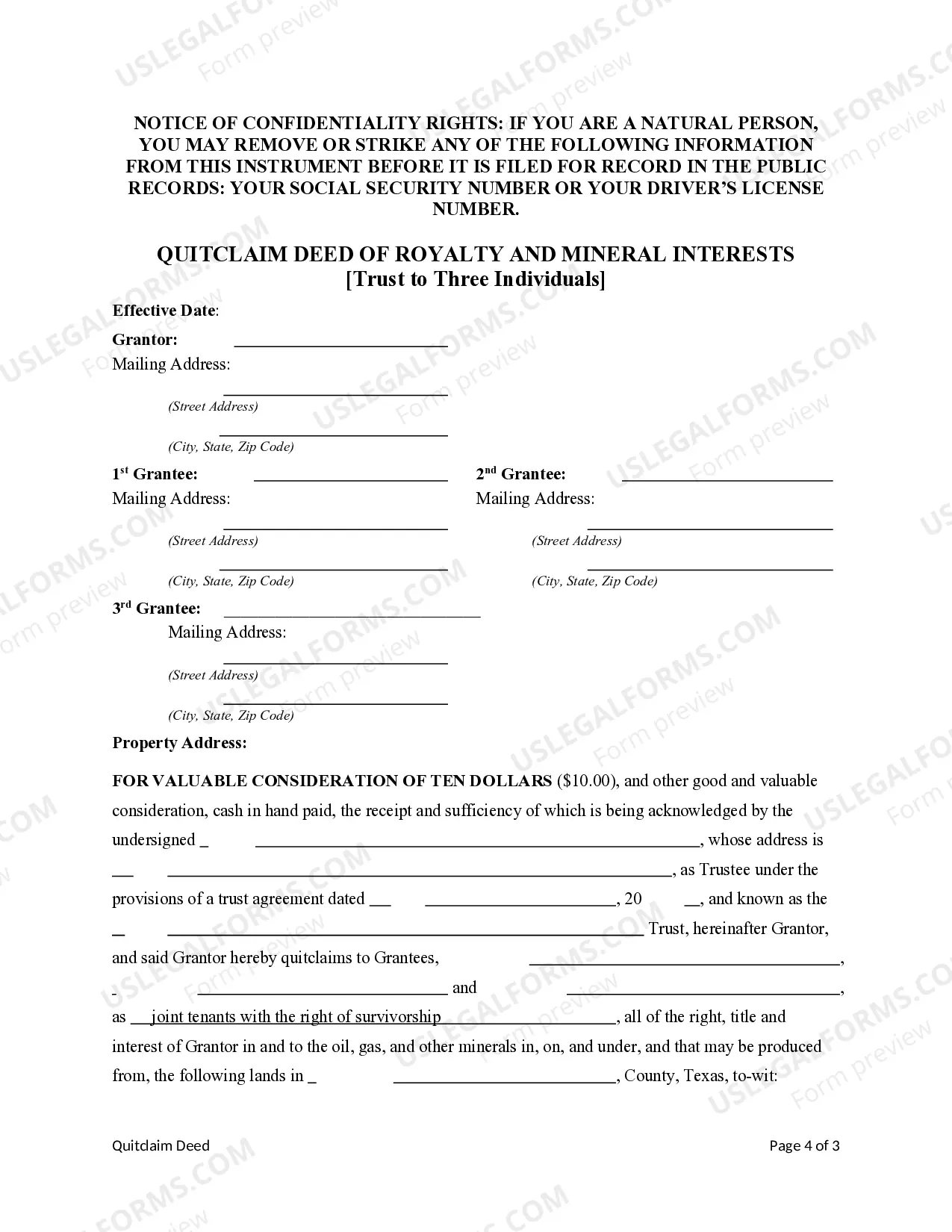

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantees are three Individuals. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

Title: Understanding Different Types of Corpus Christi Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three (3) Individuals Introduction: A Corpus Christi Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three (3) Individuals is a legal document that transfers ownership and rights to royalty and mineral interests from a trust to three individuals. This detailed description aims to shed light on the different types of such quitclaim deeds and their significance. Understanding these variations can be valuable for individuals involved in real estate, mineral rights, and trust management in Corpus Christi, Texas. 1. General Corpus Christi Texas Quitclaim Deed of Royalty and Mineral Interests: This type of quitclaim deed is the most common and straightforward. It transfers all ownership rights to royalty and mineral interests from the trust to three specific individuals. It establishes a clear transfer of property rights and ensures that these individuals become the sole owners of the assets. 2. Partial Corpus Christi Texas Quitclaim Deed of Royalty and Mineral Interests: This variation of the quitclaim deed is used when the trust wishes to transfer only a portion of its ownership or interest in royalty and mineral rights to the three individuals. The partial transfer can be for a specific area, a certain percentage, or any other specified division of the trust's overall ownership. 3. Corpus Christi Texas Quitclaim Deed of Royalty and Mineral Interests with Restrictions: This type of quitclaim deed imposes certain restrictions on the ownership and usage of the royalty and mineral interests being transferred. These restrictions can include limitations on access, surface use rights, environmental considerations, or additional stipulations agreed upon by the trust and the three individuals. It ensures that the transferred interests are utilized in accordance with specific guidelines. 4. Corpus Christi Texas Quitclaim Deed of Royalty and Mineral Interests with Reserved Rights: In some cases, a trust may choose to retain certain rights or interests concerning the royalty and mineral assets being transferred. This quitclaim deed includes provisions that specify the rights reserved by the trust. These reservations can include surface usage rights, right to access the property, or other applicable permissions, ensuring that the trust maintains specific control over certain aspects of the interests. Conclusion: Understanding the various types of Corpus Christi Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three (3) Individuals is crucial for anyone involved in real estate, mineral rights, or trust management. Whether it is a general transfer, partial transfer, restricted transfer, or a transfer with reserved rights, each type serves a unique purpose. By familiarizing themselves with these