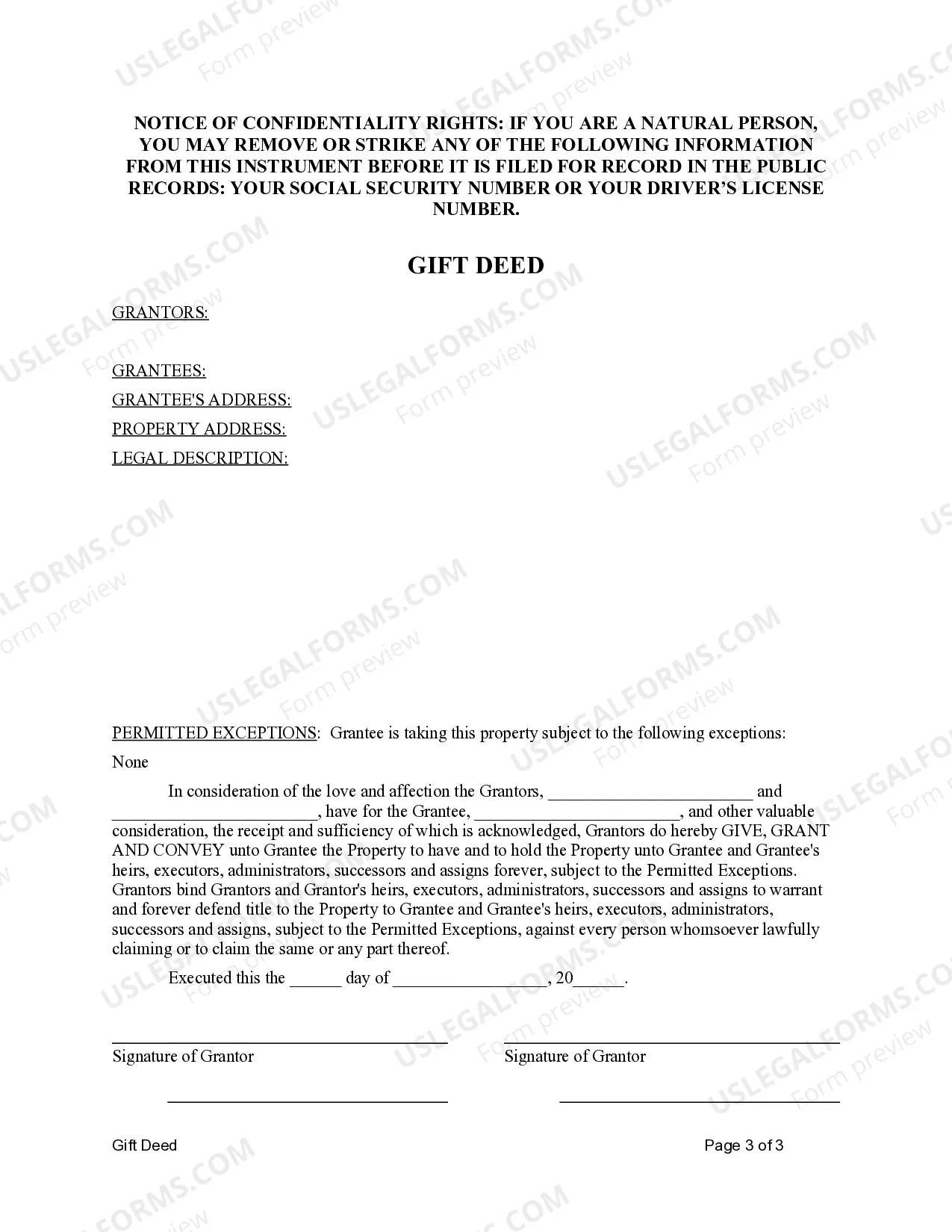

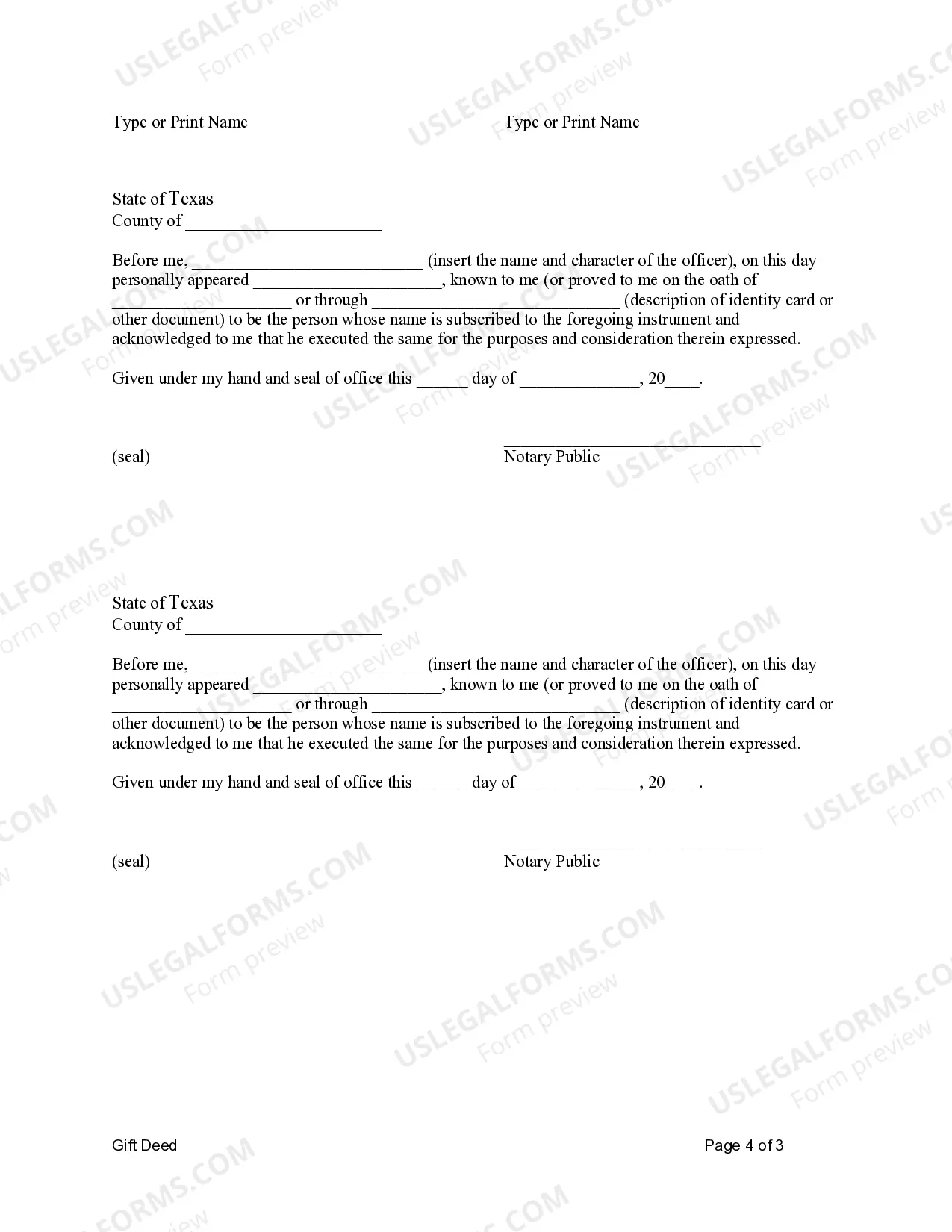

This form is a Gift Deed where the grantors are two individuals and the grantor is an individual. Grantors give and convey the described property to grantee. This deed complies with all state statutory laws.

Pearland Texas Gift Deed — Two Individuals to One Individual is a legal document that facilitates the transfer of real property ownership between two individuals to another individual without any monetary compensation. This type of gift deed is commonly used for gifting properties, such as homes or land, in Pearland, Texas. The primary purpose of a gift deed is to legally establish the transfer of ownership without it being considered a taxable sale or purchase. The deed serves as evidence that the current owners willingly and voluntarily gift their property to the recipient. Pearland Texas Gift Deed — Two Individuals to One Individual provides the legal framework for this transaction. Gift deeds in Pearland Texas can be further categorized based on the specific circumstances of the transfer. Some common variations include: 1. Gift Deed — Married Couple to Individual: This type of gift deed is used when a married couple jointly owns the property and wishes to gift it to a third party individual. It ensures that both individuals' consent is given in the transfer. 2. Gift Deed — Parent to Child: This variation is used when a parent wishes to gift their property to their child. It can be a way to pass down family assets or provide financial support. 3. Gift Deed — Siblings to Individual: In some cases, siblings may jointly own a property and decide to gift it to another individual, such as a relative or friend. This type of gift deed outlines the transfer process and ensures legal compliance. 4. Gift Deed — Multiple Individuals to One Individual: If there are multiple owners of a property, all of them can collectively gift it to a single individual. This type of deed ensures clear transfer of ownership and minimizes potential conflicts or disputes. Pearland Texas Gift Deed — Two Individuals to One Individual is an important legal document that requires careful consideration and execution. Consulting