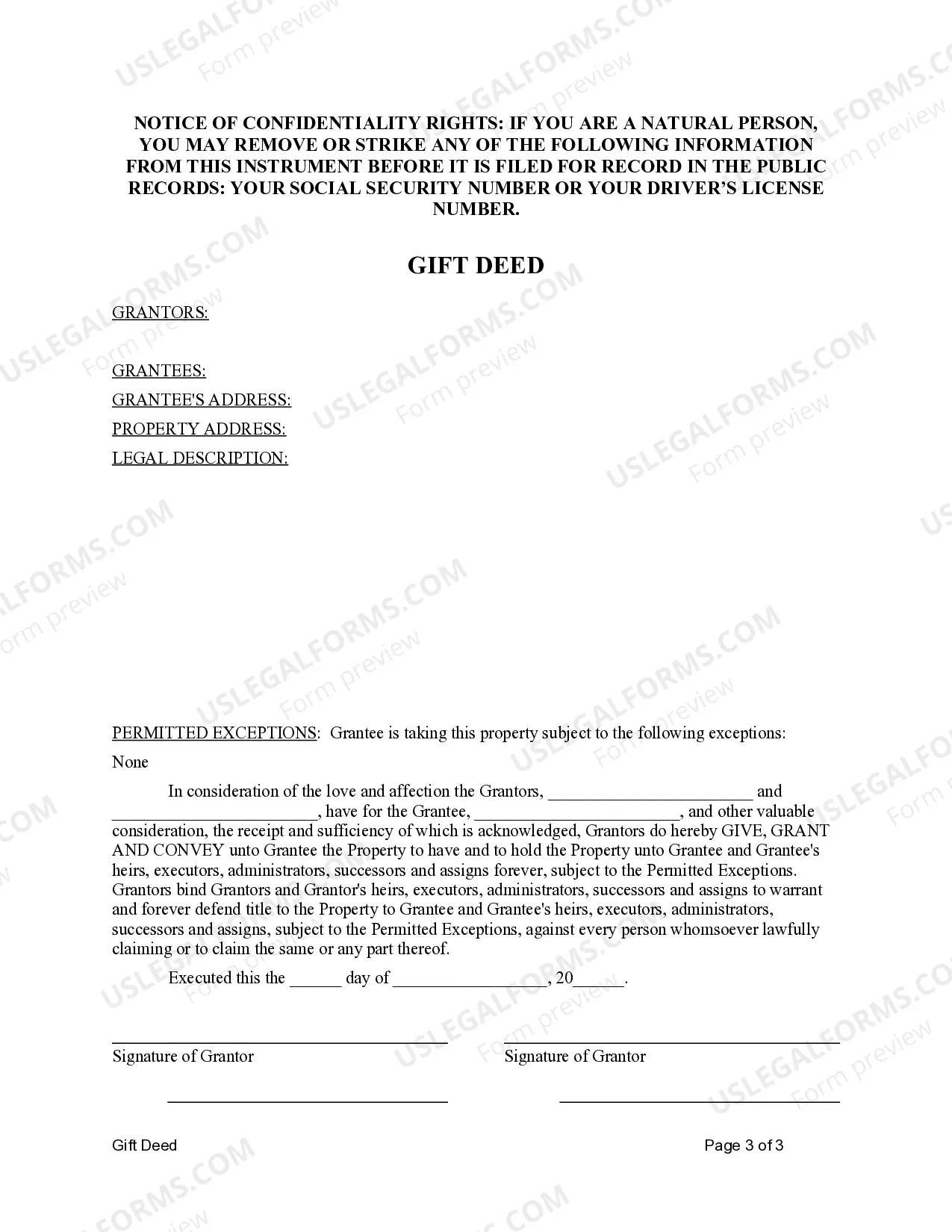

This form is a Gift Deed where the grantors are two individuals and the grantor is an individual. Grantors give and convey the described property to grantee. This deed complies with all state statutory laws.

