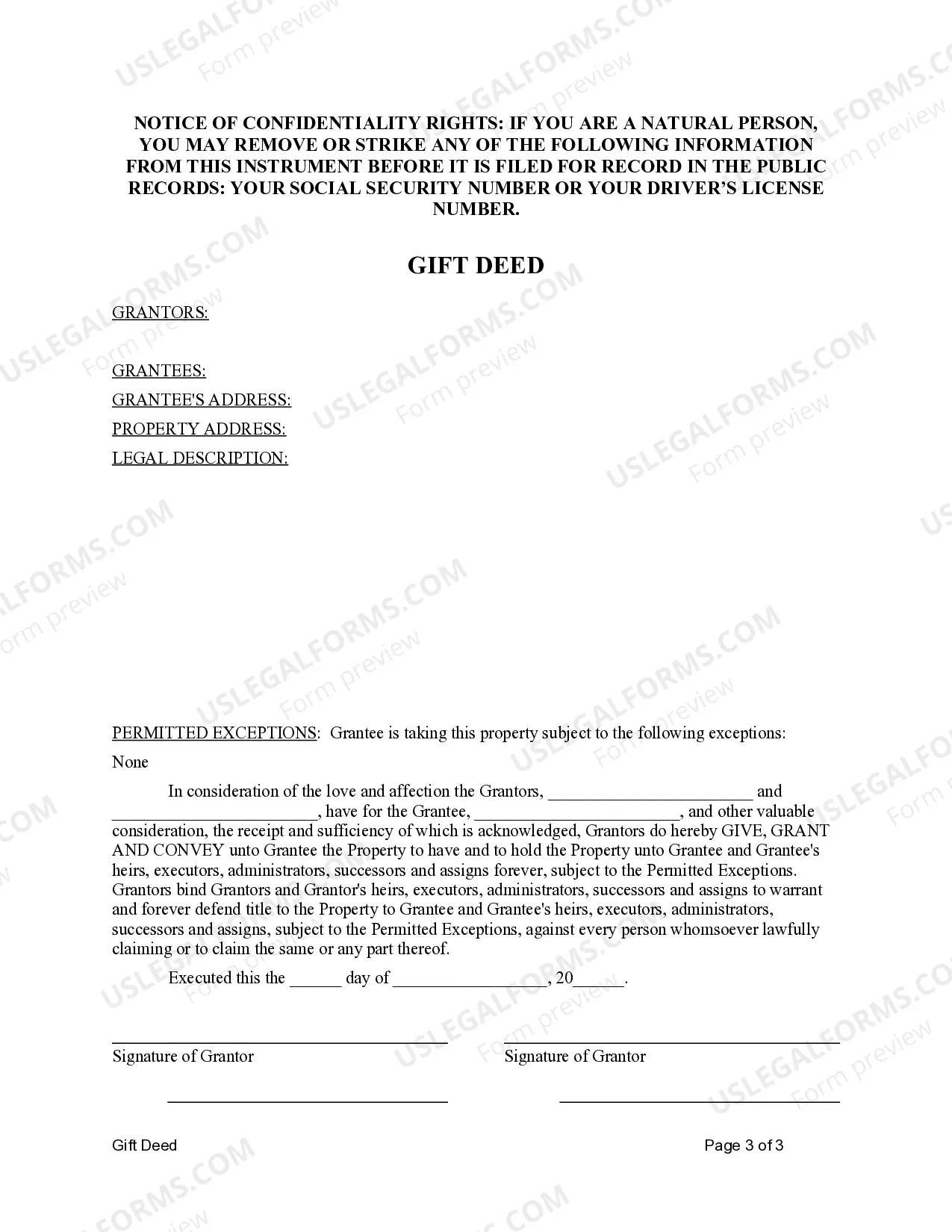

This form is a Gift Deed where the grantors are two individuals and the grantor is an individual. Grantors give and convey the described property to grantee. This deed complies with all state statutory laws.

