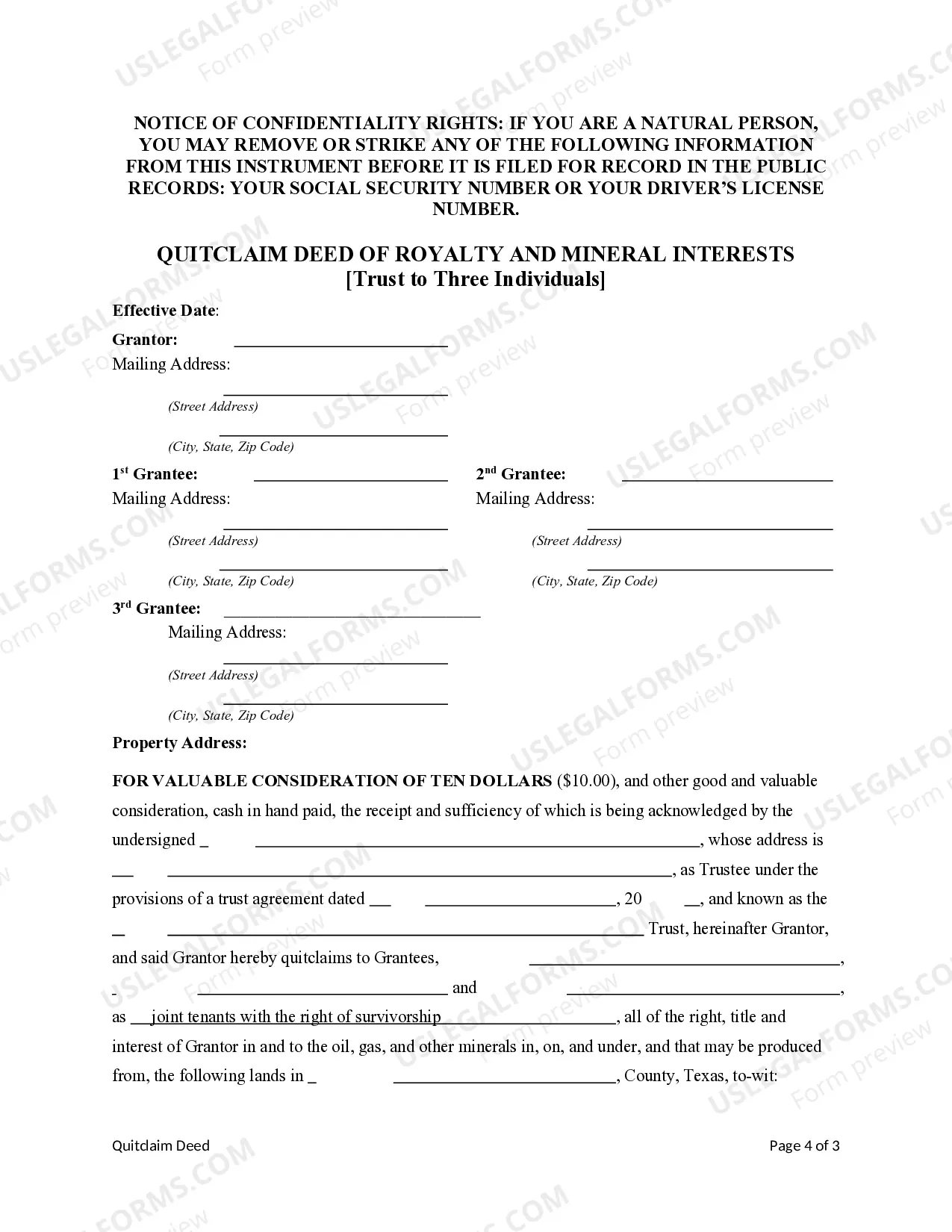

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantees are three Individuals. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

When it comes to transferring ownership of royalty and mineral interests from a trust to three individuals in McAllen, Texas, an essential legal document is the McAllen Texas Quitclaim Deed. This deed acts as a legal instrument for conveying the interest in royalties and minerals from the trust to the specified individuals. With the Quitclaim Deed, the trust relinquishes all rights and interests it holds, without guaranteeing any validity of title or ownership. By utilizing a McAllen Texas Quitclaim Deed of Royalty and Mineral Interests, the trust can transfer these interests to the three individuals more efficiently, without undergoing a lengthy and complex process. It is worth noting that the McAllen Texas Quitclaim Deed may have different types, depending on the specific circumstances and requirements of the parties involved. Two common types include: 1. McAllen Texas Quitclaim Deed of Royalty and Mineral Interests with Full Warranty: In this type of deed, the trust guarantees the validity of the title and ownership of the royalty and mineral interests being transferred to the three individuals. This provides a higher level of assurance for the recipients, ensuring that there are no encumbrances or issues with the conveyed interests. 2. McAllen Texas Quitclaim Deed of Royalty and Mineral Interests without Warranty: This type of deed implies that the trust gives no guarantee regarding the title or ownership of the royalty and mineral interests being transferred. The trust essentially transfers the interests "as is," without any warranty against potential claims, liens, or defects in the chain of ownership. When drafting a McAllen Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals, it is essential to include specific details about the trust, such as its legal name, address, and the date of its establishment. The deed should also identify the three individuals receiving the interests and provide their complete names and addresses. Furthermore, the deed must accurately describe the royalty and mineral interests being transferred, including any relevant legal descriptions or identifying information, such as survey numbers, property identification numbers, or lease numbers. It is crucial to work with a qualified legal professional experienced in mineral and royalty transactions to ensure all necessary details are properly included. In summary, the McAllen Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals is a crucial legal document for transferring ownership of these interests. Its various types, such as the Full Warranty and Without Warranty variants, offer different levels of assurance. Properly drafting this document with precise details and following legal requirements is essential to ensure a smooth and valid transfer of royalty and mineral interests in McAllen, Texas.