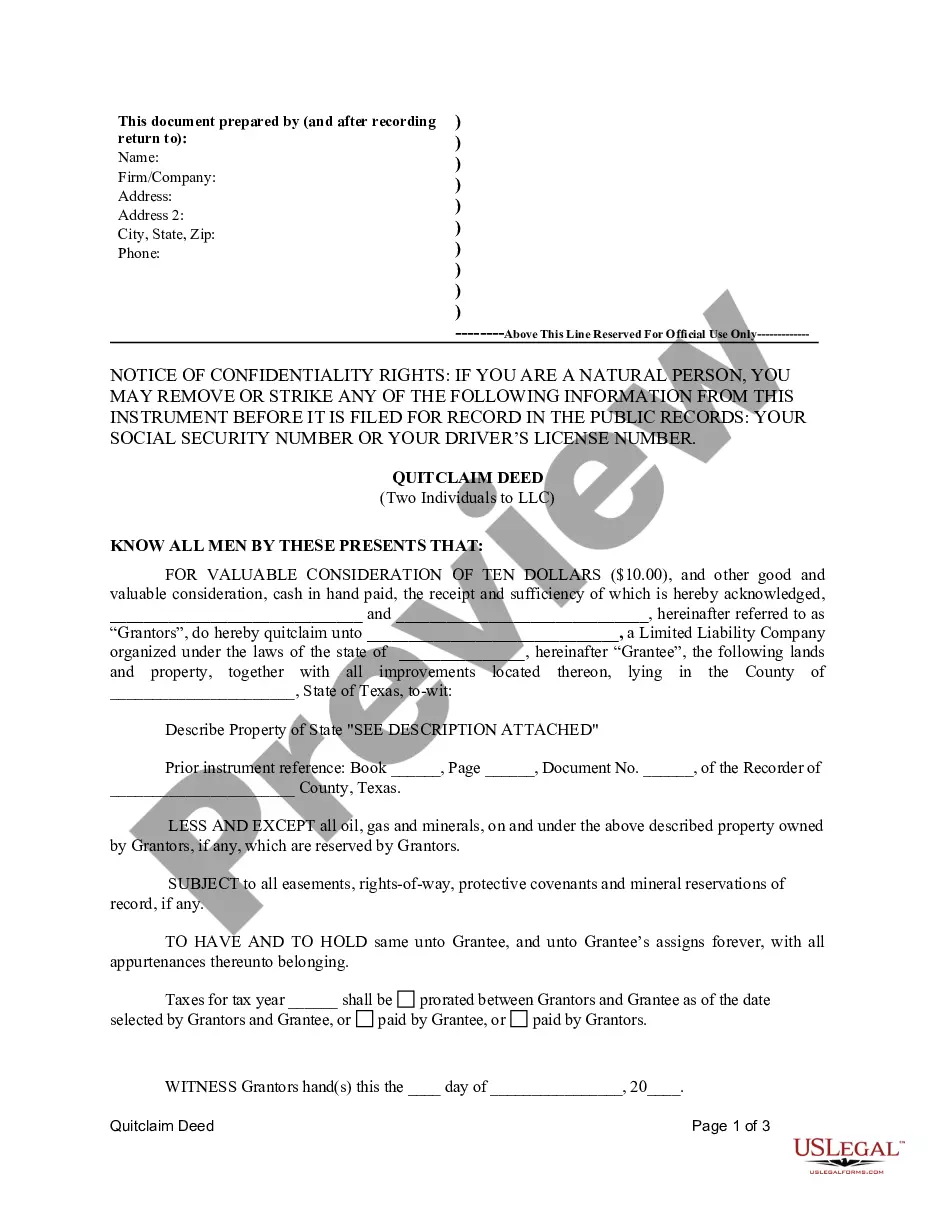

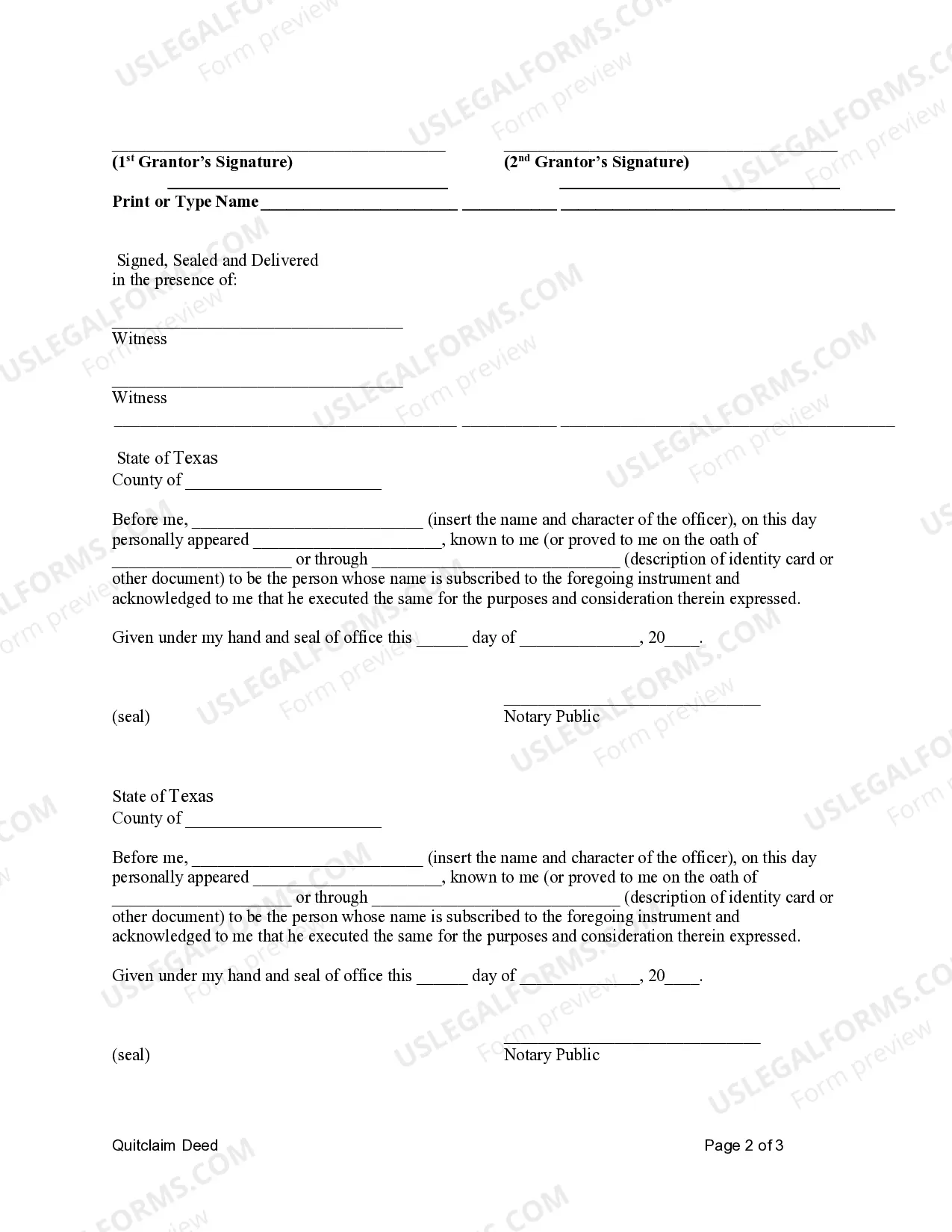

This Quitclaim Deed is used where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and quitclaim the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This form complies with all state statutory laws.

