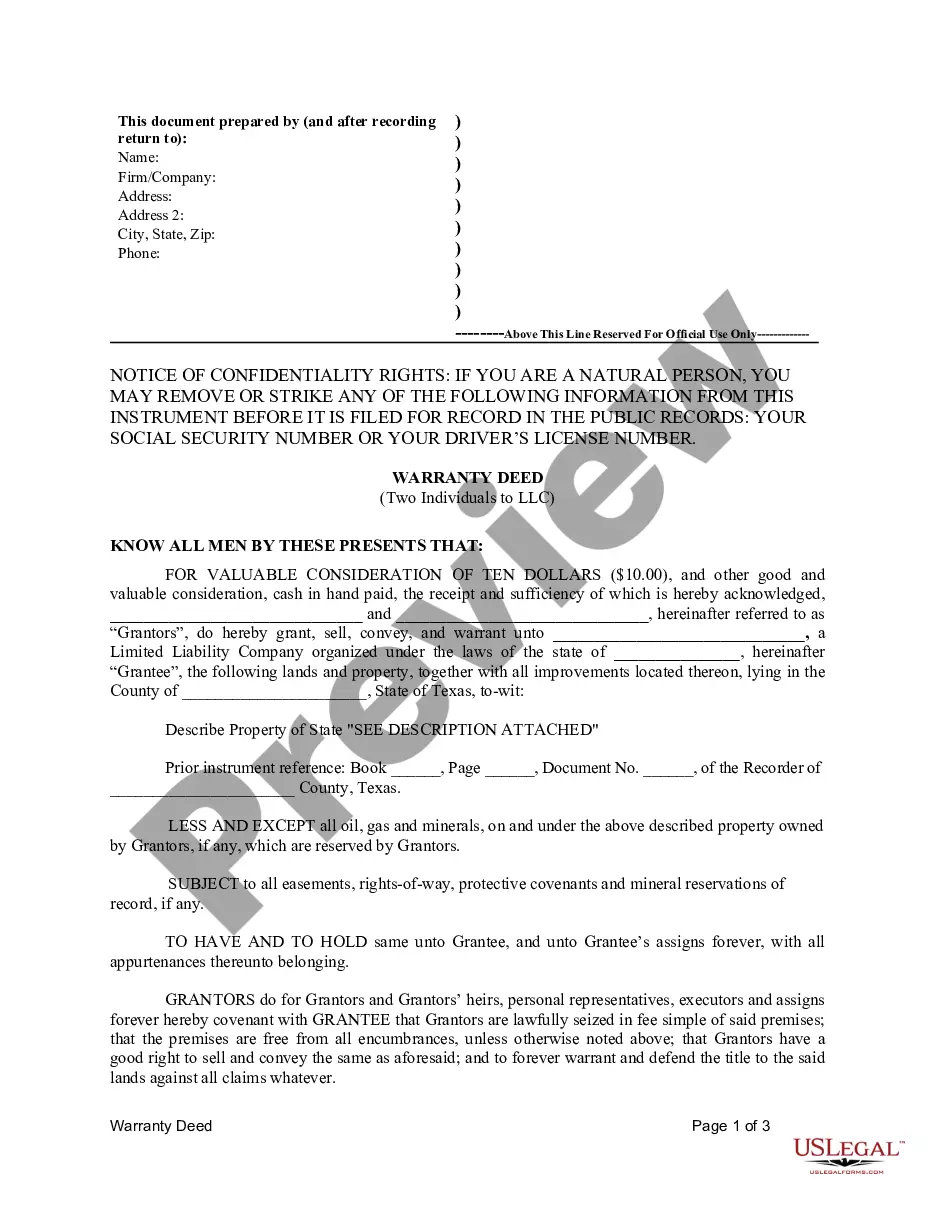

This Warranty Deed from two Individuals to LLC form is a Warranty Deed where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and warrant the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Dallas Texas Warranty Deed from two Individuals to LLC

Description

How to fill out Texas Warranty Deed From Two Individuals To LLC?

