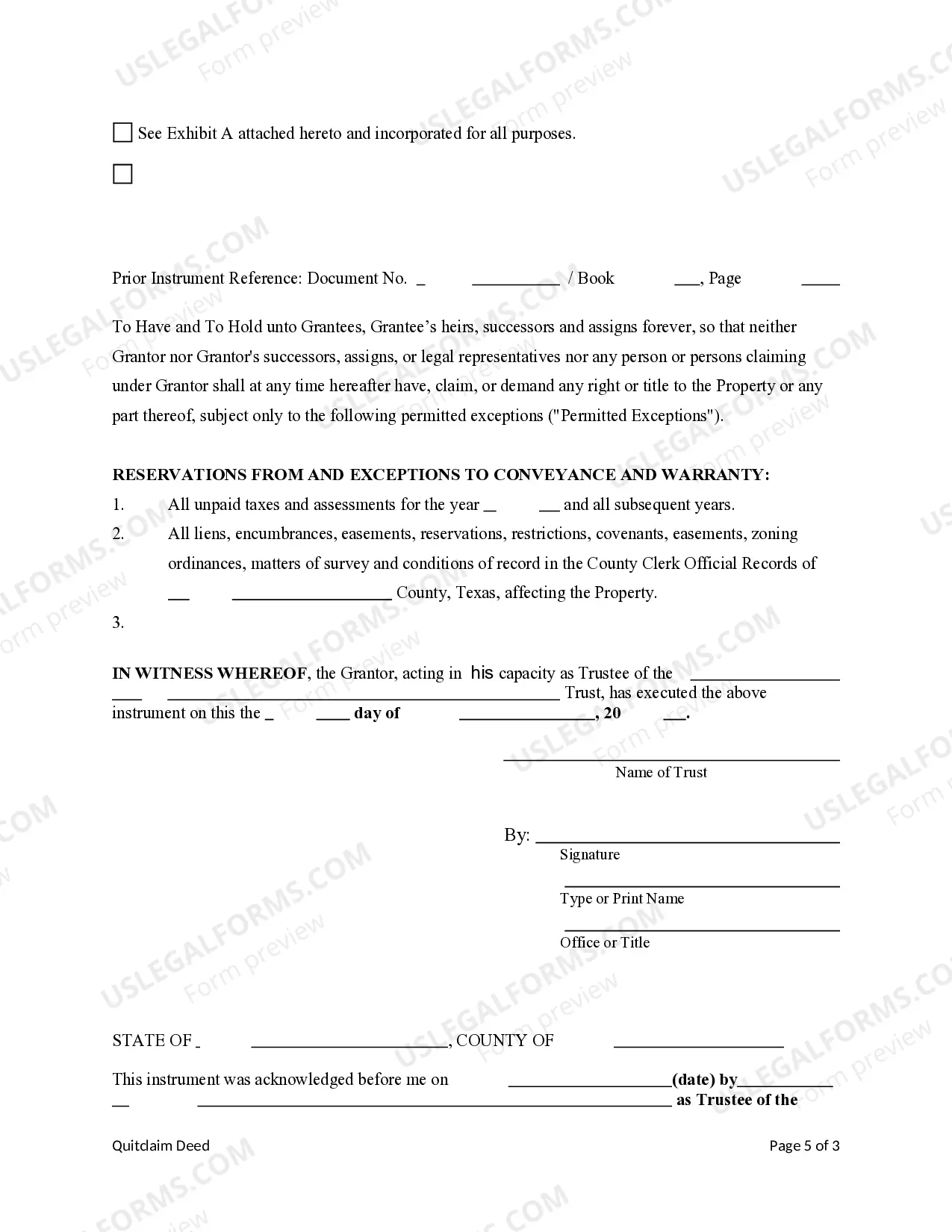

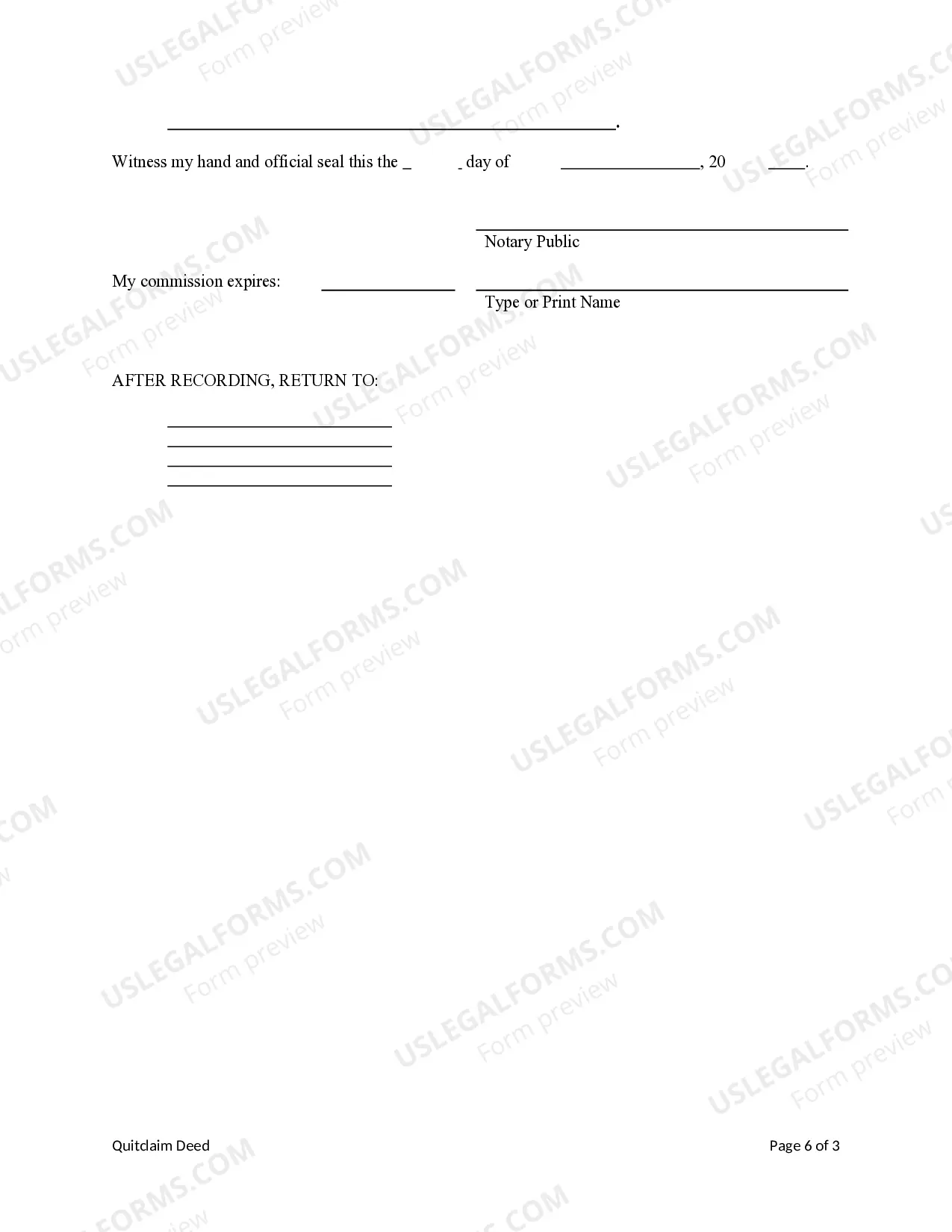

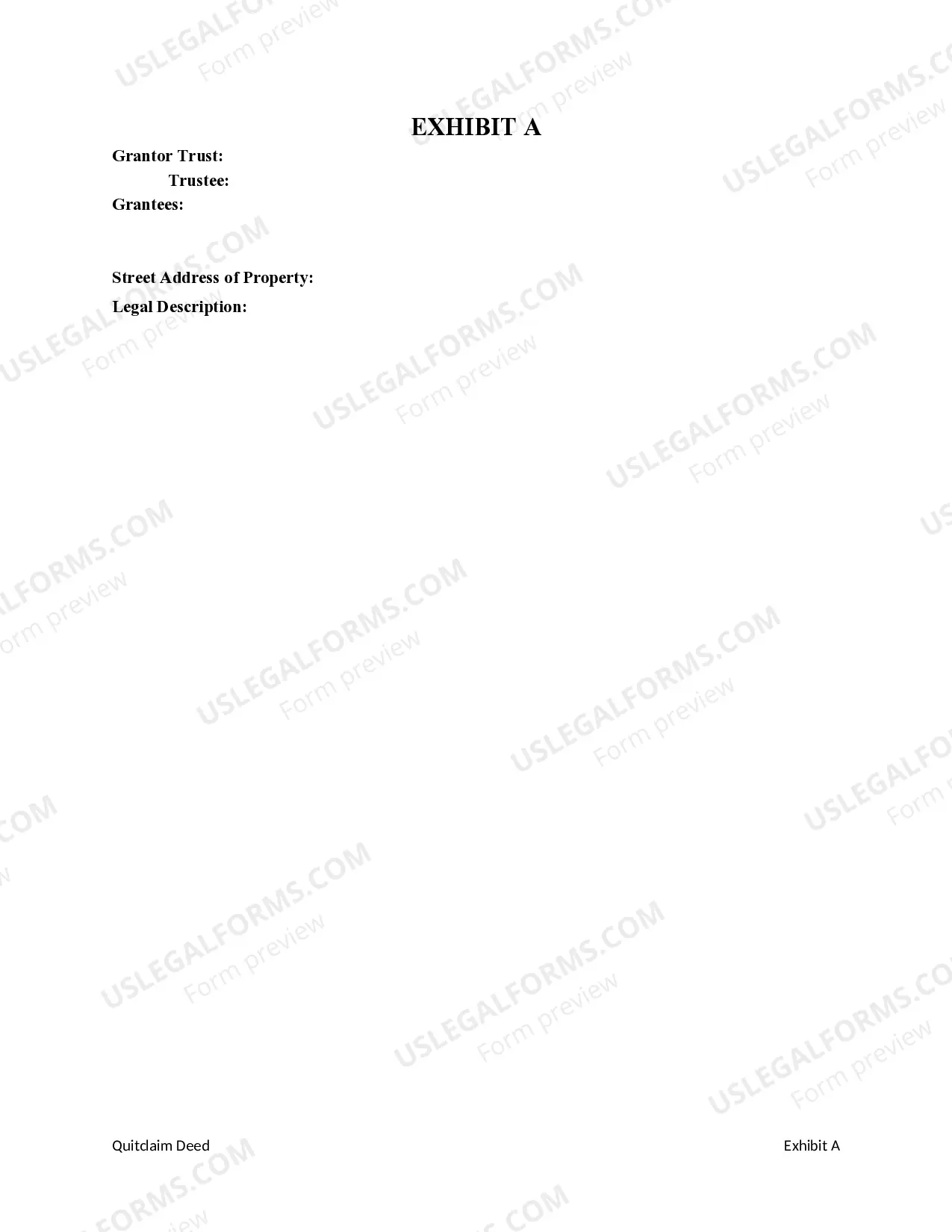

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantees are three Individuals. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

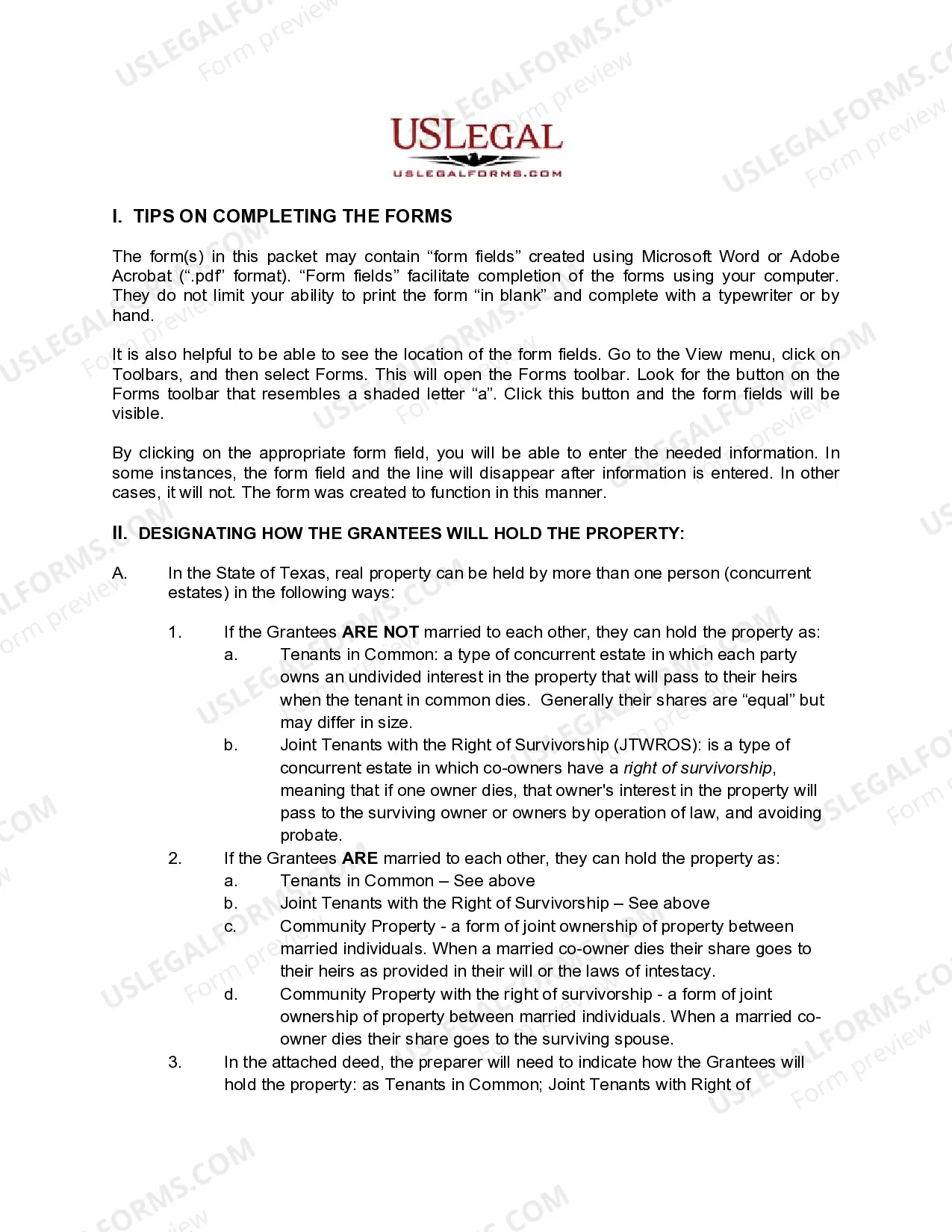

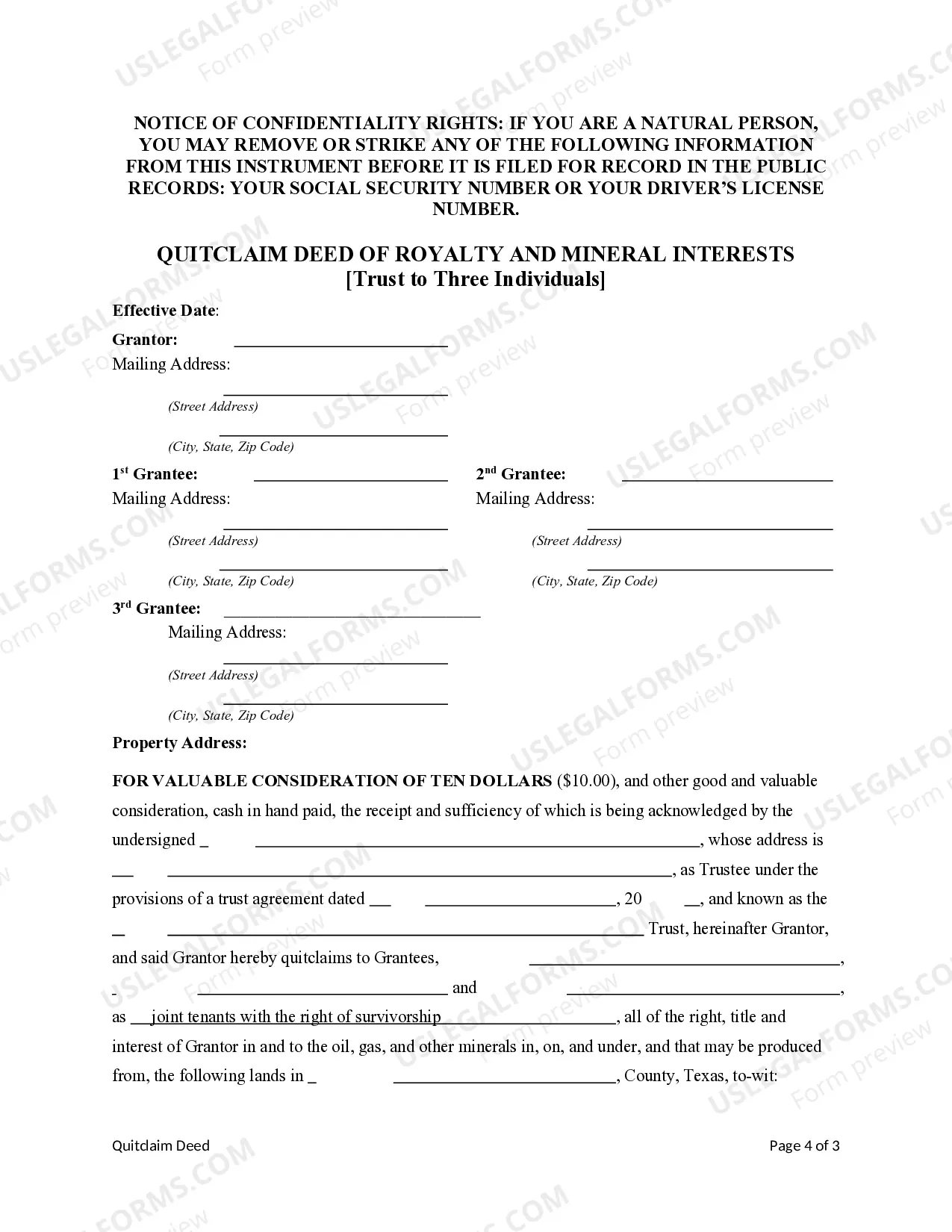

A San Angelo Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three (3) Individuals is a legal document that transfers ownership of royalty and mineral interests from a trust to three specific individuals. This type of deed is commonly used in the state of Texas, particularly in the San Angelo area, where oil and