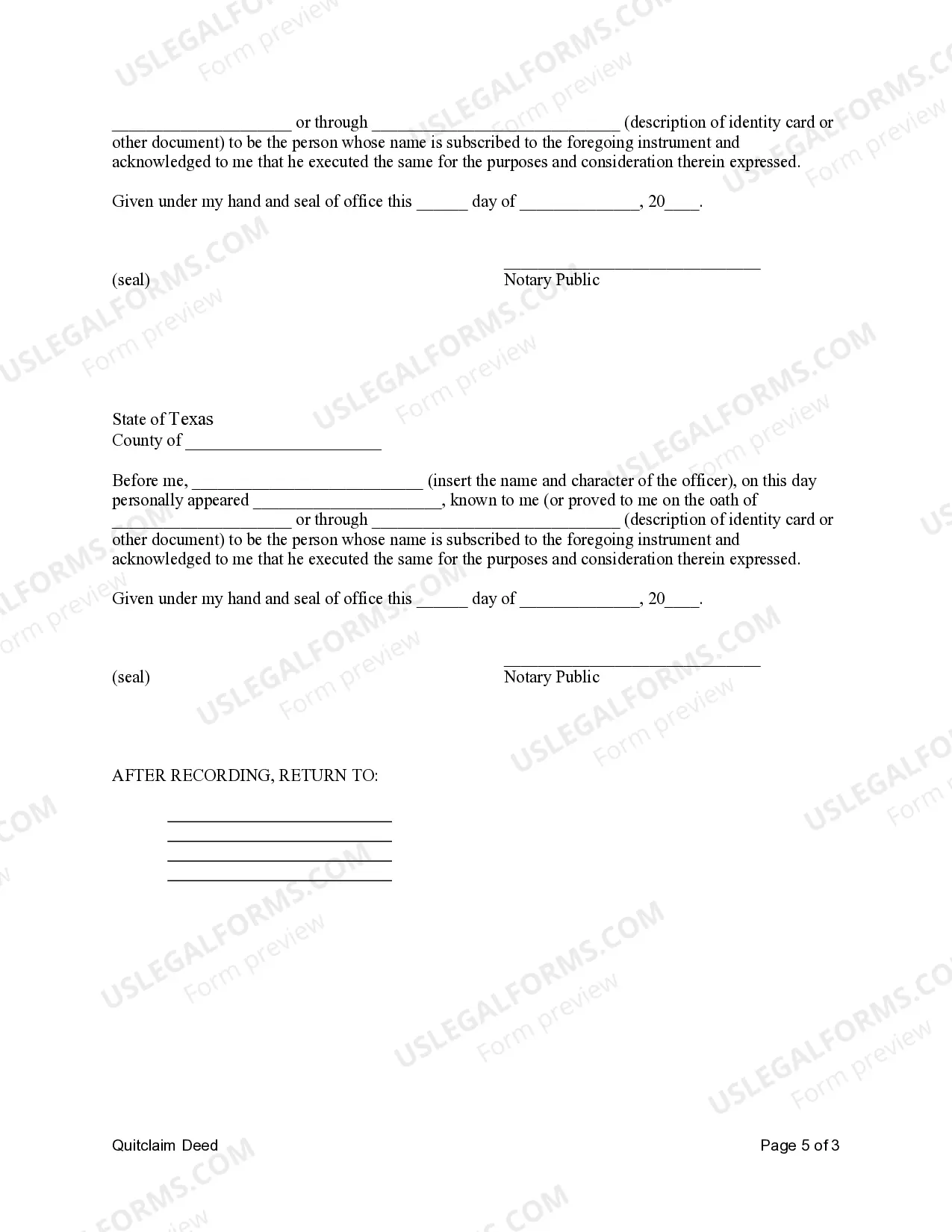

This form is a Quitclaim Deed where the Grantors are Three Individuals and the grantee is an individual. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

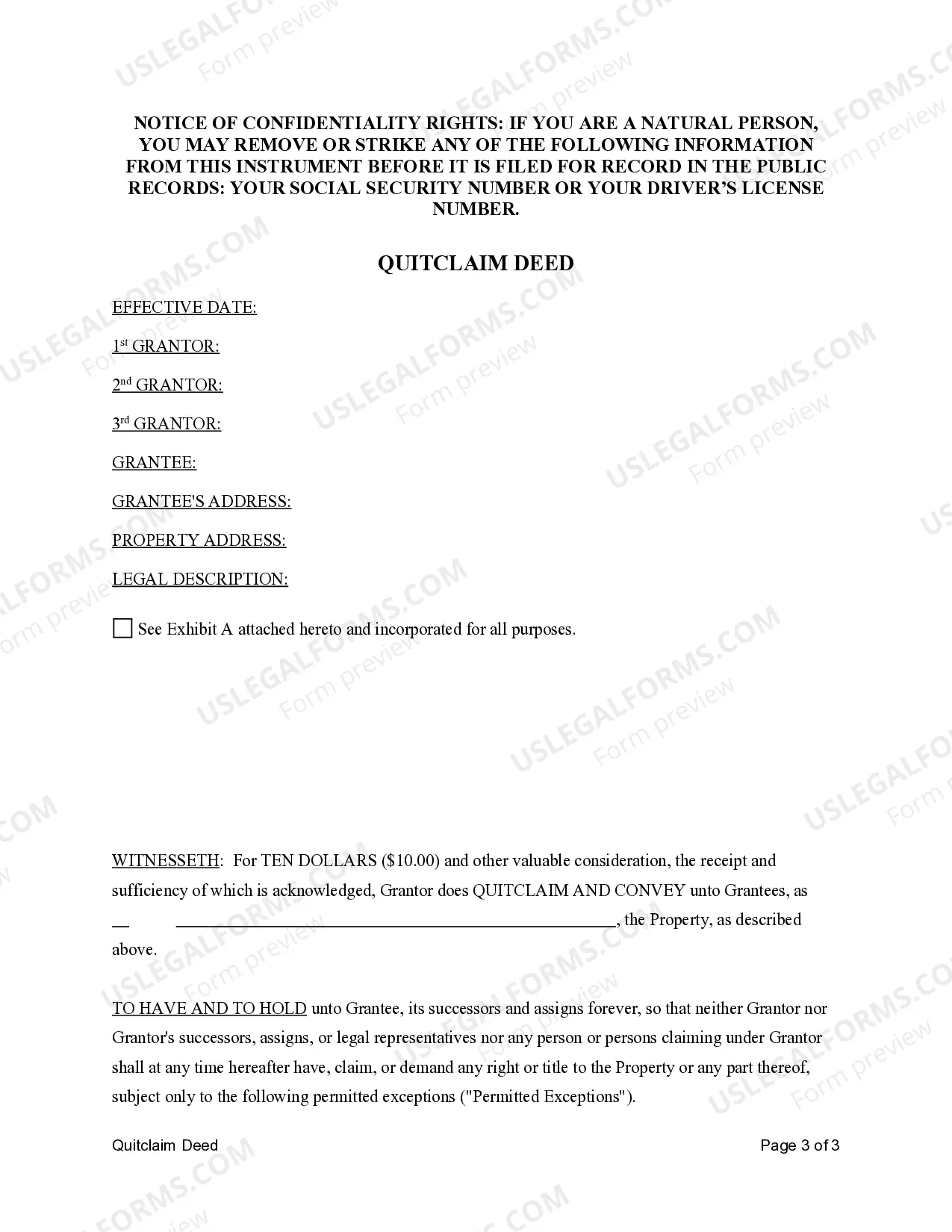

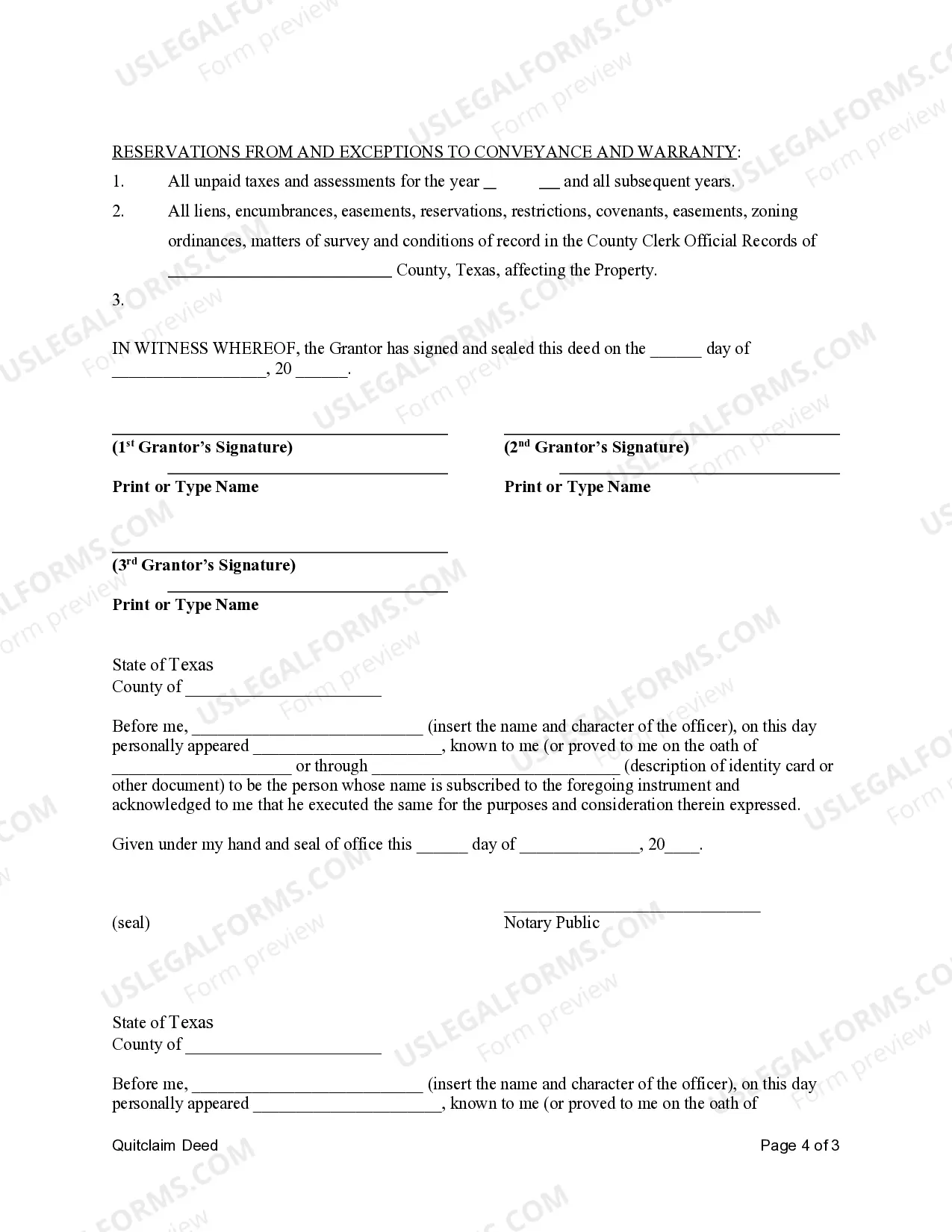

An Austin Texas Quitclaim Deed — Three Individuals to One Individual refers to a legal document used to transfer ownership of a property in Austin, Texas, from three individuals to one individual without any warranties or guarantees. A quitclaim deed is commonly used when transferring property between family members, divorcing spouses, or for other private transactions where the parties involved have a high level of trust. The Austin Texas Quitclaim Deed — Three Individuals to One Individual outlines the details of the transfer, including the names of the three individuals who are relinquishing their ownership rights and the name of the individual who will be assuming sole ownership of the property. Additionally, the property address and legal description are included, ensuring that the transfer is specific and accurate. The quitclaim deed also confirms that the transfer is being made without any warranties or guarantees. This means that the three individuals transferring the property are not guaranteeing the title or defending against any potential claims, unlike a warranty deed. The quitclaim deed only transfers the rights, if any, that the three individuals have in the property to the individual receiving the property. It is important to note that a quitclaim deed does not provide any assurance that there are no liens, mortgages, or other encumbrances on the property. The individual receiving the property assumes all risks associated with the property's title. Therefore, it is advisable for the individual receiving the property to conduct a thorough title search and due diligence before accepting the transfer. Different types of Austin Texas Quitclaim Deeds — Three Individuals to One Individual may include variations in the language used or additional provisions specific to the circumstances of the transfer. For example, there may be different quitclaim deeds used for transfers due to divorce, inheritances, or gifting. It is crucial to use the appropriate quitclaim deed that aligns with the specific situation to ensure a smooth and legally valid transfer of property ownership.