Irrespective of social or professional rank, filling out law-related documentation is a regrettable requirement in today’s society.

Frequently, it’s nearly unfeasible for an individual lacking legal expertise to draft such documents from beginning, primarily due to the intricate terminology and legal subtleties they entail.

This is where US Legal Forms steps in to assist.

Ensure that the template you have selected is appropriate for your area since the laws of one state or territory do not apply to another.

Examine the document and review a brief summary (if available) of scenarios where the paper can be utilized.

- Our platform offers an extensive library with over 85,000 ready-to-use state-specific documents that cater to nearly any legal requirement.

- US Legal Forms is also a valuable resource for associates or legal advisors wanting to conserve time by using our DYI papers.

- Whether you need the Dallas Texas Warranty Deed from two Individuals to LLC or another document applicable in your state or locality, with US Legal Forms, everything is accessible.

- Here’s how you can quickly obtain the Dallas Texas Warranty Deed from two Individuals to LLC using our reliable platform.

- If you are already a member, you can proceed to Log In to your account to access the desired form.

- On the other hand, if you are new to our platform, please follow these steps before acquiring the Dallas Texas Warranty Deed from two Individuals to LLC.

Form popularity

FAQ

Yes, you can sell a property with a warranty deed. This type of deed is advantageous as it assures the buyer of a clear title and protection against future claims. However, ensure that all information is accurate and that you have the legal right to sell. Utilizing services like US Legal Forms can help you navigate the specifics of a Dallas Texas Warranty Deed from two Individuals to LLC for a seamless sale.

To transfer ownership of property in Illinois, you typically need to prepare and file a deed with the county recorder's office. A Warranty Deed is often used for this purpose, ensuring that the new owners receive clear title. For a streamlined experience, consider platforms like US Legal Forms, especially if you are navigating the intricacies of a Dallas Texas Warranty Deed from two Individuals to LLC. Be mindful of local regulations to ensure a smooth transfer.

One key disadvantage of a warranty deed is that it provides a strong commitment from the seller regarding the property's title and condition. If issues arise with the title after the transfer, the seller may be held liable. This added responsibility can sometimes discourage sellers from using a warranty deed. It's important to weigh these factors, especially when dealing with a Dallas Texas Warranty Deed from two Individuals to LLC.

