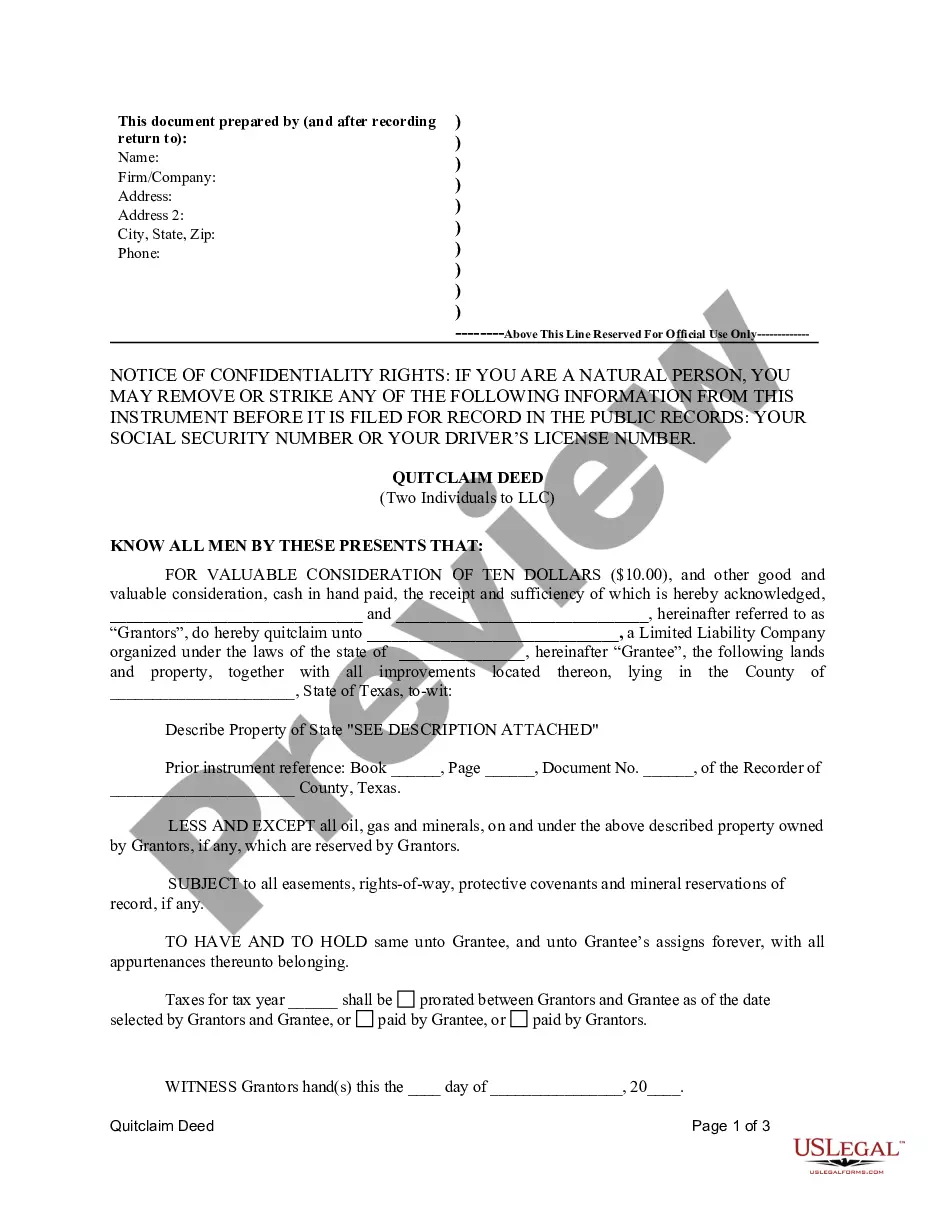

This Quitclaim Deed is used where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and quitclaim the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This form complies with all state statutory laws.

A Sugar Land Texas Quitclaim Deed by Two Individuals to LLC is a legal document that transfers the ownership interest of a property from two individuals to a Limited Liability Company (LLC) in Sugar Land, Texas. This type of deed is commonly used for various reasons, such as asset protection, tax planning, or forming a new business entity. It is important to note that there can be different variations of Sugar Land Texas Quitclaim Deeds by Two Individuals to LLC, including: 1. Voluntary Transfer: This type of quitclaim deed involves a voluntary transfer of ownership interest between two individuals and an LLC in Sugar Land, Texas. It is typically used when individuals want to transfer their ownership rights to an LLC they own or plan to establish. 2. Business Formation: Sometimes, two individuals may decide to form an LLC together in Sugar Land, Texas, for business purposes. In this case, they can use a quitclaim deed to transfer the property they own jointly to the newly formed LLC, establishing ownership and liability protection for their business. 3. Asset Protection Strategy: Individuals looking to protect their personal assets from potential lawsuits or financial obligations may transfer their property through a Sugar Land Texas Quitclaim Deed to an LLC they own, providing a layer of legal separation between their personal assets and the property. 4. Estate Planning: A Sugar Land Texas Quitclaim Deed by Two Individuals to LLC can also be used as a part of estate planning. For example, individuals may transfer their property to an LLC they own and then include the LLC's ownership interest in their estate plan, ensuring a smoother transfer of assets to their heirs or beneficiaries upon their passing. In summary, a Sugar Land Texas Quitclaim Deed by Two Individuals to LLC is a legal instrument that facilitates the transfer of property ownership from two individuals to an LLC in Sugar Land, Texas. It serves various purposes, including business formation, asset protection, and estate planning. It is essential to consult with a qualified legal professional when considering such a transfer to ensure compliance with local laws and optimize the desired outcomes.A Sugar Land Texas Quitclaim Deed by Two Individuals to LLC is a legal document that transfers the ownership interest of a property from two individuals to a Limited Liability Company (LLC) in Sugar Land, Texas. This type of deed is commonly used for various reasons, such as asset protection, tax planning, or forming a new business entity. It is important to note that there can be different variations of Sugar Land Texas Quitclaim Deeds by Two Individuals to LLC, including: 1. Voluntary Transfer: This type of quitclaim deed involves a voluntary transfer of ownership interest between two individuals and an LLC in Sugar Land, Texas. It is typically used when individuals want to transfer their ownership rights to an LLC they own or plan to establish. 2. Business Formation: Sometimes, two individuals may decide to form an LLC together in Sugar Land, Texas, for business purposes. In this case, they can use a quitclaim deed to transfer the property they own jointly to the newly formed LLC, establishing ownership and liability protection for their business. 3. Asset Protection Strategy: Individuals looking to protect their personal assets from potential lawsuits or financial obligations may transfer their property through a Sugar Land Texas Quitclaim Deed to an LLC they own, providing a layer of legal separation between their personal assets and the property. 4. Estate Planning: A Sugar Land Texas Quitclaim Deed by Two Individuals to LLC can also be used as a part of estate planning. For example, individuals may transfer their property to an LLC they own and then include the LLC's ownership interest in their estate plan, ensuring a smoother transfer of assets to their heirs or beneficiaries upon their passing. In summary, a Sugar Land Texas Quitclaim Deed by Two Individuals to LLC is a legal instrument that facilitates the transfer of property ownership from two individuals to an LLC in Sugar Land, Texas. It serves various purposes, including business formation, asset protection, and estate planning. It is essential to consult with a qualified legal professional when considering such a transfer to ensure compliance with local laws and optimize the desired outcomes.