gas activities are prevalent. The purpose of this quitclaim deed is to officially convey the rights and interests in the existing trust to the three designated individuals. By executing this deed, the trust releases any claims or interests it may have had in the royalties and minerals, and transfers them to the named individuals. It is important to note that a quitclaim deed only transfers whatever interest the granter has in the property, making it imperative to conduct due diligence and title research prior to executing the deed. There are different variations of San Angelo Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three (3) Individuals, depending on the specific circumstances and requirements. Some possible types of such deeds include: 1. Standard Quitclaim Deed: This is the most common type of quitclaim deed used for transferring mineral interests from a trust to three individuals. It states the granter, the three grantees, a legal description of the property, and the rights being transferred. Relevant keywords: San Angelo Texas, quitclaim deed, royalty interests, mineral interests, trust, three individuals, standard, legal description. 2. Quitclaim Deed of Partial Interests: This type of deed is utilized when the trust wishes to transfer only a portion of the royalty and mineral interests to each of the three individuals, rather than the entire interest. Relevant keywords: San Angelo Texas, quitclaim deed, royalty interests, mineral interests, trust, three individuals, partial interests, legal description. 3. Quitclaim Deed with Retained Interests: In some cases, a trust may wish to convey a portion of the royalty and mineral interests to the three individuals while retaining some interest for itself. This type of deed clarifies the distribution of interests between all parties involved. Relevant keywords: San Angelo Texas, quitclaim deed, royalty interests, mineral interests, trust, three individuals, retained interests, legal description. 4. Joint Tenancy Quitclaim Deed: If the three individuals wish to hold the transferred royalty and mineral interests in joint tenancy, this specific deed structure can be used. It establishes their co-ownership rights and the right of survivorship. Relevant keywords: San Angelo Texas, quitclaim deed, royalty interests, mineral interests, trust, three individuals, joint tenancy, right of survivorship, legal description. It is essential to consult with a qualified attorney or legal professional experienced in real estate matters to ensure the accuracy and legality of the San Angelo Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three (3) Individuals.