variations, individuals can make informed decisions and manage their assets effectively and legally.Title: Understanding Different Types of Corpus Christi Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three (3) Individuals Introduction: A Corpus Christi Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three (3) Individuals is a legal document that transfers ownership and rights to royalty and mineral interests from a trust to three individuals. This detailed description aims to shed light on the different types of such quitclaim deeds and their significance. Understanding these variations can be valuable for individuals involved in real estate, mineral rights, and trust management in Corpus Christi, Texas. 1. General Corpus Christi Texas Quitclaim Deed of Royalty and Mineral Interests: This type of quitclaim deed is the most common and straightforward. It transfers all ownership rights to royalty and mineral interests from the trust to three specific individuals. It establishes a clear transfer of property rights and ensures that these individuals become the sole owners of the assets. 2. Partial Corpus Christi Texas Quitclaim Deed of Royalty and Mineral Interests: This variation of the quitclaim deed is used when the trust wishes to transfer only a portion of its ownership or interest in royalty and mineral rights to the three individuals. The partial transfer can be for a specific area, a certain percentage, or any other specified division of the trust's overall ownership. 3. Corpus Christi Texas Quitclaim Deed of Royalty and Mineral Interests with Restrictions: This type of quitclaim deed imposes certain restrictions on the ownership and usage of the royalty and mineral interests being transferred. These restrictions can include limitations on access, surface use rights, environmental considerations, or additional stipulations agreed upon by the trust and the three individuals. It ensures that the transferred interests are utilized in accordance with specific guidelines. 4. Corpus Christi Texas Quitclaim Deed of Royalty and Mineral Interests with Reserved Rights: In some cases, a trust may choose to retain certain rights or interests concerning the royalty and mineral assets being transferred. This quitclaim deed includes provisions that specify the rights reserved by the trust. These reservations can include surface usage rights, right to access the property, or other applicable permissions, ensuring that the trust maintains specific control over certain aspects of the interests. Conclusion: Understanding the various types of Corpus Christi Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three (3) Individuals is crucial for anyone involved in real estate, mineral rights, or trust management. Whether it is a general transfer, partial transfer, restricted transfer, or a transfer with reserved rights, each type serves a unique purpose. By familiarizing themselves with these variations, individuals can make informed decisions and manage their assets effectively and legally.