This form is a Quitclaim Deed where the Grantor is aTrust and the Grantee is a partnership. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

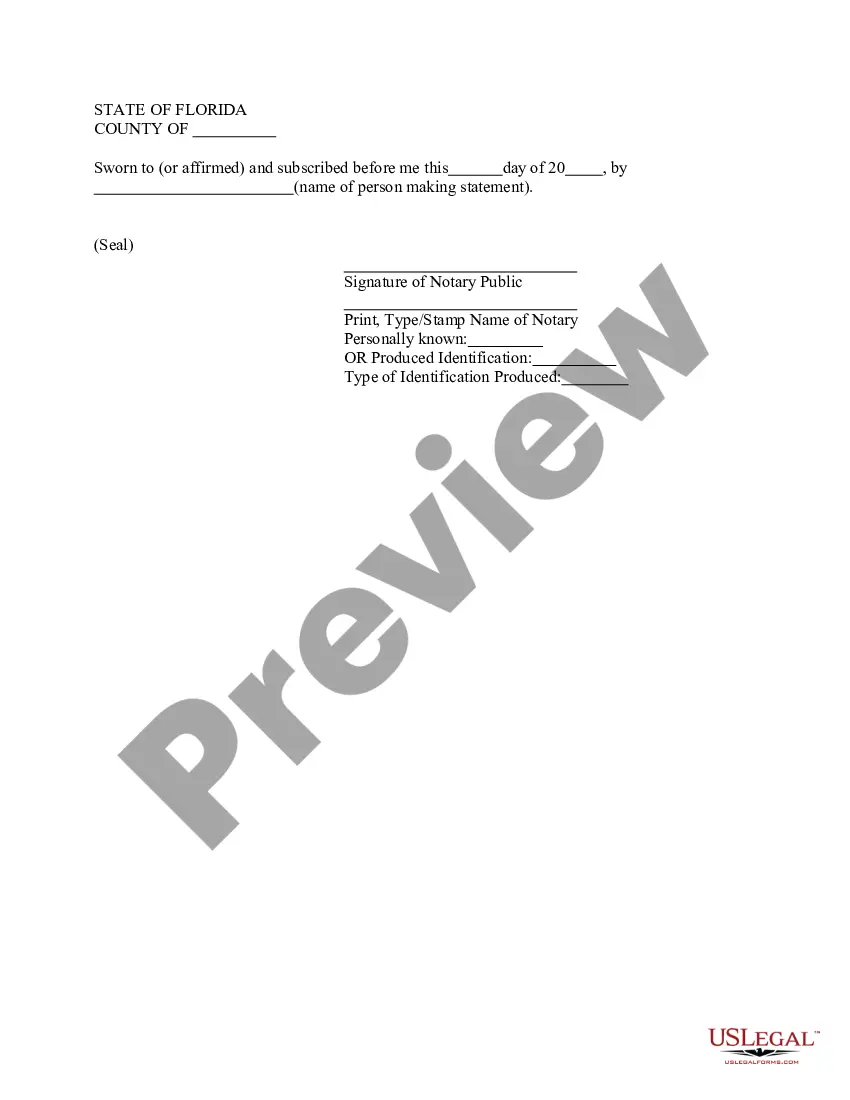

A Harris Texas Quitclaim Deed of Mineral Interests — Trust to Partnership is a legal document that transfers ownership of mineral interests from a trust to a partnership. This type of deed is commonly used when a trust is formed to hold mineral rights and decides to transfer those rights to a partnership for various reasons. The Harris Texas Quitclaim Deed of Mineral Interests — Trust to Partnership allows for a seamless transfer of mineral interests between two entities. It ensures that the partnership becomes the rightful owner of the mineral rights, holding the same rights and privileges as previously held by the trust. Some key features of this type of deed include: 1. Trust to Partnership Transfer: The deed specifically outlines the transfer of mineral interests from a trust to a partnership. It clearly states the parties involved and the effective date of the transfer. 2. Quitclaim Deed: A quitclaim deed is commonly used in these transactions, as it transfers whatever rights the granter possesses without making any guarantees or warranties regarding the property title. This means that the partnership accepts the mineral interests "as is," assuming any potential risks or encumbrances attached to the property. 3. Mineral Interests Description: The deed provides a detailed description of the mineral interests being transferred, including the legal description of the property. This ensures clarity regarding the specific rights and locations of the mineral interests. 4. Consideration: The consideration section outlines any financial arrangement or compensation involved in the transfer of the mineral interests. It may specify a purchase price or other agreed-upon terms between the trust and the partnership. 5. Signature and Notary Requirement: Like all legal documents, the Harris Texas Quitclaim Deed of Mineral Interests — Trust to Partnership requires signature and notarization. All parties involved must sign the deed in the presence of a notary public to make it legally binding and enforceable. Different types or variations of Harris Texas Quitclaim Deeds of Mineral Interests — Trust to Partnership may include additional clauses or provisions tailored to specific circumstances. For instance, there could be variations depending on the nature of the partnership, how the mineral interests are valued, or any applicable tax considerations. It is crucial to consult with legal professionals experienced in real estate and mineral rights law to accurately prepare and execute this type of deed. Professional advice can help ensure compliance with local laws and regulations and prevent any future disputes or complications that may arise from the transfer of mineral interests.A Harris Texas Quitclaim Deed of Mineral Interests — Trust to Partnership is a legal document that transfers ownership of mineral interests from a trust to a partnership. This type of deed is commonly used when a trust is formed to hold mineral rights and decides to transfer those rights to a partnership for various reasons. The Harris Texas Quitclaim Deed of Mineral Interests — Trust to Partnership allows for a seamless transfer of mineral interests between two entities. It ensures that the partnership becomes the rightful owner of the mineral rights, holding the same rights and privileges as previously held by the trust. Some key features of this type of deed include: 1. Trust to Partnership Transfer: The deed specifically outlines the transfer of mineral interests from a trust to a partnership. It clearly states the parties involved and the effective date of the transfer. 2. Quitclaim Deed: A quitclaim deed is commonly used in these transactions, as it transfers whatever rights the granter possesses without making any guarantees or warranties regarding the property title. This means that the partnership accepts the mineral interests "as is," assuming any potential risks or encumbrances attached to the property. 3. Mineral Interests Description: The deed provides a detailed description of the mineral interests being transferred, including the legal description of the property. This ensures clarity regarding the specific rights and locations of the mineral interests. 4. Consideration: The consideration section outlines any financial arrangement or compensation involved in the transfer of the mineral interests. It may specify a purchase price or other agreed-upon terms between the trust and the partnership. 5. Signature and Notary Requirement: Like all legal documents, the Harris Texas Quitclaim Deed of Mineral Interests — Trust to Partnership requires signature and notarization. All parties involved must sign the deed in the presence of a notary public to make it legally binding and enforceable. Different types or variations of Harris Texas Quitclaim Deeds of Mineral Interests — Trust to Partnership may include additional clauses or provisions tailored to specific circumstances. For instance, there could be variations depending on the nature of the partnership, how the mineral interests are valued, or any applicable tax considerations. It is crucial to consult with legal professionals experienced in real estate and mineral rights law to accurately prepare and execute this type of deed. Professional advice can help ensure compliance with local laws and regulations and prevent any future disputes or complications that may arise from the transfer of mineral interests.