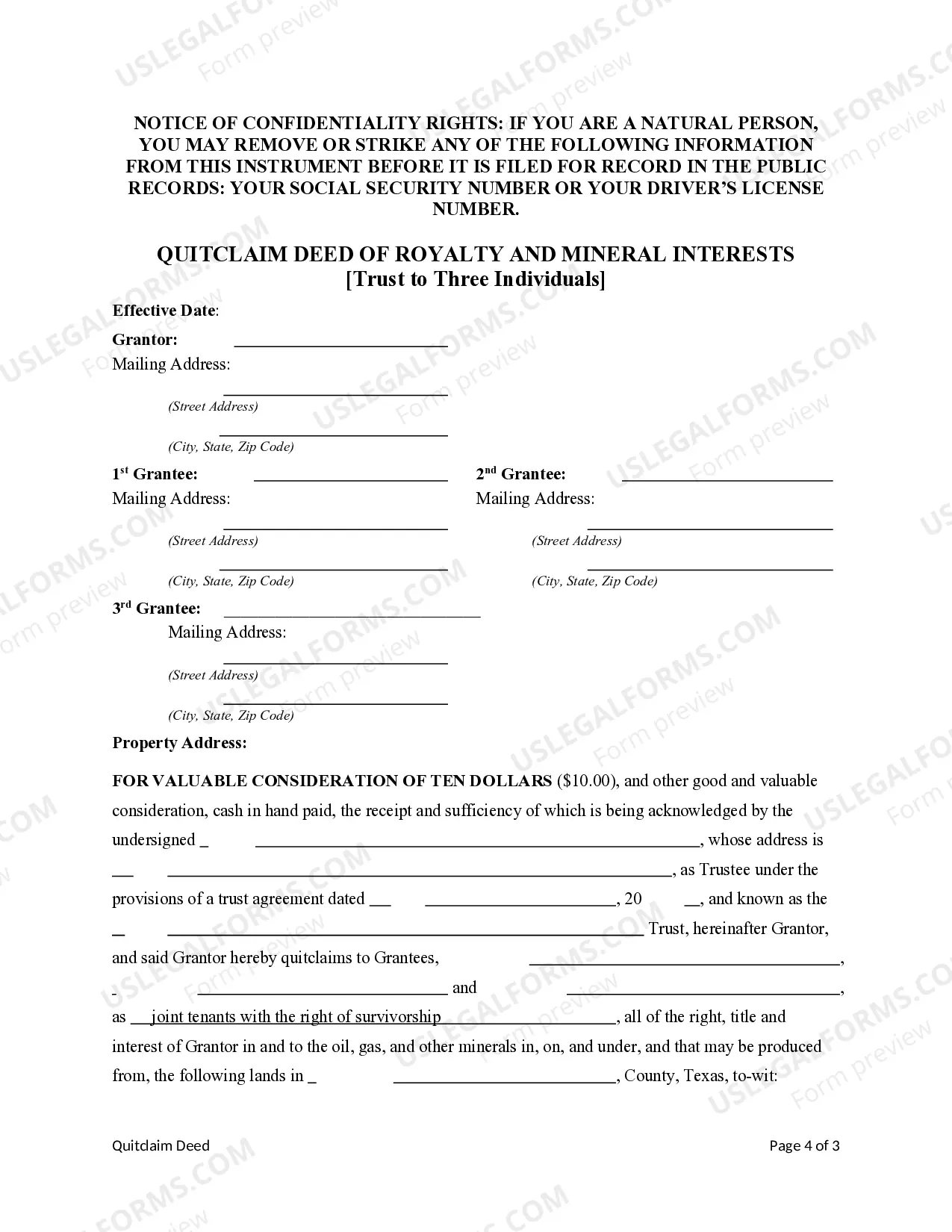

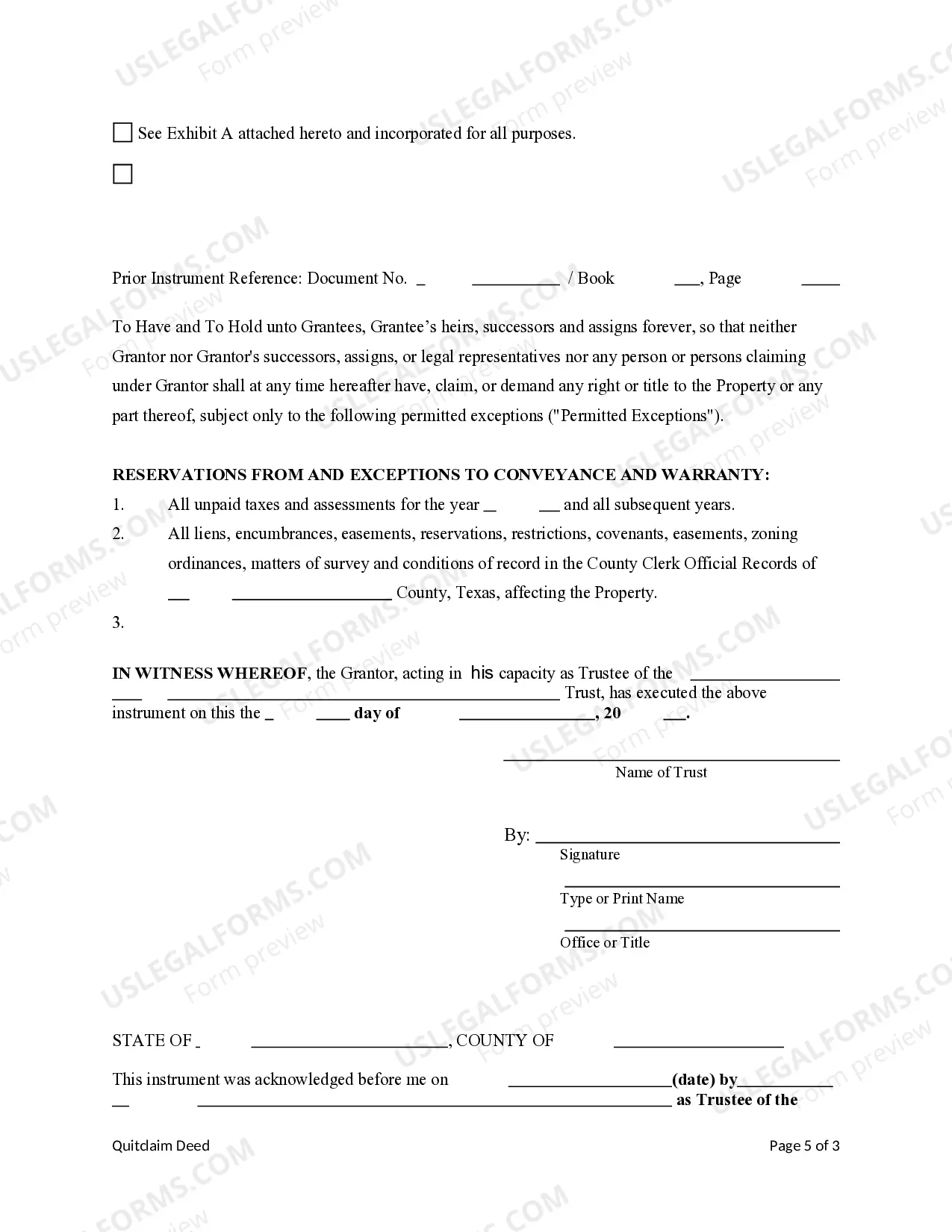

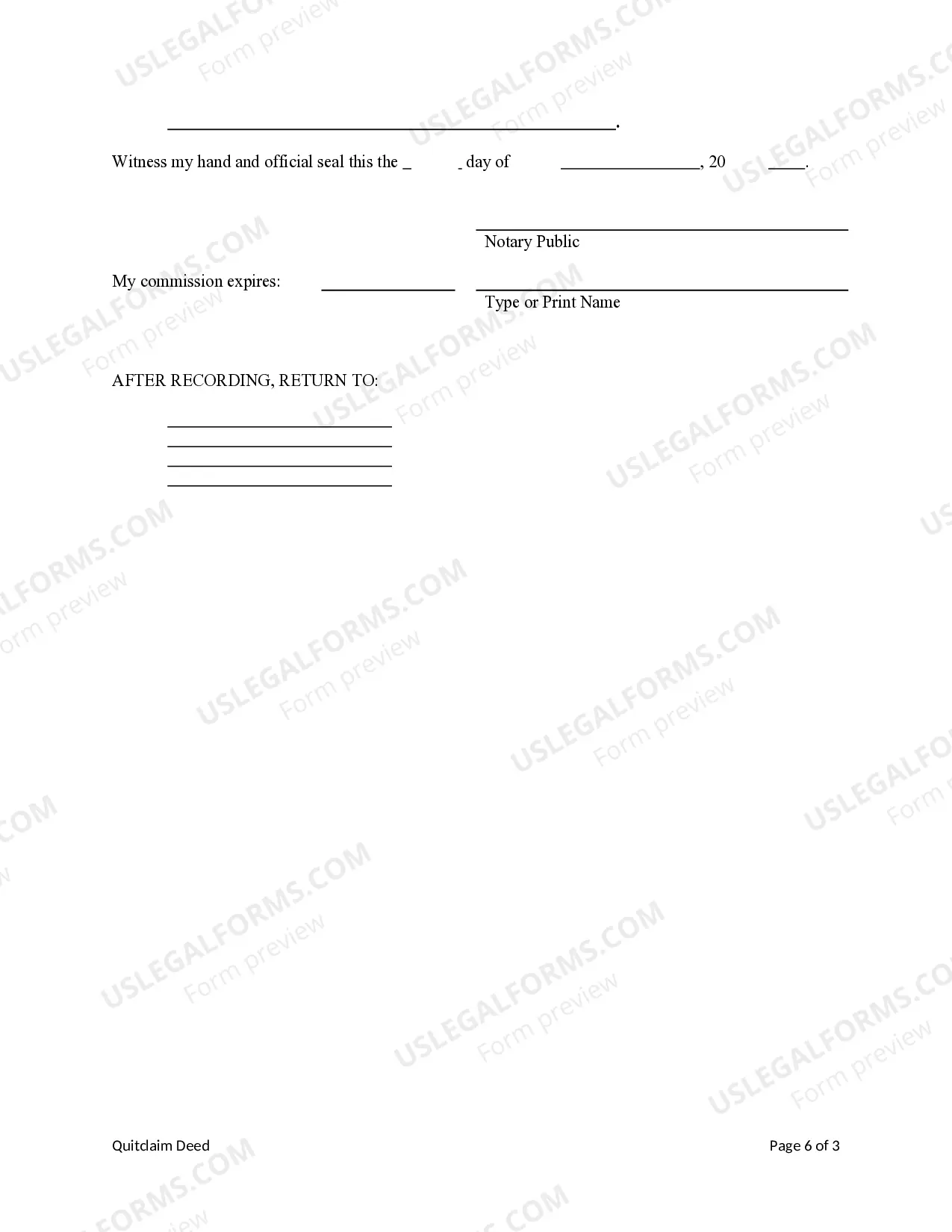

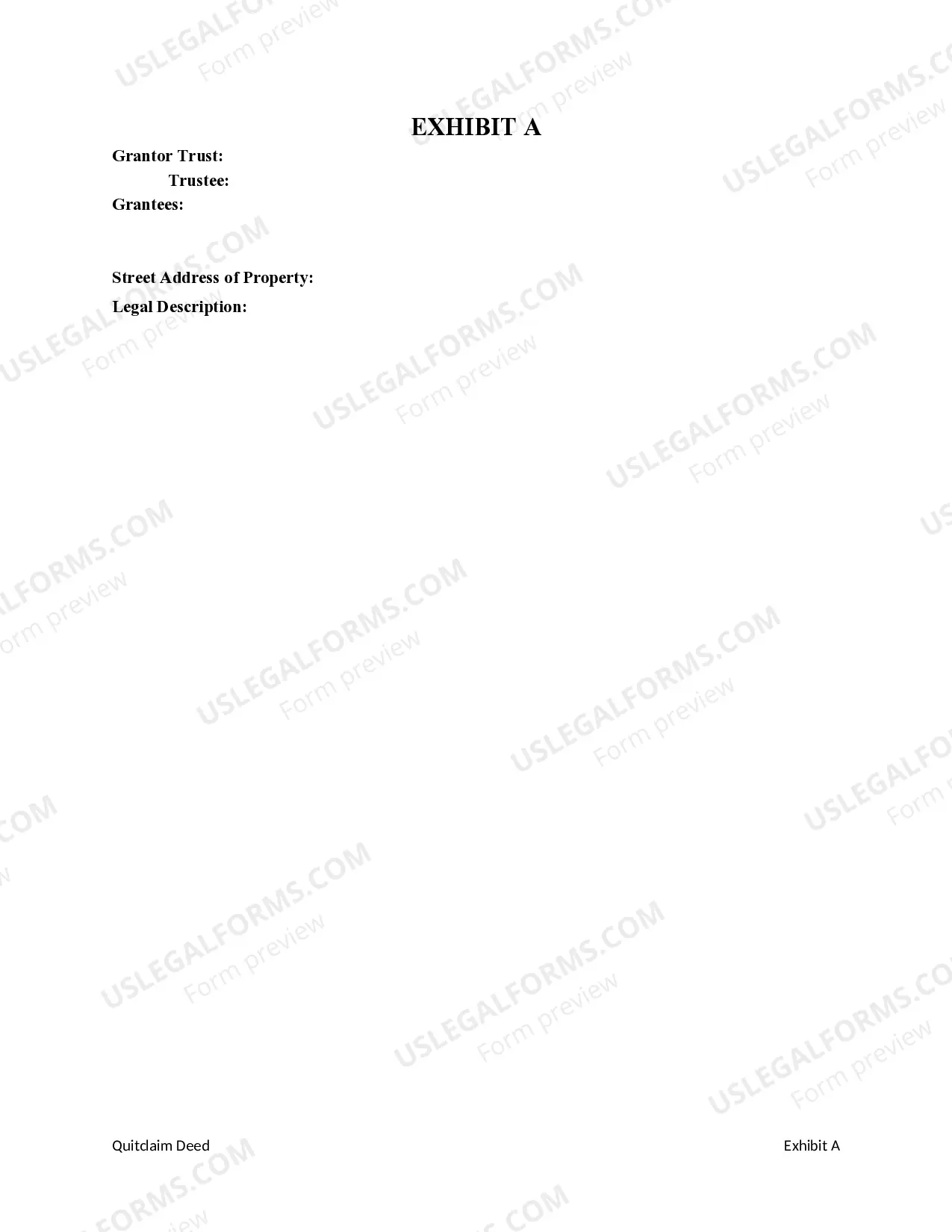

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantees are three Individuals. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

The Austin Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three (3) Individuals is a legal document used to transfer ownership of royalty and mineral interests from a trust to three individuals in the city of Austin, Texas. This type of deed is commonly used when there is a trust that holds these interests, and the beneficiaries of the trust wish to formally receive their portion of the ownership. The deed establishes the transfer of ownership rights and protects the interests of all parties involved. There may be different variations of this deed depending on the specific circumstances. Some possible types include: 1. General Quitclaim Deed: This type of deed transfers all royalty and mineral interests from the trust to the three individuals without any specific restrictions or conditions. 2. Specific Quitclaim Deed: This type of deed can outline specific limitations or conditions for the transfer of the royalty and mineral interests. For example, it may specify that the transfer is limited to a certain number of acres or exclude certain areas of land. 3. Partial Quitclaim Deed: In some cases, the trust may only transfer a portion of its royalty and mineral interests to the three individuals. This type of deed would clearly outline the specific percentage or fraction being transferred. It is important for all parties involved to understand the specific terms and conditions outlined in the deed. The deed should include relevant keywords such as "quitclaim," "royalty," "mineral interests," "trust," "transfer," "ownership," "beneficiaries," and "Austin, Texas." These keywords help to accurately describe the nature of the document and its legal implications.