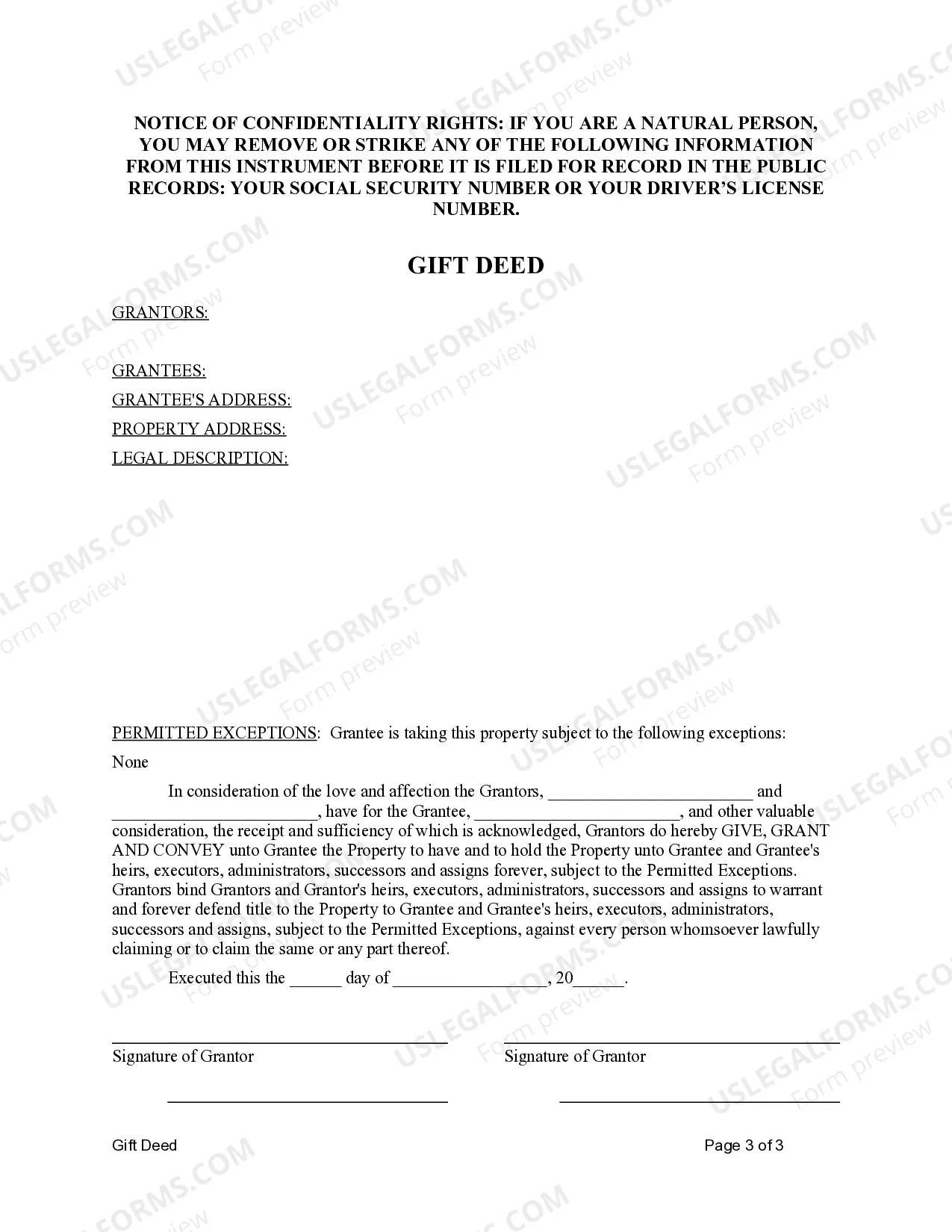

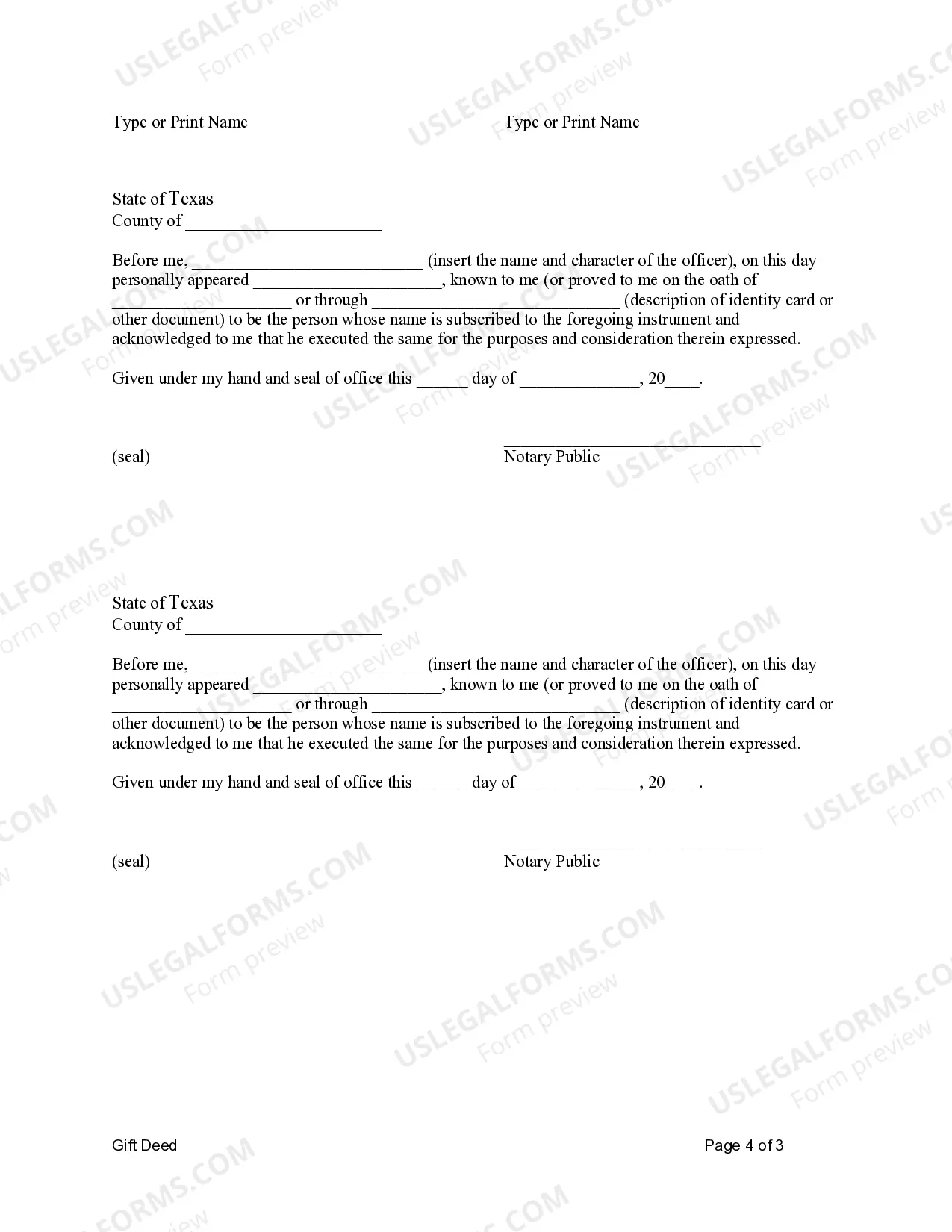

This form is a Gift Deed where the grantors are two individuals and the grantor is an individual. Grantors give and convey the described property to grantee. This deed complies with all state statutory laws.

