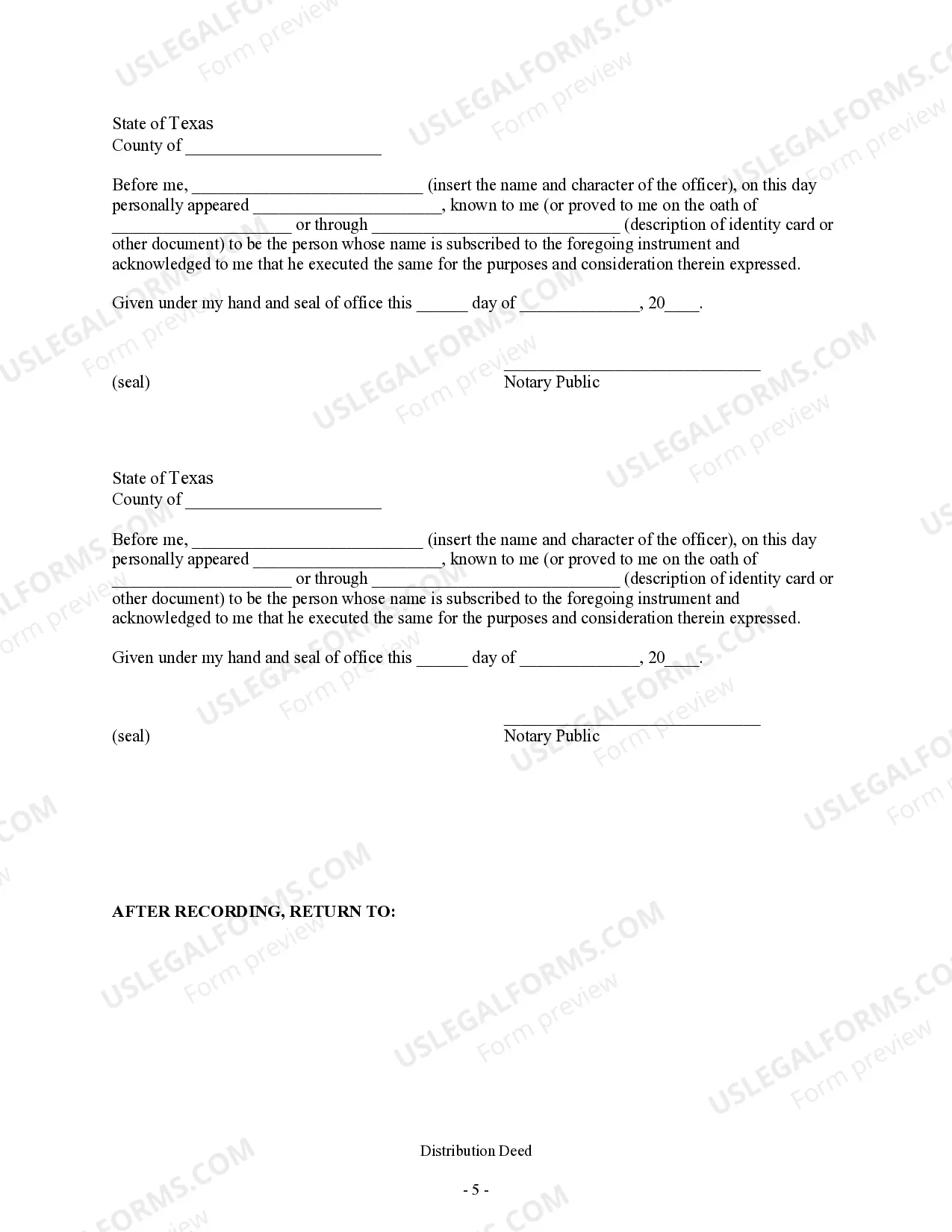

This form is a Distribution Deed whereby Joint Independent Executors transfer real property from the estate of the decedent to the Grantee. This deed complies with all state statutory laws.

Beaumont Texas Distribution Deed — Joint Independent Executors to an Individual Beneficiary is a legal document that outlines the process of distributing assets from a deceased person's estate to an individual beneficiary in Beaumont, Texas. This deed serves as evidence of the beneficiaries' rightful ownership and transfer of the specified assets. Keywords: Beaumont Texas Distribution Deed, Joint Independent Executors, Individual Beneficiary, estate distribution, legal document, asset transfer, ownership, executor duties, probate process, inheritance process, beneficiary rights, estate planning. Different types of Beaumont Texas Distribution Deed — Joint Independent Executors to an Individual Beneficiary might include: 1. Real Estate Distribution Deed: This entails the transfer of real property, such as land, houses, or commercial buildings, from the deceased person's estate to the individual beneficiary in Beaumont, Texas. 2. Financial Asset Distribution Deed: This specific type of deed deals with the transfer of financial assets like bank accounts, stocks, bonds, or retirement accounts from the deceased person's estate to the individual beneficiary mentioned in the document. 3. Personal Property Distribution Deed: This type of deed covers the distribution of various personal belongings, including jewelry, vehicles, artwork, furniture, or any tangible assets, to an individual beneficiary based in Beaumont, Texas. It's crucial to consult with a qualified attorney or legal professional in Beaumont, Texas, to ensure that all the legal requirements and procedures are followed correctly when drafting and executing a Beaumont Texas Distribution Deed — Joint Independent Executors to an Individual Beneficiary.