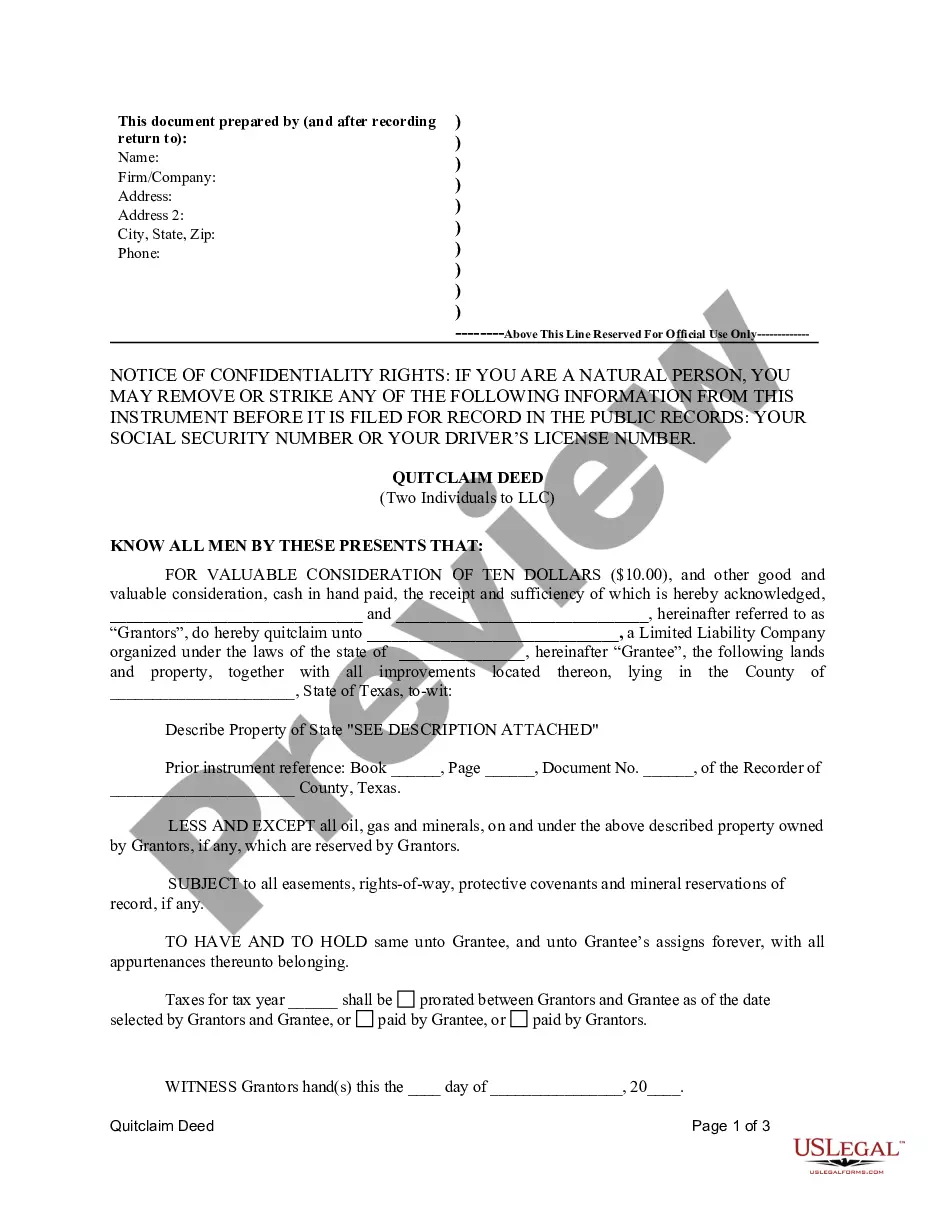

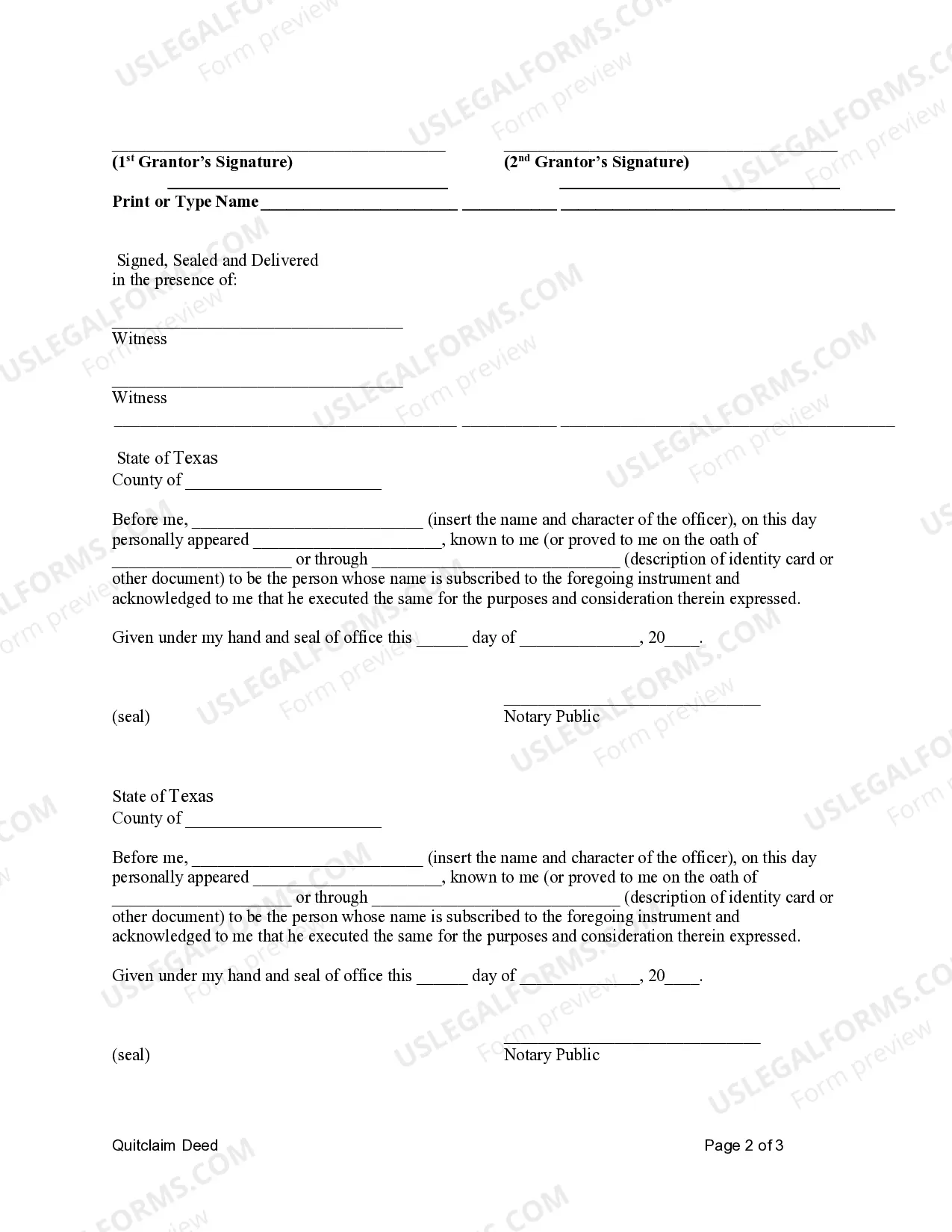

This Quitclaim Deed is used where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and quitclaim the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This form complies with all state statutory laws.

