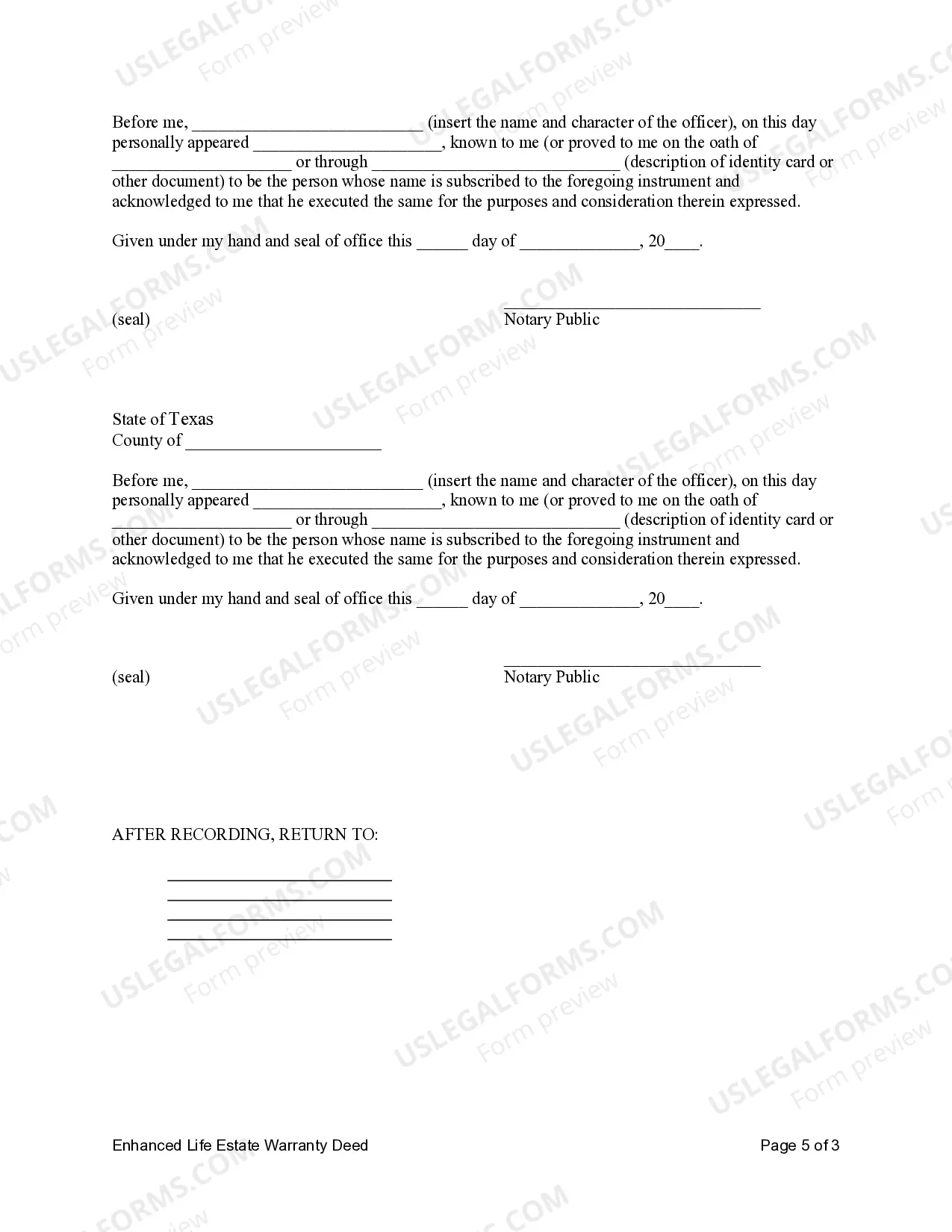

This form is a Warranty Deed with a retained Enhanced Life Estate where the Grantors are two individuals or husband and wife and the Grantee is an individual. Grantors convey the property to Grantee subject to an enhanced retained life estate. The Grantors retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

McAllen Texas Enhanced Life Estate or Lady Bird Grant Deed from Two Individuals, or Husband and Wife, to an Individual: A Comprehensive Guide In McAllen, Texas, an Enhanced Life Estate or Lady Bird Grant Deed refers to a property transfer method that allows two individuals, typically a husband and wife, to convey title ownership of their property to an individual (grantee) while retaining certain recognized rights until their passing. This type of deed offers advantageous features, protecting the granters' interests and addressing estate planning concerns. In general, an Enhanced Life Estate or Lady Bird Grant Deed can have different variations, including: 1. Enhanced Life Estate Deed: This grant deed commonly allows the granters, a husband and wife, to retain absolute control and possessor rights over the property during their lifetimes. It permits them to enjoy the property's income, sell or mortgage it without the consent of the grantee, and even terminate the life estate without involving the grantee. 2. Lady Bird Grant Deed: Named after former First Lady Bird Johnson, this type of enhanced life estate deed is similar to the enhanced life estate deed. The key distinction lies in the ability of the granters to convey a warranty of title during their lifetime, providing an additional layer of protection to the grantee. This warranty covers any claims against the property arising before or during the granters' lifetime. Both the Enhanced Life Estate Deed and Lady Bird Grant Deed offer significant benefits to the granter(s) and grantee, such as: a. Avoidance of Probate: By utilizing this type of deed, the property transfer occurs outside the probate process, saving time and costs associated with the court-supervised distribution of assets. b. Homestead Protections: McAllen, Texas, being located within Hidalgo County, benefits from specific homestead laws. These laws offer certain tax advantages and protect the family home from creditors, making an enhanced life estate or Lady Bird grant deed a valuable asset protection tool. c. Flexibility and Decision-Making Authority: With an enhanced life estate or Lady Bird grant deed, the granter(s) retain control over the property during their lifetimes. They can make decisions regarding its use, sale, or mortgaging without needing the grantee's approval. d. Stepped-Up Basis for Income Tax Purposes: The grantee receives a stepped-up basis equal to the fair market value of the property at the time of the granter(s)' death. This can significantly reduce capital gains taxes if the grantee decides to sell the property later on. It is crucial to consult with a qualified real estate attorney or estate planning professional familiar with McAllen, Texas, laws and regulations to evaluate which type of enhanced life estate or Lady Bird grant deed best suits the specific circumstances of the granter(s). They will guide you through the legal requirements, prepare the necessary documents, and ensure a smooth and proper property transfer process. Remember, the specific terminology and requirements