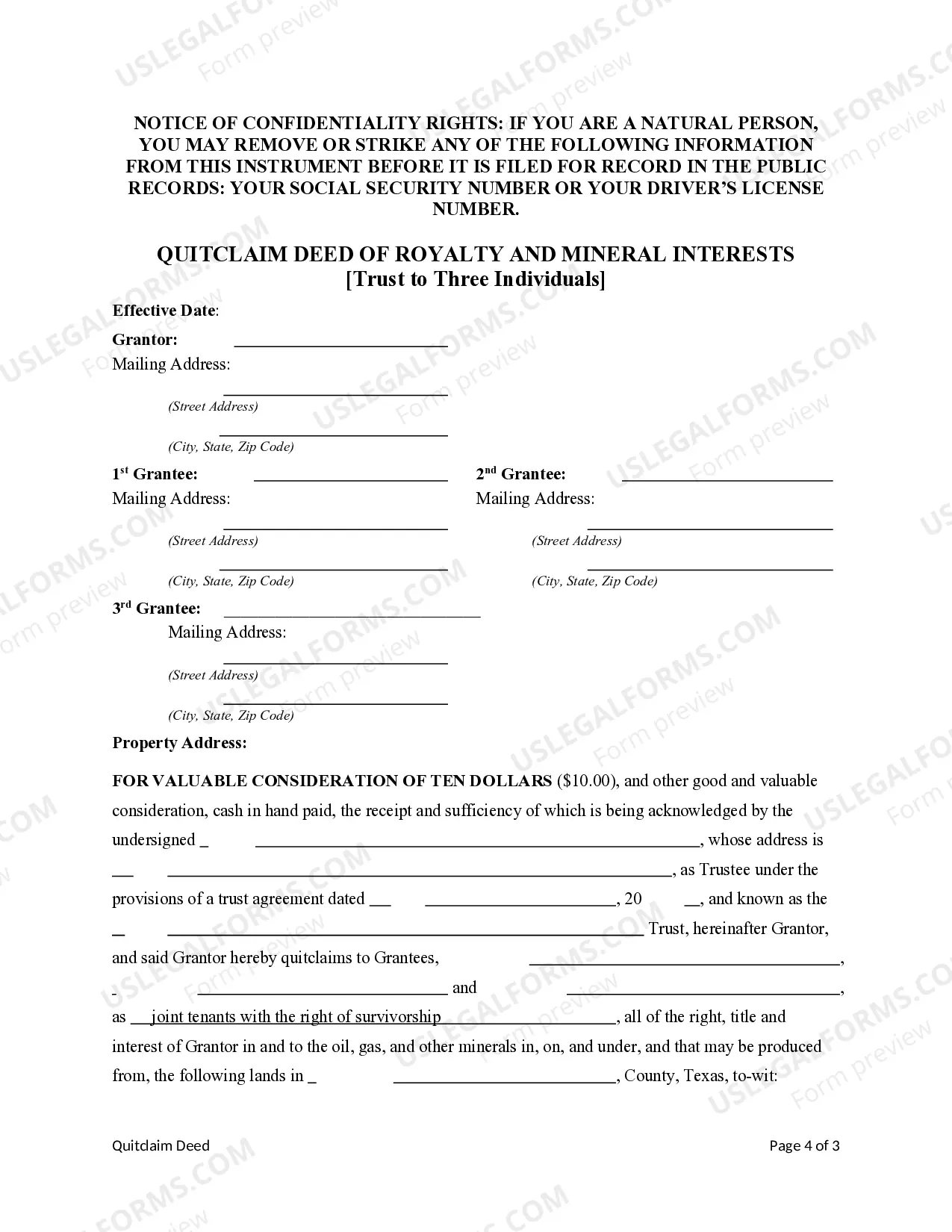

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantees are three Individuals. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

Title: Understanding the Harris Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three (3) Individuals Introduction: When it comes to transferring ownership of royalty and mineral interests in Harris, Texas, the Harris Texas Quitclaim Deed plays a significant role. This legal document facilitates the conveyance of such interests from a trust to three individuals. In this article, we will delve into the intricacies of the Harris Texas Quitclaim Deed of Royalty and Mineral Interests, exploring its various types and crucial aspects. Keywords: Harris Texas Quitclaim Deed, royalty interests, mineral interests, trust, three individuals 1. Exploring the Harris Texas Quitclaim Deed: The Harris Texas Quitclaim Deed is a legally binding document used for transferring ownership of royalty and mineral interests. It is commonly employed in Harris County, Texas, to facilitate the conveyance of such interests from a trust to three individuals. 2. Understanding Royalty Interests: Royalty interests represent a share of revenue derived from the production of minerals, typically oil, gas, or other natural resources. These interests can be owned by individuals, trusts, or corporations, entitling them to a portion of the income generated from the extraction and sale of these resources. 3. Delving into Mineral Interests: Mineral interests encompass ownership of the rights to extract and exploit minerals present in a specific property. These minerals could include oil, gas, coal, or other valuable substances. Ownership of these interests grants individuals certain rights related to exploration, extraction, and royalties. 4. The Role of Trusts in Conveyance: Trusts often hold ownership of royalty and mineral interests on behalf of beneficiaries. A trust acts as a fiduciary arrangement where the trustee manages the assets for the trust's benefit and the beneficiaries' interests. Transferring these assets to individuals requires the execution of a Quitclaim Deed. 5. Types of Harris Texas Quitclaim Deeds of Royalty and Mineral Interests: a) Individual-to-Individual Transfer: This type of Quitclaim Deed involves the direct transfer of royalty and mineral interests from an individual trust to three other individuals. It ensures the seamless transition of ownership without the involvement of additional entities. b) Trust-to-Individual Transfer: In this case, the Quitclaim Deed facilitates the transfer of royalty and mineral interests from a trust holding these assets to three individual beneficiaries. The trust acts as an intermediary ensuring proper conveyance of the interests. c) Trust-to-Trust Transfer: In certain situations, a Quitclaim Deed may allow the transfer of royalty and mineral interests from one trust to another. This option may arise during a reorganization or restructuring of trust assets, allowing for a seamless continuation of ownership. 6. Essential Elements of the Quitclaim Deed: To ensure the legality and validity of the transfer, a Harris Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals should include: — Clear identification of the trust and the three individuals involved. — Comprehensive description of the royalty and mineral interests being conveyed. — The consideration exchanged in return for the transfer. — Execution signatures from both thgranteror and the grantee, along with notarization. — Detailed legal descriptions of the specific properties associated with the interests. Conclusion: The Harris Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals is a crucial legal document used for transferring ownership of these significant assets. Understanding its different types and essential elements ensures