A Tarrant Texas quitclaim deed by two individuals to an LLC is a legal document used to transfer ownership of a property located in Tarrant County, Texas, from two individuals to a limited liability company (LLC). This type of transaction is commonly undertaken for various purposes, such as asset protection, estate planning, or business restructuring. Understanding the different types of Tarrant Texas quitclaim deeds by two individuals to an LLC can help individuals navigate the complexities of real estate transactions and make well-informed decisions. One type of Tarrant Texas quitclaim deed by two individuals to an LLC is the Standard Quitclaim Deed. This straightforward document explicitly states the intent of the granters (the two individuals) to transfer any interest or claim they have in the property to the LLC, without making any warranties or guarantees regarding the property's title or condition. The granters essentially "quit" any claim they may have had on the property, thereby allowing the LLC to assume full ownership and legal responsibility. Another type of Tarrant Texas quitclaim deed by two individuals to an LLC is the Enhanced Life Estate Deed, commonly known as a Lady Bird Deed. This variation provides certain benefits, particularly for estate planning purposes. The granters retain a life estate, allowing them to live in or use the property during their lifetimes. Upon the death of the granters, the property automatically transfers to the LLC without the need for probate or other legal processes, thus streamlining the transfer of assets. A third type of Tarrant Texas quitclaim deed by two individuals to an LLC is the Trustee's Deed. This type of deed is used when property owned by two individuals is transferred to an LLC that is acting as a trustee for a trust. The deed conveys the property from the individuals to the LLC, which holds legal title to the property for the benefit of the trust's beneficiaries. This deed ensures that the LLC exercises its duties as a trustee in managing and distributing the property as directed by the trust. When executing a Tarrant Texas quitclaim deed by two individuals to an LLC, it is essential to consult with experienced real estate attorneys or professionals to ensure a smooth and legally compliant transaction. They can provide specific guidance tailored to individual circumstances, including determining the most suitable type of quitclaim deed and ensuring all necessary documentation and legal requirements are met. Keywords: Tarrant Texas, quitclaim deed, two individuals, LLC, property transfer, legal document, limited liability company, asset protection, estate planning, business restructuring, real estate transactions, Standard Quitclaim Deed, Enhanced Life Estate Deed, Lady Bird Deed, life estate, probate, legal processes, Trustee's Deed, trust, beneficiaries, legal title, real estate attorneys, professionals, transaction, documentation, legal requirements.A Tarrant Texas quitclaim deed by two individuals to an LLC is a legal document used to transfer ownership of a property located in Tarrant County, Texas, from two individuals to a limited liability company (LLC). This type of transaction is commonly undertaken for various purposes, such as asset protection, estate planning, or business restructuring. Understanding the different types of Tarrant Texas quitclaim deeds by two individuals to an LLC can help individuals navigate the complexities of real estate transactions and make well-informed decisions. One type of Tarrant Texas quitclaim deed by two individuals to an LLC is the Standard Quitclaim Deed. This straightforward document explicitly states the intent of the granters (the two individuals) to transfer any interest or claim they have in the property to the LLC, without making any warranties or guarantees regarding the property's title or condition. The granters essentially "quit" any claim they may have had on the property, thereby allowing the LLC to assume full ownership and legal responsibility. Another type of Tarrant Texas quitclaim deed by two individuals to an LLC is the Enhanced Life Estate Deed, commonly known as a Lady Bird Deed. This variation provides certain benefits, particularly for estate planning purposes. The granters retain a life estate, allowing them to live in or use the property during their lifetimes. Upon the death of the granters, the property automatically transfers to the LLC without the need for probate or other legal processes, thus streamlining the transfer of assets. A third type of Tarrant Texas quitclaim deed by two individuals to an LLC is the Trustee's Deed. This type of deed is used when property owned by two individuals is transferred to an LLC that is acting as a trustee for a trust. The deed conveys the property from the individuals to the LLC, which holds legal title to the property for the benefit of the trust's beneficiaries. This deed ensures that the LLC exercises its duties as a trustee in managing and distributing the property as directed by the trust. When executing a Tarrant Texas quitclaim deed by two individuals to an LLC, it is essential to consult with experienced real estate attorneys or professionals to ensure a smooth and legally compliant transaction. They can provide specific guidance tailored to individual circumstances, including determining the most suitable type of quitclaim deed and ensuring all necessary documentation and legal requirements are met. Keywords: Tarrant Texas, quitclaim deed, two individuals, LLC, property transfer, legal document, limited liability company, asset protection, estate planning, business restructuring, real estate transactions, Standard Quitclaim Deed, Enhanced Life Estate Deed, Lady Bird Deed, life estate, probate, legal processes, Trustee's Deed, trust, beneficiaries, legal title, real estate attorneys, professionals, transaction, documentation, legal requirements.