of these deeds may vary from state to state. Therefore, seeking expert advice ensures compliance with McAllen, Texas, laws and maximizes protection for all parties involved.McAllen Texas Enhanced Life Estate or Lady Bird Grant Deed from Two Individuals, or Husband and Wife, to an Individual: A Comprehensive Guide In McAllen, Texas, an Enhanced Life Estate or Lady Bird Grant Deed refers to a property transfer method that allows two individuals, typically a husband and wife, to convey title ownership of their property to an individual (grantee) while retaining certain recognized rights until their passing. This type of deed offers advantageous features, protecting the granters' interests and addressing estate planning concerns. In general, an Enhanced Life Estate or Lady Bird Grant Deed can have different variations, including: 1. Enhanced Life Estate Deed: This grant deed commonly allows the granters, a husband and wife, to retain absolute control and possessor rights over the property during their lifetimes. It permits them to enjoy the property's income, sell or mortgage it without the consent of the grantee, and even terminate the life estate without involving the grantee. 2. Lady Bird Grant Deed: Named after former First Lady Bird Johnson, this type of enhanced life estate deed is similar to the enhanced life estate deed. The key distinction lies in the ability of the granters to convey a warranty of title during their lifetime, providing an additional layer of protection to the grantee. This warranty covers any claims against the property arising before or during the granters' lifetime. Both the Enhanced Life Estate Deed and Lady Bird Grant Deed offer significant benefits to the granter(s) and grantee, such as: a. Avoidance of Probate: By utilizing this type of deed, the property transfer occurs outside the probate process, saving time and costs associated with the court-supervised distribution of assets. b. Homestead Protections: McAllen, Texas, being located within Hidalgo County, benefits from specific homestead laws. These laws offer certain tax advantages and protect the family home from creditors, making an enhanced life estate or Lady Bird grant deed a valuable asset protection tool. c. Flexibility and Decision-Making Authority: With an enhanced life estate or Lady Bird grant deed, the granter(s) retain control over the property during their lifetimes. They can make decisions regarding its use, sale, or mortgaging without needing the grantee's approval. d. Stepped-Up Basis for Income Tax Purposes: The grantee receives a stepped-up basis equal to the fair market value of the property at the time of the granter(s)' death. This can significantly reduce capital gains taxes if the grantee decides to sell the property later on. It is crucial to consult with a qualified real estate attorney or estate planning professional familiar with McAllen, Texas, laws and regulations to evaluate which type of enhanced life estate or Lady Bird grant deed best suits the specific circumstances of the granter(s). They will guide you through the legal requirements, prepare the necessary documents, and ensure a smooth and proper property transfer process. Remember, the specific terminology and requirements of these deeds may vary from state to state. Therefore, seeking expert advice ensures compliance with McAllen, Texas, laws and maximizes protection for all parties involved.