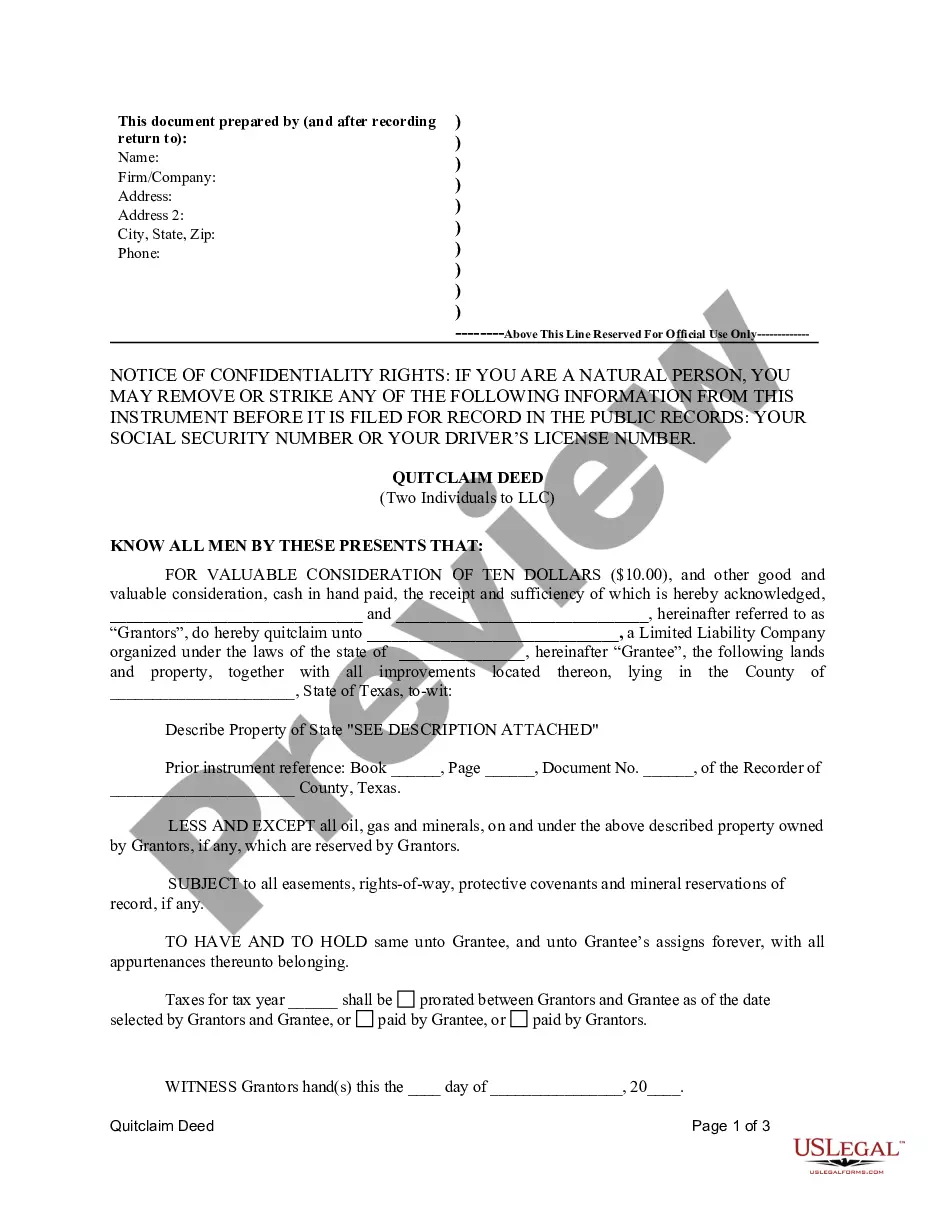

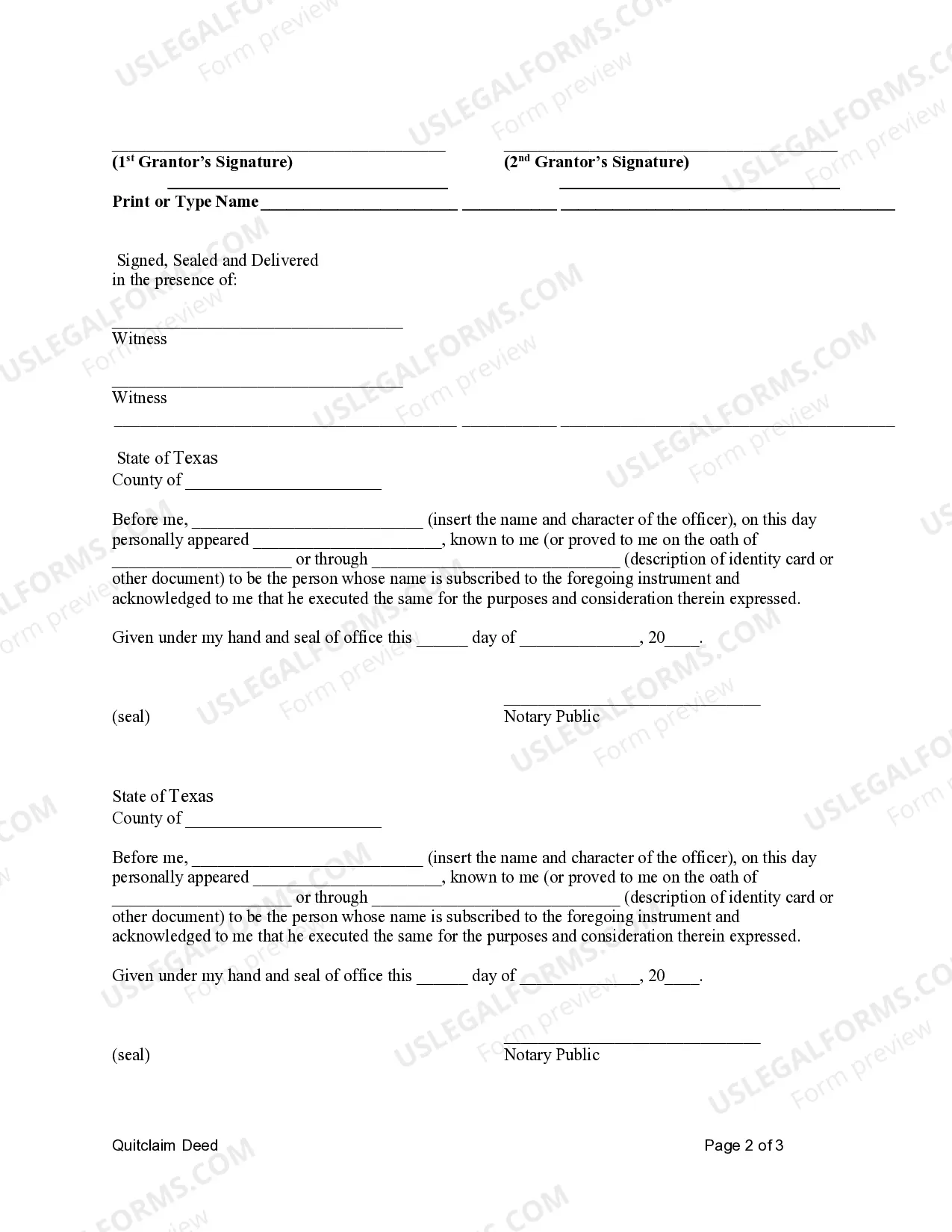

This Quitclaim Deed is used where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and quitclaim the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This form complies with all state statutory laws.

