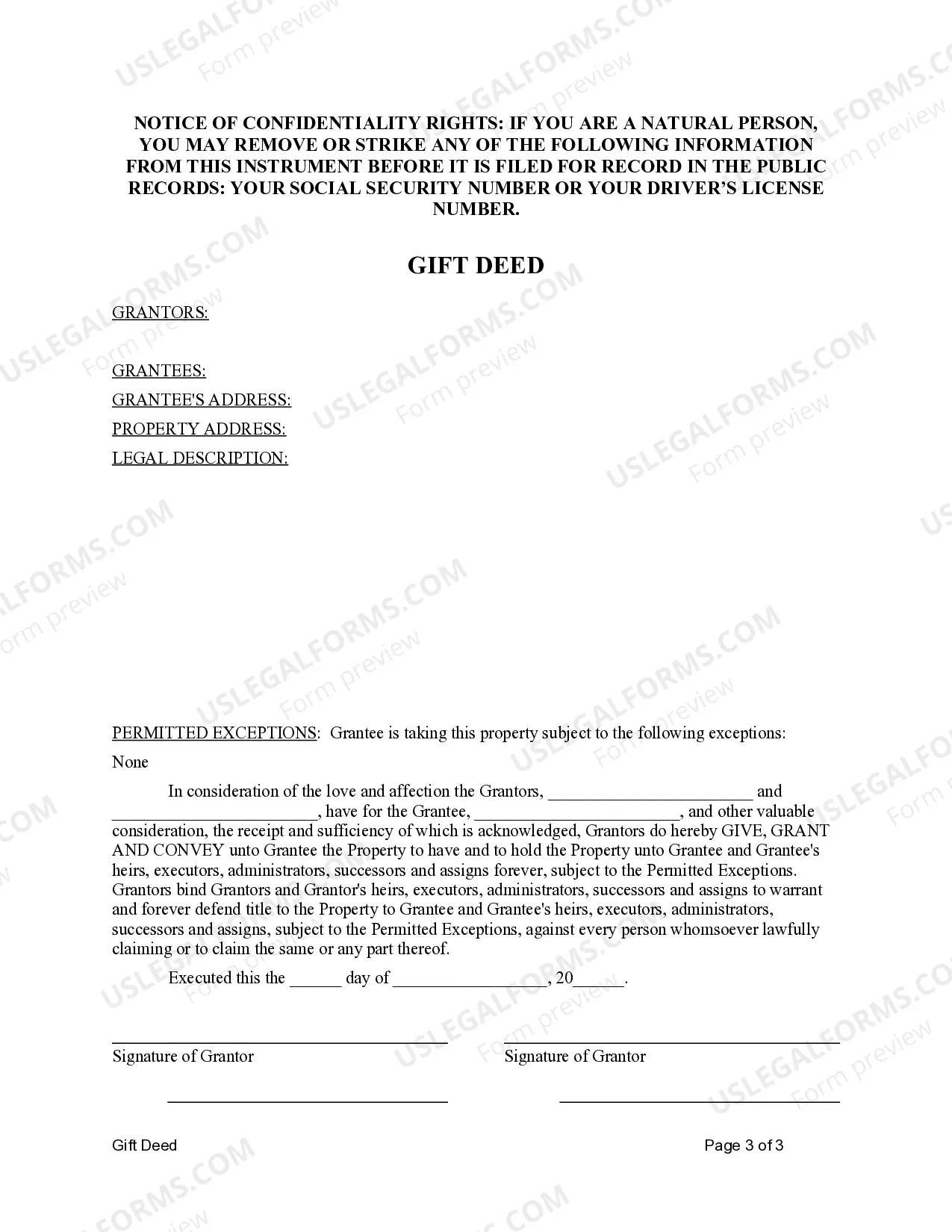

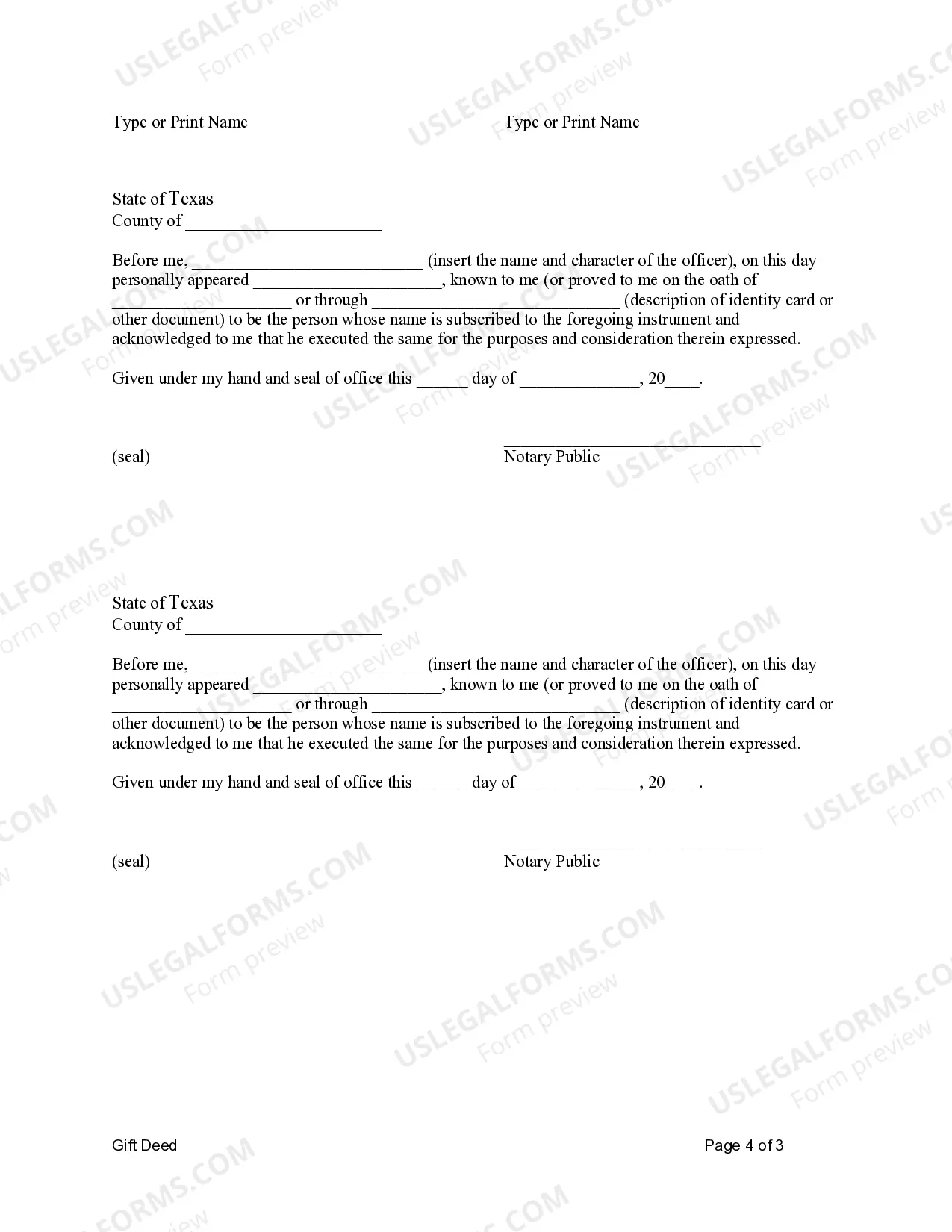

This form is a Gift Deed where the grantors are two individuals and the grantor is an individual. Grantors give and convey the described property to grantee. This deed complies with all state statutory laws.

A Fort Worth Texas Gift Deed — Two Individuals to One Individual is a legal document that transfers ownership of real property from two individuals to one individual as a gift. This type of deed is commonly used when individuals want to gift a property to a single person, such as a family member, friend, or beneficiary. The gift deed must comply with the laws and regulations of Texas and the county where the property is located, in this case, Fort Worth. It is important to consult with an attorney or a real estate professional to ensure the deed is prepared correctly and all necessary requirements are met. There are different types of Fort Worth Texas Gift Deed — Two Individuals to One Individual, depending on the specific situation or conditions involved. Some common variations may include: 1. Simple Gift Deed: This is a basic gift deed that involves a straightforward transfer of the property from two individuals to one individual without any additional conditions or considerations. 2. Gift Deed with Reservation of Life Estate: In this type of gift deed, the two individuals transferring the property retain the right to live in or use the property until their death. Once they pass away, ownership of the property will transfer fully to the single individual. 3. Gift Deed with Conditions: This type of gift deed includes specific conditions or restrictions that the single individual receiving the property must follow. These conditions may include limitations on how the property is used, maintained, or sold. 4. Gift Deed with Remainder Interest: In this variation, the two individuals transferring the property retain a remainder interest in the property. This means that while they gift the property to the single individual, they still have the right to receive any income or profit generated from the property during their lifetime. It is important to note that these are just some examples of the different types of Fort Worth Texas Gift Deeds — Two Individuals to