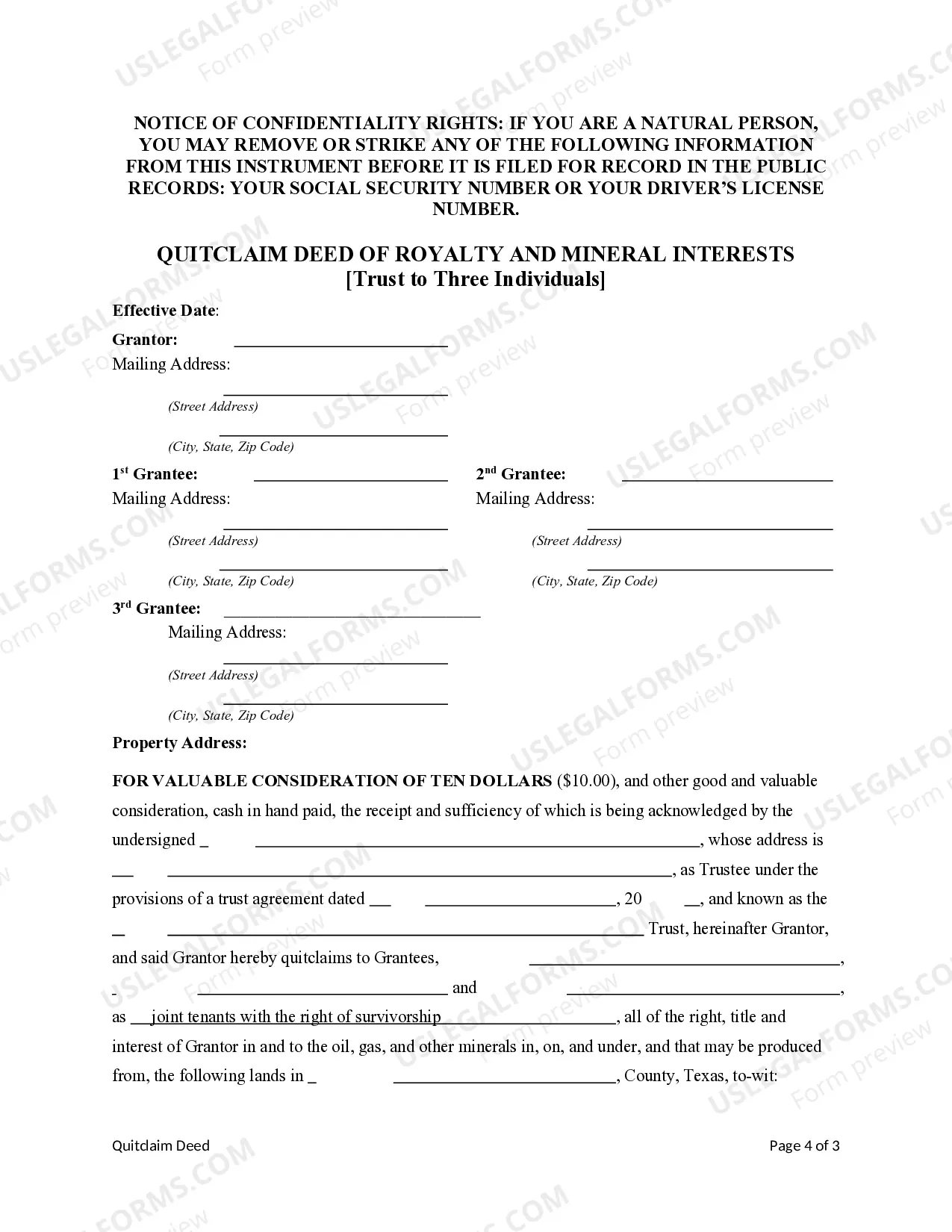

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantees are three Individuals. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

Title: Understanding the Waco Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three (3) Individuals Keywords: Waco Texas, Quitclaim Deed, Royalty, Mineral Interests, Trust, Individuals Introduction: The Waco Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three (3) Individuals is a legal instrument followed in Waco, Texas, to transfer ownership rights of royalty and mineral interests from a trust to three individual parties. This detailed description will provide an overview of the process, different types, and key considerations while executing such deeds. 1. Waco Texas Quitclaim Deed: A quitclaim deed is a legal document used to transfer interest or rights to a property from one party to another without any warranties attached. In Waco, Texas, quitclaim deeds are commonly used to transfer royalty and mineral interests. 2. Royalty and Mineral Interests: Royalty and mineral interests pertain to ownership rights of oil, gas, and other valuable minerals found beneath the surface of a property. These rights may include the right to receive royalties, access to the resources, or leasing them to production companies. 3. Transfer from Trust to Three Individuals: The Waco Texas Quitclaim Deed of Royalty and Mineral Interests from a trust to three individuals is a specific type of quitclaim deed where the ownership rights are transferred from a trust entity to three individual parties. This could occur due to inheritance, estate planning, or rearrangement of asset distribution within a trust. Types of Waco Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals: 1. Inheritance Transfers: In cases where royalty and mineral interests are held within a trust, this type of quitclaim deed allows the transfer of those rights to three individuals as beneficiaries or heirs. 2. Trust Amendment or Revision: If a trust decides to modify its asset distribution by transferring royalty and mineral interests to three individuals, a quitclaim deed can be used to execute the transfer. 3. Trust Distribution: When a trust reaches its termination period, the assets, including royalty and mineral interests, are distributed to its designated beneficiaries using a quitclaim deed. Key Considerations: 1. Title Search: Prior to executing the quitclaim deed, a comprehensive title search is crucial to determine the validity and ownership of the royalty and mineral interests being transferred. 2. Legal Assistance: Consulting with an attorney experienced in real estate and probate law is recommended to ensure the quitclaim deed is accurately prepared and executed, protecting the interests of all involved parties. 