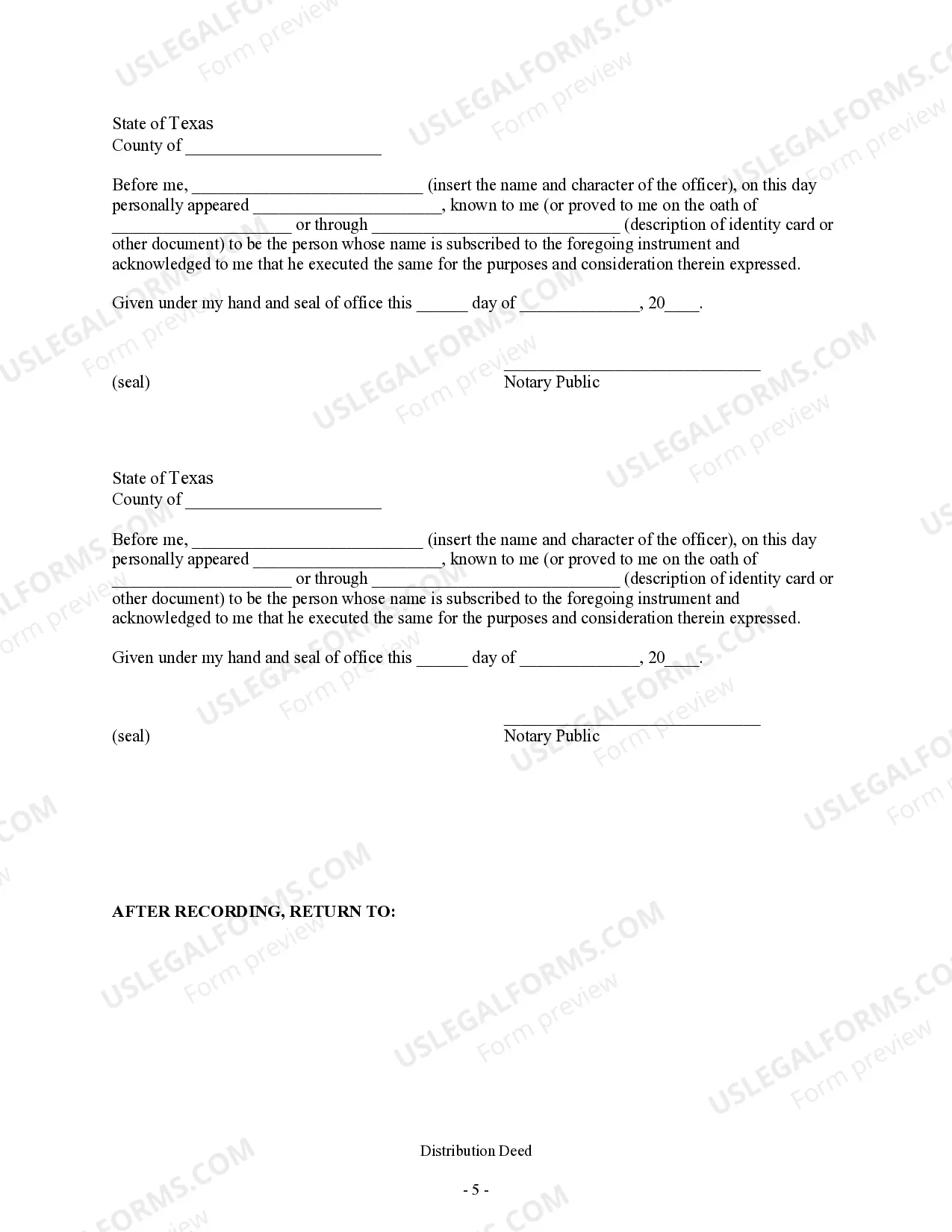

This form is a Distribution Deed whereby Joint Independent Executors transfer real property from the estate of the decedent to the Grantee. This deed complies with all state statutory laws.

The Dallas Texas Distribution Deed — Joint Independent Executors to an Individual Beneficiary is a legal document that facilitates the transfer of property from joint independent executors to an individual beneficiary. This type of deed is commonly used in the state of Texas and ensures a seamless distribution of assets to the rightful recipient. To provide a comprehensive understanding of the subject, let's explore different types of Dallas Texas Distribution Deeds — Joint Independent Executors to an Individual Beneficiary: 1. Real Estate Distribution Deed: This type of distribution deed is used when transferring real estate property, such as residential homes, commercial buildings, or vacant land, to an individual beneficiary. It ensures a smooth transition of ownership, without the need for probate court involvement. 2. Financial Asset Distribution Deed: In cases where joint independent executors need to distribute financial assets, such as bank accounts, retirement funds, stocks, bonds, or other securities, to an individual beneficiary, a financial asset distribution deed is utilized. This document streamlines the process, preventing any complications or delays in asset transfer. 3. Personal Property Distribution Deed: When it comes to distributing personal property items, like furniture, vehicles, artwork, jewelry, or other valuable possessions, a personal property distribution deed plays a crucial role. This ensures the proper allocation of personal assets to the intended beneficiary, bypassing the need for estate litigation or court involvement. 4. Inheritance Tax Distribution Deed: In certain cases, inheritance tax obligations may arise, requiring the joint independent executors to distribute assets while addressing tax implications. An inheritance tax distribution deed allows for the seamless transfer of assets, taking into account any tax considerations that may need to be managed during the distribution process. 5. Special Circumstances Distribution Deed: There may be occasions where unique circumstances arise, necessitating a specialized distribution deed. Examples include distributions involving significant debt settlement, disputed assets, or when an individual beneficiary is incapacitated or underage. A special circumstances distribution deed ensures that the transfer of assets adheres to specific legal requirements and protects the rights of all parties involved. In conclusion, the Dallas Texas Distribution Deed — Joint Independent Executors to an Individual Beneficiary encompasses various types to facilitate the smooth and efficient transfer of assets in compliance with Texas state laws. Through these deeds, real estate, financial assets, personal property, inheritance tax obligations, and special circumstances affecting the distribution process can all be successfully navigated, ensuring a fair and lawful transfer to the intended beneficiary.