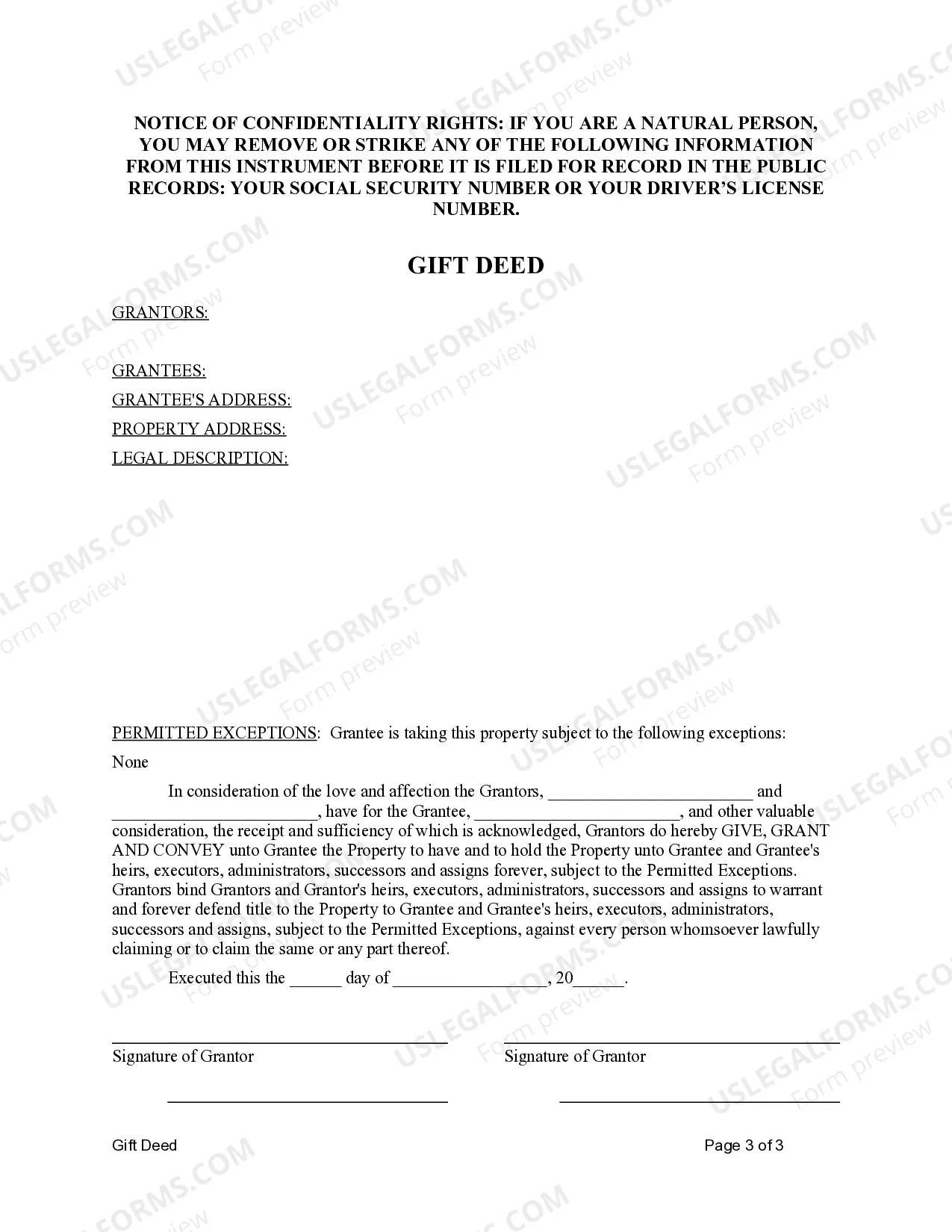

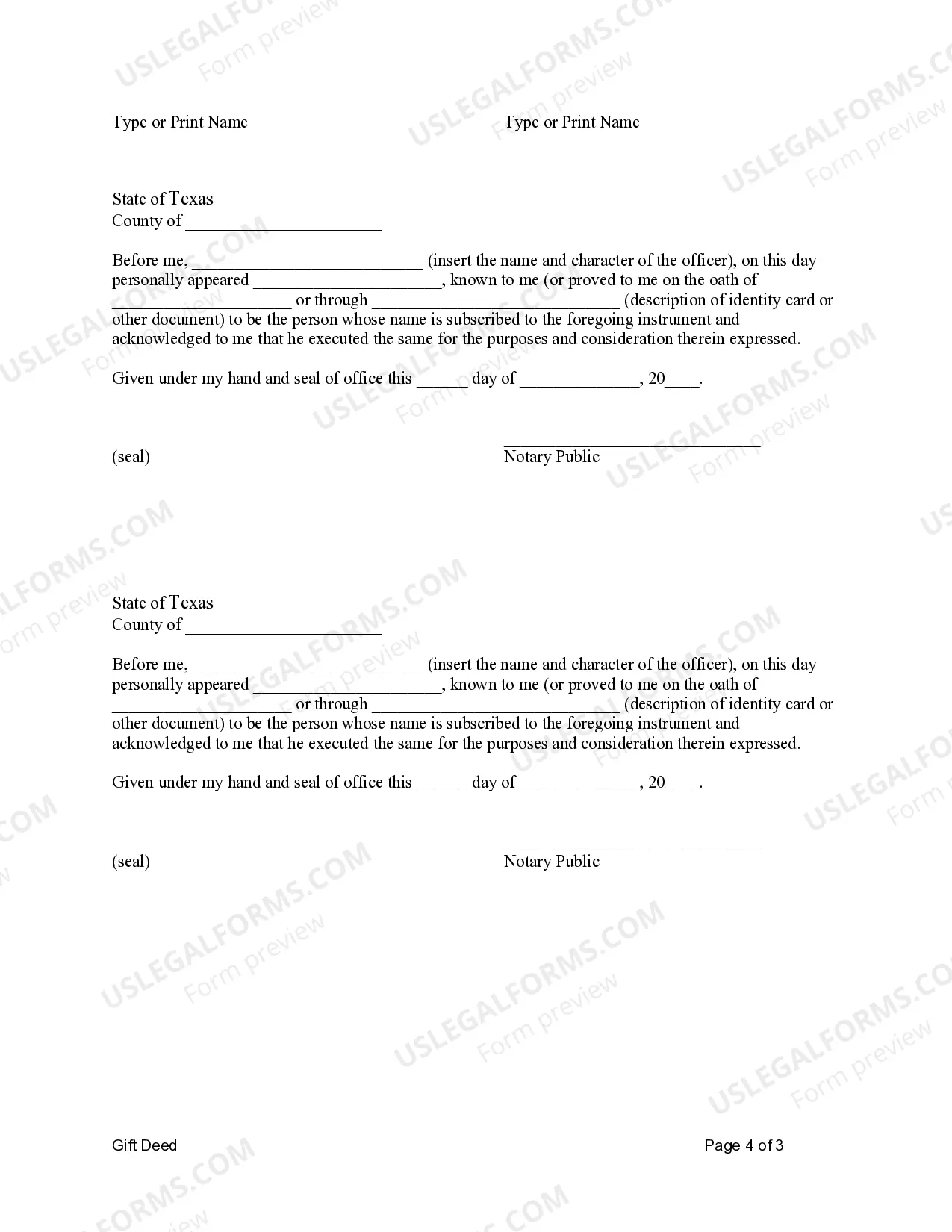

This form is a Gift Deed where the grantors are two individuals and the grantor is an individual. Grantors give and convey the described property to grantee. This deed complies with all state statutory laws.

A Carrollton Texas Gift Deed — Two Individuals to One Individual is a legal document that transfers ownership of a property from two individuals to a single individual as a gift, without any consideration or payment involved. This type of gift deed is commonly used when parents or relatives want to transfer ownership of a property to their child or loved one. In Carrollton, Texas, there are different types of Gift Deeds — Two Individuals to One Individual that can be used depending on the specific circumstances and requirements. Some of these types may include: 1. Conventional Gift Deed: This type of gift deed is used when the transfer of ownership is made voluntarily, without any legal obligation or condition attached. 2. Conditional Gift Deed: In certain cases, a gift deed may have certain conditions or restrictions attached. For example, the donor may specify that the property can only be used for residential purposes or that it cannot be sold within a specific time frame. 3. Joint Tenancy with Right of Survivorship Gift Deed: This type of gift deed is commonly used when the donors, who are usually spouses, want to transfer ownership of a property to their child or loved one with the provision that if one donor passes away, the surviving donor automatically becomes the sole owner of the property. 4. Tenancy in Common Gift Deed: In this type of gift deed, ownership of the property is divided among the donors and the recipient as tenants in common. Each party has a distinct share in the property, which can be sold or transferred independently. When creating a Carrollton Texas Gift Deed — Two Individuals to One Individual, it is crucial to consult with a qualified attorney who specializes in real estate law to ensure the document is legally binding and compliant with the applicable rules and regulations. The