A Waco Texas Quitclaim Deed by Two Individuals to LLC is a legal document used to transfer the ownership of real property from two individuals to a Limited Liability Company (LLC) in Waco, Texas. This type of deed allows the individuals to relinquish any interest or claim they may have in the property in favor of the LLC. By executing this deed, the individuals are essentially "quitting" their claim or interest in the property, without making any warranties or guarantees regarding the property's title. This quitclaim deed is commonly used in a variety of situations, such as when two individuals want to transfer a property they own jointly to an LLC they have established for various business or investment purposes. It is important to note that a quitclaim deed only transfers the interest or claim the individuals have at the time of transfer and does not provide any guarantee of clear title or protect against any existing liens or encumbrances. There can be different variations of the Waco Texas Quitclaim Deed by Two Individuals to LLC, depending on specific circumstances or requirements. Some of these variations include: 1. Individual to Multiple Member LLC: This type of quitclaim deed is used when two individuals are transferring their ownership interest in a property to an LLC with more than two members. It outlines the proportional share each individual is transferring to the LLC. 2. Individual to Single Member LLC: In this case, two individuals are transferring their property interest to an LLC consisting of only one member. This type of quitclaim deed is frequently used when individuals want to consolidate their ownership interests or establish a legal entity for investment purposes. 3. Partial Interest Transfer: This variation is utilized when two individuals wish to transfer only a portion of their ownership interest in the property to the LLC. It specifies the exact percentage or fractional interest being transferred and may involve multiple deeds if both individuals are transferring different partial interests. 4. Subject to Existing Liens or Encumbrances: In some cases, a property may have existing liens or encumbrances (such as mortgages or tax liens) that can affect its ownership. In such instances, a specific quitclaim deed can be used, explicitly mentioning that the transfer is subject to these pre-existing financial obligations. It is crucial to consult with a qualified real estate attorney or legal professional experienced in Waco, Texas real estate laws when drafting or executing a Waco Texas Quitclaim Deed by Two Individuals to LLC. This ensures that the transfer is legally valid, accurately reflects the parties' intentions, and protects the interests of both the individuals and the LLC.A Waco Texas Quitclaim Deed by Two Individuals to LLC is a legal document used to transfer the ownership of real property from two individuals to a Limited Liability Company (LLC) in Waco, Texas. This type of deed allows the individuals to relinquish any interest or claim they may have in the property in favor of the LLC. By executing this deed, the individuals are essentially "quitting" their claim or interest in the property, without making any warranties or guarantees regarding the property's title. This quitclaim deed is commonly used in a variety of situations, such as when two individuals want to transfer a property they own jointly to an LLC they have established for various business or investment purposes. It is important to note that a quitclaim deed only transfers the interest or claim the individuals have at the time of transfer and does not provide any guarantee of clear title or protect against any existing liens or encumbrances. There can be different variations of the Waco Texas Quitclaim Deed by Two Individuals to LLC, depending on specific circumstances or requirements. Some of these variations include: 1. Individual to Multiple Member LLC: This type of quitclaim deed is used when two individuals are transferring their ownership interest in a property to an LLC with more than two members. It outlines the proportional share each individual is transferring to the LLC. 2. Individual to Single Member LLC: In this case, two individuals are transferring their property interest to an LLC consisting of only one member. This type of quitclaim deed is frequently used when individuals want to consolidate their ownership interests or establish a legal entity for investment purposes. 3. Partial Interest Transfer: This variation is utilized when two individuals wish to transfer only a portion of their ownership interest in the property to the LLC. It specifies the exact percentage or fractional interest being transferred and may involve multiple deeds if both individuals are transferring different partial interests. 4. Subject to Existing Liens or Encumbrances: In some cases, a property may have existing liens or encumbrances (such as mortgages or tax liens) that can affect its ownership. In such instances, a specific quitclaim deed can be used, explicitly mentioning that the transfer is subject to these pre-existing financial obligations. It is crucial to consult with a qualified real estate attorney or legal professional experienced in Waco, Texas real estate laws when drafting or executing a Waco Texas Quitclaim Deed by Two Individuals to LLC. This ensures that the transfer is legally valid, accurately reflects the parties' intentions, and protects the interests of both the individuals and the LLC.