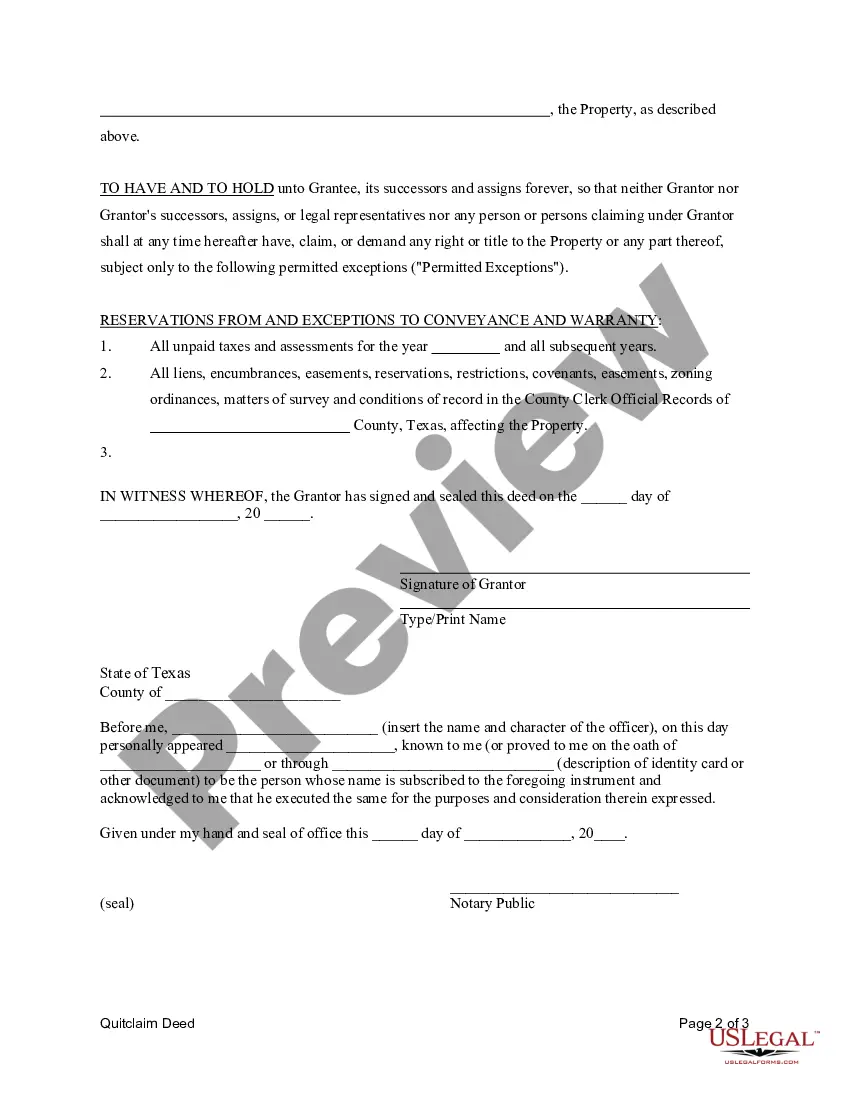

This form is a Quitclaim Deed where the Grantor is an individual and the Grantees are three individuals. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

A Round Rock Texas Quitclaim Deed from an Individual to Three Individuals is a legally binding document that transfers the ownership interest in a property from one individual (the granter) to three individuals (the grantees) using the quitclaim deed method. The purpose of a quitclaim deed is to convey whatever interest the granter may have in the property, without making any guarantees or warranties about the title. It is often used in situations where the granter wants to transfer their interest in the property quickly and without extensive legal documentation. In Round Rock, Texas, there are different variations of Quitclaim Deeds from an Individual to Three Individuals, including: 1. General Round Rock Texas Quitclaim Deed: this type of quitclaim deed transfers the ownership interest in a property located in Round Rock, Texas, from an individual to three individuals. It is a straightforward legal document that outlines the names of the granter and grantees, the property description, and the consideration (if any) provided for the transfer. 2. Round Rock Texas Quitclaim Deed with a Right of Survivorship: this type of quitclaim deed includes a special provision that grants the surviving grantees the right to automatically inherit the interest of any deceased grantee. It ensures that the property interest remains with the surviving individuals, bypassing the need for probate. 3. Round Rock Texas Quitclaim Deed with Reserved Life Estate: in this type of quitclaim deed, the granter transfers their property interest to three individuals while retaining the right to live on the property for the remainder of their life. This arrangement allows the granter to continue occupying the property until their death, after which the grantees will gain full ownership. When drafting a Round Rock Texas Quitclaim Deed from an Individual to Three Individuals, it is crucial to include the correct legal description of the property, including the lot of number, block number, and subdivision (if applicable). The deed should clearly state the names and addresses of the granter and grantees, the consideration (if any), and any additional terms or conditions agreed upon by the parties involved. It is essential to consult with a qualified real estate attorney or title company to ensure that the quitclaim deed complies with all state and local laws and accurately reflects the intentions of the granter and grantees. Proper execution and recording of the deed with the appropriate county office are necessary to protect the rights of all parties involved in the transfer of property ownership.