a smooth and legally sound conveyance of royalty and mineral interests in Harris, Texas.Title: Understanding the Harris Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three (3) Individuals Introduction: When it comes to transferring ownership of royalty and mineral interests in Harris, Texas, the Harris Texas Quitclaim Deed plays a significant role. This legal document facilitates the conveyance of such interests from a trust to three individuals. In this article, we will delve into the intricacies of the Harris Texas Quitclaim Deed of Royalty and Mineral Interests, exploring its various types and crucial aspects. Keywords: Harris Texas Quitclaim Deed, royalty interests, mineral interests, trust, three individuals 1. Exploring the Harris Texas Quitclaim Deed: The Harris Texas Quitclaim Deed is a legally binding document used for transferring ownership of royalty and mineral interests. It is commonly employed in Harris County, Texas, to facilitate the conveyance of such interests from a trust to three individuals. 2. Understanding Royalty Interests: Royalty interests represent a share of revenue derived from the production of minerals, typically oil, gas, or other natural resources. These interests can be owned by individuals, trusts, or corporations, entitling them to a portion of the income generated from the extraction and sale of these resources. 3. Delving into Mineral Interests: Mineral interests encompass ownership of the rights to extract and exploit minerals present in a specific property. These minerals could include oil, gas, coal, or other valuable substances. Ownership of these interests grants individuals certain rights related to exploration, extraction, and royalties. 4. The Role of Trusts in Conveyance: Trusts often hold ownership of royalty and mineral interests on behalf of beneficiaries. A trust acts as a fiduciary arrangement where the trustee manages the assets for the trust's benefit and the beneficiaries' interests. Transferring these assets to individuals requires the execution of a Quitclaim Deed. 5. Types of Harris Texas Quitclaim Deeds of Royalty and Mineral Interests: a) Individual-to-Individual Transfer: This type of Quitclaim Deed involves the direct transfer of royalty and mineral interests from an individual trust to three other individuals. It ensures the seamless transition of ownership without the involvement of additional entities. b) Trust-to-Individual Transfer: In this case, the Quitclaim Deed facilitates the transfer of royalty and mineral interests from a trust holding these assets to three individual beneficiaries. The trust acts as an intermediary ensuring proper conveyance of the interests. c) Trust-to-Trust Transfer: In certain situations, a Quitclaim Deed may allow the transfer of royalty and mineral interests from one trust to another. This option may arise during a reorganization or restructuring of trust assets, allowing for a seamless continuation of ownership. 6. Essential Elements of the Quitclaim Deed: To ensure the legality and validity of the transfer, a Harris Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals should include: — Clear identification of the trust and the three individuals involved. — Comprehensive description of the royalty and mineral interests being conveyed. — The consideration exchanged in return for the transfer. — Execution signatures from both thgranteror and the grantee, along with notarization. — Detailed legal descriptions of the specific properties associated with the interests. Conclusion: The Harris Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals is a crucial legal document used for transferring ownership of these significant assets. Understanding its different types and essential elements ensures a smooth and legally sound conveyance of royalty and mineral interests in Harris, Texas.