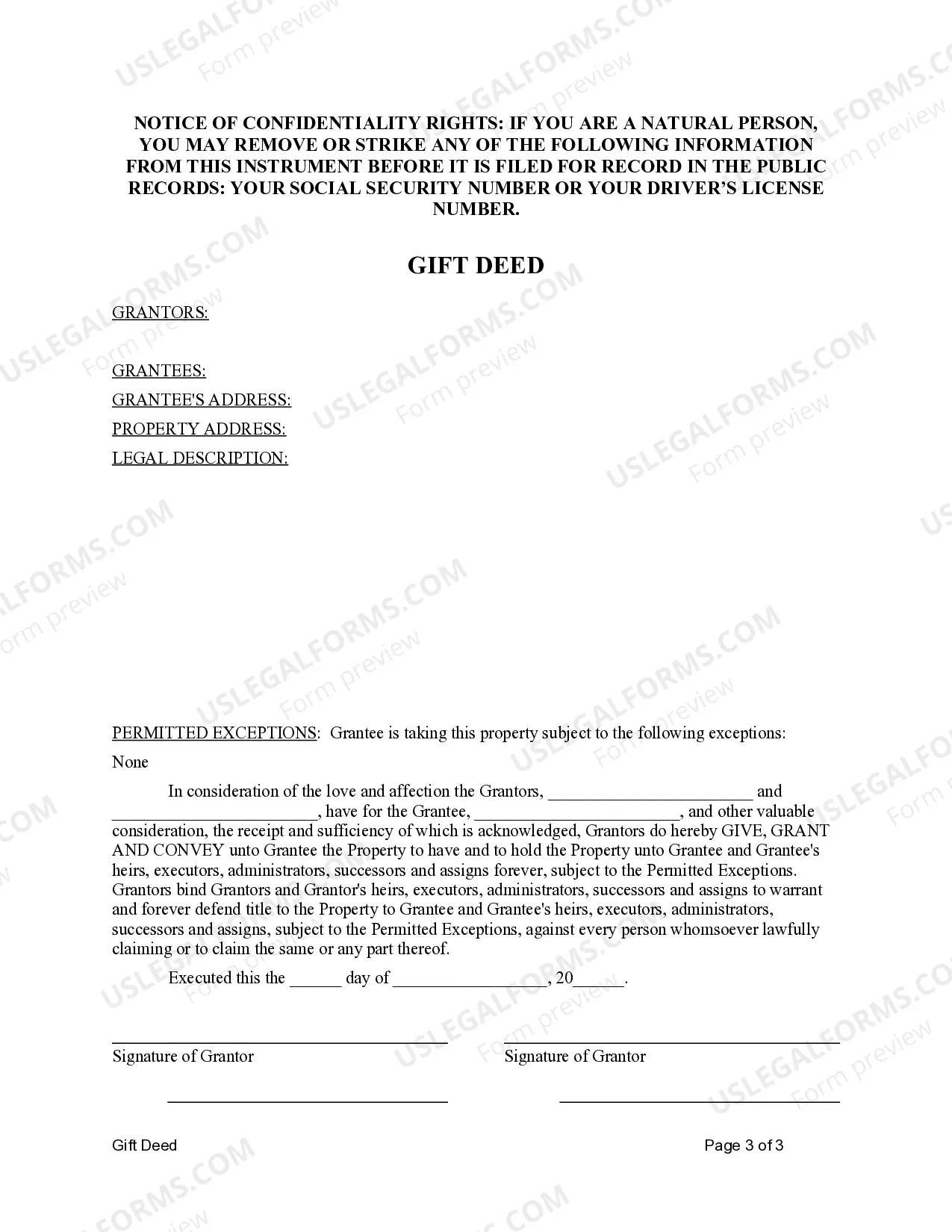

This form is a Gift Deed where the grantors are two individuals and the grantor is an individual. Grantors give and convey the described property to grantee. This deed complies with all state statutory laws.

