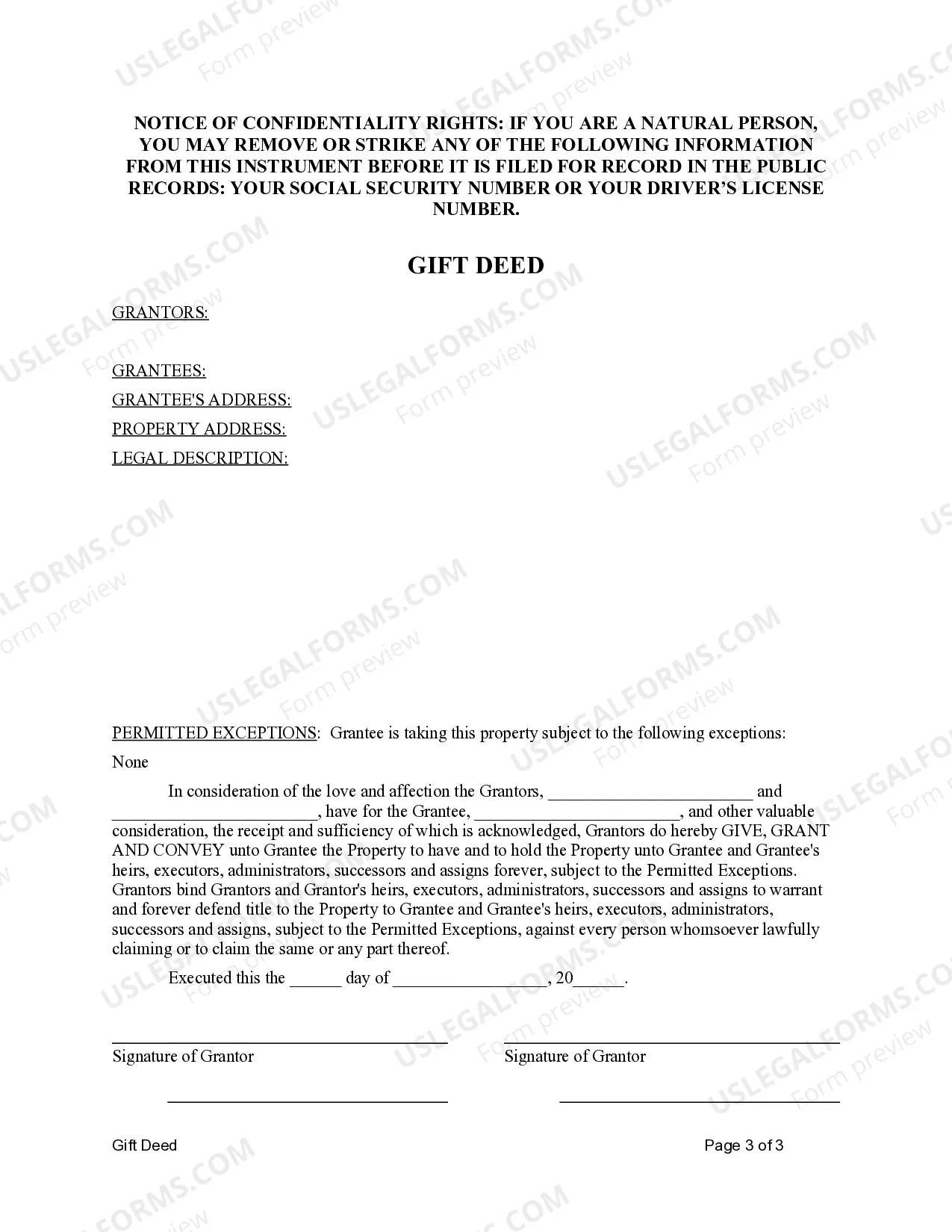

This form is a Gift Deed where the grantors are two individuals and the grantor is an individual. Grantors give and convey the described property to grantee. This deed complies with all state statutory laws.