with a qualified attorney or real estate professional is highly recommended ensuring compliance with local laws and smooth transfer of ownership.Pearland Texas Gift Deed — Two Individuals to One Individual is a legal document that facilitates the transfer of real property ownership between two individuals to another individual without any monetary compensation. This type of gift deed is commonly used for gifting properties, such as homes or land, in Pearland, Texas. The primary purpose of a gift deed is to legally establish the transfer of ownership without it being considered a taxable sale or purchase. The deed serves as evidence that the current owners willingly and voluntarily gift their property to the recipient. Pearland Texas Gift Deed — Two Individuals to One Individual provides the legal framework for this transaction. Gift deeds in Pearland Texas can be further categorized based on the specific circumstances of the transfer. Some common variations include: 1. Gift Deed — Married Couple to Individual: This type of gift deed is used when a married couple jointly owns the property and wishes to gift it to a third party individual. It ensures that both individuals' consent is given in the transfer. 2. Gift Deed — Parent to Child: This variation is used when a parent wishes to gift their property to their child. It can be a way to pass down family assets or provide financial support. 3. Gift Deed — Siblings to Individual: In some cases, siblings may jointly own a property and decide to gift it to another individual, such as a relative or friend. This type of gift deed outlines the transfer process and ensures legal compliance. 4. Gift Deed — Multiple Individuals to One Individual: If there are multiple owners of a property, all of them can collectively gift it to a single individual. This type of deed ensures clear transfer of ownership and minimizes potential conflicts or disputes. Pearland Texas Gift Deed — Two Individuals to One Individual is an important legal document that requires careful consideration and execution. Consulting with a qualified attorney or real estate professional is highly recommended ensuring compliance with local laws and smooth transfer of ownership.