attorney can guide the parties involved through the process, prepare the necessary paperwork, and ensure a smooth transfer of property ownership.A Carrollton Texas Gift Deed — Two Individuals to One Individual is a legal document that transfers ownership of a property from two individuals to a single individual as a gift, without any consideration or payment involved. This type of gift deed is commonly used when parents or relatives want to transfer ownership of a property to their child or loved one. In Carrollton, Texas, there are different types of Gift Deeds — Two Individuals to One Individual that can be used depending on the specific circumstances and requirements. Some of these types may include: 1. Conventional Gift Deed: This type of gift deed is used when the transfer of ownership is made voluntarily, without any legal obligation or condition attached. 2. Conditional Gift Deed: In certain cases, a gift deed may have certain conditions or restrictions attached. For example, the donor may specify that the property can only be used for residential purposes or that it cannot be sold within a specific time frame. 3. Joint Tenancy with Right of Survivorship Gift Deed: This type of gift deed is commonly used when the donors, who are usually spouses, want to transfer ownership of a property to their child or loved one with the provision that if one donor passes away, the surviving donor automatically becomes the sole owner of the property. 4. Tenancy in Common Gift Deed: In this type of gift deed, ownership of the property is divided among the donors and the recipient as tenants in common. Each party has a distinct share in the property, which can be sold or transferred independently. When creating a Carrollton Texas Gift Deed — Two Individuals to One Individual, it is crucial to consult with a qualified attorney who specializes in real estate law to ensure the document is legally binding and compliant with the applicable rules and regulations. The attorney can guide the parties involved through the process, prepare the necessary paperwork, and ensure a smooth transfer of property ownership.