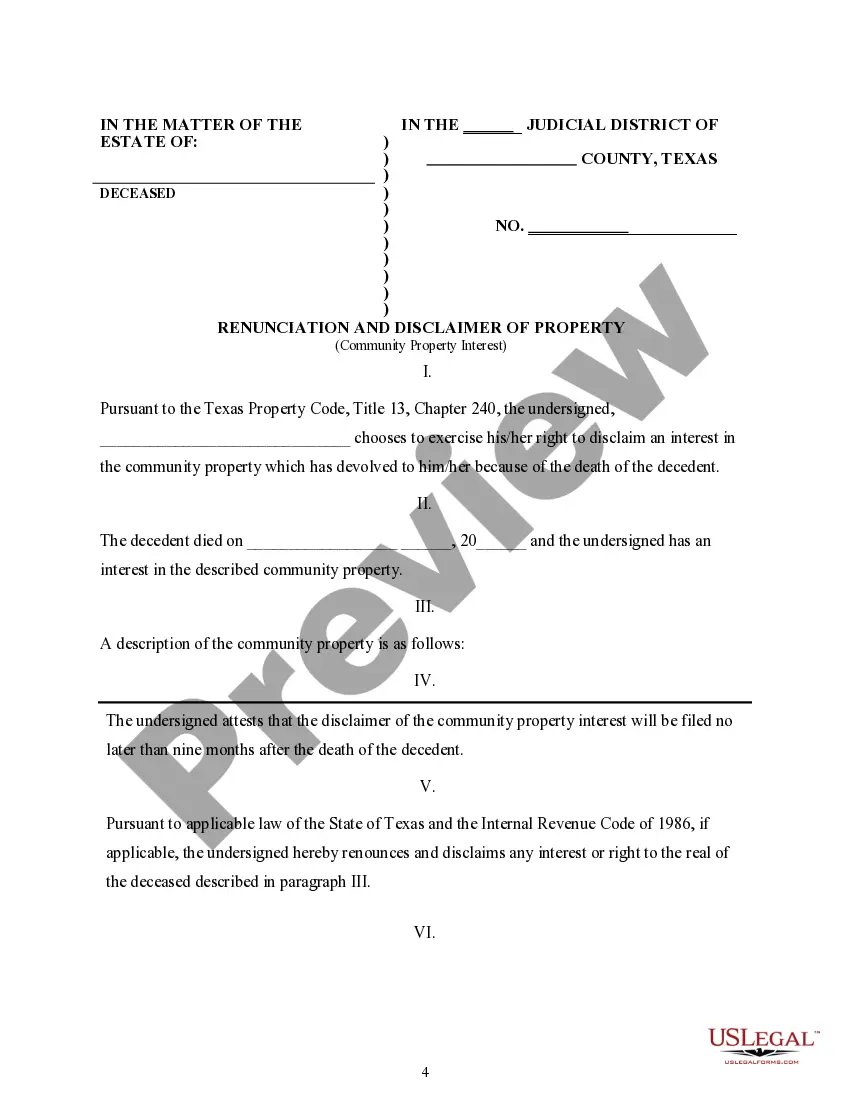

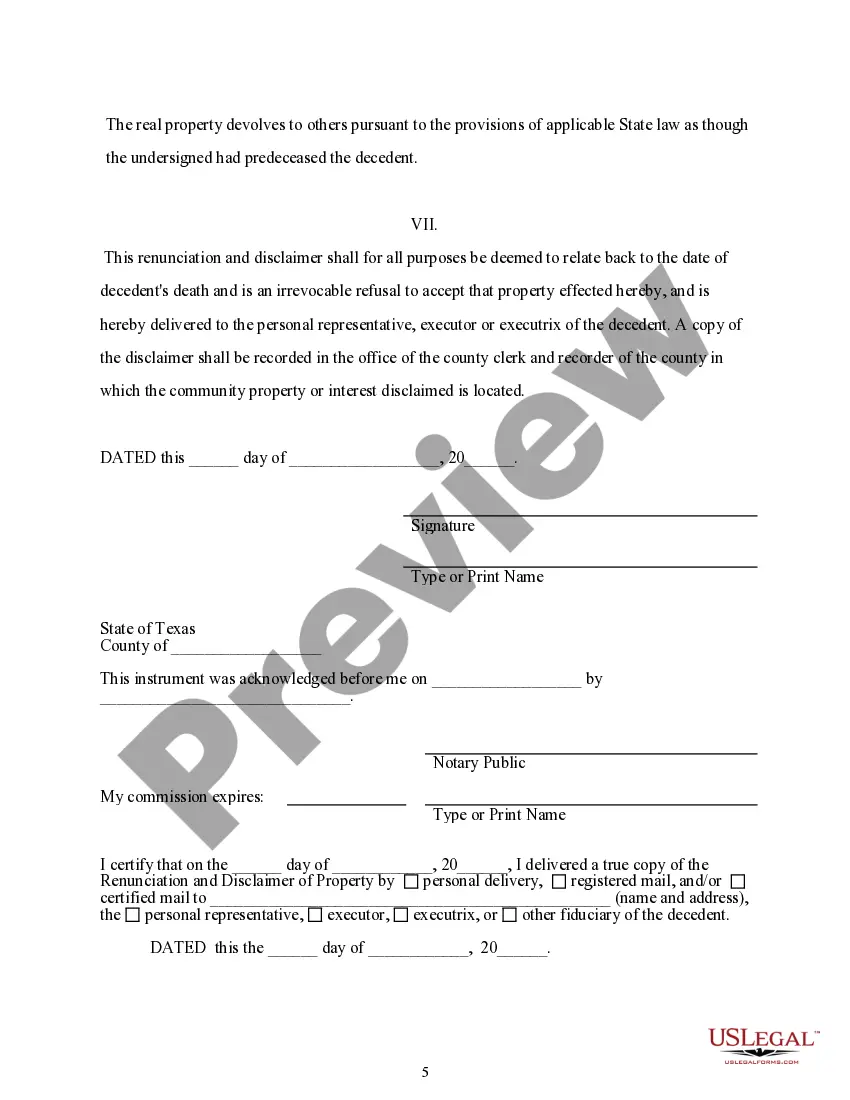

This form is a Renunciation and Disclaimer of a Community Property Interest, where the beneficiary gained an interest in the described community property upon the death of the decedent, but, pursuant to the Texas Statutes, Chapter II, the beneficiary has chosen to disclaim his/her rightful interest in the property. Therefore, the property will devolve to others as though the beneficiary predeceased the decedent. The form also includes a state specific acknowledgment and a certificate to verify the delivery of the document.