Arlington Texas Gift Deed — Two Individuals to One Individual is a legal document that transfers ownership of real property from two individuals, known as the granters, to another individual, referred to as the grantee, without any monetary exchange. This type of gift deed serves as a means of giving a property as a gift, typically within a family or close relationship, and is commonly used for estate planning purposes. The Arlington Texas Gift Deed — Two Individuals to One Individual is a legally binding instrument that must adhere to certain guidelines and requirements as laid out by the state of Texas. It is crucial to have a clear understanding of the specifics involved in this type of gift deed to ensure a smooth transfer process and avoid any potential legal complications. Here are some relevant keywords associated with the Arlington Texas Gift Deed — Two Individuals to One Individual: 1. Real property transfer: The gift deed facilitates the transfer of real property, including land, houses, or buildings, from two individuals to one individual. 2. Ownership transfer: The deed transfers full ownership rights from the granters to the grantee, effectively making the recipient the sole owner of the property. 3. Gift transaction: The transfer is considered a gift, meaning no money or valuable consideration is exchanged in return for the property. 4. Estate planning: Many individuals use gift deeds as part of their estate planning strategy to ensure the seamless transfer of assets to their intended beneficiaries. 5. Tax implications: It is essential to understand the potential tax implications associated with gift deeds, including gift tax and property tax reassessment. 6. Gifting within family: The Arlington Texas Gift Deed — Two Individuals to One Individual is often used within families, where parents may gift a property to their children or grandchildren. Different types of Arlington Texas Gift Deed — Two Individuals to One Individual may include: 1. Residential property gift deed: This type of gift deed involves the transfer of ownership of a residential property, such as a house or condominium. 2. Vacant land gift deed: A vacant land gift deed refers to the transfer of ownership of land without any structures or buildings on it. 3. Multi-family property gift deed: If the property being transferred is a multi-family dwelling, such as a duplex or apartment complex, specific considerations may apply. 4. Commercial property gift deed: When the property being gifted is a commercial building or land, additional legal and financial considerations may come into play. Remember, seeking legal advice from a qualified attorney specializing in real estate law is strongly recommended when preparing and executing an Arlington Texas Gift Deed — Two Individuals to One Individual to ensure compliance with state laws and regulations.Arlington Texas Gift Deed — Two Individuals to One Individual is a legal document that transfers ownership of real property from two individuals, known as the granters, to another individual, referred to as the grantee, without any monetary exchange. This type of gift deed serves as a means of giving a property as a gift, typically within a family or close relationship, and is commonly used for estate planning purposes. The Arlington Texas Gift Deed — Two Individuals to One Individual is a legally binding instrument that must adhere to certain guidelines and requirements as laid out by the state of Texas. It is crucial to have a clear understanding of the specifics involved in this type of gift deed to ensure a smooth transfer process and avoid any potential legal complications. Here are some relevant keywords associated with the Arlington Texas Gift Deed — Two Individuals to One Individual: 1. Real property transfer: The gift deed facilitates the transfer of real property, including land, houses, or buildings, from two individuals to one individual. 2. Ownership transfer: The deed transfers full ownership rights from the granters to the grantee, effectively making the recipient the sole owner of the property. 3. Gift transaction: The transfer is considered a gift, meaning no money or valuable consideration is exchanged in return for the property. 4. Estate planning: Many individuals use gift deeds as part of their estate planning strategy to ensure the seamless transfer of assets to their intended beneficiaries. 5. Tax implications: It is essential to understand the potential tax implications associated with gift deeds, including gift tax and property tax reassessment. 6. Gifting within family: The Arlington Texas Gift Deed — Two Individuals to One Individual is often used within families, where parents may gift a property to their children or grandchildren. Different types of Arlington Texas Gift Deed — Two Individuals to One Individual may include: 1. Residential property gift deed: This type of gift deed involves the transfer of ownership of a residential property, such as a house or condominium. 2. Vacant land gift deed: A vacant land gift deed refers to the transfer of ownership of land without any structures or buildings on it. 3. Multi-family property gift deed: If the property being transferred is a multi-family dwelling, such as a duplex or apartment complex, specific considerations may apply. 4. Commercial property gift deed: When the property being gifted is a commercial building or land, additional legal and financial considerations may come into play. Remember, seeking legal advice from a qualified attorney specializing in real estate law is strongly recommended when preparing and executing an Arlington Texas Gift Deed — Two Individuals to One Individual to ensure compliance with state laws and regulations.