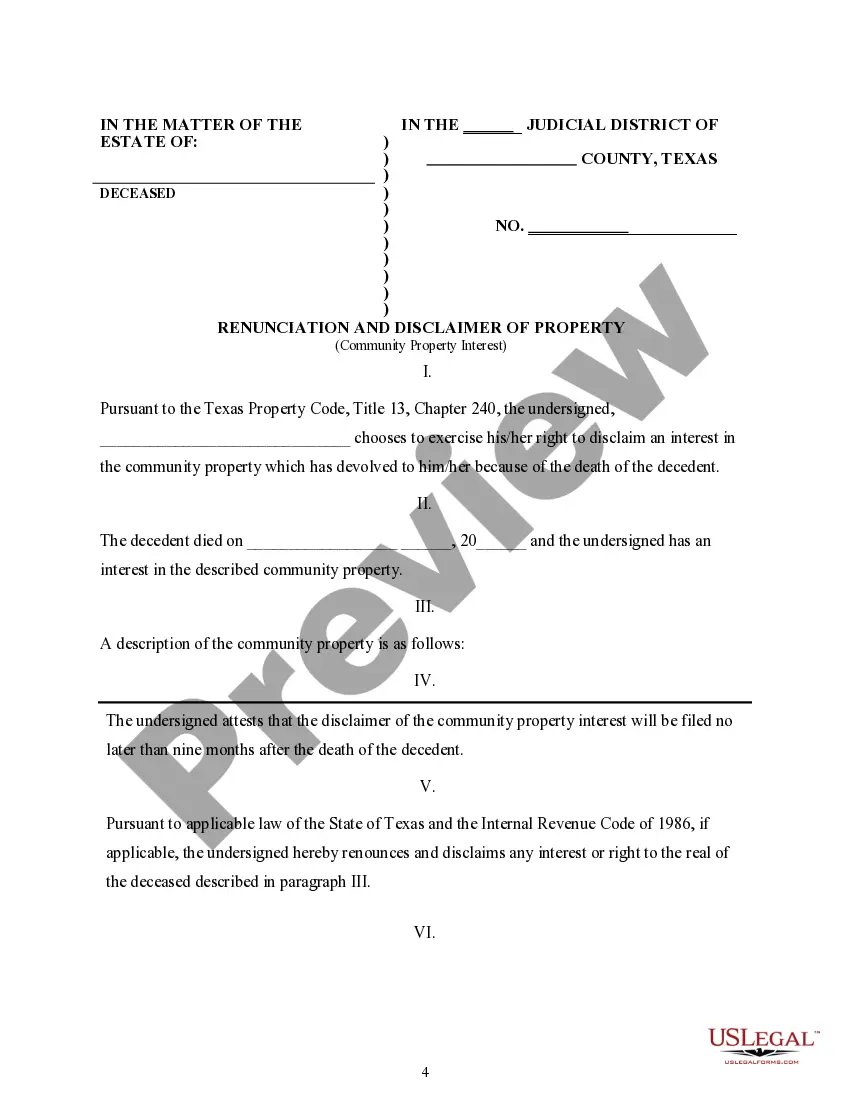

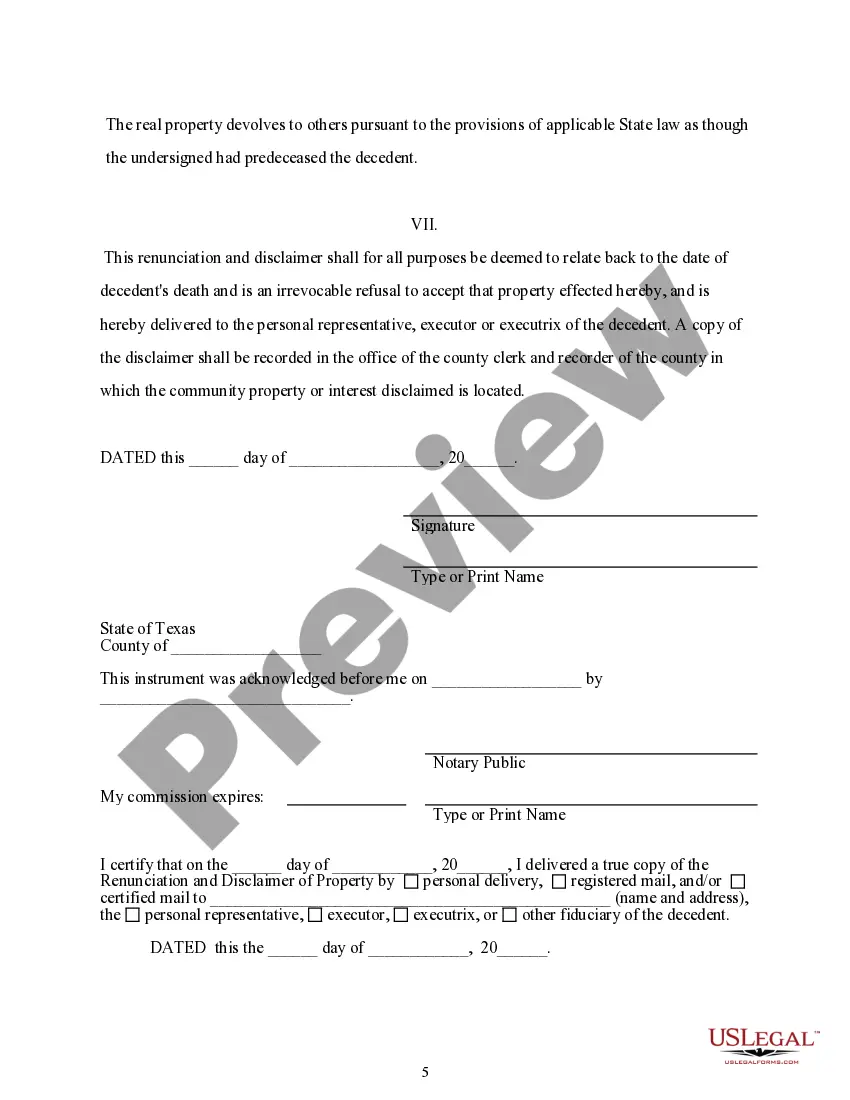

This form is a Renunciation and Disclaimer of a Community Property Interest, where the beneficiary gained an interest in the described community property upon the death of the decedent, but, pursuant to the Texas Statutes, Chapter II, the beneficiary has chosen to disclaim his/her rightful interest in the property. Therefore, the property will devolve to others as though the beneficiary predeceased the decedent. The form also includes a state specific acknowledgment and a certificate to verify the delivery of the document.

Travis Texas Renunciation And Disclaimer of Property - Community Property Interest

Description

How to fill out Texas Renunciation And Disclaimer Of Property - Community Property Interest?

Do you require a reliable and affordable legal documents provider to obtain the Travis Texas Renunciation And Disclaimer of Property - Community Property Interest? US Legal Forms is your ideal choice.

Whether you need a simple agreement to establish guidelines for living together with your partner or a collection of forms to advance your divorce case in court, we have you covered. Our platform features over 85,000 current legal document templates for both personal and business purposes. All templates we offer are not generic and are adapted to meet the specifications of individual states and counties.

To access the form, you must Log In to your account, find the necessary form, and click the Download button next to it. Please keep in mind that you can download your previously acquired document templates at any time in the My documents section.

Are you a newcomer to our website? No problem. You can set up an account in minutes, but first, make sure to do the following.

Now you can create your account. Then select the subscription option and continue to payment. Once the payment is completed, download the Travis Texas Renunciation And Disclaimer of Property - Community Property Interest in any offered format. You can return to the website whenever needed and redownload the form without any additional fees.

