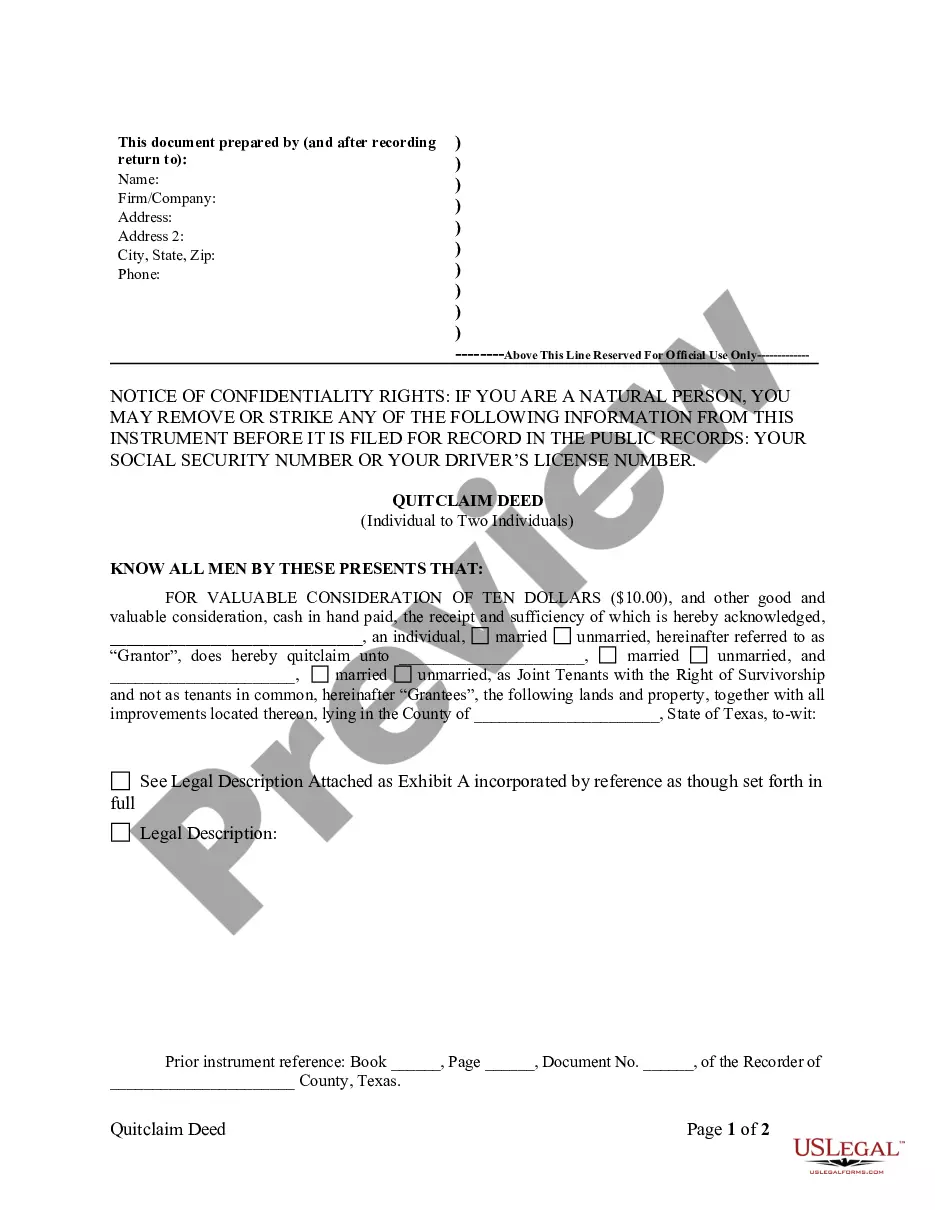

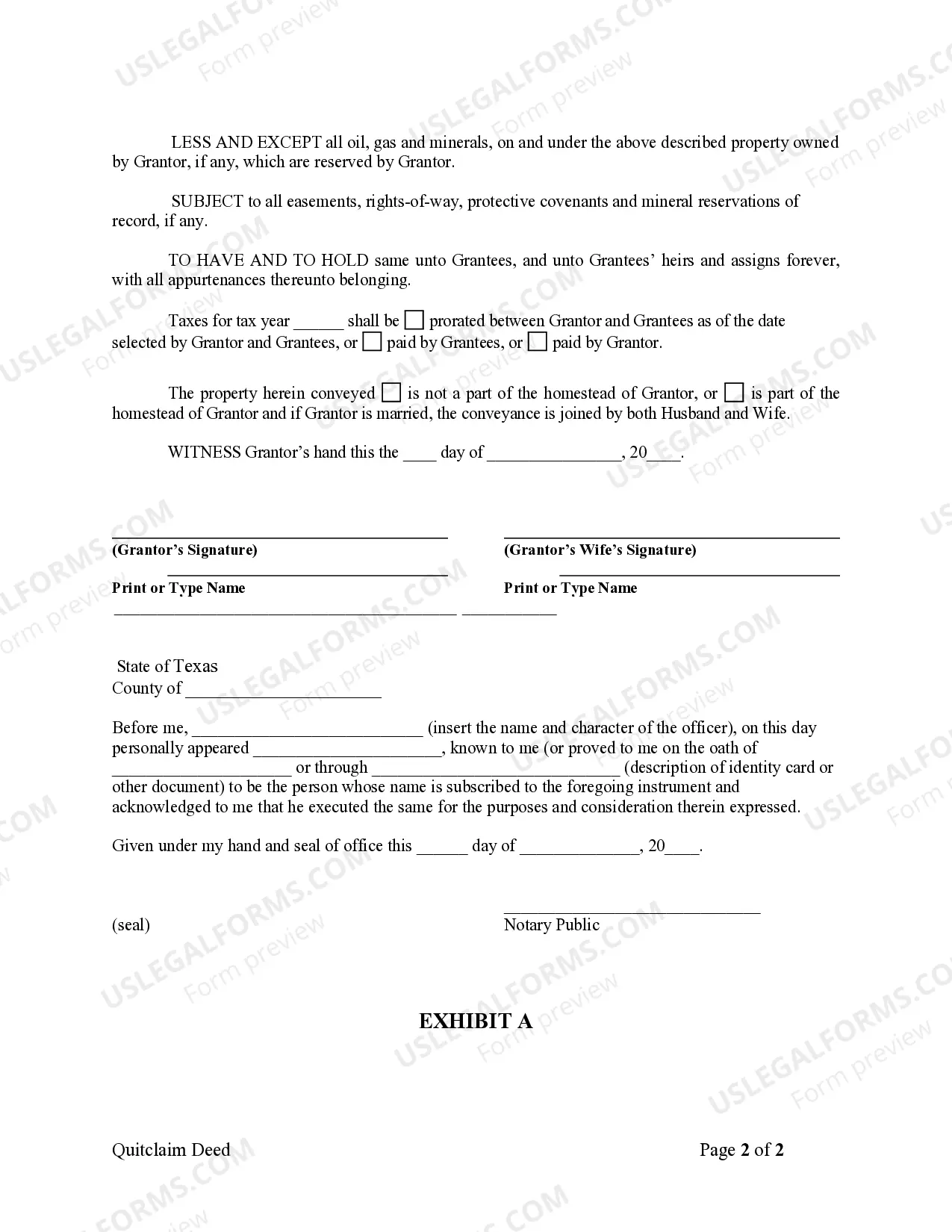

This Quitclaim Deed from Individual to Two Individuals in Joint Tenancy form is a Quitclaim Deed where the Grantor is an individual and the Grantees are two individuals. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This form complies with all state statutory laws.

A San Antonio Texas Quitclaim Deed from Individual to Two Individuals in Joint Tenancy is a legal document used to transfer ownership of real estate property in San Antonio, Texas. This type of deed is commonly used when a property owner wants to transfer their interest in the property to two other individuals who will hold the property as joint tenants. A quitclaim deed is a type of deed that transfers any interest the granter (individual transferring the property) may have in the property, without making any guarantees about the validity or marketability of the title. It is important to note that a quitclaim deed does not provide any warranties, hence it is typically used in situations where the granter is not making any promises or guarantees about the property's title. In the context of joint tenancy, two individuals will hold equal ownership interests in the property. This means that both individuals have the right to use and enjoy the property, and in the event of one individual's death, their ownership interest automatically transfers to the surviving joint tenant. There may be different variations or types of San Antonio Texas Quitclaim Deeds from Individual to Two Individuals in Joint Tenancy, such as: 1. Regular Quitclaim Deed to Two Individuals in Joint Tenancy: This is the most common type of quitclaim deed used to transfer property ownership to two individuals in joint tenancy. It is a simple document that identifies the granter, the two joint tenants, and the specific property being transferred. 2. Special Purpose Quitclaim Deed: This type of quitclaim deed may include additional provisions or restrictions specified by either the granter or the joint tenants. For example, it could specify certain limitations on the use of the property or any rights reserved by the granter. A special purpose quitclaim deed may be used when there are unique circumstances or specific conditions that need to be addressed in the transfer. 3. Enhanced Life Estate Quitclaim Deed: This type of quitclaim deed is also known as a "Lady Bird Deed." It allows the granter (individual transferring the property) to retain certain rights, such as the ability to live on the property for the duration of their life. This type of deed is often used in estate planning, as it provides a way to transfer property while maintaining some control and rights for the granter during their lifetime. In all cases, it is highly recommended consulting with a legal professional, such as a real estate attorney, when preparing and executing a quitclaim deed. This ensures that the deed is accurately prepared and complies with all applicable laws and regulations in San Antonio, Texas.