Dallas Texas Gift Deed - Two Individuals to One Individual

Description

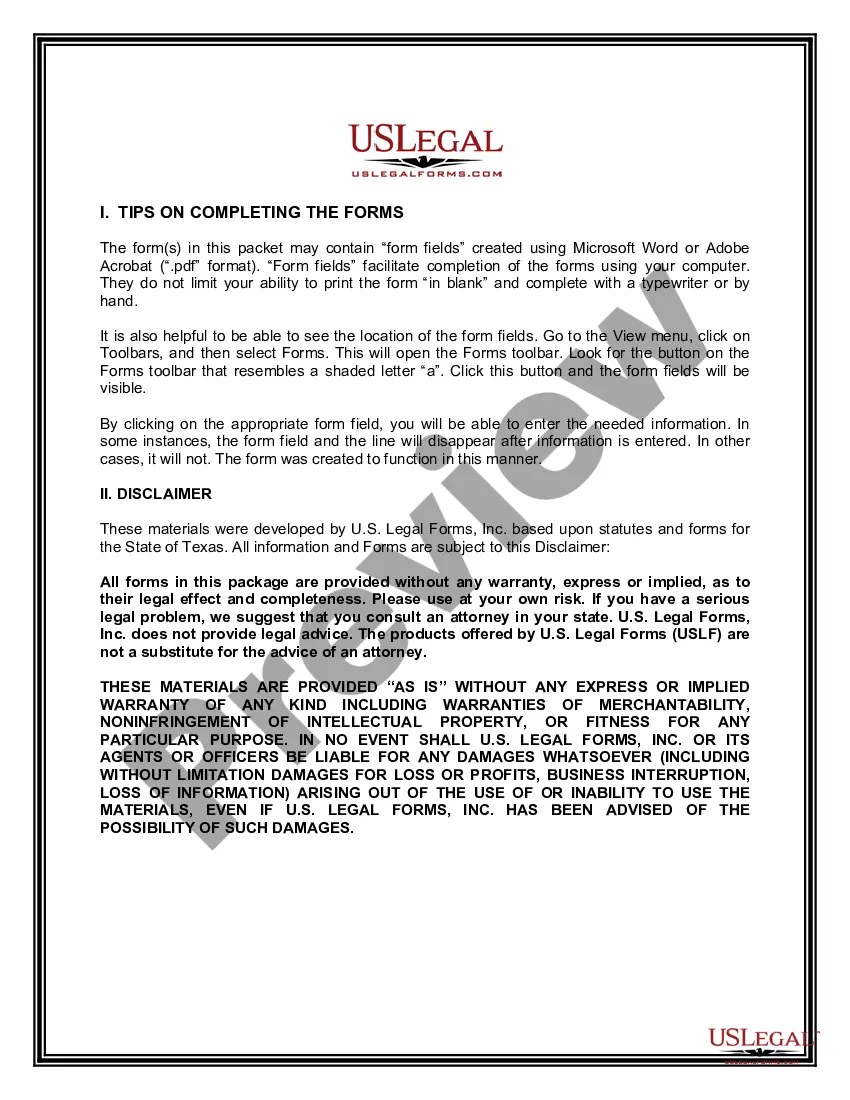

How to fill out Texas Gift Deed - Two Individuals To One Individual?

Take advantage of the US Legal Forms and gain immediate access to any document you need.

Our helpful platform with a vast array of document templates streamlines the process of locating and acquiring nearly any document sample required.

You can download, fill out, and sign the Dallas Texas Gift Deed - Two Individuals to One Individual in just a few minutes rather than spending hours online searching for a suitable template.

Utilizing our catalog is an excellent method to enhance the security of your form submissions. Our knowledgeable attorneys routinely review all records to ensure that the forms are appropriate for specific states and in accordance with current laws and regulations.

Initiate the saving process. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and complete your order using a credit card or PayPal.

Download the file. Select the format to obtain the Dallas Texas Gift Deed - Two Individuals to One Individual and edit and finalize, or sign it according to your specifications.