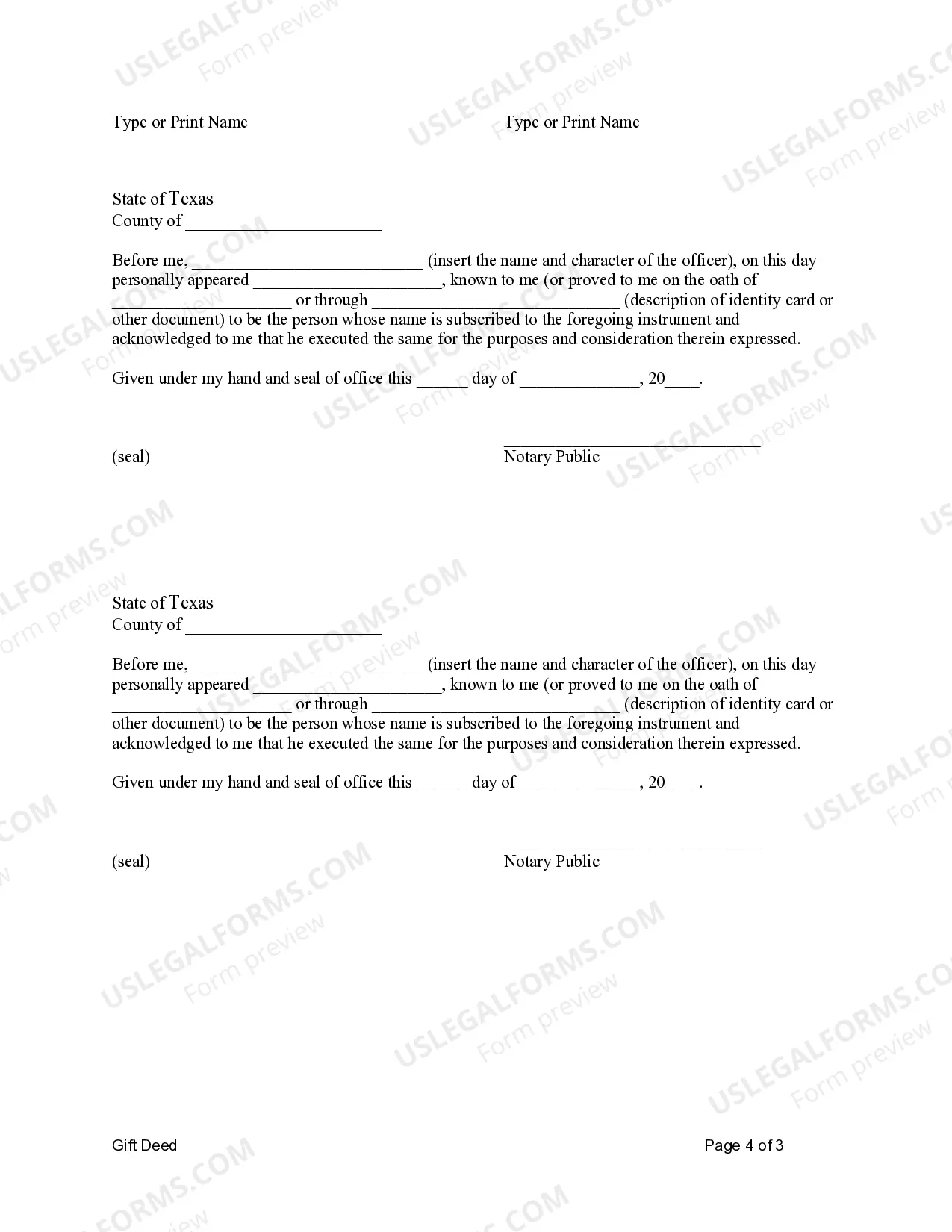

A Gift Deed is a legal document that facilitates the transfer of ownership of a property from one person to another without any monetary consideration in return. In Austin, Texas, there is a specific type of Gift Deed known as "Austin Texas Gift Deed — Two Individuals to One Individual." This type of Gift Deed involves the transfer of property from two individuals to another single individual. This type of Gift Deed is commonly used in scenarios where two individuals, who may be joint owners or co-owners of a property, want to gift their interests or shares in the property to a single individual. The gifting process is done without any exchange of money or compensation, and it is typically executed out of generosity, personal relationships, or estate planning purposes. The Austin Texas Gift Deed — Two Individuals to One Individual must be a written document that includes essential details such as the names and contact information of the granters (the individuals giving the property), the name and contact information of the grantee (the individual receiving the property), a clear description of the property being transferred, the legal description of the property, and the acknowledgement of the gift. The Gift Deed must be signed by all parties involved, including the granters, the grantee, and two witnesses. It is also advisable to have the document notarized for added authenticity and legal validity. There may be various types or variations of the Austin Texas Gift Deed — Two Individuals to One Individual, depending on the specific circumstances of the transfer. These variations may include different scenarios such as a married couple gifting their property to an individual, siblings gifting their inherited property to a single family member, or business partners transferring their share of property to another partner. Regardless of the variation, it is crucial to consult with a qualified real estate attorney or legal professional to ensure that the Gift Deed complies with all local and state laws, properly reflects the intentions and wishes of the granters, and is executed correctly.A Gift Deed is a legal document that facilitates the transfer of ownership of a property from one person to another without any monetary consideration in return. In Austin, Texas, there is a specific type of Gift Deed known as "Austin Texas Gift Deed — Two Individuals to One Individual." This type of Gift Deed involves the transfer of property from two individuals to another single individual. This type of Gift Deed is commonly used in scenarios where two individuals, who may be joint owners or co-owners of a property, want to gift their interests or shares in the property to a single individual. The gifting process is done without any exchange of money or compensation, and it is typically executed out of generosity, personal relationships, or estate planning purposes. The Austin Texas Gift Deed — Two Individuals to One Individual must be a written document that includes essential details such as the names and contact information of the granters (the individuals giving the property), the name and contact information of the grantee (the individual receiving the property), a clear description of the property being transferred, the legal description of the property, and the acknowledgement of the gift. The Gift Deed must be signed by all parties involved, including the granters, the grantee, and two witnesses. It is also advisable to have the document notarized for added authenticity and legal validity. There may be various types or variations of the Austin Texas Gift Deed — Two Individuals to One Individual, depending on the specific circumstances of the transfer. These variations may include different scenarios such as a married couple gifting their property to an individual, siblings gifting their inherited property to a single family member, or business partners transferring their share of property to another partner. Regardless of the variation, it is crucial to consult with a qualified real estate attorney or legal professional to ensure that the Gift Deed complies with all local and state laws, properly reflects the intentions and wishes of the granters, and is executed correctly.