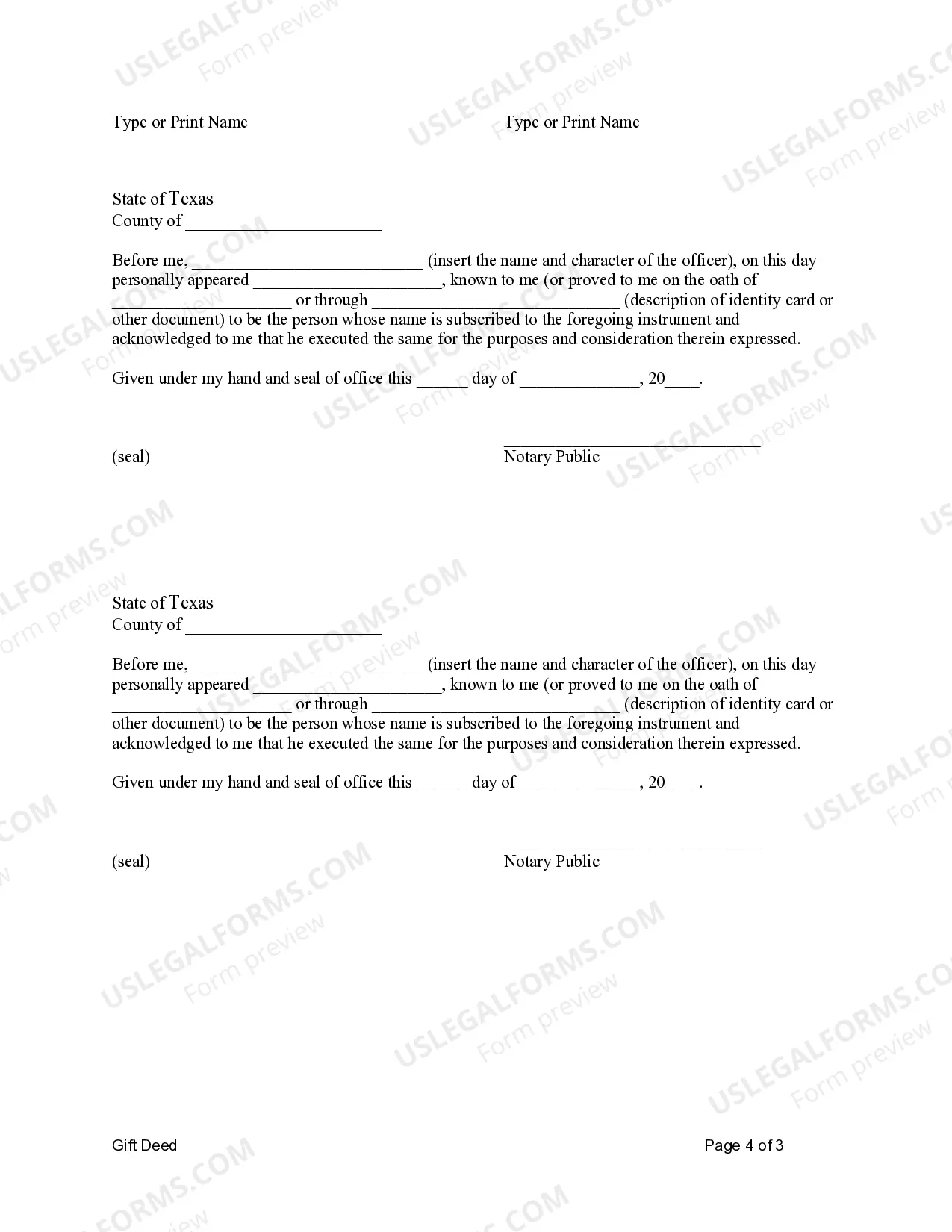

A Killeen Texas Gift Deed — Two Individuals to One Individual refers to a legal document that facilitates the transfer of property ownership from two individuals to a single individual without any monetary compensation involved. This type of deed is commonly used in cases where a person intends to gift their property to someone, such as a family member or a close friend, either for estate planning purposes or as a gesture of goodwill. The Killeen Texas Gift Deed — Two Individuals to One Individual is a legally binding instrument that must comply with the state's specific laws and regulations regarding property transfers. It usually includes detailed information about the property being gifted, such as the legal description, address, and any encumbrances or liens attached to the property. The names and addresses of both the donors (the two individuals) and the recipient (the one individual) must also be clearly stated in the deed. Different types of Killeen Texas Gift Deed — Two Individuals to One Individual may include variations based on the nature of the property being transferred. For instance, it can be used to gift residential real estate, commercial property, vacant land, or even personal property like vehicles or valuable possessions. Each type of gift deed may have specific requirements and considerations to ensure a smooth transfer of ownership. It is important to consult with a qualified real estate attorney to ensure compliance with all legal formalities and to understand the implications and potential tax consequences associated with such a transaction. In conclusion, a Killeen Texas Gift Deed — Two Individuals to One Individual is a legal document used to transfer property ownership as a gift from two individuals to one individual without involving any monetary exchange. It helps facilitate the transfer of assets while adhering to local laws and regulations. It is advisable to seek legal guidance to ensure all requirements are met and to understand the implications of such a gift deed.A Killeen Texas Gift Deed — Two Individuals to One Individual refers to a legal document that facilitates the transfer of property ownership from two individuals to a single individual without any monetary compensation involved. This type of deed is commonly used in cases where a person intends to gift their property to someone, such as a family member or a close friend, either for estate planning purposes or as a gesture of goodwill. The Killeen Texas Gift Deed — Two Individuals to One Individual is a legally binding instrument that must comply with the state's specific laws and regulations regarding property transfers. It usually includes detailed information about the property being gifted, such as the legal description, address, and any encumbrances or liens attached to the property. The names and addresses of both the donors (the two individuals) and the recipient (the one individual) must also be clearly stated in the deed. Different types of Killeen Texas Gift Deed — Two Individuals to One Individual may include variations based on the nature of the property being transferred. For instance, it can be used to gift residential real estate, commercial property, vacant land, or even personal property like vehicles or valuable possessions. Each type of gift deed may have specific requirements and considerations to ensure a smooth transfer of ownership. It is important to consult with a qualified real estate attorney to ensure compliance with all legal formalities and to understand the implications and potential tax consequences associated with such a transaction. In conclusion, a Killeen Texas Gift Deed — Two Individuals to One Individual is a legal document used to transfer property ownership as a gift from two individuals to one individual without involving any monetary exchange. It helps facilitate the transfer of assets while adhering to local laws and regulations. It is advisable to seek legal guidance to ensure all requirements are met and to understand the implications of such a gift deed.