houston Texas Quitclaim Deed from Limited Liability Company to Limited Liability Company is a legal document that transfers the ownership or interest in a property from one limited liability company (LLC) to another LLC. This type of deed is commonly used when there is a change in ownership structure or when one LLC wants to transfer its property rights to another LLC without making any guarantees about the title or the property itself. Keywords associated with a Houston Texas Quitclaim Deed from LLC to LLC include: 1. Houston, Texas: This specifies the geographical location where the deed is executed, which is important for identifying the jurisdiction and legal requirements governing the transfer. 2. Quitclaim Deed: It refers to the type of deed being used for the property transfer, wherein the transferring party (granter) relinquishes their rights and interests in the property to the receiving party (grantee), without providing any guarantees or warranties about the property's title. 3. Limited Liability Company (LLC): It signifies the legal entity type involved in the transfer. LCS are popular business structures that provide limited liability protection to their owners while allowing flexibility in management and taxation. 4. Transfer of Ownership: The deed serves as a legal instrument to transfer ownership rights from one LLC to another. 5. Limited Liability Company to Limited Liability Company: This emphasizes the involvement of LCS on both sides of the property transfer, indicating that the transacting parties are organized as limited liability companies. 6. Change in Ownership Structure: This implies that the transfer may be a result of a change in the ownership structure, such as a merger, acquisition, reorganization, or internal restructuring within the LCS involved. 7. Guarantee of Title: A quitclaim deed does not provide any guarantees or warranties regarding the title, which means the receiving LLC accepts the property "as-is" without any assurance of clear ownership or absence of liens or claims. 8. Legal Compliance: The deed is executed following the legal requirements of the state of Texas and specifically tailored for property transfers within the city of Houston. There may not be distinct types of Houston Texas Quitclaim Deed from LLC to LLC, as the specifics of each transfer will depend on the unique circumstances of the property transfer and the objectives of the parties involved. However, variations in the language, terms, or conditions of the deed may arise, depending on the specific agreements between the LCS regarding the transfer or any additional considerations involved, such as financial transactions, liabilities, or conditions precedent.A Houston Texas Quitclaim Deed from Limited Liability Company to Limited Liability Company is a legal document that transfers the ownership or interest in a property from one limited liability company (LLC) to another LLC. This type of deed is commonly used when there is a change in ownership structure or when one LLC wants to transfer its property rights to another LLC without making any guarantees about the title or the property itself. Keywords associated with a Houston Texas Quitclaim Deed from LLC to LLC include: 1. Houston, Texas: This specifies the geographical location where the deed is executed, which is important for identifying the jurisdiction and legal requirements governing the transfer. 2. Quitclaim Deed: It refers to the type of deed being used for the property transfer, wherein the transferring party (granter) relinquishes their rights and interests in the property to the receiving party (grantee), without providing any guarantees or warranties about the property's title. 3. Limited Liability Company (LLC): It signifies the legal entity type involved in the transfer. LCS are popular business structures that provide limited liability protection to their owners while allowing flexibility in management and taxation. 4. Transfer of Ownership: The deed serves as a legal instrument to transfer ownership rights from one LLC to another. 5. Limited Liability Company to Limited Liability Company: This emphasizes the involvement of LCS on both sides of the property transfer, indicating that the transacting parties are organized as limited liability companies. 6. Change in Ownership Structure: This implies that the transfer may be a result of a change in the ownership structure, such as a merger, acquisition, reorganization, or internal restructuring within the LCS involved. 7. Guarantee of Title: A quitclaim deed does not provide any guarantees or warranties regarding the title, which means the receiving LLC accepts the property "as-is" without any assurance of clear ownership or absence of liens or claims. 8. Legal Compliance: The deed is executed following the legal requirements of the state of Texas and specifically tailored for property transfers within the city of Houston. There may not be distinct types of Houston Texas Quitclaim Deed from LLC to LLC, as the specifics of each transfer will depend on the unique circumstances of the property transfer and the objectives of the parties involved. However, variations in the language, terms, or conditions of the deed may arise, depending on the specific agreements between the LCS regarding the transfer or any additional considerations involved, such as financial transactions, liabilities, or conditions precedent.