This form is a Quitclaim Deed where the Grantor is a Trust and the Grantees are three Individuals. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

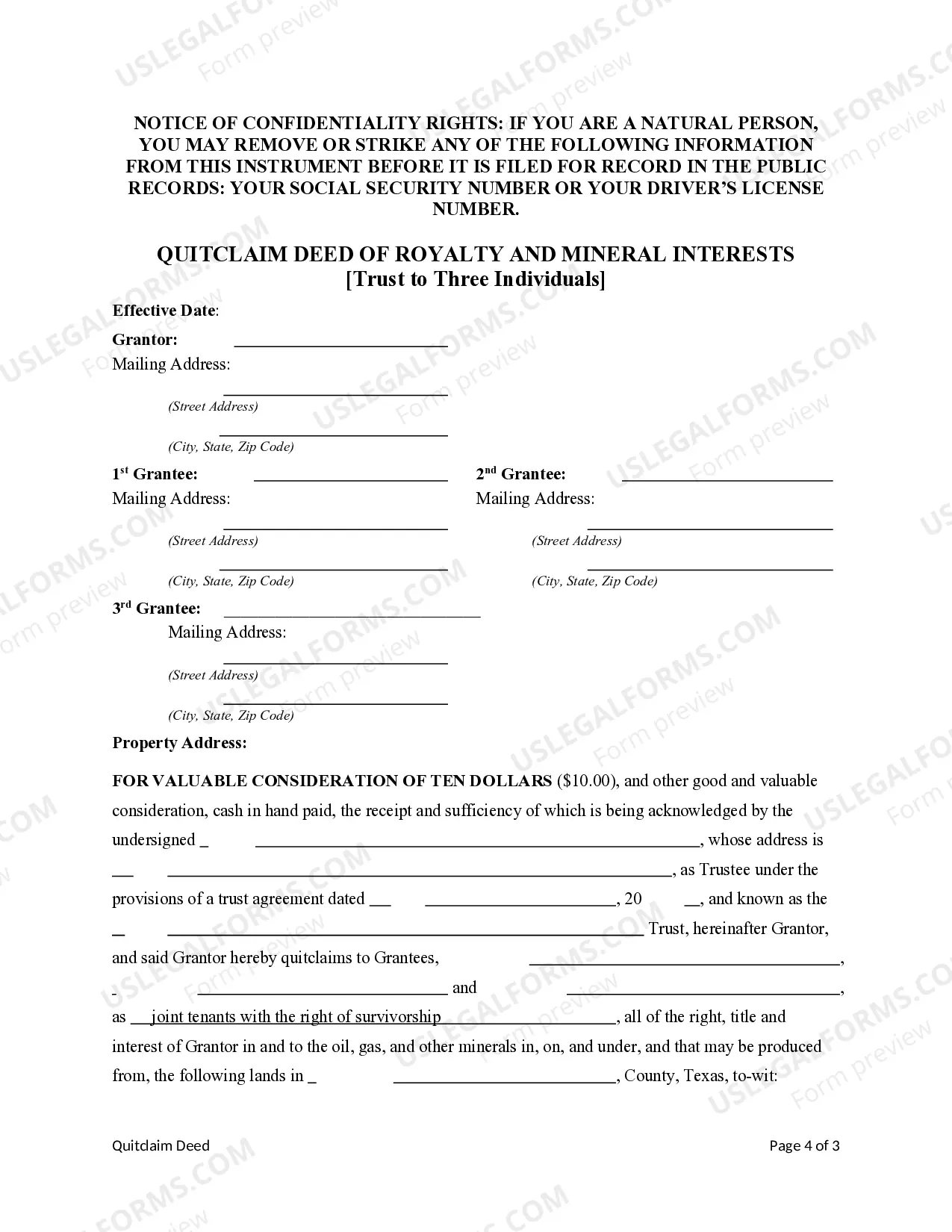

Title: Understanding the Round Rock Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals Keywords: Round Rock Texas, Quitclaim Deed, Royalty Interests, Mineral Interests, Trust, Three Individuals Introduction: In Round Rock, Texas, the Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals is an important legal document that transfers ownership of royalty and mineral interests from a trust to three specified individuals. This comprehensive guide will discuss the process, significance, and potential types of such deeds in Round Rock, Texas. 1. What is a Quitclaim Deed? A Quitclaim Deed is a legal instrument used to transfer property rights from one party to another. It helps convey ownership interest in real estate, including royalty and mineral interests, without providing any warranty or guarantee of the title. 2. Understanding Royalty and Mineral Interests: Royalty interests refer to the percentage of net revenue derived from the production of minerals extracted from a landowner's property, typically in the form of oil, gas, or other minerals. Mineral interests, on the other hand, involve ownership of the actual minerals beneath the surface of the land. 3. Significance of the Quitclaim Deed of Royalty and Mineral Interests: The Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals in Round Rock, Texas, is executed when a trust wishes to transfer these interests to specific individuals. This can be done for various reasons, such as estate planning, asset distribution, or changing ownership structure. 4. Process of Executing the Quitclaim Deed: The process begins with drafting a legally valid Quitclaim Deed, which includes the following information: — Names and addresses of thgranteror (trust) and grantees (three individuals) — Property description, including identification of the royalty and mineral interests — Consideration, if any, for the transfer — Signatures of thgranteror and witnesses 5. Types of Round Rock Texas Quitclaim Deed of Royalty and Mineral Interests: While the specific types of these deeds may vary based on the circumstances and parties involved, a few examples could include: — Partial Conveyance: Transferring a fraction or percentage of royalty and mineral interests to the grantees. — Full Conveyance: Complete transfer of all royalty and mineral interests to the grantees, leaving no ownership with the trust. — Conditional Conveyance: Modifying the deed with certain conditions, limitations, or restrictions. Conclusion: The Round Rock Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals plays a vital role in the transfer of ownership concerning these valuable assets. Whether it involves partial or full conveyance, understanding the process and exploring different types of deeds can aid individuals in making informed decisions when dealing with such transfers. Consulting legal professionals is recommended