In McAllen, Texas, a gift deed is a legal instrument used to transfer ownership of a property from two individuals to another individual without any monetary exchange involved. This type of transaction is typically enacted between family members or close friends as a gesture of goodwill or to facilitate estate planning. The gift deed serves as proof of the transfer of ownership and provides legal protection to both parties involved. Keywords: McAllen Texas, gift deed, two individuals, one individual, property transfer, ownership, legal instrument, monetary exchange, family members, close friends, goodwill, estate planning, proof, legal protection. Different types of McAllen Texas Gift Deed — Two Individuals to One Individual: 1. Ceremonial Gift Deed: This type of gift deed is often used for special occasions or significant life events where the transfer of property represents a celebratory act. It can be presented in a formal ceremony or off-the-books gathering, adding sentiment and personal significance to the transaction. 2. Estate Planning Gift Deed: Estate planning gift deeds are commonly used to transfer property between family members for the purposes of inheritance planning. These transfers may occur while the original owners are still alive (inter vivos) or can be posthumous (testamentary), ensuring a smooth transition and avoiding potential legal complications. 3. Tax Planning Gift Deed: In certain situations, individuals may utilize gift deeds to optimize tax benefits. By transferring property assets as gifts to loved ones, one can potentially reduce estate taxes or even avoid them altogether. This type of gift deed requires careful consideration of tax laws and regulations to ensure compliance and maximize the available advantages. 4. Charitable Gift Deed: This particular gift deed involves the transfer of property to a charitable organization or nonprofit entity, promoting philanthropy and supporting worthy causes. Individuals who wish to contribute to a specific charitable mission or organization can use this gift deed to effectuate their donations while enjoying potential tax benefits related to charitable giving. 5. Lifetime Support Gift Deed: In some cases, individuals may choose to transfer property to another individual, such as a dependent or beloved family member, as a means of providing support during their lifetime. This type of gift deed ensures that the recipient has a place to live or a financial asset, allowing for financial stability and security. Overall, McAllen Texas Gift Deed — Two Individuals to One Individual provides a legal framework for transferring property without involving monetary considerations, offering flexibility and opportunities for various personal, familial, or financial purposes.In McAllen, Texas, a gift deed is a legal instrument used to transfer ownership of a property from two individuals to another individual without any monetary exchange involved. This type of transaction is typically enacted between family members or close friends as a gesture of goodwill or to facilitate estate planning. The gift deed serves as proof of the transfer of ownership and provides legal protection to both parties involved. Keywords: McAllen Texas, gift deed, two individuals, one individual, property transfer, ownership, legal instrument, monetary exchange, family members, close friends, goodwill, estate planning, proof, legal protection. Different types of McAllen Texas Gift Deed — Two Individuals to One Individual: 1. Ceremonial Gift Deed: This type of gift deed is often used for special occasions or significant life events where the transfer of property represents a celebratory act. It can be presented in a formal ceremony or off-the-books gathering, adding sentiment and personal significance to the transaction. 2. Estate Planning Gift Deed: Estate planning gift deeds are commonly used to transfer property between family members for the purposes of inheritance planning. These transfers may occur while the original owners are still alive (inter vivos) or can be posthumous (testamentary), ensuring a smooth transition and avoiding potential legal complications. 3. Tax Planning Gift Deed: In certain situations, individuals may utilize gift deeds to optimize tax benefits. By transferring property assets as gifts to loved ones, one can potentially reduce estate taxes or even avoid them altogether. This type of gift deed requires careful consideration of tax laws and regulations to ensure compliance and maximize the available advantages. 4. Charitable Gift Deed: This particular gift deed involves the transfer of property to a charitable organization or nonprofit entity, promoting philanthropy and supporting worthy causes. Individuals who wish to contribute to a specific charitable mission or organization can use this gift deed to effectuate their donations while enjoying potential tax benefits related to charitable giving. 5. Lifetime Support Gift Deed: In some cases, individuals may choose to transfer property to another individual, such as a dependent or beloved family member, as a means of providing support during their lifetime. This type of gift deed ensures that the recipient has a place to live or a financial asset, allowing for financial stability and security. Overall, McAllen Texas Gift Deed — Two Individuals to One Individual provides a legal framework for transferring property without involving monetary considerations, offering flexibility and opportunities for various personal, familial, or financial purposes.