One Individual. The specific terms and conditions of the gift deed may vary depending on the preferences and circumstances of the parties involved.A Fort Worth Texas Gift Deed — Two Individuals to One Individual is a legal document that transfers ownership of real property from two individuals to one individual as a gift. This type of deed is commonly used when individuals want to gift a property to a single person, such as a family member, friend, or beneficiary. The gift deed must comply with the laws and regulations of Texas and the county where the property is located, in this case, Fort Worth. It is important to consult with an attorney or a real estate professional to ensure the deed is prepared correctly and all necessary requirements are met. There are different types of Fort Worth Texas Gift Deed — Two Individuals to One Individual, depending on the specific situation or conditions involved. Some common variations may include: 1. Simple Gift Deed: This is a basic gift deed that involves a straightforward transfer of the property from two individuals to one individual without any additional conditions or considerations. 2. Gift Deed with Reservation of Life Estate: In this type of gift deed, the two individuals transferring the property retain the right to live in or use the property until their death. Once they pass away, ownership of the property will transfer fully to the single individual. 3. Gift Deed with Conditions: This type of gift deed includes specific conditions or restrictions that the single individual receiving the property must follow. These conditions may include limitations on how the property is used, maintained, or sold. 4. Gift Deed with Remainder Interest: In this variation, the two individuals transferring the property retain a remainder interest in the property. This means that while they gift the property to the single individual, they still have the right to receive any income or profit generated from the property during their lifetime. It is important to note that these are just some examples of the different types of Fort Worth Texas Gift Deeds — Two Individuals to One Individual. The specific terms and conditions of the gift deed may vary depending on the preferences and circumstances of the parties involved.