- How can you obtain the Dallas Texas Gift Deed - Two Individuals to One Individual.

- If you have an account, simply Log In to your profile. The Download option will be activated for all the samples you view.

- Additionally, you can access all previously saved documents in the My documents section.

- If you haven't created an account yet, follow the instructions below.

- Navigate to the page with the necessary form. Ensure that it is the template you were looking for: verify its title and description, and utilize the Preview feature if available. If not, utilize the Search bar to find the correct one.

Form popularity

FAQ

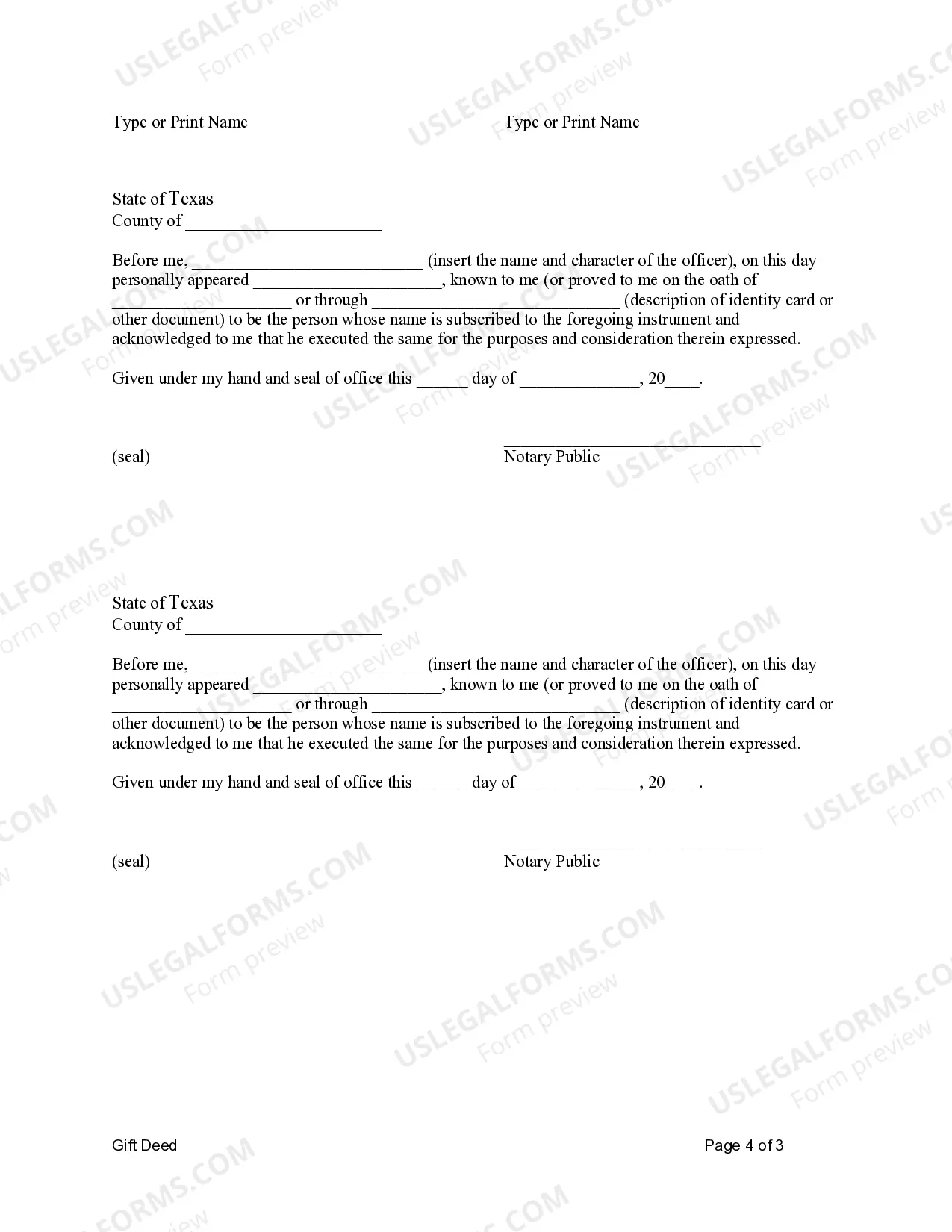

Adding someone to a deed in Texas involves creating a new deed that includes the name of the additional person. Utilizing a Dallas Texas Gift Deed - Two Individuals to One Individual is an effective way to do this, as it clearly outlines the transfer of ownership. Make sure to sign the new deed in the presence of a notary, then file it with your local county clerk's office. For a seamless experience, consider using resources available on uslegalforms to ensure you complete everything correctly.

To add a person to a property deed in Texas, you typically need to file a new deed with the county clerk. This can be done using a Dallas Texas Gift Deed - Two Individuals to One Individual, which transfers ownership in a straightforward manner. Ensure that you include the necessary information about both parties involved, and follow the local regulations. If you have questions, consider using a platform like uslegalforms for guidance on the required documentation.

You do not necessarily need a lawyer to transfer a deed in Texas; however, having legal guidance can simplify the process. With a Dallas Texas Gift Deed - Two Individuals to One Individual, you'll want to ensure that all paperwork is completed accurately to avoid potential issues in the future. A lawyer can help clarify any questions and ensure compliance with state laws. Ultimately, whether you choose to work with a lawyer or not, understanding the process is essential.

No, a quitclaim deed is not the same as a gift deed. While a quitclaim deed transfers rights without offering any guarantees regarding the property's title, a gift deed explicitly indicates that ownership is being transferred freely without consideration. Understanding this difference is vital when preparing a Dallas Texas Gift Deed - Two Individuals to One Individual, as each serves unique purposes in property transactions.