A Harris Texas Quitclaim Deed by Two Individuals to LLC is a legal document used to transfer the ownership of real property from two individuals to a limited liability company (LLC) in Harris County, Texas. This type of deed is commonly used when individuals want to contribute their real estate holdings to an LLC they have formed for various reasons, such as asset protection, tax advantages, or business purposes. The Harris Texas Quitclaim Deed by Two Individuals to LLC allows the two individuals, known as granters, to transfer their interests in the property to the LLC, known as the grantee, using a quitclaim deed. A quitclaim deed is a legal instrument that conveys any interest in the property that the granter may have, without guaranteeing that there are no encumbrances or other claims on the property. It simply transfers whatever interest the granter possesses at the time of the deed's execution. There are several variations or additional types of Harris Texas Quitclaim Deeds by Two Individuals to LLC, including: 1. Joint Tenancy Quitclaim Deed by Two Individuals to LLC: This type of quitclaim deed is commonly used when the two individuals hold the property as joint tenants with right of survivorship. It allows for the seamless transfer of their interests to the LLC. 2. Tenancy in Common Quitclaim Deed by Two Individuals to LLC: When the two individuals own the property as tenants in common, meaning they may have unequal shares or rights to the property, this type of quitclaim deed is utilized to transfer their respective interests to the LLC. 3. Enhanced Life Estate Quitclaim Deed by Two Individuals to LLC: Sometimes referred to as a Lady Bird Deed, this variation allows the individuals to transfer their life estate interests in the property to the LLC while retaining the right to use and control the property during their lifetime. This type of deed can be attractive for estate planning purposes. 4. Trustee Quitclaim Deed by Two Individuals to LLC: If the two individuals hold the property in a trust arrangement, they can use this type of quitclaim deed to transfer the property to the LLC as the new trustee, thereby changing the ownership structure. Overall, a Harris Texas Quitclaim Deed by Two Individuals to LLC serves as a legal means to transfer property ownership from two individuals to an LLC, offering flexibility and potential benefits based on the specific circumstances and goals of the individuals involved. It is crucial to consult with a qualified attorney or real estate professional to ensure compliance with local laws and to address any specific requirements for executing this type of deed in Harris County, Texas.A Harris Texas Quitclaim Deed by Two Individuals to LLC is a legal document used to transfer the ownership of real property from two individuals to a limited liability company (LLC) in Harris County, Texas. This type of deed is commonly used when individuals want to contribute their real estate holdings to an LLC they have formed for various reasons, such as asset protection, tax advantages, or business purposes. The Harris Texas Quitclaim Deed by Two Individuals to LLC allows the two individuals, known as granters, to transfer their interests in the property to the LLC, known as the grantee, using a quitclaim deed. A quitclaim deed is a legal instrument that conveys any interest in the property that the granter may have, without guaranteeing that there are no encumbrances or other claims on the property. It simply transfers whatever interest the granter possesses at the time of the deed's execution. There are several variations or additional types of Harris Texas Quitclaim Deeds by Two Individuals to LLC, including: 1. Joint Tenancy Quitclaim Deed by Two Individuals to LLC: This type of quitclaim deed is commonly used when the two individuals hold the property as joint tenants with right of survivorship. It allows for the seamless transfer of their interests to the LLC. 2. Tenancy in Common Quitclaim Deed by Two Individuals to LLC: When the two individuals own the property as tenants in common, meaning they may have unequal shares or rights to the property, this type of quitclaim deed is utilized to transfer their respective interests to the LLC. 3. Enhanced Life Estate Quitclaim Deed by Two Individuals to LLC: Sometimes referred to as a Lady Bird Deed, this variation allows the individuals to transfer their life estate interests in the property to the LLC while retaining the right to use and control the property during their lifetime. This type of deed can be attractive for estate planning purposes. 4. Trustee Quitclaim Deed by Two Individuals to LLC: If the two individuals hold the property in a trust arrangement, they can use this type of quitclaim deed to transfer the property to the LLC as the new trustee, thereby changing the ownership structure. Overall, a Harris Texas Quitclaim Deed by Two Individuals to LLC serves as a legal means to transfer property ownership from two individuals to an LLC, offering flexibility and potential benefits based on the specific circumstances and goals of the individuals involved. It is crucial to consult with a qualified attorney or real estate professional to ensure compliance with local laws and to address any specific requirements for executing this type of deed in Harris County, Texas.