Obtaining up-to-date legal forms has never been simpler. Try US Legal Forms today, and stop wasting your valuable time searching for legal documents online once and for all.

- Verify that the Travis Texas Renunciation And Disclaimer of Property - Community Property Interest complies with the regulations of your state and locality.

- Review the form’s description (if available) to understand who and what the form is aimed at.

- Reinitiate the search if the form isn’t suitable for your particular scenario.

Form popularity

FAQ

When a husband dies with community property ownership, the surviving spouse typically retains their half of the community property. The deceased's half can be transferred to beneficiaries as determined by their will or, if there is no will, according to Texas intestacy laws. Understanding these dynamics is crucial for effective estate planning and ensuring asset protection. By utilizing the Travis Texas Renunciation And Disclaimer of Property - Community Property Interest framework, families can navigate this process smoothy.

The disclaimer of interest in the Texas estate Code allows individuals to renounce their rights to receive property under certain conditions. This legal process must meet specific criteria outlined in the estate code to be valid. By understanding this disclaimer, individuals can better manage their inheritance choices and estate planning. The Travis Texas Renunciation And Disclaimer of Property - Community Property Interest can help clarify these legal provisions for your benefit.

Disclaiming jointly held property is more complex and typically requires agreement among all joint owners. In Texas, each owner must individually renounce their interest for a successful disclaimer. If you're navigating this process, it's essential to understand the implications and ensure compliance with Texas law. The Travis Texas Renunciation And Disclaimer of Property - Community Property Interest framework can guide you through the complexities of this situation.

Yes, you can disclaim community property in Texas, but specific procedures must be followed. This involves filing a written disclaimer that complies with Texas law, declaring your intention to reject your interest. It's important to note that this process is irreversible, so consideration is vital before proceeding. You can utilize the Travis Texas Renunciation And Disclaimer of Property - Community Property Interest to navigate this effectively.

A beneficiary might want to disclaim property for several reasons, including financial planning or personal circumstances. Disclaiming property can help avoid potential tax burdens or complications with debt. Moreover, it allows the property to pass to other heirs, which might be preferable for the beneficiary. The Travis Texas Renunciation And Disclaimer of Property - Community Property Interest provides valuable guidelines for making an informed decision.

To disclaim an inheritance in Texas, you must file a written disclaimer with the probate court. This document should clearly state your intention to renounce your rights to the property. Additionally, ensure this action occurs within nine months of the decedent's death, as the Texas statute requires. Using the Travis Texas Renunciation And Disclaimer of Property - Community Property Interest process can simplify this procedure and ensure proper compliance.

To write a disclaimer of interest, begin by identifying the specific property or interest you wish to decline. Clearly state your intent in a written format, mentioning the applicable laws in Texas. Make sure to sign and date the document, and consider filing it with the appropriate court or agency for formal recognition. For templates and examples, visit US Legal Forms to simplify the process and ensure compliance with Texas law.

A disclaimer of interest in property in Texas is a legal way to refuse ownership of property, particularly in cases of inheritance. This process allows individuals to avoid taxes and responsibilities associated with the property while ensuring that the property passes to other designated heirs. It is essential to understand how a disclaimer functions within the framework of Travis Texas Renunciation and Disclaimer of Property - Community Property Interest. Consulting resources like US Legal Forms can provide clarity on this topic.

Writing an inheritance disclaimer letter involves declaring your intention not to accept a specific inheritance or community property interest. Start by addressing the relevant parties and clearly stating your decision to disclaim. Include necessary details, such as the description of the property and your relationship to the deceased. For assistance in drafting this letter, US Legal Forms provides templates that ensure your disclaimer is valid in Travis Texas.

Renunciation and disclaimer of interests in estate allow individuals to refuse benefits from an inheritance. In Travis Texas, this means you can legally decline your right to a community property interest without affecting other beneficiaries. This process ensures that your decisions do not unintentionally burden others with your choices. You may consider using resources like US Legal Forms to guide you through this process effectively.