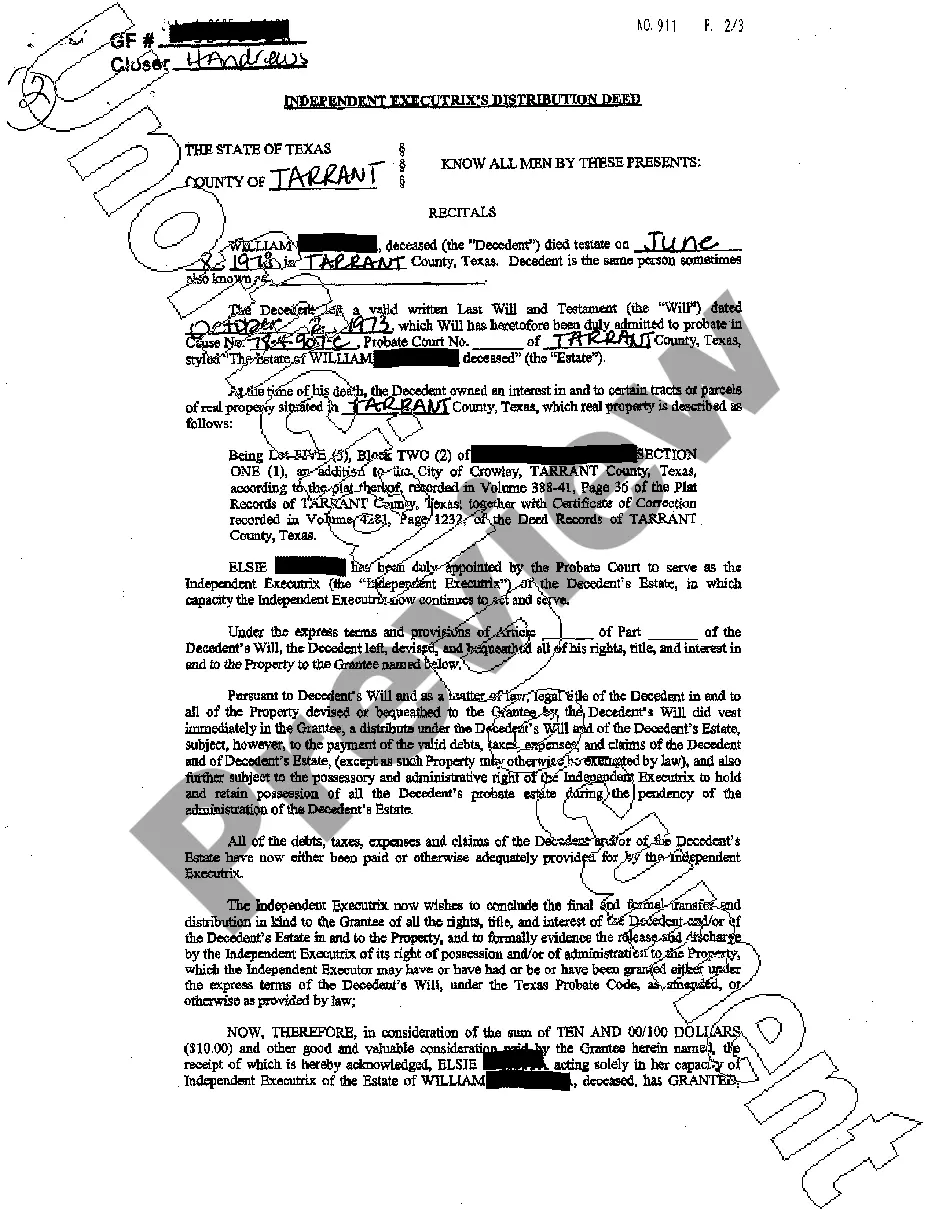

This form is a Distribution Deed whereby Joint Independent Executors transfer real property from the estate of the decedent to the Grantee. This deed complies with all state statutory laws.