to ensure compliance with local laws and protect the rights and interests of all parties involved.Title: Understanding the Round Rock Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals Keywords: Round Rock Texas, Quitclaim Deed, Royalty Interests, Mineral Interests, Trust, Three Individuals Introduction: In Round Rock, Texas, the Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals is an important legal document that transfers ownership of royalty and mineral interests from a trust to three specified individuals. This comprehensive guide will discuss the process, significance, and potential types of such deeds in Round Rock, Texas. 1. What is a Quitclaim Deed? A Quitclaim Deed is a legal instrument used to transfer property rights from one party to another. It helps convey ownership interest in real estate, including royalty and mineral interests, without providing any warranty or guarantee of the title. 2. Understanding Royalty and Mineral Interests: Royalty interests refer to the percentage of net revenue derived from the production of minerals extracted from a landowner's property, typically in the form of oil, gas, or other minerals. Mineral interests, on the other hand, involve ownership of the actual minerals beneath the surface of the land. 3. Significance of the Quitclaim Deed of Royalty and Mineral Interests: The Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals in Round Rock, Texas, is executed when a trust wishes to transfer these interests to specific individuals. This can be done for various reasons, such as estate planning, asset distribution, or changing ownership structure. 4. Process of Executing the Quitclaim Deed: The process begins with drafting a legally valid Quitclaim Deed, which includes the following information: — Names and addresses of thgranteror (trust) and grantees (three individuals) — Property description, including identification of the royalty and mineral interests — Consideration, if any, for the transfer — Signatures of thgranteror and witnesses 5. Types of Round Rock Texas Quitclaim Deed of Royalty and Mineral Interests: While the specific types of these deeds may vary based on the circumstances and parties involved, a few examples could include: — Partial Conveyance: Transferring a fraction or percentage of royalty and mineral interests to the grantees. — Full Conveyance: Complete transfer of all royalty and mineral interests to the grantees, leaving no ownership with the trust. — Conditional Conveyance: Modifying the deed with certain conditions, limitations, or restrictions. Conclusion: The Round Rock Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals plays a vital role in the transfer of ownership concerning these valuable assets. Whether it involves partial or full conveyance, understanding the process and exploring different types of deeds can aid individuals in making informed decisions when dealing with such transfers. Consulting legal professionals is recommended to ensure compliance with local laws and protect the rights and interests of all parties involved.