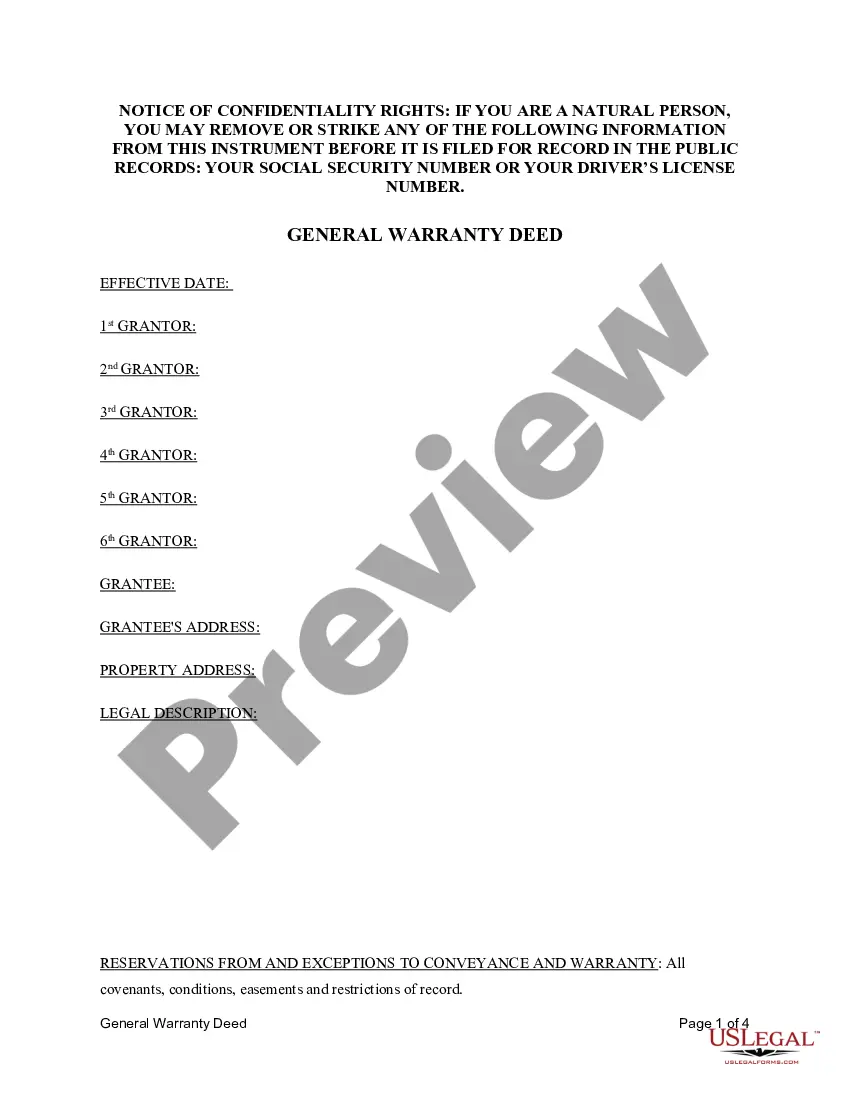

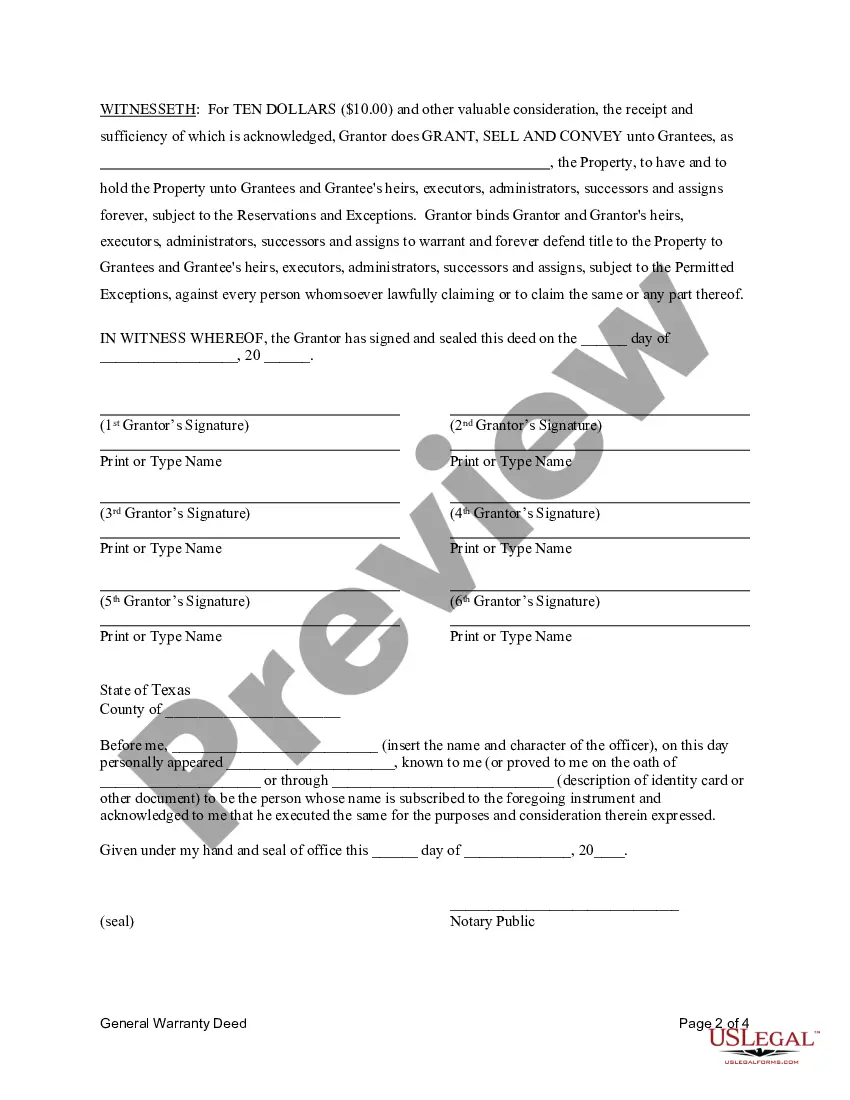

This form is a General Warranty Deed where the Grantors are Six Individuals and the grantee an Individual. Grantors convey and generally warrant the described property to the Grantee. This deed complies with all state statutory laws.

Odessa Texas General Warranty Deed — SiGrantersrs to One Grantee is a legal document used to transfer ownership of real estate property in Odessa, Texas. This type of deed ensures that the property is free from any encumbrances, except those explicitly mentioned in the deed. This article will dive into the details of what this type of deed entails and shed light on the different scenarios in which it may be used. A General Warranty Deed is a land transfer document that guarantees the granter's clear legal title to the property being transferred. It provides a comprehensive set of warranties and assurances to the grantee, protecting them from risks or claims that may arise from previous owners or parties. In the case of an Odessa Texas General Warranty Deed — SiGrantersrs to One Grantee, the property is being conveyed by six individuals (granters) to a single recipient (grantee). The purpose of using a Six Granters to One Grantee format may vary. It could occur when a property is jointly owned by six individuals, such as family members or business partners, who have decided to transfer their collective interest to a single individual. This can simplify the ownership structure and streamline decision-making processes. Examples of different types of Odessa Texas General Warranty Deed — SiGrantersrs to One Grantee include: 1. Family Transfer: A family property owned by siblings or multiple generations may be transferred to one individual for management or ownership consolidation purposes. This type of transfer ensures that the property remains within the family while making it easier to manage or pass down through generations. 2. Business Consolidation: In cases where a property is co-owned by multiple partners or shareholders of a business, the transfer can be made to one individual who will have sole ownership. This type of deed simplifies business operations and allows for more straightforward decision-making. 3. Estate Settlement: In the event of an estate settlement, where multiple heirs inherit a property, all individuals involved may choose to transfer their interest to a single heir. This consolidation prevents potential conflicts between beneficiaries and ensures a clear ownership structure. It is crucial for both the granters and the grantee to seek legal advice and ensure that the Odessa Texas General Warranty Deed — SiGrantersrs to One Grantee is drafted accurately. This deed protects the grantee from any unforeseen complications and potential challenges to the title. Additionally, it provides a legal framework for the granters to transfer their ownership interests smoothly. Understanding the implications and requirements of an Odessa Texas General Warranty Deed — SiGrantersrs to One Grantee is essential for all parties involved in the property transfer process. By relying