3. Tax Implications: The transfer of royalty and mineral interests might have potential tax consequences. Seek advice from a tax professional to understand the implications and possible advantages or disadvantages. Conclusion: The Waco Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals serves as an essential legal instrument for transferring ownership rights to valuable resources. Understanding the different types of transfers and seeking appropriate legal guidance are crucial steps to ensuring a smooth and lawful transaction.Title: Understanding the Waco Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three (3) Individuals Keywords: Waco Texas, Quitclaim Deed, Royalty, Mineral Interests, Trust, Individuals Introduction: The Waco Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three (3) Individuals is a legal instrument followed in Waco, Texas, to transfer ownership rights of royalty and mineral interests from a trust to three individual parties. This detailed description will provide an overview of the process, different types, and key considerations while executing such deeds. 1. Waco Texas Quitclaim Deed: A quitclaim deed is a legal document used to transfer interest or rights to a property from one party to another without any warranties attached. In Waco, Texas, quitclaim deeds are commonly used to transfer royalty and mineral interests. 2. Royalty and Mineral Interests: Royalty and mineral interests pertain to ownership rights of oil, gas, and other valuable minerals found beneath the surface of a property. These rights may include the right to receive royalties, access to the resources, or leasing them to production companies. 3. Transfer from Trust to Three Individuals: The Waco Texas Quitclaim Deed of Royalty and Mineral Interests from a trust to three individuals is a specific type of quitclaim deed where the ownership rights are transferred from a trust entity to three individual parties. This could occur due to inheritance, estate planning, or rearrangement of asset distribution within a trust. Types of Waco Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals: 1. Inheritance Transfers: In cases where royalty and mineral interests are held within a trust, this type of quitclaim deed allows the transfer of those rights to three individuals as beneficiaries or heirs. 2. Trust Amendment or Revision: If a trust decides to modify its asset distribution by transferring royalty and mineral interests to three individuals, a quitclaim deed can be used to execute the transfer. 3. Trust Distribution: When a trust reaches its termination period, the assets, including royalty and mineral interests, are distributed to its designated beneficiaries using a quitclaim deed. Key Considerations: 1. Title Search: Prior to executing the quitclaim deed, a comprehensive title search is crucial to determine the validity and ownership of the royalty and mineral interests being transferred. 2. Legal Assistance: Consulting with an attorney experienced in real estate and probate law is recommended to ensure the quitclaim deed is accurately prepared and executed, protecting the interests of all involved parties. 3. Tax Implications: The transfer of royalty and mineral interests might have potential tax consequences. Seek advice from a tax professional to understand the implications and possible advantages or disadvantages. Conclusion: The Waco Texas Quitclaim Deed of Royalty and Mineral Interests from Trust to Three Individuals serves as an essential legal instrument for transferring ownership rights to valuable resources. Understanding the different types of transfers and seeking appropriate legal guidance are crucial steps to ensuring a smooth and lawful transaction.