College Station Texas Renunciation And Disclaimer of Property — Community Property Interest: A Comprehensive Guide Introduction: In College Station, Texas, the Renunciation And Disclaimer of Property — Community Property Interest is a legal process that enables individuals to renounce or disclaim their interest in community property. This guide aims to provide a detailed description of what this process entails, its significance, and the different types of renunciation and disclaimers of property available in College Station, Texas. What is Community Property? Before delving into the specifics, it is essential to understand the concept of community property. In Texas, community property refers to assets and liabilities acquired during a marriage, excluding separate property. Both spouses equally own community property, which is subject to division in case of divorce, separation, or death. Understanding Renunciation and Disclaimer: Renunciation and disclaimer are legal terms used to describe the act of relinquishing one's claim, interest, or right in a property. In College Station, Texas, individuals may choose to renounce or disclaim their community property interests in various reasons, including estate planning purposes, protecting personal assets, or avoiding potential liabilities. Types of Renunciation and Disclaimer in College Station, Texas: 1. Renunciation of Community Property Interest: This type of renunciation occurs when an individual voluntarily chooses to give up their interest in certain community property assets. By renouncing their rights, they ensure that those specific assets will not be included in the property division process during divorce or separation proceedings. 2. Disclaimer of Community Property Interest: A disclaimer occurs when an individual disavows or rejects their ownership rights in community property. This action is usually taken to safeguard personal assets and prevent potentially unfavorable consequences, such as creditors seizing community property assets to satisfy debts. Benefits and Considerations: Renunciation and disclaimer of property interest in College Station, Texas, present several potential advantages. These include: — Protecting personal assets: Individuals can safeguard their separate property from being subject to division or potential liabilities arising from community property. — Estate planning strategies: Renunciation and disclaimer of assets can be effective tools for organizing an individual's estate, ensuring specific assets go to intended beneficiaries. — Reducing potential financial burden: In the case of significant debts or obligations, renunciation and disclaimer can help shield a person's assets from being used to satisfy community obligations. Although renunciation and disclaimer offer benefits, it is crucial to consult with a qualified attorney who specializes in family law and estate planning. This ensures that the process is conducted correctly, and all legal implications are understood. Conclusion: The Renunciation And Disclaimer of Property — Community Property Interest process in College Station, Texas, provides individuals with a means to renounce or disclaim their interest in community property for various purposes. Understanding the types and implications of renunciation and disclaimer is essential to protect personal assets and plan for future contingencies. Seeking guidance from a knowledgeable attorney is highly advised to ensure compliance with all legal requirements.College Station Texas Renunciation And Disclaimer of Property — Community Property Interest: A Comprehensive Guide Introduction: In College Station, Texas, the Renunciation And Disclaimer of Property — Community Property Interest is a legal process that enables individuals to renounce or disclaim their interest in community property. This guide aims to provide a detailed description of what this process entails, its significance, and the different types of renunciation and disclaimers of property available in College Station, Texas. What is Community Property? Before delving into the specifics, it is essential to understand the concept of community property. In Texas, community property refers to assets and liabilities acquired during a marriage, excluding separate property. Both spouses equally own community property, which is subject to division in case of divorce, separation, or death. Understanding Renunciation and Disclaimer: Renunciation and disclaimer are legal terms used to describe the act of relinquishing one's claim, interest, or right in a property. In College Station, Texas, individuals may choose to renounce or disclaim their community property interests in various reasons, including estate planning purposes, protecting personal assets, or avoiding potential liabilities. Types of Renunciation and Disclaimer in College Station, Texas: 1. Renunciation of Community Property Interest: This type of renunciation occurs when an individual voluntarily chooses to give up their interest in certain community property assets. By renouncing their rights, they ensure that those specific assets will not be included in the property division process during divorce or separation proceedings. 2. Disclaimer of Community Property Interest: A disclaimer occurs when an individual disavows or rejects their ownership rights in community property. This action is usually taken to safeguard personal assets and prevent potentially unfavorable consequences, such as creditors seizing community property assets to satisfy debts. Benefits and Considerations: Renunciation and disclaimer of property interest in College Station, Texas, present several potential advantages. These include: — Protecting personal assets: Individuals can safeguard their separate property from being subject to division or potential liabilities arising from community property. — Estate planning strategies: Renunciation and disclaimer of assets can be effective tools for organizing an individual's estate, ensuring specific assets go to intended beneficiaries. — Reducing potential financial burden: In the case of significant debts or obligations, renunciation and disclaimer can help shield a person's assets from being used to satisfy community obligations. Although renunciation and disclaimer offer benefits, it is crucial to consult with a qualified attorney who specializes in family law and estate planning. This ensures that the process is conducted correctly, and all legal implications are understood. Conclusion: The Renunciation And Disclaimer of Property — Community Property Interest process in College Station, Texas, provides individuals with a means to renounce or disclaim their interest in community property for various purposes. Understanding the types and implications of renunciation and disclaimer is essential to protect personal assets and plan for future contingencies. Seeking guidance from a knowledgeable attorney is highly advised to ensure compliance with all legal requirements.