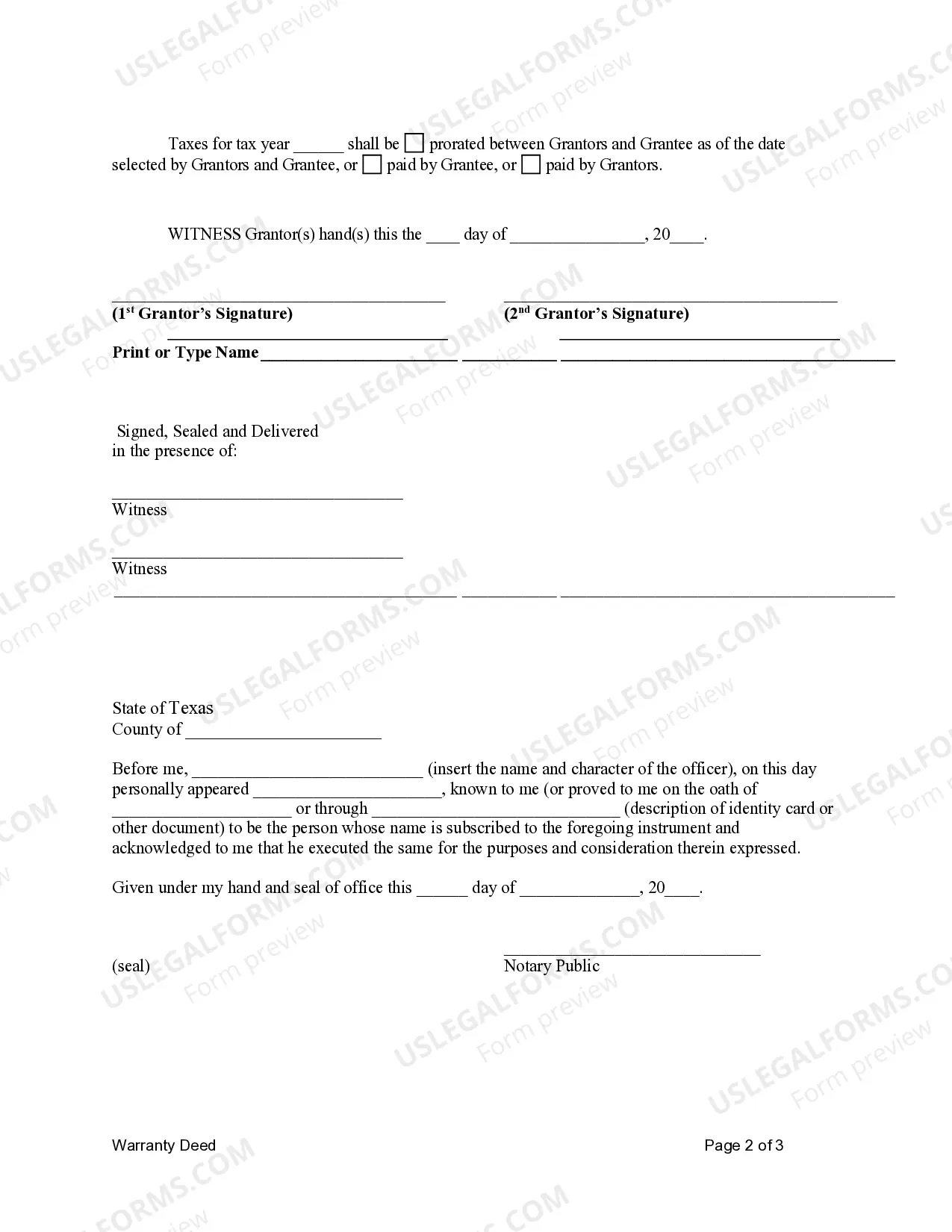

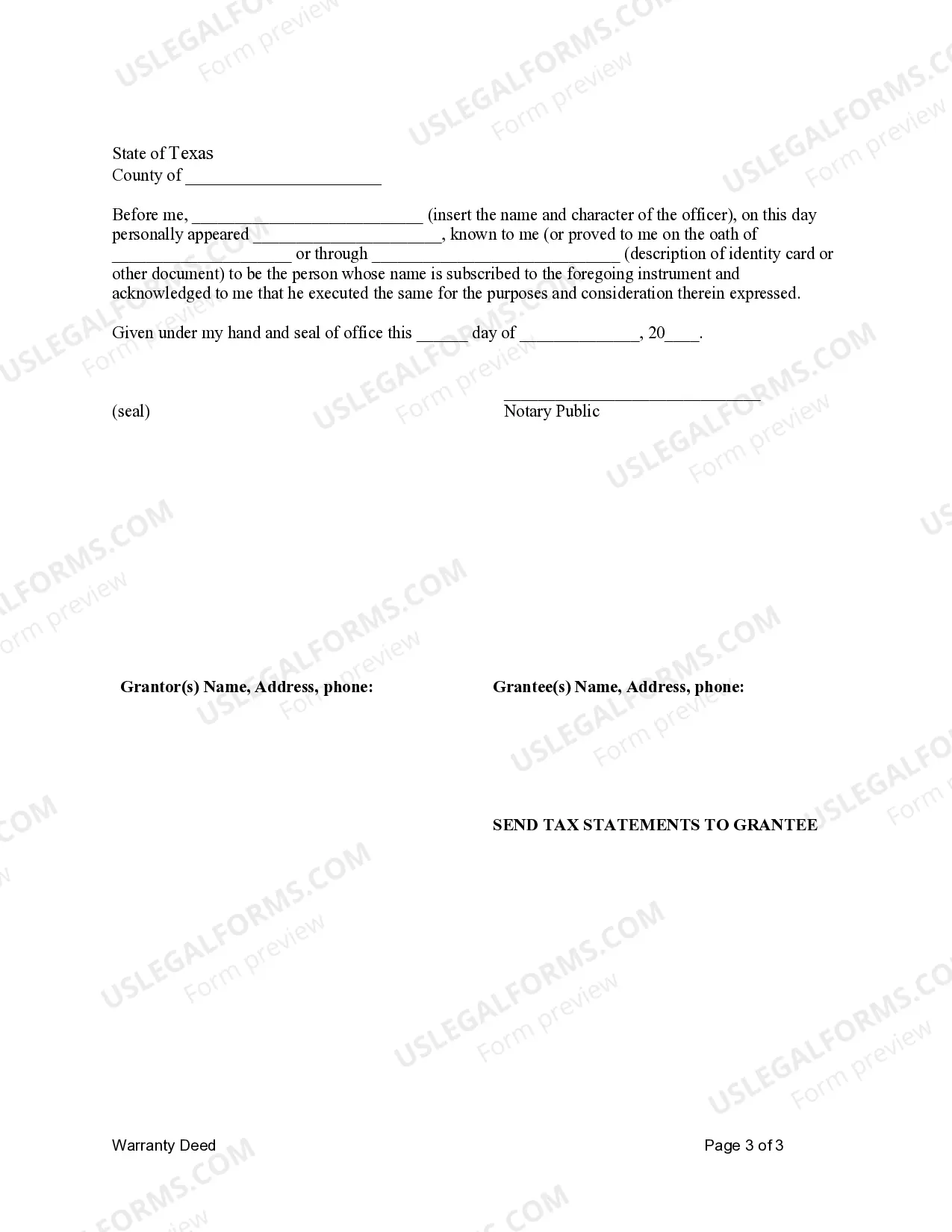

To transfer a warranty deed, you need to complete a new deed form, typically called a Warranty Deed. Identify the current owners and the new entity, in this case, an LLC. Ensure all information is accurate and file the deed with the appropriate county office. Always consider using a platform like US Legal Forms to streamline this process, especially for a Dallas Texas Warranty Deed from two Individuals to LLC.

To transfer a deed to an LLC, you must draft a Dallas Texas Warranty Deed from two Individuals to LLC. Include the names of the current property owners and the LLC on the deed. Ensure you sign the deed with a notary present to authenticate the transfer. Afterward, be sure to file the deed with your county’s clerk to make the ownership change official.

Transferring a deed from personal ownership to an LLC requires executing a Dallas Texas Warranty Deed from two Individuals to LLC. You must create the deed, reflecting both the individual's names and the LLC's name. After signing the deed in front of a notary, submit it to your local county clerk's office. This process officially documents the transfer of ownership to the LLC.

To transfer your property to an LLC in Texas, you need to prepare a Dallas Texas Warranty Deed from two Individuals to LLC. First, ensure the LLC is properly registered with the state. Then, fill out the deed accurately, listing both the current owners and the LLC as the new owner. Finally, sign the deed in front of a notary and file it with the county clerk to complete the transfer.

To transfer a deed to an LLC in Texas, you begin by drafting a warranty deed that specifies the LLC as the new owner. The existing owners must sign this Dallas Texas Warranty Deed from two Individuals to LLC and have it notarized. Finally, to complete the process, file the deed with the county clerk where the property is located.

Transferring a deed from an individual to an LLC involves preparing a new warranty deed that names the LLC as the new owner. It is crucial to ensure that the Dallas Texas Warranty Deed from two Individuals to LLC is signed and notarized correctly. After completing these steps, file the deed with your local county clerk to finalize the transfer.

To transfer a warranty deed in Texas, you must create a new deed that clearly identifies the new owner. The current owners must sign the Dallas Texas Warranty Deed from two Individuals to LLC and ensure it is notarized. Afterward, you will need to file the deed with the county clerk's office where the property is located.