on this legal document, the grantee can have peace of mind knowing that their ownership interest is secure and free from any undisclosed claims or encumbrances.Odessa Texas General Warranty Deed — SiGrantersrs to One Grantee is a legal document used to transfer ownership of real estate property in Odessa, Texas. This type of deed ensures that the property is free from any encumbrances, except those explicitly mentioned in the deed. This article will dive into the details of what this type of deed entails and shed light on the different scenarios in which it may be used. A General Warranty Deed is a land transfer document that guarantees the granter's clear legal title to the property being transferred. It provides a comprehensive set of warranties and assurances to the grantee, protecting them from risks or claims that may arise from previous owners or parties. In the case of an Odessa Texas General Warranty Deed — SiGrantersrs to One Grantee, the property is being conveyed by six individuals (granters) to a single recipient (grantee). The purpose of using a Six Granters to One Grantee format may vary. It could occur when a property is jointly owned by six individuals, such as family members or business partners, who have decided to transfer their collective interest to a single individual. This can simplify the ownership structure and streamline decision-making processes. Examples of different types of Odessa Texas General Warranty Deed — SiGrantersrs to One Grantee include: 1. Family Transfer: A family property owned by siblings or multiple generations may be transferred to one individual for management or ownership consolidation purposes. This type of transfer ensures that the property remains within the family while making it easier to manage or pass down through generations. 2. Business Consolidation: In cases where a property is co-owned by multiple partners or shareholders of a business, the transfer can be made to one individual who will have sole ownership. This type of deed simplifies business operations and allows for more straightforward decision-making. 3. Estate Settlement: In the event of an estate settlement, where multiple heirs inherit a property, all individuals involved may choose to transfer their interest to a single heir. This consolidation prevents potential conflicts between beneficiaries and ensures a clear ownership structure. It is crucial for both the granters and the grantee to seek legal advice and ensure that the Odessa Texas General Warranty Deed — SiGrantersrs to One Grantee is drafted accurately. This deed protects the grantee from any unforeseen complications and potential challenges to the title. Additionally, it provides a legal framework for the granters to transfer their ownership interests smoothly. Understanding the implications and requirements of an Odessa Texas General Warranty Deed — SiGrantersrs to One Grantee is essential for all parties involved in the property transfer process. By relying on this legal document, the grantee can have peace of mind knowing that their ownership interest is secure and free from any undisclosed claims or encumbrances.