Edinburg Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary

Description

How to fill out Texas Distribution Deed - Joint Independent Executors To An Individual Beneficiary?

If you are looking for a legitimate form template, it's hard to find a more user-friendly platform than the US Legal Forms website – one of the most extensive collections online.

Here you can access a multitude of document samples for business and personal use categorized by type and location, or key phrases.

With the enhanced search functionality, acquiring the latest Edinburg Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary is straightforward.

Finalize your purchase. Use your credit card or PayPal account to complete the registration process.

Retrieve the form. Specify the format and download it to your device. Make modifications. Fill in, alter, print, and sign the downloaded Edinburg Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary.

- Additionally, the relevance of each document is confirmed by a team of expert attorneys who regularly review the templates on our site and update them according to the latest state and county regulations.

- If you are familiar with our system and possess an account, all you need to do to obtain the Edinburg Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary is to sign in to your profile and click the Download button.

- If you use US Legal Forms for the first time, simply follow the instructions outlined below.

- Confirm that you have located the form you require. Review its description and utilize the Preview feature to check its contents. If it does not satisfy your needs, use the Search box at the top of the page to locate the required document.

- Validate your selection. Click on the Buy now button. Then choose the desired pricing plan and enter your information to create an account.

Form popularity

FAQ

The best way to transfer property after death often involves probate to validate the will and ensure rightful distribution. Quick action is essential, as delays can complicate matters for beneficiaries. Implementing tools like the Edinburg Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary can provide clarity and structure in the transfer of ownership, benefitting all parties involved.

In Texas, beneficiaries typically have four years from the date of death to claim property through probate. This timeframe emphasizes the importance of initiating the probate process quickly to safeguard entitlements. Engaging with the Edinburg Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary can help streamline the claims process and ensure beneficiaries understand their rights.

To transfer ownership from a deceased owner in Texas, you will need the death certificate, a copy of the will, and, in some cases, court documents affirming the executor's authority. Additionally, relevant documents like the Edinburg Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary can facilitate the process. By gathering these documents, you can ensure a smooth transition of property ownership.

In Texas, an executor must disclose important information, including the estate's assets, liabilities, and the overall value of the estate. Beneficiaries have the right to access updates regarding the estate's administration. Transparency is vital to maintain trust among all parties involved. The Edinburg Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary can aid executors in fulfilling these disclosure requirements.

To transfer ownership of a property after death in Texas, you typically need to file a probate case. This process involves validating the will and appointing an executor. Using the Edinburg Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary can simplify the transfer, ensuring all legal requirements are met efficiently.

Yes, an executor can also be a beneficiary of the estate. This is common in many cases, especially when the executor is a family member or a close friend. However, the distribution process should follow specific guidelines to ensure transparency and fairness. The Edinburg Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary can help clarify these roles and responsibilities.

An independent co-executor is a designated person who shares management duties of an estate with another co-executor, but exercises those duties without court oversight. This role typically ensures an efficient and transparent administration of the estate while minimizing delays. The Edinburg Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary helps define these responsibilities clearly, ensuring all parties adhere to their roles effectively.

In general, co-executors in Texas must collaborate to make decisions regarding the estate. However, if the will allows for it, a co-executor may have the power to act independently for specific tasks. Understanding the provisions of the Edinburg Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary will clarify the extent of their authority and responsibilities.

Yes, a personal representative can also be a beneficiary of the estate under Texas law. This dual role is common and often beneficial, ensuring that the personal representative has a vested interest in administering the estate properly. In cases involving the Edinburg Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary, this relationship can strengthen trust among beneficiaries and streamline distribution processes.

An independent executor in Texas holds significant powers, including managing assets, paying debts, and distributing property as outlined in the will. They can also initiate legal actions on behalf of the estate without seeking court approval. Using the Edinburg Texas Distribution Deed - Joint Independent Executors to an Individual Beneficiary grants clarity to these roles and responsibilities, facilitating efficient estate management.