To add a person to a house deed in Texas, you typically need to execute a new deed, such as a gift deed or a quitclaim deed, that names the current owner and the new owner. The new deed must be signed and then filed with the county clerk's office where the property is located. If you're considering a Dallas Texas Gift Deed - Two Individuals to One Individual, using our platform at UsLegalForms can streamline this process and ensure compliance with local regulations.

In Texas, a gift deed must be in writing and signed by the person making the gift. The deed must also contain a clear description of the property being transferred and the intent to give it as a gift. When utilizing a Dallas Texas Gift Deed - Two Individuals to One Individual, it's important to ensure that all local laws are followed, as these rules safeguard both the donor and recipient’s interests.

A quitclaim deed transfers any ownership interest without guaranteeing title validity, making it a straightforward way to relinquish property rights. In contrast, a gift deed specifically conveys property without receiving payment, emphasizing the intent to transfer ownership as a gift. If you are considering a Dallas Texas Gift Deed - Two Individuals to One Individual, it's crucial to understand these distinctions to choose the right method for your needs.

To add someone to a deed in Texas, you will need to draft and execute a new deed that includes the names of the current owner and the person being added. The new deed acts as a Dallas Texas Gift Deed - Two Individuals to One Individual if the addition is a gift. After executing the deed, you must have it notarized and then file it with the county to update the property records. This step is crucial for establishing clear legal ownership.

To write a gift deed in Texas, start by identifying the granter and grantee as well as a detailed description of the property being gifted. You should include the terms of the gift, ensuring it reflects the intention to transfer ownership without expecting anything in return. Utilizing a template for a Dallas Texas Gift Deed - Two Individuals to One Individual can simplify the process. Once completed, have the deed signed, notarized, and recorded at the local county office to make it legally binding.

To add someone to the deed of your house in Texas, you must create a new deed that specifies the new ownership arrangement. This process usually involves drafting a new document known as a Dallas Texas Gift Deed - Two Individuals to One Individual if you intend to give a part of your property as a gift. After you prepare the deed, you should sign and notarize it, then file it with the county clerk's office. This will officially add the individual to the property ownership records.